alacatr

Thesis

Stanley Black & Decker (NYSE:SWK) invested in inventory during an unfavorable macro environment, which negatively impacted its working capital and free cash flow. The company and the industry are in distress as the housing market is cooling down on increasing interest rates and high inflation.

Historically, these factors are temporary. Back in 2007/2008, after the global financial crisis, SWK and the housing market were under similar distress, which was the perfect environment for value investors to invest in SWK to make a market-beating return.

We can draw parallels to the current environment and invest in a fundamentally strong company with cash flows and a robust international business with famous brands that are predominant on any construction site in the US and the world.

Introduction

Stanley Black & Decker got hammered by the market due to excessive inventory buildup, devastating cash flow numbers, and a worsening macro environment.

SB&D invested in inventory while the US has entered a tightening cycle, which the housing and construction market is feeling firsthand. Opposite to what ex-CEO James M. Loree wrote in his 2021 shareholder letter, the macro environment turned unfavorable for SB&D.

In 2021, we capitalized on extraordinarily strong customer demand fueled by macro trends, including the reconnection with home and garden, eCommerce and electrification.

Jamer M. Loree – 2021 Shareholder Letter

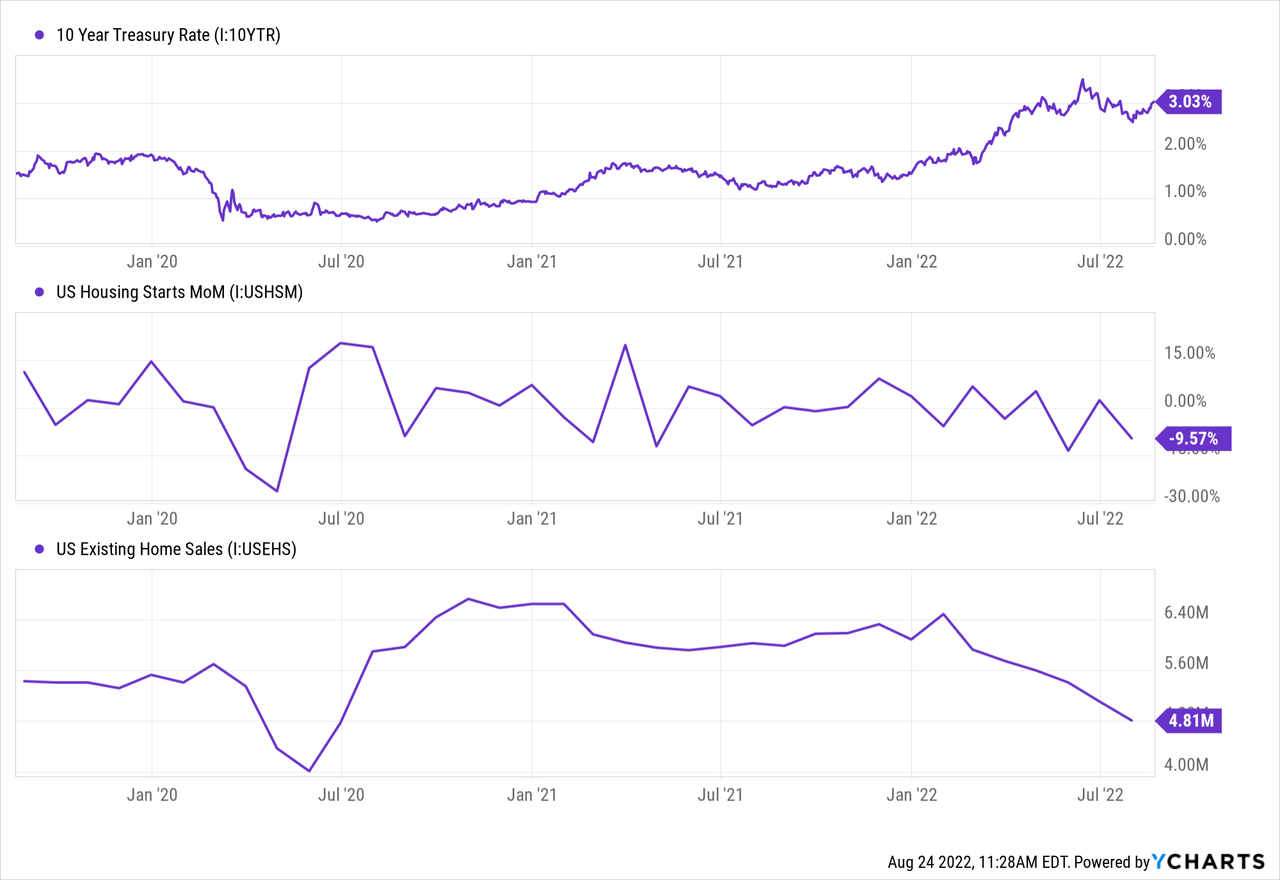

Interest rates have been increasing, and housing starts growth is negative, and existing home sales that support renovation and construction decreased as well.

At the same time, SB&D built up inventories due to tight supply chains and false expectations of high demand. The inventory buildup increased SB&D’s working capital, which decreased its free cash flow, operating, and even gross margins.

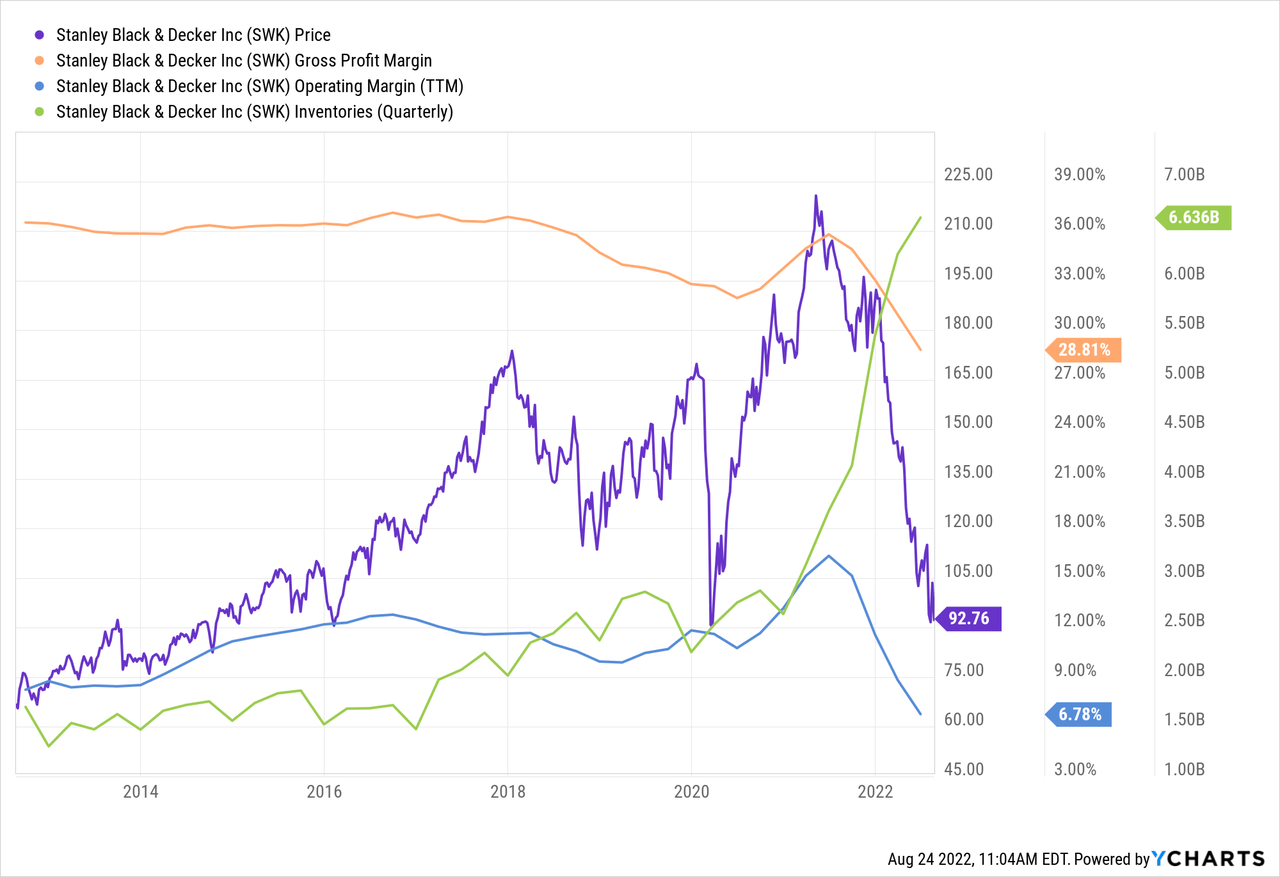

The combination of tight supply chains, inflation, inventory buildup, and a drop in demand led to a decline in valuation. The gross margin in Q2 2022 was 27.5%, down 8% YoY. The operating margin was 8.1%, down from double-digit numbers in prior years.

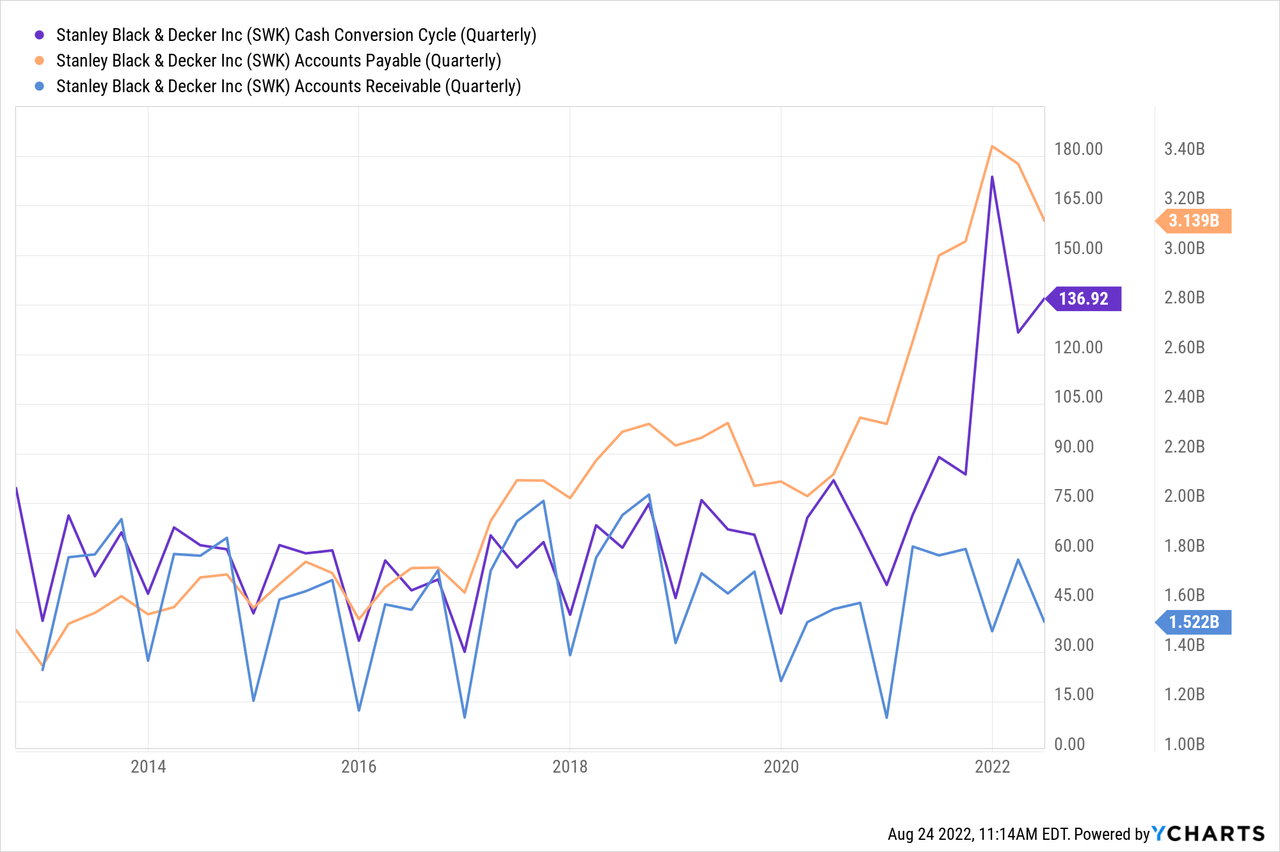

The biggest issue is the green line on the graph above – inventories. At the end of Q1 2022, inventories were $6.6 bn, up $400mn QoQ and $2.6bn YoY. I discussed the reasons above – lower demand and dwindling effects of supply chain constraints.

The Cash Conversion Cycle

Excess inventory and lower demand lead to much higher cash conversion cycles – CCC – which means that the company can’t convert its investment in inventory and other resources into cash flows from sales.

A company generally wants money from customers faster than it pays its suppliers.

CCC is measured in days. A CCC > 0 means that the company needs longer to sell and collect cash than it needs to pay its vendors. A CCC < 0 means that it faster sells the goods and collects the cash than it is paying its suppliers.

CCC is calculated in the following way:

CCC = DIO + DSO – DPO

DIO = Days of inventory outstanding = (Inventory / COGS) * Days in period

DSO = Days Sales outstanding = (Accounts Receivable / Revenue) * Days in period

DPO = Days Payable Outstanding = (Accounts Payable / Costs of Goods Sold) * Days in that period

Back to Stanley Black & Decker

SB&D accumulated tons of inventory that it can’t immediately sell, which looks like this.

Yet, the goods that the company sells do not perish. It’s a temporary issue that the company during an unfavorable macro-environment.

Value Investment Key Points

Over the last few weeks, I have been thinking about how I could streamline my value investment strategy.

A few years ago, I read “The Dhandho Investor” by Mohnish Pabrai and “The Little Book that Beats the Market” by Joel Greenblatt. Both are value investors and special situation traders that look for investments that trade below intrinsic value.

Both investors rely on Warren Buffett’s and Benjamin Graham’s investment principles, which can be summarized in the following way:

- Invest in simple businesses in easy-to-understand industries with slow rates of change.

- Invest in companies and industries that are in distress

- Buy businesses that have a durable competitive advantage or moat

- Buy businesses at a discount to their intrinsic value

- Buy businesses with low-risk and high-uncertainty

We can use these points, build a thesis for Stanley Black & Decker, and see if it would fall into this category.

Invest in simple businesses in easy-to-understand industries with slow rates of change

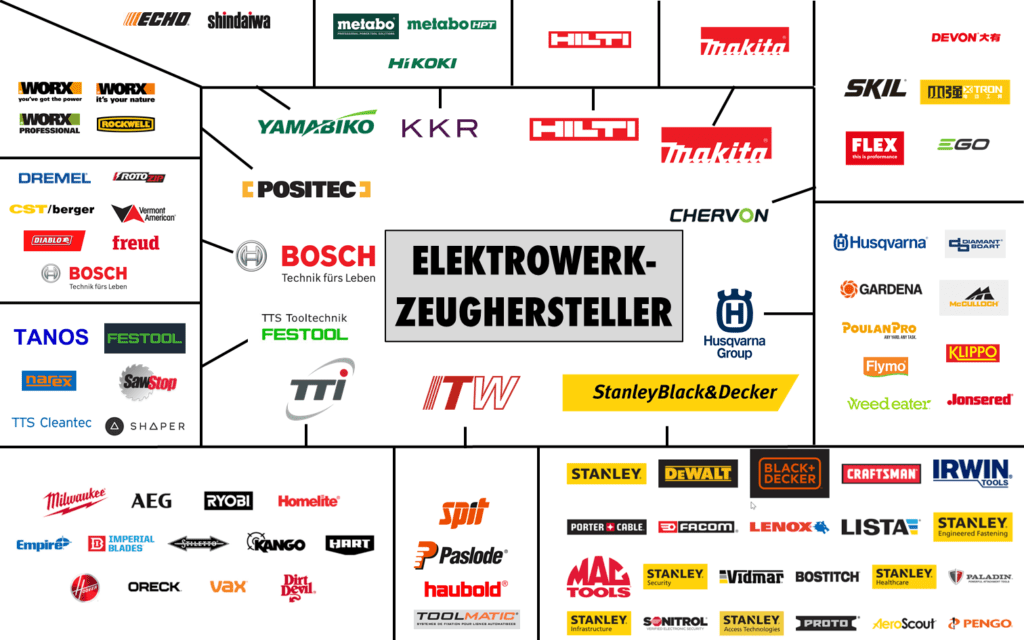

Stanley Black & Decker operates in the tool industry. It sells corded and battery-operated power tools to end consumers and construction companies.

The tooling industry is manageable, with a few large companies leading. The largest power tooling company is Stanley Black & Decker, followed by TTI, Bosch, and Festool.

Overview of the tooling industry (BZwekzeuge – Hersteller)

Stanley Black & Decker owns iconic brands like DeWalt, BLACK + DECKER, or Craftsman. SB&D dominates the US market (60% of revenue) and operates very successfully in the European (17% of revenue) and emerging markets (14% of revenue).

The tooling industry can be split into cordless and corded power tools, with the tendency shifting to cordless tools as battery technology improves and allows for similar power compared to corded power tools.

The global power tool was valued at $32bn in 2019 and is expected to reach $48bn in 2027, which results in a CAGR of 4.8%.

The cordless power tools market is expected to grow faster than the power tool market, with a CAGR of 10.67% between 2022 and 2027.

The big players in the power tools market regularly acquire new up-and-coming brands within the industry to expand their brand and technology portfolio. SB&D is worldwide, the most prevalent power tools company.

Power tools are pretty much a necessity for home renovation and construction sites. Their expected lifetime is predictable, and the industry expands and contracts with the housing and construction market.

Invest in companies and industries that are in distress

The housing and construction market came under distress when inflation was picking, and the Fed started steering against it by raising interest rates.

Rising interest rates directly impact new and existing home sales, and high inflation impacts consumers’ priorities for renovation and investment in durable goods and renovation. Consumers focus more on immediate needs like energy and food than renovating the garden shed.

SB&D overestimated demand and built up a huge inventory. SB&D’s inventory bound billions in cash and negatively impacted its margins along the spectrum.

The short-term prospect of SB&D looks murky, as we don’t know how inflation and interest rates will develop over the coming months and years.

Yet, SB&D is firmly positioned worldwide in the power tools market and shows no signs of bankruptcy.

Buy businesses that have a durable competitive advantage or moat

The power tool industry is a pretty static canvas, with the big players mentioned in the graph above.

SB&D’s competitive advantage is its brands that are known worldwide. DeWalt and BLACK + DECKER are iconic brands that appear continuously within the industry. They’re pretty much the Coca-Cola of the power tools industry.

Buy businesses at a discount to their intrinsic value

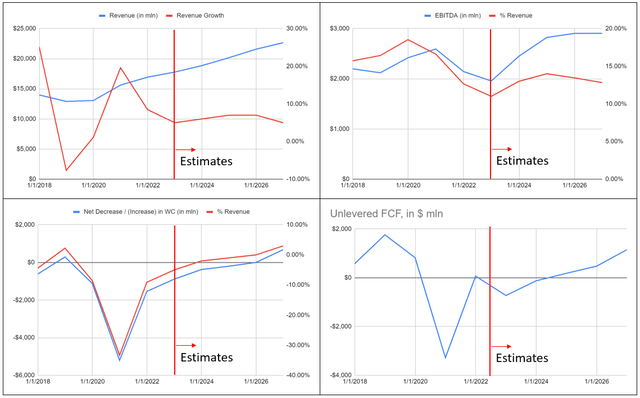

Using the industry growth rates, we can make a DCF analysis for SB&D over the next 5 years.

I used conservative growth rates between 5% and 7% for SBD’s revenue over the next 5 years. SB&D’s free cash flow will only turn positive in year three, not even reaching its 2019 level in year five.

Stanley Black and Decker Discounted Cash Flow Analysis – Projections (Keyanoush – The Value Bull)

Based on management projections about working capital, margins, and inventory levels, I estimated that SB&D would only reach positive working capital in years three to four.

Using these estimates as the basis for our DCF analysis, we get the following intrinsic value for our shares.

Stanley Black and Decker Discounted Cash Flow Analysis (Keyanoush, The Value Bull)

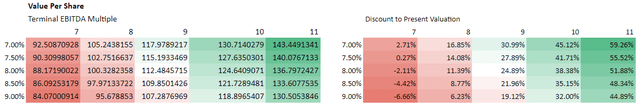

Our model estimates that at an EBITDA multiple of 9 and a WACC of 8%, the shares are trading ~20% below intrinsic value of have ~25% upside potential. With SB&D’s shares trading at $90, our model also estimates the downside limit to -6.6%.

Buy businesses with low-risk and high-uncertainty

The last point in our value investors analysis is to buy businesses with low risk and high uncertainty.

We can’t precisely project how the macro environment evolves in the following months and years. Inflation remains elevated, and rising rent and owner’s equivalent rent make inflation stickier over the short term.

Stanley Black & Decker sells essential equipment for any kind and size of construction work. Over the long term, its business is low risk because it will always have demand, especially with the iconic brands it owns.

Conclusion

Stanley Black & Decker is in distress. The industry it operates in has a murky short-term outlook, with high inflation and rising interest rates. Rising energy prices are not doing it a favor at the moment.

Over the long term, things look different. SB&D sells essential tools prevalent on any construction site. Construction has always operated in cycles and is a crucial area where governments worldwide will invest in accelerating the economic machine.

Our DCF analysis shows that the company’s shares are undervalued even with conservative growth rates and positive free cash flow 3-4 years from now. Shares are currently trading ~20% below intrinsic value.

When investing in value stocks, remember that markets can stay irrational longer than you can stay solvent.

When I invest, I’ll do it as part of a well-diversified portfolio and weigh it according to the potential outcome I calculate and my portfolio size.

I always welcome constructive criticism and open discussions. Please feel free to comment or PM me about my calculations and/or sources that I use in my articles.

Be the first to comment