znm

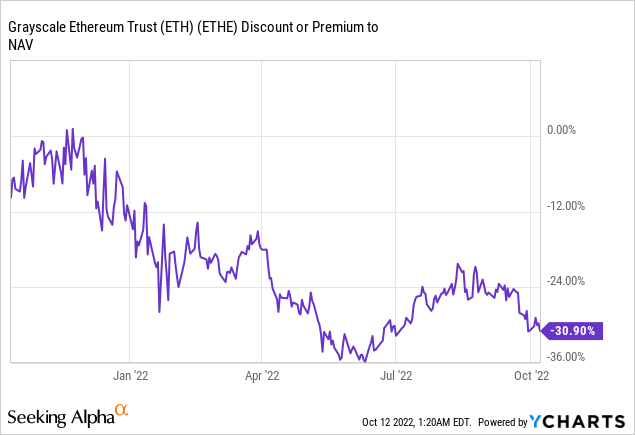

Grayscale Ethereum Trust (OTCQX:ETHE) is a fine way to gain exposure to Ethereum at a discount. However, many people wrongly assume that the discount to NAV ETHE provides, currently -30.9%, is ‘free money.’

This is simply not the case.

In this article, I’ll present my case for going with either spot Ethereum or Ether futures instead of Grayscale Ethereum Trust, and for ETHE declining to at least a discount of -40% to the fund’s NAV.

We’ll start by painting a picture of ETHE’s decreasing attractiveness relative to alternatives before revisiting the likelihood of ETHE becoming an ETF.

To brief anyone who’s not familiar with the discount to NAV Grayscale’s Ethereum Trust has: ETHE trades at a discount to NAV as like most funds you cannot redeem the shares freely, and thus the Ethereum held in the trust is trapped within the trust – trapped paying a nasty 2.5% annual fee.

This is why ETHE trades at a discount – the discount can vary depending on market conditions, if Ethereum is in high demand the discount will often close slightly. But with the introduction and growing popularity of Ethereum futures, there’s less and less reason to own ETHE, which is why I believe the discount to NAV has expanded so drastically since the beginning of the year.

This decline in NAV really became an issue after the CME launched Ethereum Micro-futures, and was made worse by the general market decline.

The Merge Fundamentally Changes The Discount-To-NAV Dynamics Of ETHE

While this discount to NAV is present in all the popular grayscale funds, in the case of ETHE it is particularly problematic.

You see with Grayscale Bitcoin Trust (GBTC) your alternatives are ProShares Bitcoin Strategy ETF (BITO), futures, or spot BTC – none of which have real yield potential, at least without taking on extra market-side risk. This makes the fund somewhat attractive, as the discount to NAV just has to close before the fund’s fees eat up that discount. At today’s prices, GBTC has a discount to NAV that would take 15 years for the fund’s fees to eat up.

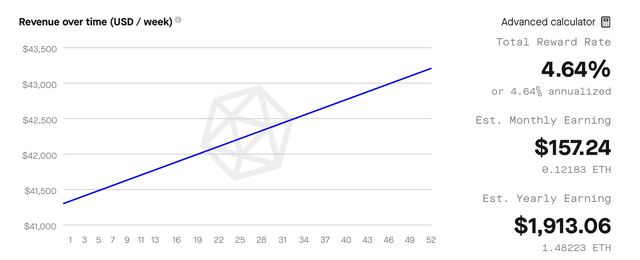

With ETHE, however, the fund has to not only outperform the fund’s high management fee of 2.5% annually, but it also has to outperform the (nearly) risk-free 4%~ yield Ethereum staking provides through a 3rd-party source such as Coinbase. You can receive more from doing it on your own:

This means the approximate risk-free drag on ETHE compared to spot ETH you stake is around 7.5% annually, which would eat up the current discount to NAV in just 4 years, less if you stake spot Ethereum on your own rather than through a trusted 3rd-party solution.

This begs the question, do you believe ETHE will be converted to a spot ETF in less than 4 years? Is the risk worth the extra volatility of spot ETH? We can agree or disagree here – I’m not saying to go buy some spot ETH and stake it on your own, or through Coinbase – that entails extra complexity. I don’t do that – and wouldn’t bother doing that myself.

The reason I’ve brought this up is to convey the changing dynamics – the attractiveness – of Grayscale’s Ethereum Trust. Due to the merge, the attractiveness of the fund is decreasing substantially.

Ethereum Futures Contango Evaporates

To make matters worse Ethereum Futures have, for the last month – and stretching out months into the future, switched from being in contango to backwardation, making the net carry of the futures positive relative to spot.

This could be occurring due to a stagnant or declining crypto market generally, however it could also be due to simple arbitrage:

For the first time, people can now buy spot Ethereum or liquid-staked-ether such as RETH/stETH and then sell futures against it, eliminating pricing risk and pocketing the yield.

Calculating the backwardation present in Ether Futures is currently 3.2%/year, which is marginally below the yield staking Ethereum generates, but above the risk-free rate currently. This validates this thesis, and suggests backwardation – or real yield backwardation – is likely to continue.

Once again this isn’t to say you should go out and arbitrage this – or that Ethereum futures are superior to ETHE because of this – but rather the relative attractiveness of ETHE has gotten worse relative to the past.

Ethereum Futures Options Made Available

While in truth Ethereum futures options were available on micro ether futures on certain brokerages in the past, the notional contract size relative to the commissions made them – as an options trader – unreasonable to trade.

With the merge, the CME group announced and successfully launched Ethererum futures options on their /ETHUSD_RR product, which has minimal fees for the contract size (50eth).

Currently selling 0.10 Delta short calls against an Ether Futures contract generates 8-9% annually, when combined with the net backwardation, this yields around 12% annually, assuming Ethereum does not go up by more than 50% in any 40-day period during the year.

Due to the /ETHUSD_RR product being a futures product rather than an OTC product, it is margin-compatible and offers around 30% in margin relief currently.

Futures are of course not without extra risk, especially when selling options against them – as you cap your upside and change the risk profile of your investment when using them.

But again – this is not to say it’s wise to go out and buy futures and sell covered calls against them (although I am doing this), it is to demonstrate the changing dynamics and the relative attractiveness of ETHE.

For reference, as someone who’s been trading these products since they came out, Ethereum futures used to have a net negative drag (contango) of around 7% per year in 2021. Combined with a substantially worse options market, it was hard to even break even if holding futures vs spot Ethereum or ETHE in the past.

Relative ETHE Value Summary

To summarize the above, on the worsening relative attractiveness of ETHE vs. alternatives such as Ether Futures or spot Ethereum:

- ETHE Trades at a 30.9% discount to NAV

- ETHE has a 2.5% annual management fee

- Spot Ethereum has no management fee and can yield market-risk-free 4%~ currently, representing a +7.5% net-positive carry relative to ETHE annually

- Ether Futures have no management fee and have a negative carry of around 3.2%/year currently, representing a +5.7% net-positive carry rate compared to ETHE annually

- Ether Futures have a liquid options market that, if an investor is willing to limit upside profits marginally, can result in a 12% yield annually, representing a +14.5% net-positive carry rate relative to ETHE annually

With this all being said, Ethereum’s merge was only announced in August as definite – this means, in my opinion, that the June discount to NAV had not even factored in the relative attractiveness issues ETHE would experience in a successful merge – yet ETHE was trading at a 34% -> 35% discount to NAV in early June.

Based on this, combined with the worsening relative fundamentals of ETHE, I believe ETHE will experience an expansion in its discount to NAV, hitting the highest discount it ever has been at over the next few months.

Revisiting The Question Of Becoming An ETF

Relative valuation doesn’t matter if an investor believes Grayscale Ethereum Trust will convert to become an ETF soon. So while the relative valuation thesis is all good in principle, it is entirely dependent on the probability of the fund being converted into a spot ETF.

In truth, the conversion would be unprecedented, and thus there’s no real way to calculate the probability of it occurring in a certain time frame. This is why my thesis is based on the fund’s relative valuation today compared to the pre-merge periods.

We may see a conversion in late 2023 if Grayscale wins their GBTC-related case against the SEC, or it could happen in 2024 if Gary Gensler is swapped out for a more crypto-friendly SEC chair. It could also happen anytime if there are sweeping, comprehensive crypto regulations. Truthfully, nobody knows and anyone speculating on when the conversion may happen is just that: speculating.

There have been no updates, change in stance, or any real analysis indicating an increased likelihood of a Bitcoin ETF approval – let alone an Ethereum ETF approval. So ultimately we’re at the same place where we were months prior when ETHE’s discount to NAV was far greater – but with far worse fundamentals and relative value, as outlined above.

With this being said, I’d leave you with this:

The SEC has refused to even approve an Ethereum-futures ETF, which occurred over a year ago in the case of Bitcoin, and a Bitcoin ETF is still no closer to reality today than it was then. We may see a resolution, and a successful case against the SEC by Grayscale regarding their GBTC fund; however, this wouldn’t greenlight Ethereum into becoming an ETF just as a bitcoin futures ETF didn’t greenlight an Ethereum futures ETF.

Bottom Line

We have a long road to go before the ETHE discount to NAV closes.

With declining relative attractiveness of the fund, no clear catalyst for this discount to NAV closing, and the likelihood of negative catalysts (such as an Ethereum futures ETF being approved) occurring far before any positive catalysts, ETHE is likely to underperform relative to alternatives.

With that being said, I rate ETHE a hold, which according to my ratings means I would not invest in it or continue to hold positions in it, but I do not see a short opportunity in the stock relative to the broad market.

Investors who agree with my thesis may benefit from a pairs trade (short ETHE, long ETH/ETHUSD_RR) or simply migrating positions out of ETHE for alternatives (spot or futures) temporarily, assuming no heavy tax consequences are incurred.

Be the first to comment