zhz_akey

Welcome to the August 2022 edition of the ‘junior’ lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

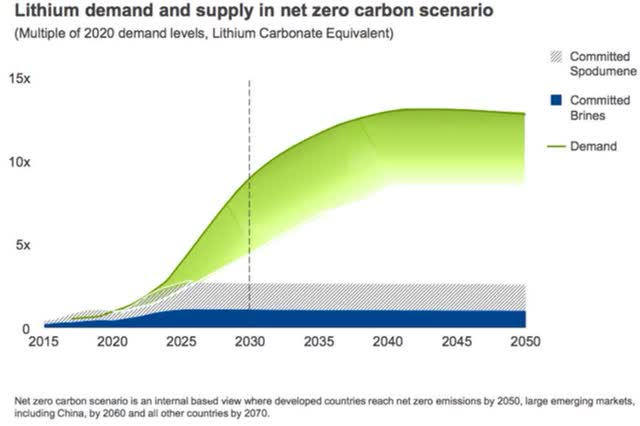

August saw plenty of great news notably from governments looking to support EVs and promote battery metal supply chains. The IEA’s report of 50 new average-sized lithium mines needed by 2030 appears to have been heard this time (last year the IEA reported the need for 13x to 42x more lithium by 2040, on 2020 levels). Biden’s Inflation Reduction Act (details here), including US$369b for climate change, showed the world the USA is now making a comeback and is serious to build a critical metals supply chain in North America and with USA free trade agreement countries.

This is all great news for the lithium juniors with demand forecast to outstrip supply this decade.

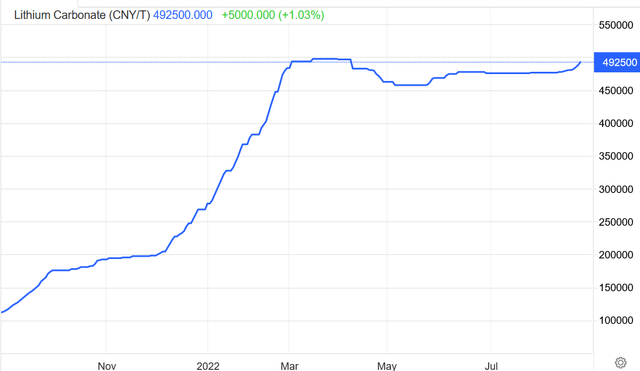

Lithium price news

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 2.82% and China lithium hydroxide prices were up 0.33%. Lithium Iron Phosphate (Li 3.9% min) prices were up 1%. Spodumene (6% min) prices were up 2.42% over the past 30 days.

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 34,535 (~USD 5,039/mt), as of August 24, 2022.

China Lithium carbonate spot price – CNY 492,500 (~USD 71,873)

Rio Tinto’s lithium emerging supply gap chart (chart from 2021)

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of August 2022” article. Highlights include:

- Tesla (TSLA) co-founder’s recycling startup is building $3.5 billion battery-material plant.

- LG Energy Solution to set up 1st Korean battery recycling plant in China.

- Race to secure battery metals heats up as GM (GM), Ford (F) ink deals.

- BMI: $200b needed to meet battery cell demand by 2030, a six-fold increase in battery demand by the end of the decade compared to 2021.

- IEA: Lithium has the largest projected demand-supply gap, requiring the equivalent of 50 new average-sized lithium mines by 2030.

- S&P: Even if every lithium project comes online we could still have a 2 million tonne deficit by 2030.

- Investing News: “The lithium market is booming. The market simply cannot keep up.”

- Insatiable lithium demand fuels investment boom in Australia. Carmakers and miners inking deals amid $42 billion funding gap.

- Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit. Details here.

- CATL to supply M3P batteries to Tesla in Q4 for Model Y, report says. M3P is an enhanced LMFP cathode doped with ternary materials.

- Mercedes (OTCPK:MBGAF) , CATL partner on $7.6 billion Hungary battery plant to produce 100GWh for EVs by mid-decade.

- China lithium prices near record as power cuts squeeze market.

- Volkswagen (OTCPK:VLKAF), Mercedes-Benz team up with Canada in battery materials push.

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On July 29, Sayona Mining announced: “June 2022 quarterly activities report.” Highlights include:

Québec, Canada

- “Sayona and Piedmont approve North American Lithium (NAL) restart, boosted by successful A$190 million placement to global institutional, professional and sophisticated investors.

- Positive Pre‐Feasibility Study highlights value of NAL operation, confirming technical and financial viability over 27‐year life‐of‐mine, with pre‐tax NPV (8% discount) of A$1 billion, IRR of 140% and capital payback within two years.

- New lithium discoveries show potential for increased resource at Moblan Lithium Project, enhancing emerging northern lithium hub.

- Positive NOVONIX battery test results reaffirm quality of Authier Lithium Project’s spodumene.

- Sayona Québec releases Corporate Social Responsibility report, highlighting commitment to sustainable development, community relations and health and safety.”

Western Australia

- “Deep diamond drilling commences at Mallina Lithium Project under earn‐in partner Morella Corporation Limited.

- Lithium targets identified at Sayona’s Mt Edon prospect.

- Maiden 60‐hole air‐core drilling program completed at Deep Well, targeting Hemi‐style gold mineralisation.”

On August 4, Sayona Mining announced: “North American Lithium restart on track for first production.” Highlights include:

- “Restart of North American Lithium (NAL) operation picks up speed, with around 30% of plant and equipment upgrade now completed, including arrival of magnetic separator and crusher…

- Project on track to deliver first spodumene (lithium) concentrate production in Q1 2023, in line with Government plan to develop 100% local battery supply chain.“

On August 5, Sayona Mining announced:

At-the-market extension and increase. Emerging lithium producer Sayona Mining Limited (ASX:SYA; OTCQB:SYAXF)is pleased to announce it has agreed with Acuity Capital to extend and increase the size of its At-the‐Market Subscription Agreement (“ATM”) (also previously referred to as a Controlled Placement Agreement). The expiry date has been extended to 31 July 2025 and the ATM facility limit has been increased to $200 million…

Upcoming catalysts include:

- 2022 – Authier permitting. Possible project financing and off-take.

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium [ASX:PLL] (Nasdaq:PLL)

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

No significant news for the month.

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Q1 2023 – NAL (25% Piedmont Lithium) production set to begin.

You can view the company’s latest presentation here.

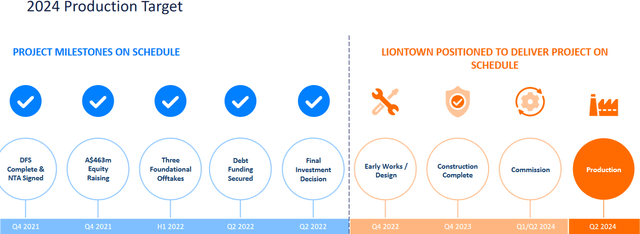

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On July 28, Liontown Resources announced: “June 2022 quarterly report.” Highlights include:

Kathleen Valley Project Development:

- “With high-calibre foundational offtake agreements in place with Ford, Tesla and LG Energy Solution, and financing commitments secured, the Liontown Board made the Final Investment Decision (FID) to proceed to develop Kathleen Valley.

- Accommodation village design, build and construction awarded to ADD Business Group, with building manufacture and site installation works commencing during the quarter.

- Front-end Engineering and Design (FEED) activities continued with a focus on advancing detailed design for the crushing and milling process areas.

- Procurement packages substantially advanced including the award of 75% of long-lead process equipment (by value)…“

Financing:

- “In late June, the Company executed a binding full-form funding facility agreement (Funding Facility) with Ford for a A$300 million debt facility.

- The Funding Facility, together with the A$463 million raised by Liontown in December 2021, means that Liontown has now secured commitments for the required funds to support the full development of the Project through to first production.

- The senior-secured Funding Facility has a 5-year maturity from supply commencement date and interest is payable at the Bank Bill Swap Rate (BBSW) plus a fixed margin of 1.5%.

- …Cash balances and funds on deposit as at 30 June 2022 of A$453 million.“

You can view the company’s latest presentation here.

Upcoming catalysts include:

- 2023: Kathleen Valley Project construction

- Q1, 2024: Commissioning with production set to begin Q2, 2024

Liontown Resources is fully funded for production start in H1 2024

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On July 28, Vulcan Energy Resources announced: “Local council approvals and license grant at Zero Carbon Lithium™ Project.” Highlights include:

-

“Eight local councils have approved Vulcan’s upcoming 3D seismic programme of works in Rhineland-Palatinate region.

-

Exploration Licence area increased by 277km 2 to a total of 1,440km2.”

On July 28, Vulcan Energy Resources announced: “Quarterly activities report June 2022.” Highlights include:

- “Vulcan agreed a A$76M (€50M) equity investment from Stellantis (NYSE / MTA / Euronext Paris: STLA, Stellantis), which is understood to be the world’s first upstream investment by a top tier automaker into a listed lithium company. In addition to becoming Vulcan’s second largest shareholder, Stellantis extended their binding lithium hydroxide offtake agreement by five years, to 2035.

- Vulcan and MVV Energie AG (MVV), the largest municipal energy supplier in Germany, executed a binding purchase agreement for Vulcan to sell 240 gigawatt hours per year of renewable heat for the next 20 years.

- Vulcan’s Upper Rhine Valley Brine Field (URVBF) license area increased by 141km2 to a total of 1,163km 2 with the acquisition of new exploration licenses…

- Work on the Definitive Feasibility Study is progressing as Vulcan aims to upscale its production plans significantly, to produce more lithium hydroxide and meet customer demand for Vulcan’s Zero Carbon Lithium™ product.

- Vulcan’s pilot plant has now been successfully operating for 15 months, testing “live” brine from two different geothermal plants, including Vulcan’s commercially operational NatürLich Insheim plant.

- Strong cash position of €175.3m ($266m) at 30 June 2022.

- The Company’s sustainability framework, which outlines ESG initiatives, targets and risks, was launched.

- Community support for geothermal production and lithium extraction continued to grow with the City Council of Landau voting to support geothermal energy production, and the cross-border Upper Rhine Council voted in favour of deep geothermal and lithium extraction in the region.

- Currently, eight local councils have approved Vulcan’s upcoming 3D seismic program of works in Rhineland-Palatinate region, in a strong demonstration of support for the Zero Carbon Lithium™ Project.

- Refurbishment of Vulcan’s electric drill rigs continues, ahead of operational readiness early 2023.

- Preassembly works for Vulcan’s sorption-demo plant are ongoing, ahead of the shipment to the construction site at Landau.“

Subsequent events post-Quarter:

- “Vulcan and Enel Green Power (EGP) signed a binding collaboration agreement to explore and develop its Cesano license in Italy through a joint scoping study…

- Vulcan received a positive result for its preliminary EIA application (UVP-V) in its Taro license, to drill six wells for geothermal energy and lithium…

- Vulcan was granted a new exploration license, designated Ried, increasing the Company’s license area in the Upper Rhine Valley Brine Field (URVBF) by 277km2 to a total of 1,440km2.”

On August 8, Vulcan Energy Resources announced: “Upcoming release of shares from Escrow.”

Upcoming catalysts include:

- H2 2022 – DFS, potential permitting and project funding.

- 2024 – Target to commence production.

POSCO [KRX:005490] (PKX)

On July 28, Yonhap News Agency reported:

POSCO Chemical bags US$10.8 bln additional deal to supply EV battery component to GM. POSCO Chemical Co. will supply a key electric vehicle (EV) battery component to General Motors Co. for three years starting 2023, in an additional US$10.8 billion deal expected to give a boost to the South Korean firm’s pivot to the battery materials sector…

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY)(took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On July 29, AVZ Minerals announced: “Activities report for the quarterending 30 June 2022.” Highlights include:

- “DRC Minister of Mines signed Ministerial Decree to award the Mining Licence for the Manono Lithium and Tin Project (Manono Project) to Dathcom Mining SA.

- DRC Mining Code required Cadastre Minier (CAMI), operating under the supervision of the Minister of Mines, to calculate the surface rights fee and officially award the Mining Licence following receipt of payment.

- Ministerial Decree to award the Mining Licence covered the entirety of the Roche Dure JORC Mineral Resource and Reserve2&3 and the Carriere de l’Este exploration target.

- An area which was excluded under the Ministerial Decree to award the Mining Licence will be renewed under a new 5-year Exploration Licence to Dathcom with discussions regarding the terms of the ongoing joint venture under discussion with the DRC Government.

- Completion of US$240M cornerstone investment with Suzhou CATH Energy Technologies extended by mutual agreement to 31 July 2022.

- Request for arbitration received from Jin Cheng Mining Company Limited, the DRC arm of Zijin Mining Corporation.

- Inaugural 2021 Sustainability Report published in June.”

On August 15, AVZ Minerals announced: “Request for extension to voluntary suspension.”

Upcoming catalysts include:

- 2022 – Initial project work. FID on the Manono Project.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Standard Lithium [TSXV:SLI] (SLI)

No significant news for the month.

Leo Lithium Limited [ASX:LLL] (OTCPK:LLLAF) (Firefinch Limited spinout 50/50 JV with Ganfeng Lithium)

On August 17, Leo Lithium announced: “ATO ruling – Leo Lithium demerger.”

On August 22, Leo Lithium announced: “Escrowed shares – application for waiver and waiver decision… ASX has determined that it will not grant the waiver requested as the proposal.”

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On July 27, Critical Elements Lithium Corp. announced: “Critical Elements files NI-43-101 technical report for the Rose Lithium-Tantalum feasibility study.”

On August 11, Critical Elements Lithium Corp. announced: “Critical Elements complete Positive Engineering Study for a Lithium Hydroxide Monohydrate Plant.”

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Global Lithium Resources [ASX:GL1]

On July 28, Global Lithium Resources announced: “Quarterly report for the period ending 30 June 2022.” Highlights include:

- “Significant high grade lithium assay results continue to be delivered from ongoing reverse circulation (RC) drilling campaign at the Marble Bar Lithium Project (MBLP) in the Pilbara region, Western Australia (refer ASX releases 2 May and 10 June 2022).

- Results include: 11m @ 1.42 Li 2O and 62ppm Ta2O 5 from 25m in MBRC0258. 12m @ 0.88% Li 2O and 44ppm Ta2O 5 from 82m in MBRC0269. 9m @ 1.09% Li 2O and 61ppm Ta2O 5 from 44m in MBRC0270…

- Wide intervals from the drilling continue to demonstrate the robustness of the MBLP and enhance the opportunities for increasing the resource base in proximity to the current Archer deposit and along strike further to the south and east.

- Potential for lithium demonstrated in the east towards the Brockman Zone where a number of drillholes intercepted wide zones of lithium mineralisation – 12m @ 0.53% Li 2O and 20m @ 0.47 Li 2O in MBRC0236 in an area previously unexplored.

- Additional outcropping lithium targets remain untested by drilling…

- Significant intervals of lithium mineralisation intersected from early RC drilling at the Manna Lithium Project (Manna) in the Goldfields region, Western Australia.

- The program validates previous drilling and resource information, further extending the orebody at depth which remains open…

- Manna East Pegmatite showing increasing width with depth: MRC0032 9m @ 1.29% Li 2O from 110m…”

On August 1, Global Lithium Resources announced: “New lithium bearing pegmatite at Marble Bar Lithium Project. Further significant intersections reported including 9m @ 1.32% Li2O, 8m @ 1.26 Li2O and 7m @ 1.67 Li2O.” Highlights include:

- “New LCT pegmatite – the Lantern Prospect – located along the eastern side of the Marble Bar Lithium Project (MBLP) in the Pilbara region of Western Australia…”

On August 10, Global Lithium Resources announced:

Exceptional Manna drilling results include 24m @ 1.03% Li2O. Significant extension to resource along strike and down dip…

On August 19, Global Lithium Resources announced:

Positive initial metallurgical test work results received for Marble Bar Lithium Project. Preliminary test achieved a grade of 5.9% Li2O with a recovery rate of 76%.

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On July 25, Proactive Investors reported:

Savannah Resources rocked by possible legal action. Savannah Resources PLC (AIM:SAV, ETR:SAV, OTC:SAVNF) shares tumbled on Monday after it confirmed that it has been included in a civil claim relating to its acquisition of certain properties at its Barroso lithium project in Portugal. Savannah has been asked to submit its defence to the proposed legal action before the end of September 2022 and will be working with its Portuguese counsel on this, the statement added…

Upcoming catalysts include:

2022 – EIA permit due.

2023 – DFS due.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources owns the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On July 29, Lake Resources announced:

Quarterly report for the quarter ended 30 June 2022… Discussions continue with Ford Motor Co., Hanwa Corporation under non-binding MOU’s and others for offtake of lithium carbonate from Kachi Project. Definitive Feasibility Study (DFS) continues to advance with final drafts expected toward the end of 3Q 2022, based on 50,000 tonnes per annum lithium carbonate equivalent (LCE) for the Kachi project. Discussions continue with UK Export Finance (UKEF) and Export Development Canada (EDC) to support approximately 70% of the total finance required for Kachi’s expanded production, subject to standard project finance terms. Drilling continuing with the arrival of a second drilling rig during the quarter at Lake’s 100 percent owned lithium brine projects at Olaroz, Cauchari and Paso, Argentina, to ensure multi-asset lithium expansion. Demonstration plant arrived in Argentina and is now on site and being assembled prior to commissioning following construction of the facility housing the demonstration modules. Lake is well-funded. Cash balance of A$173 million (US$120m) as at end of financial year increased due to conversion of A$62m of options in June. The company would like to thank shareholders for their ongoing support.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater (SBSW) for US$490m.

On July 25, ioneer Ltd announced: “Quarterly activities report for the period ending 30 June 2022.” Highlights include:

- “…Lithium offtake discussions advancing.

- Permitting advancing with revised Plan of Operations resubmitted to BLM in early July. NOI to start NEPA process expected shortly.

- Detailed due diligence process continuing with US Department of Energy’s Loan Programs Office.

- Detailed engineering and procurement activities advanced.

- ESG programs in development and being incorporated into business…”

On August 1, Reuters reported:

Toyota-Panasonic battery JV to buy lithium from ioneer’s Nevada mine… ioneer will supply 4,000 tonnes of lithium carbonate annually for five years to Prime Planet Energy & Solutions (PPES), which was formed by Toyota and Panasonic in 2020… Supplies are slated to begin in 2025, a timeline that depends in part on ioneer obtaining financing and permitting.

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

On July 29, European Metals Holdings announced:

Quarterly activities report – June 2022. During the reporting period, European Metals was accepted to trade on the globally renowned US based OTCQX® Best Market Platform. The Company commenced trading under the codes EMHXY, ERPNF and EMHLF on 12 May 2022…

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

Galan Lithium [ASX:GLN] (OTCPK:GLNLF)

Galan is developing its flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On July 28, Galan Lithium announced: “Quarterly activities report June 2022.” Highlights include:

- “Outstanding initial well test results reported from first Pata Pila pumping well (PPB-01-21) at HMW Project. Brine sampling confirmed high grade resource (Li > 910 mg/L). Hydraulic testing demonstrated favourable conditions for high volume brine production (15 – 20L per second). Long term (30-day) pumping tests underway and flowing steadily.

- Positive results returned from porosity test (RBRC) on second Pata Pila well core samples (range of 10.21 – 21.0%, mean of 14.1%).

- Pumping tests to be completed on three further wells: a second well at Pata Pila and two wells at Rana de Sal.

- HMW Project Definitive Feasibility Study activities continued during the quarter.

- First pegmatite lens discovered at Greenbushes South. Airborne radiometric, magnetic and DEM survey data processed. Interpretation provided 18 key target zones for lithium pegmatites near the mineralising Donnybrook-Bridgetown Shear Zone. Further soil samples and rock chips sent for geochemical analysis.

- Galan continues to adhere to Covid-19 protocols in Argentina, Chile and Australia with personnel and community health and safety its number one priority.

- Cash on hand at end of quarter was ≈A$54 million.”

On August 1, Galan Lithium announced: “Greenbushes South exploration update. New pegmatite discovery, anomalous lithium soils and pilot geophysics.” Highlights include:

- “Discovery of new outcropping pegmatite with 500m+ strike length; remains open along strike with geological mapping ongoing.

- New soil assays spatially associated with prior pegmatite discovery reveal up to 215 ppm Li; further soil and rock chip assay results pending.

- UltraFine+ assay method also confirms presence of anomalous pathfinder element concentrations (As, Cs).

- Pilot ground geophysics program in process, consisting of passive seismic (HSVR), gravity and resistivity methods.

- Processed HSVR and gravity data outcomes expected in next few weeks.”

Cypress Development Corp. (TSXV:CYP) (OTCQX:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

On August 4, Cypress Development Corp. announced: “Cypress Development announces drill results from Clayton Valley Lithium Project, Nevada.” Highlights include:

- “Best intersection of 70.1 meters of 1,336 parts per million (“ppm”) lithium.

- …Acquired 15 tonnes of claystone for testing at the Company’s Pilot Plant.

- Confirmed resource model built by Global Resource Engineering (“GRE”).

- Confirmed drill data obtained in the acquisition of Enertopia Corporation (“Enertopia”) property.”

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On August 17, Frontier Lithium reported: “Frontier intersects 357.5m of high-grade lithium averaging 1.63% Li2O over a horizontal distance of 110 metres and remains open.” Highlights include:

- “Phase XII delineation and infill drilling with two drill rigs is currently being conducted, whereby, the Company has completed 8,000m of drilling in 24 holes at the time of this press release. Currently, analysis from 8 of the holes have been received; 4 of which were reported in the July 25th press release and the remaining 4 are reported herein.

- DDH PL-059-22 intersected 145m of pegmatite over a 316m interval from surface with an average grade of 1.5% Li2O along with some minor mafic volcanic sheets (<6m apparent width).

- DDH PL-060-22 intersected 357.5m of spodumene-bearing pegmatite averaging 1.63% Li2O throughout the entire hole representing a horizontal distance of 110m. An enriched 28 m tantalum-rubidium-tin zone was intersected from 84 to 112m grading 370 ppm Ta2O5, 0.62% Rb2O and 328 ppm SnO2. Hole was terminated in spodumene-bearing pegmatite at 360m (vertical depth of 345m).

- DDH PL-061-22 was collared in pegmatite intersecting 280.7m averaging 1.42% Li2O. Hole was terminated in mafic volcanics prior to intersecting the southernmost identified zone of the pegmatite and will be extended.

- DDH PL-068-22 intersected spodumene pegmatite zones typically 20 to 50 m thick with grades ranging from 1.42% to 2% Li2O; Includes 12m zone from 28 to 40m averaging 3% Li2O. Also includes elevated Ta (213 ppm Ta2O5) from 59.3 to 66.3m.”

Patriot Battery Metals [TSXV:PMET] (OTCQB:PMETF)

Patriot Battery Metals own the Corvette Lithium Project in James Bay, Quebec. No resource yet but some great long length drill results.

On July 28, Patriot Battery Metals announced: “Patriot drills 1.25% Li2O over 96.9 m in first drill hole of summer program, and extends strike length of pegmatite to 1.9 km, Corvette, Quebec.” Highlights include:

- “Strong lithium grades over wide intervals returned from first two drill holes completed during the summer phase of the 2022 drill campaign. 1.25% Li2O and 118 ppm Ta2O5 over 96.9 m, including 2.53% Li2O and 130 ppm Ta2O5 over 27.0 m (CV22-035). 1.38% Li2O and 99 ppm Ta2O5 over 27.0 m, and 2.00% Li2O and 167 ppm Ta2O5 over 7.3 m (CV22-036).

- …The main pegmatite body has now been traced through drilling over a strike length of approximately 1,900 m and remains open in all directions.

- A third drill rig and barge have now been mobilized to the drill area and is expected to collar shortly.

- A total of 10,355 m over thirty-six (36) holes have now been completed over the 2022 drill campaign – 4,345 m over 20 holes in the winter program, and 6,010 m over sixteen (16) holes in the summer program.”

On August 4, Patriot Battery Metals announced: “Patriot achieves 6% Li2O spodumene concentrate grade in preliminary HLS metallurgical test work on the CV5 pegmatite at the Corvette Property, Quebec.”

On August 10, Patriot Battery Metals announced: “Patriot discovers new lithium pegmatite cluster on-trend with the CV5 pegmatite and samples 3.73% Li2O, Corvette Property, Quebec.”

- “…Approximately 20 km of prospective CV Lithium Trend/Corridor remains to be prospected for lithium pegmatite, including the majority of the Felix, Deca-Goose, and Corvette East claim blocks…

- Due to the CV13 Pegmatite discovery, the surface program has been extended until mid‑October / first snowfall and will continue with mapping, channel sampling, and prospecting across the Property.”

Lithium Power International [ASX:LPI] (OTCPK:LTHHF)

LPI is consolidating to own 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd.

On July 28, Lithium Power International announced: “Activity report for the quarter ended June 2022.” Highlights include:

- “Consolidating 100% ownership of Maricunga Lithium Brine Project in Chile by way of a three-party all-scrip merger with our JV Partners: The transactions will increase the current LPI shareholders’ proportionate interest in Maricunga from 51.55% to ~57.9%. LPI will consolidate the ~48.45% of the project that it does not currently own at a valuation discount of ~17.1%2 compared with LPI’s current look-through value of Maricunga. By holding 100% ownership of the project, LPI will simplify decision making and provide the optimal structure to oversee and fund the rapid development of Maricunga.

- Significantly increased tenement holdings in Western Australia, to become the largest coverage in the Greenbushes Region: The acquisition of CMC Lithium and its Greenbushes Project in Western Australia adds an extra 365km2 of prospective ground around Talison Lithium’s Greenbushes Mine, the world’s largest hard-rock spodumene operation.

- Acquisition of two tenements in the mineral rich Eastern Goldfields of WA, granting LPI tenements in each of the three major WA hard rock lithium areas – Greenbushes, the Pilbara Craton and the Eastern Goldfields.”

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

On August 2, American Lithium Corp. announced: “American Lithium announces financial and operating results for the period ended May 31, 2022.” Highlights include:

- “Launch of final phase of PEA compilation at TLC – appointment of DRA Global as lead engineer to finalize the TLC PEA, along with Stantec Consulting and ANSTO Minerals, Australia who have deep collective expertise in lithium processing, resource calculation and mine / project design and construction.

- Acquisition of water rights for TLC – agreement to acquire 431 acres of privately held agricultural lands near TLC, along with the accompanying 1,468 acre-feet of water rights for consideration of US$3.125 million. This brings the total water rights owned by the Company to approximately 2,500 acre-feet, which is expected to provide sufficient water for at least the initial phases of future production at TLC…”

On August 24, American Lithium Corp. announced:

American Lithium commences EIA drilling at Falchani and awards PEA update work to DRA Global and Stantec Inc.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On August 9, Wealth Minerals announced:

Wealth Minerals enters into strategic partnership with thyssenkrupp Mining Technologies for development of Ollagüe Salar. Under the Strategic Partnership, Wealth Minerals and thyssenkrupp Mining Technologies will collaborate to: Identify, evaluate and select the most beneficial and environmentally sustainable processing technology for lithium extraction and purification treatment for the Ollagüe Project. Develop the Ollagüe Project from the exploration stage through to commercial scale production capacity of high-purity lithium products. Define new standards in green mining and foster the involvement of local communities in Chile.

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OU7A] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On July 28, E3 Lithium Ltd. announced:

E3 Lithium completes first production of commercial scale sorbent. “We are extremely pleased with the results of our first commercial production of sorbent and its high lithium recovery rates,” said Chris Doornbos, President and CEO of E3. “This commercially-produced sorbent provides confidence in the viability of scaling up E3’s production to deliver the larger volumes of high-quality sorbent needed for commercial operations.”

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCQB:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

No news for the month.

Arena Minerals [TSXV:AN] (OTCQX:AMRZF)

On August 8, Arena Minerals announced: “Arena Minerals strategic shareholders to exercise warrants for $7,368,000…”

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

No lithium news for the month.

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On August 10, Lithium South Development Corp. announced: “High grade lithium discovery at Alba Sabrina Claim Block.” Highlights include:

- “Five double packer samples obtained from first hole AS01.

- Lithium values range from 732 mg/l lithium to 772 mg/l lithium.

- Lithium magnesium ratio remains favorable at under 4 to 1.

- Drilling will continue to basement rock.”

On August 17, Lithium South Development Corp. announced: “Second drill rig added to HMN Lithium Project, Argentina.”

On August 19, Lithium South Development Corp. announced:

Evaporation test work underway at HMN Li Project. The Company is pleased to provide an update on process test work currently being conducted on a 12,500-liter bulk brine sample from the Hombre Muerto North Lithium Project (HMN Li Project), located in Salta. Argentina. The purpose of the test work is to validate evaporation as a viable concentration method to produce battery grade lithium carbonate… We are pleased to report lithium recoveries of 86% for the pre-concentration evaporation, 80% for liming and 97% for concentration evaporation. The cumulative lithium recovery after these front-end stages was 67%.

Alpha Lithium [TSXV:ALLI][GR:2P62] (OTCPK:APHLF)

On August 8, Alpha Lithium announced:

Alpha Lithium =conditionally approved to upgrade listing to Senior Canadian Stock Exchange… Upon uplisting to the NEO Exchange, the Company will delist from the Canadian TMX Group’s venture exchange, the TSXV. Trading of the Company’s securities will not be disrupted in any way.

On August 16, Alpha Lithium announced: “Alpha Lithium reports first operational results in Hombre Muerto Salar, Argentina.” Highlights include:

- “Company Reports Vertical Electrical Sounding (“VES”) Results on its Santo Tomas Property in Hombre Muerto Salar.

- Company Progresses Additional VES Campaign on its Gran Victoria Property in Hombre Muerto Salar.

…Exploration and drilling activity by surrounding competitors indicate Alpha’s property should contain a prolific lithium brine aquifer. Two nearby wells, both drilled within 300 meters of Santo Tomas’ boundaries, produced at highly significant flow rates with at least one of the wells returning lithium concentrations better than 750 mg/L, which is typical in the Salar del Hombre Muerto. The results of the VES evaluation indicate the presence of three large units, all of which are expected to be productive…”

On August 23, Alpha Lithium announced:

Alpha Lithium announces maiden resource at Tolillar Salar, Argentina. The resource estimate includes 2,119,000 tonnes of indicated, and 1,158,000 tonnes of inferred, lithium carbonate (“Li2CO3”) equivalent (“LCE”). The resource estimate also includes 7,387,000 tonnes of potassium equivalent (“KCl”) in the indicated category and a further 4,786,000 tonnes of KCI in the inferred category… Only 9,000 (33%) of the 27,500-hectare site has been explored…

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M&I Petalite Zone Resource of 6.28mt grading 1.37% Li2O, plus an Inferred Resource of 0.94mt at 1.3%. Avalon also has a Partnership JV Agreement with Indian conglomerate Essar to establish Ontario’s first regional lithium battery materials refinery in Thunder Bay.

On August 17, Avalon Advanced Materials announced:

Avalon provides update on Separation Rapids Lithium Project… The 5,000 tonne bulk sample collected from the project site in 2021 will now be crushed and returned to the Quarry site as initial feed for the DMS Plant to begin producing petalite concentrate product samples for the many international glass-ceramic manufacturers that have expressed interest…

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On July 29, Essential Metals announced: “June 2022 quarterly report. Outstanding high grade lithium drill results from shallow Resource drilling enhance the potential economics of the Dome North lithium Resource.” Highlights include:

- “Pioneer Dome Lithium Project, WA… Cade Deposit: 19.2m @ 1.44% Li2 O from 15m (PDD596)…

- Three composite samples were selected to represent the upper zone of the Cade deposit, the upper zone of the Davy deposit and the fresh rock zone of the Davy deposit for metallurgical test work, complementing the successful test work already completed on the fresh rock zone of the Cade deposit...

- Closing cash on hand as at 30 June 2022 was $10.5 million.

- Corporate: An unsolicited, confidential, non-binding indicative takeover proposal was received in April from a credible lithium industry participant to acquire 100% of the issued capital of Essential by way of an off-market takeover, however it was subsequently withdrawn in light of the upward trajectory in the trading price of Essential shares around that time.“

On August 12, Essential Metals announced:

Pioneer Dome drilling nearing completion – results to underpin Resource update and Scoping Study. The current Resource extension drilling program is expected to be completed in the next two weeks, with assays expected by end-October to feed into a Mineral Resource update…

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a projects (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On July 29, Green Technology Metals announced: “Quarterly activities report for the quarter ended 30 June 2022.”

On August 8, Green Technology Metals announced: “Drilling to commence at Root…

- …Demonstrated down-dip continuity at McCombe with prior intercepts including 67m @ 1.75% Li20.

- Mapping suggests potential for extensive 7 km pegmatite west-east strike extent across Root.

- First drill rig on site, second mobilising; drilling to commence in August.

- Drilling of GT1’s flagship Seymour Project continuing in parallel.“

On August 12, Green Technology Metals announced: “Quarterly activities report addendum for the quarter ended 30 June 2022…”

On August 22, Green Technology Metals announced: “Further extensional drilling success at North Aubry.” Highlights include:

- “…Hole GTDD-22-0323 intersected 17.9m and 7.7m thick pegmatites with significant intercepts: 6.0m @ 1.37% Li2O (from 218.9m to 225.0m); and 3.6m @ 2.08% Li2O (from 378.3m to 382.0m)…

- Root hosts known high-grade pegmatites ready for drilling and Mineral Resource Estimation.”

International Lithium Corp. [TSXV:ILC] [FSE: IAH] (OTCQB:ILHMF)

No news for the month.

Lithium Energy Limited [ASX:LEL]

On August 18, Lithium Energy Limited announced: “Highly encouraging geophysics paves way for commencement of drill testing of brines at Solaroz.” Highlights include:

- “Lithium Energy’s Solaroz Lithium Brine Project is located in the highly prospective Lithium Triangle in Argentina and is directly adjacent to or principally surrounded by lithium majors Allkem Limited (ASX/TSX:AKE) and Lithium Americas Corporation (TSX/NYSE:LAC).

- Interpretation of geophysics completed to date confirms the presence of significant volumes of potentially lithium hosting brines at Solaroz, consistent with the Exploration Target previously announced by the Company.

- Geophysics have encouragingly indicated brine thicknesses up to 300 metres and to depths up to 500 metres below surface in sections.

- Geophysics data collection and interpretation is progressing to build a complete picture of the Solaroz Project.

- Priority drill targets have now been established for an initial drilling programme which will test the extent and grades of lithium mineralisation, porosity and flow rates across the layer(s) of conductive brines which have been identified by the geophysics.

- Site preparation works for commencement of drilling are currently underway, with 5,000 metre drill programme to commence shortly.

- The initial drilling programme will seek to validate the Exploration Target previously announced by the Company and define a maiden JORC Mineral Resource of lithium at Solaroz.”

Argentina Lithium and Energy Corp. [TSXV: LIT] (OTCQB:PNXLF)

No significant news for the month.

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On August 23, Rock Tech Lithium announced:

Strategic partnership: Mercedes-Benz intends to source battery material lithium hydroxide from Rock Tech Lithium… Under the intended binding agreement, Rock Tech has agreed to deliver up to 10,000 tonnes per year of its planned production to the premium manufacturer and its partners starting in 2026. The two companies made the announcement on Tuesday during a visit to Canada by a business delegation from Germany led by Chancellor Olaf Scholz…

Neometals (OTC:RRSSF) (Nasdaq:OTCPK:RDRUY) [ASX:NMT]

On July 29, Neometals announced: “Quarterly activities report for the quarter ended 30 June 2022.”

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On August 5, Nano One Materials announced: “Nano One provides quarterly progress update and reports Q2 2022 results.” Highlights include:

- “Working capital of ~$47.5 million; cash of ~$47.9 million.

- Acquisition of Johnson Matthey Battery Materials.

- Joint Development Agreement with BASF.

- Strategic Investment by Rio Tinto for ~$12.5 million.”

On August 23, Nano One Materials announced: “Nano One receives C$1.8M towards SDTC milestone 4 and granted 2 patents.”

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY] (OTCQB:ANSNF), Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF), Bryah Resources Ltd [ASX:BYH] (BYHHF), Carnaby Resources Ltd [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC] (OTCQB:ELECF), Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), European Lithium Ltd [ASX:EUR] (OTCQB:EULIF), Foremost Lithium Resource & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (OTCQB:HXLTF) (formely Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR] (OTC:HHNNF), Infinity Lithium [ASX:INF] (OTCPK:INLCF), International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION] (OTCQB:IONGF), Jadar Resources Limited [ASX:JDR], Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (OTCPK:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI] (OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH] (OTCQB:LTHCF), Lithium Plus Minerals [ASX:LPM], Metals Australia [ASX:MLS] (OTC:MTLAF), MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Portofino Resources Inc.[TSXV:POR] [GR:POT] (OTCQB:PFFOF), Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Prospect Resources [ASX:PSC] (OTCPK:PRSTF), Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Snow Lake Lithium (LITM), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX] [FSE:1T0] (OTCQB:TTLXF), Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Winsome Resources Limited [ASX:WR1], Xantippe Resources [ASX:XTC] (OTCPK:XTCPF), Zinnwald Lithium [LN:ZNWD] (OTCPK:ZNWLF).

Conclusion

August saw lithium chemicals prices and spodumene prices higher.

Highlights for the month were:

- Demand for lithium insatiable. IEA says 50 new average-sized lithium mines needed by 2030.

- Sayona Mining/Piedmont Lithium NAL operation ~30% of plant and equipment upgrade completed, on track for Q1, 2023 production restart.

- Liontown Resources Kathleen Valley Project fully funded to production start in H1, 2024. Offtake agreements in place with Ford, Tesla and LGES.

- Global Lithium Resources discovers new LCT pegmatite – the Lantern Prospect – located along the eastern side of the Marble Bar Lithium Project.

- Toyota-Panasonic battery JV to buy lithium from ioneer’s Nevada mine.

- Galan Lithium makes new outcropping pegmatite discovery with 500m+ strike length at Greenbushes South.

- Frontier Lithium intersects 357.5m of high-grade lithium averaging 1.63% Li2O.

- Patriot Battery Metals drills 1.25% Li2O over 96.9m in first drill hole of summer program and discovers new lithium pegmatite cluster on-trend with the CV5 pegmatite. Achieves 6% Li2O spodumene concentrate grade in preliminary HLS metallurgical test work.

- Lithium Power International is consolidating to own 100% of the Maricunga Lithium Brine Project in Chile, plus plans to demerge its Australian assets into a new company called Western Lithium Ltd.

- Lithium South Development Corp. announces high grade lithium discovery (732 mg/l lithium to 772 mg/l lithium) at Alba Sabrina Claim Block.

- Alpha Lithium reported from Hombre Muerto: “at least one of the wells returning lithium concentrations better than 750 mg/L.” Maiden Resource at Tolillar Salar, Argentina of 2,119,000 tonnes of indicated, and 1,158,000 tonnes of inferred LCE from 1/3 of the salar.

- Essential Metals Pioneer Dome drill results to lead to a Mineral Resource update soon.

- Lithium Energy Limited: Highly encouraging geophysics paves way for commencement of drill testing of brines at Solaroz.

- Mercedes-Benz intends to source battery material lithium hydroxide from Rock Tech Lithium.

As usual all comments are welcome.

Be the first to comment