Hector Vivas

Thesis

EPR Properties (NYSE:EPR) delivered a robust Q2 earnings release in early August, but has given back all its gains from July and August, moving closer to its June lows. The recent sell-off was exacerbated by concerns over Regal’s parent Cineworld (OTCPK:CNNWF), as it is reportedly filing for bankruptcy.

As a result, investors are justifiably concerned over the impact on EPR’s rental base, as Regal accounted for 14.4% of its revenue base in Q2 and 8.4% in FY21. Therefore, we postulate that the market has adjusted its expectations of a rental impact moving ahead, even though EPR highlighted that it wasn’t in negotiation with Regal currently on its obligations.

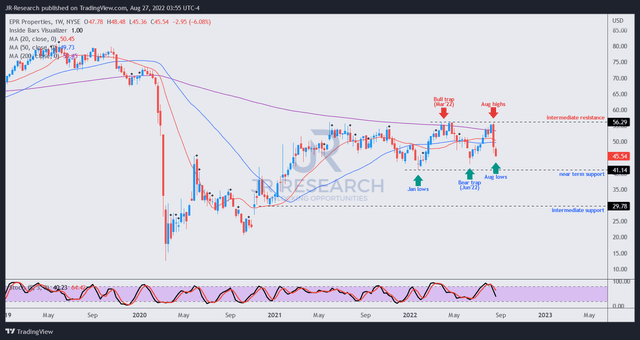

Accordingly, we like the deep pullback, as it helped improve the reward-to-risk profile with a less aggressive entry point. In our previous article (Hold rating), we highlighted that investors need to be cautious, as we posited that EPR could face robust selling pressure at its intermediate resistance zone ($56). Consequently, EPR’s buying momentum was denied decisively at that zone again in August, as it had done so since June 2021.

With EPR moving closer to its June lows and a critical support zone with the meaningful pullback, we are ready to re-rate EPR.

Accordingly, we revise our rating on EPR from Hold to Buy, with a medium-term price target (PT) of $54 (implying a potential upside of 19%).

The Market Was Spooked By Cineworld’s Troubles

Cineworld reported in mid-August it needed to take proactive steps to cope with its high debt load, given relatively poor ticket sales performance. As a result, EPR also felt the brunt of the sell-off, given its exposure to Regal.

As a result, it sent EPR down markedly from its recent August highs, as the market reflected the potential impact on its rental base. The selling pressure continued last week, heaping further losses on EPR, as it collapsed nearly 20% in a couple of weeks.

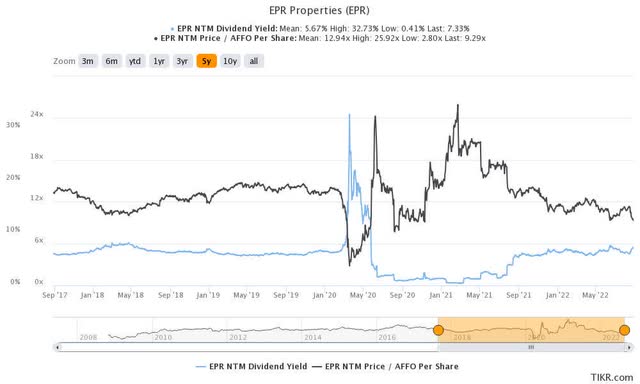

Consequently, EPR’s NTM AFFO per share multiple has fallen significantly to 9.29x, 28% below its 5Y mean of 12.94x. Moreover, its NTM dividend yield has improved to 7.33%, discernibly above its 5Y mean of 5.67%. Street analysts have also adjusted their projections, as they factored in potential rental cuts from Regal, as BofA (BAC) highlighted:

According to the Wall Street Journal, Cineworld, the parent company of Regal Theaters and 13.5% of the EPR portfolio, is preparing to file bankruptcy. Half of EPR’s Regal leases are in two master leases. The rest of the leases are cross defaulted. Our updated model assumes a 15% haircut to Regal’s rent in a bankruptcy. – The Fly

While we think a de-rating by the market is justified, given EPR’s meaningful exposure to Regal, we are confident that the move has de-risked EPR’s valuations sufficiently. In addition, investors should note that EPR’s Q2 release highlighted that the company continues to see a strong recovery cadence from its theater tenants, despite the worsening macros exacerbated by high inflation rates and a hawkish Fed.

Furthermore, management accentuated that it expects its tenant base to remain resilient, which lends further credence to our conviction of EPR’s high AFFO visibility. Management highlighted:

While broadly, there is increasing uncertainty and concern around inflation and the possibility of a recession, historically, our value-oriented drive-to destinations have proven to be more resilient in times of recession because they provide a compelling value proposition for families. To date, we have not seen meaningful impact from inflation or gas prices, and our expectation is that this will be the case in the event of an economic slowdown. (EPR FQ2’22 earnings call)

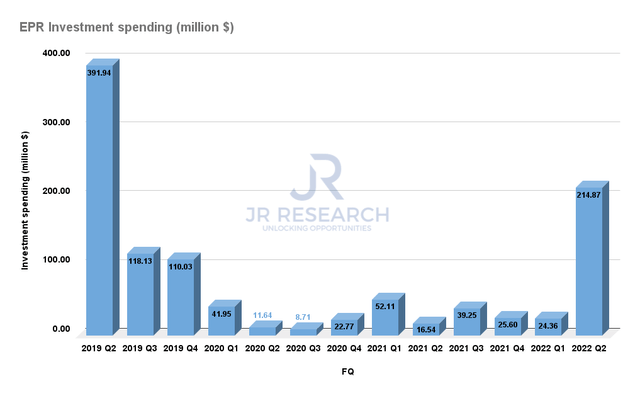

EPR investment spending (Company filing)

Moreover, the company has continued its investment cadence, seeing opportunities in the current environment, bolstered by a strong balance sheet. As a result, it posted investment spending of $214.9M in Q2. The company also expects further investment spending in H2’22, targeting $600M (midpoint) for FY22. With cap rates of about 8%, we posit that EPR is well-positioned to continue investing for growth and improving the resilience of its AFFO visibility moving forward.

Is EPR Stock A Buy, Sell, Or Hold?

EPR price chart (weekly) (TradingView)

With the significant pullback in EPR in August, we are confident that buying momentum should return to undergird its stock.

As seen above, EPR has fallen closer to its June lows as it digested all its gains from July and August over the past two weeks. Nevertheless, we gleaned that its near-term support zone ($41) should help provide robust buying upside for EPR, helping stem further downside volatility.

As a result, we revise our rating on EPR from Hold to Buy and urge patient investors to leverage the pullback to add more positions.

Be the first to comment