Prostock-Studio/iStock via Getty Images

Digi International Inc. (NASDAQ:NASDAQ:DGII) will most likely enjoy significant revenue growth thanks to ongoing digital transformation in many businesses. In particular, the company recently noted an increase in the demand for OEM Solutions and Infrastructure Management as well as tools for smart cities. Motivated by beneficial financial forecasts made by other analysts, I ran my own financial models. My results included a fair price that could touch $56 per share thanks to further acquisitions and successful reorganization of product categories. Even considering supply chain risks and impairment of goodwill, I believe that Digi is a stock to follow carefully.

Digi International

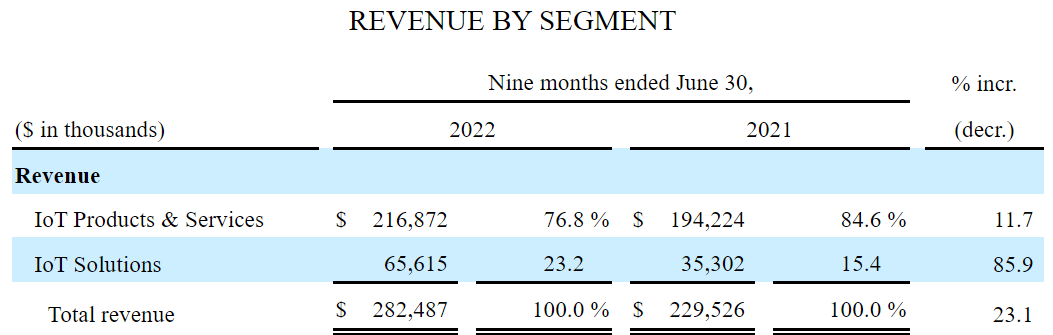

Digi International offers mission-critical Internet of Things (IoT) connectivity products and related services. The company contains two business segments. Most revenue comes from the company’s products and services. Both business segments report sales growth.

10-Q

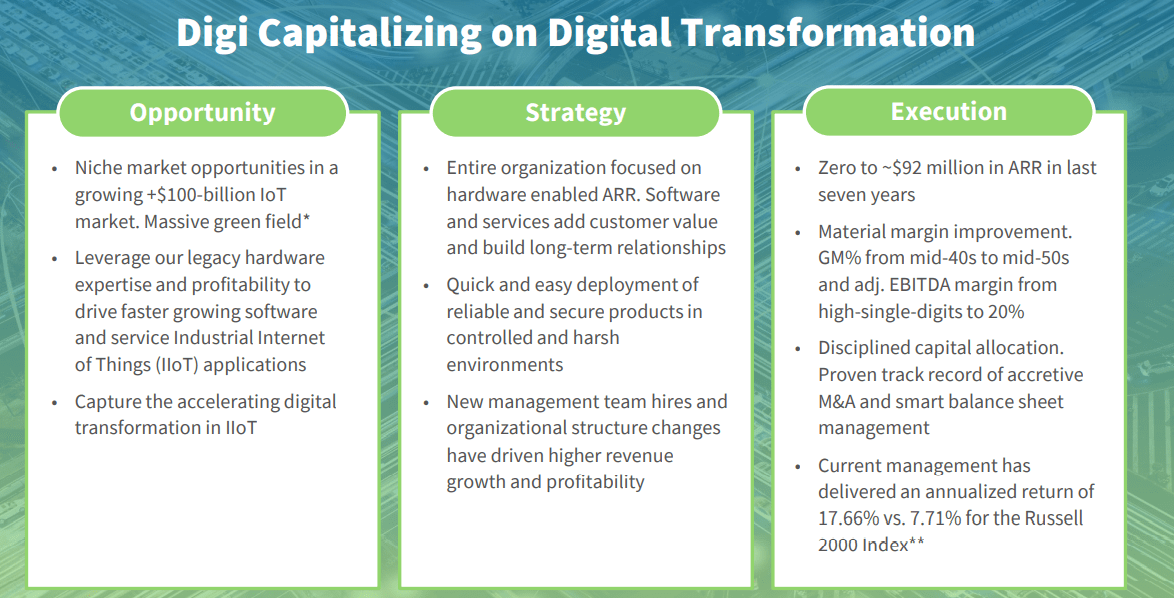

In order to make a long story short, I would say that Digi is capitalizing on the digital transformation inside business organizations. We are talking about a market opportunity of more than $100 billion and a company that developed 17% annualized return in the most recent years.

Presentation

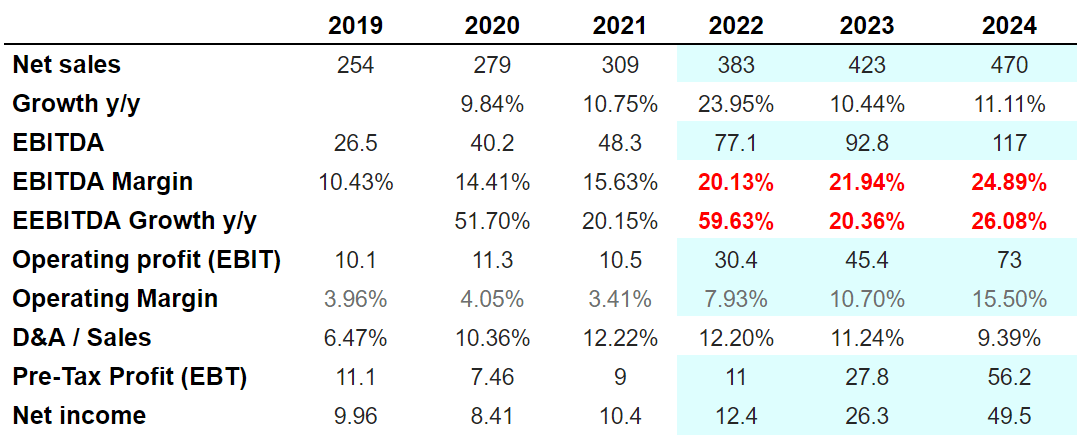

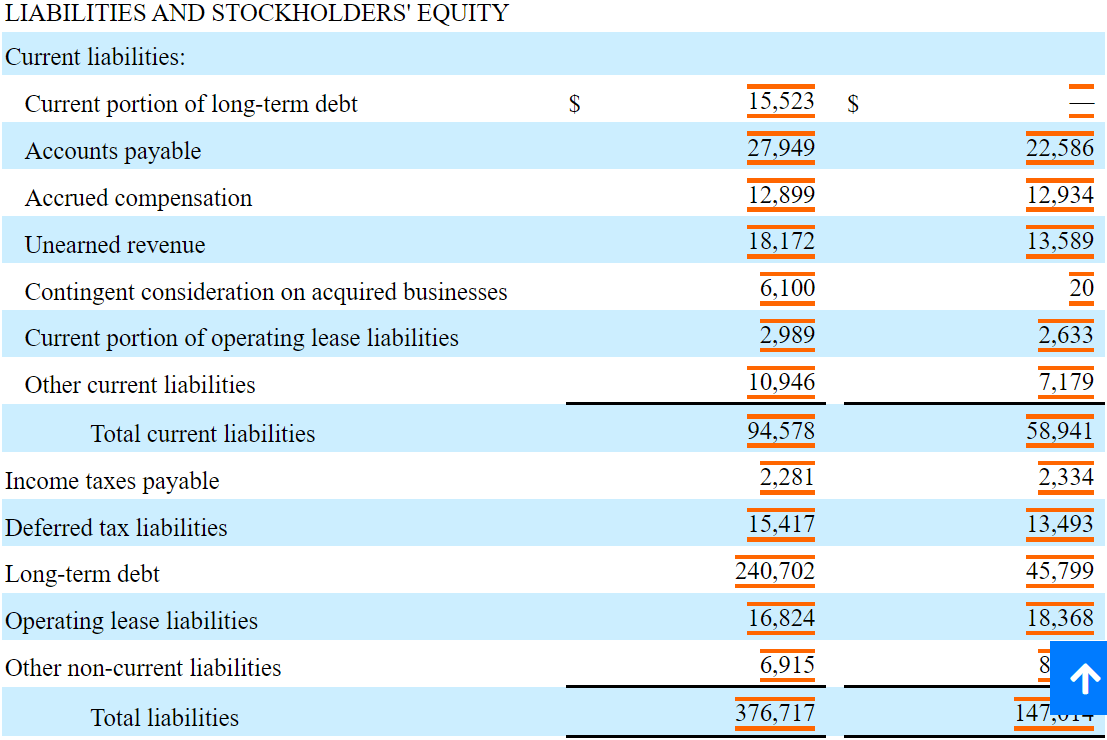

Market Estimates Include Double Digit EBITDA Growth, Less Capex, And FCF Growth

Forecasts for Digi International are quite beneficial. Sales growth is expected to be close to 23.9% in 2022, 10% in 2023, and 11% in 2024. Investment analysts also expect the EBITDA margin to be around 59% and 20%, and net income could grow from $12 million in 2022 to $49 million in 2024. I decided to run my own discounted cash flow (“DCF”) model when I saw the figures from other analysts, so I believe that readers will do good by looking at them.

Marketscreener.com

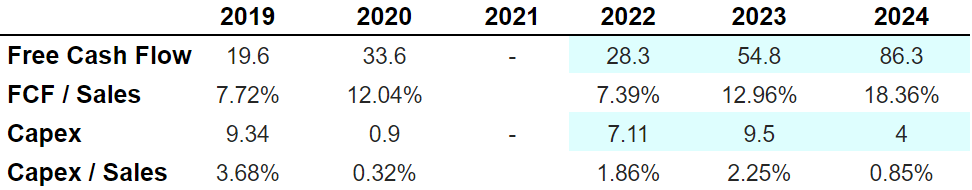

It is also worth noting that analysts expect the free cash flow (“FCF”) to grow from $28 million in 2022 to $86 million in 2024. The increase in free cash flow is not only due to increases in sales growth. Capital expenditures are also expected to decrease.

Marketscreener.com

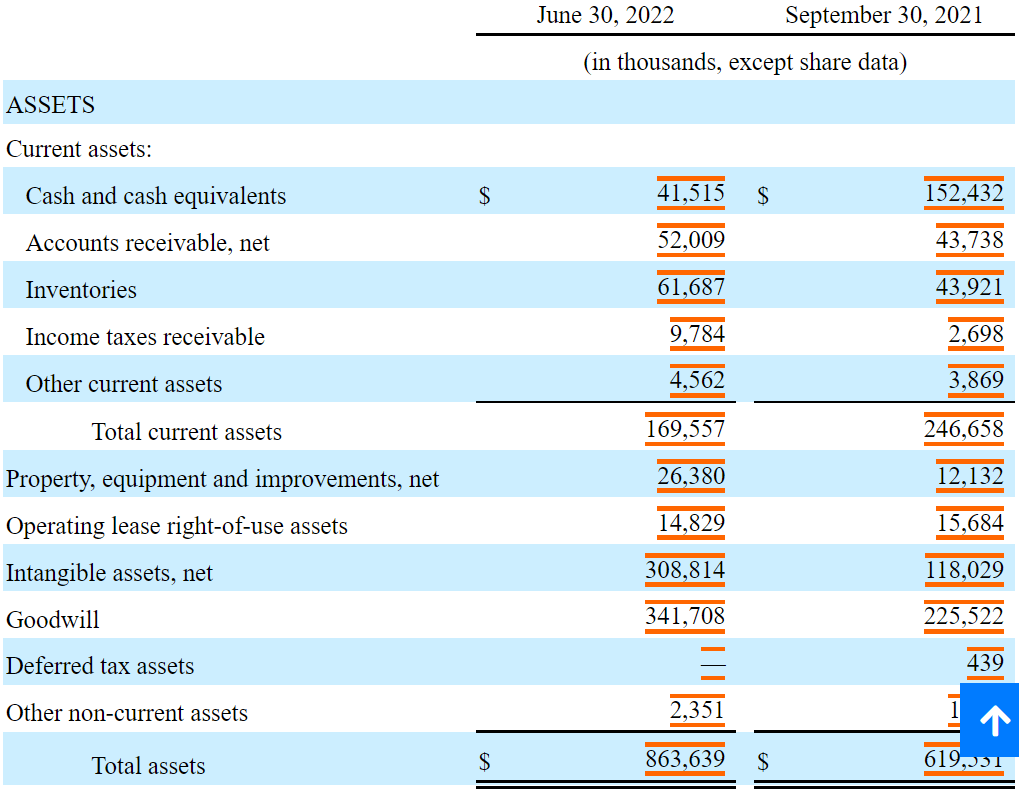

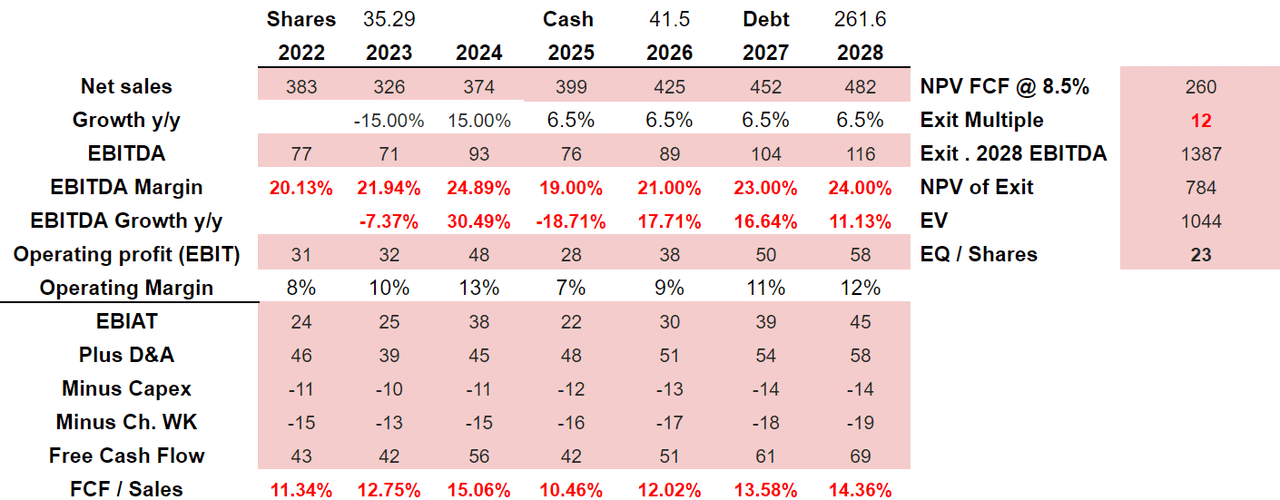

Balance Sheet: More Debt May Not Bother Certain Investors

As of June 30, 2022, with an asset/liability ratio of more than 2x and $41 million in cash, I believe that Digit’s financial shape is quite stable.

10-k

Including long term debt and a contingent consideration, I obtained a total debt of $261 million. I believe that the net debt/EBITDA of around 2x-3x is not worrying. In my view, certain investors would also expect even more leverage.

10-k

Conservative Case Scenario: Smart Cities, Reorganization Of Products, And More Acquisitions Could Mean A Valuation Of $56 Per Share

I believe that the recent information that we obtained from the most recent quarterly report throws significant light on what may be coming. In my view, an increase in the demand for new IoT products for smart cities could be very beneficial for Digi. Let’s keep in mind that the company reported an increase in the demand for these solutions in 2022. The following is a text from the last 10-Q.

Recently we have seen some resumption of opportunities to make these project based sales, most notably in the areas mass transit and smart cities. Demand generally has been strong for many products in this segment during fiscal 2022 and has driven record sales bookings and backlogs that we are constrained to meet at present because of supply chain challenges. Source: 10-Q

The smart cities market is expected to grow at a compound annual growth rate is 24.2% from 2022 to 2030 to reach USD 6,965.02 billion by 2030. Source: Smart Cities Market Size & Growth Report, 2022 – 2030

Management recently undertook certain reorganization of products and categories, which in my view could bring significant EBITDA generation in the coming years. As a result, Digi could experience significant free cash flow generation and stock appreciation in the coming years.

We have grouped our products under the following categories: Cellular Routers, Console Servers, OEM Solutions and Infrastructure Management. Consequently, the measure of segment operating profit used by our chief operating decision maker changed. Source: 10-Q

Finally, it is worth noting that in the last quarterly report, Digi International also included growing demand in sales of console server and cellular products. In my opinion, certain clients may be undertaking new deployments, and may invest more in capital expenditures in the coming years. If momentum continues to push demand up, in my opinion, Digi’s free cash flow may follow.

Increased sales of console server and cellular products in both periods driven by demand for data center and edge based deployments and increased OEM sales in the third quarter. Source: 10-Q

Finally, I would expect even more acquisitions if debt covenants don’t stop management from doing so. Let’s keep in mind that Digi International acquired several entities in 2021, and may do so from 2023. If free cash flow trends north, debt reduction may follow, which would allow more aggressive M&A strategies.

On March 26, 2021, we acquired Haxiot, Inc., a Dallas-based provider of low power wide area wireless technology.

On July 6, 2021, we acquired Ctek, Inc., a San Pedro, California-based provider that specializes in solutions for remote monitoring and industrial controls. Source: 10-k

On November 2, 2021 we announced our acquisition of Ventus Holdings. Source: 10-k

With sales growth around 11%, an EBITDA margin of 19%-24%, and operating margin close to 10%15%, I obtained 2028 EBIAT close to $83 million. Also, with D&A around $34 and $64 million, and capex close to $8 million and $14 million, the free cash flow/sales would stand at approximately 11% and 15%.

If we sum the FCF from 2022 to 2028 with a discount of 8.5%, and use an exit multiple of 12x, the enterprise value would be $1.508 billion. Now, with cash of $41 million, debt worth $261 million, and 35 million shares outstanding, the equity per share would be $36 per share.

12x EBITDA is close to the EV/EBITDA median exhibited by competitors of Digi International. Digi is trading at more expensive multiples. If we use a multiple of 19x EBITDA, the implied valuation would be closer to $56 per share, which I believe is much more appropriate for Digi International. I am assuming that in the future, the market will continue to recognize the advantages of Digi over peers, so the EV/EBITDA may be more expensive.

Arie’s DCF Model

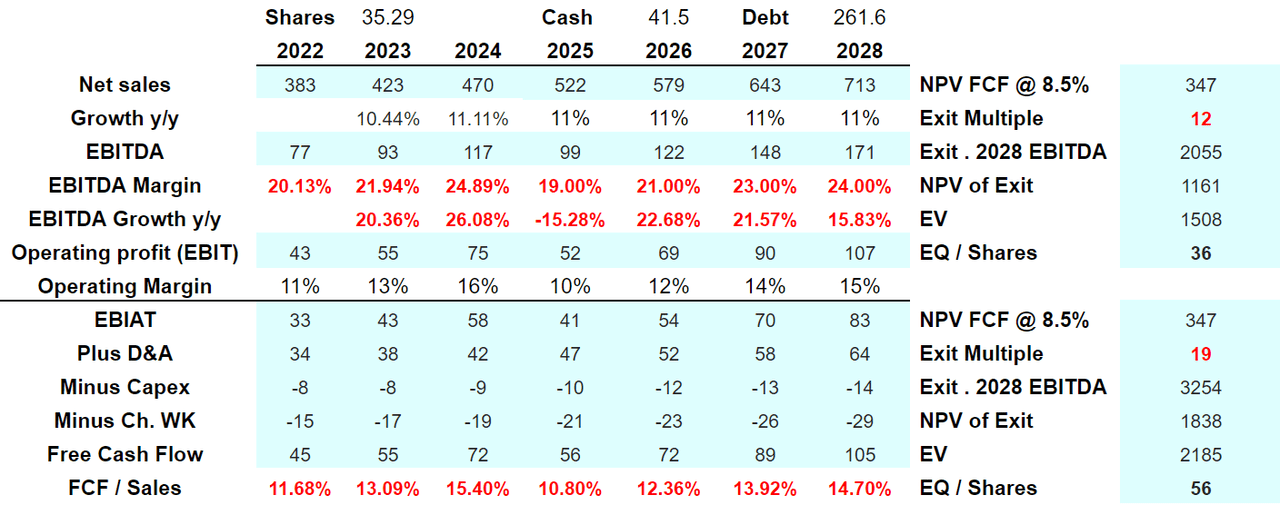

Impairment Of Goodwill, Supply Chain Disruptions, Or Lower Product Generation Would Mean A Fair Price Of $23 Per Share

Considering the level of acquisitions executed in the past, in my opinion, goodwill impairments could occur. As a result, I expect a reduction in the total amount of assets per share. Besides, perhaps less synergies may lead to fewer free cash flow expectations and less stock valuation. The company mentioned the results of some impairment tests in the last quarterly results. So far, most acquisitions are working pretty well.

SmartSense and Ventus fair values exceeded carrying values by less than 10%. We will continue to monitor potential impacts that could potentially affect our cash flows and market capitalization. Source: 10-Q

I would also note the company’s concerns about disruptions in the supply and production of components and products from China. If production does not increase as expected for a supply chain issue, the free cash flow may not grow.

We also are monitoring policy actions by the Chinese government that could cause other disruptions in the supply and production of components and products. Collectively these issues have led to shortfalls in available components we need to make products as well as increased costs to obtain components, to make products and to transport components and products. It has also lengthened the timelines for us to fulfill customer orders. Source: 10-k

Finally, Digi’s sales growth could diminish significantly as a result of a decline in the design of new products. Even considering the total amount of research and development expenses, clients may believe that the products are not necessary. Besides, if the company does not manage to sign new agreements with sales channel partners, revenue growth may be lower than expected.

If we fail to manage our existing or future sales channel partners effectively, our business and operating results could be materially and adversely affected.

If we are unable to enhance existing products and develop new products, applications and services as a result of our research and development efforts, if we encounter delays in deploying these enhanced or new products, applications and services, or if the products, applications and services we enhance or develop are not successful, our business could be harmed. Source: 10-k

Under the previous circumstances, I would expect sales growth of -15% and very pessimistic growth of 6.5% from 2025 to 2028. If we also assume capex close to $10 million and $14.5 million, 2028 FCF/Sales would stand at 15%. Finally, with an exit multiple of 12x, the implied enterprise value would stand at close to $1.05 billion, and the equity per share would be $23 per share.

Arie’s DCF Model

Conclusion

Digi International is already noticing an increase in the demand for IoT products necessary for smart cities. Besides, management noted, in a recent release, an increase in the demand for Console Servers, OEM Solutions, and Infrastructure Management. If momentum in the sales growth continues, and the EBITDA margin remains stable, stock appreciation is, in my view, very likely. Under my DCF model, under conservative assumptions, I think the stock price could reach a valuation of $56. There are obviously risks out there from supply chain issues and failed R&D development. However, I expect more good news than bad news from Digi.

Be the first to comment