JMrocek

This article was written by Chuck Walston.

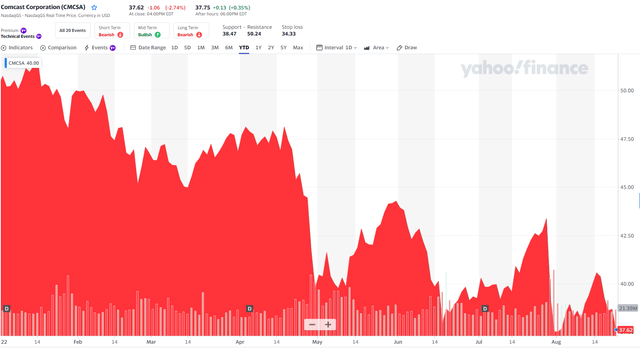

Shares of Comcast (NASDAQ:CMCSA) have fallen nearly 24% in 2022.

This is largely due to a double-digit drop in late July following Q2 2022 earnings. The market’s reaction might seem a bit puzzling in that the company beat on the top and bottom lines and reported the highest adjusted EBITDA margin on record.

However, analysts and investors were taken aback when Comcast reported zero growth in broadband customers. For many, broadband was viewed as the answer to the cord-cutting trend.

While the cable communications segment provides just over half of the firm’s revenues, that division has a number of moving parts.

Additionally, Comcast as a whole is a multi-faceted business.

Q2 Results: A Plethora Of Positives Sandwiched Between Two Big Negatives

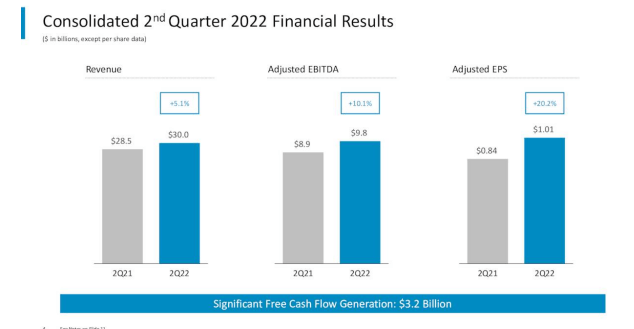

Comcast reported Q2 2022 earnings very late in July. There’s a great deal to digest in the Q2 report. While some of the data is quite encouraging, other aspects of Q2 might give investors pause. Non-GAAP EPS of $1.01 beat by $0.09.

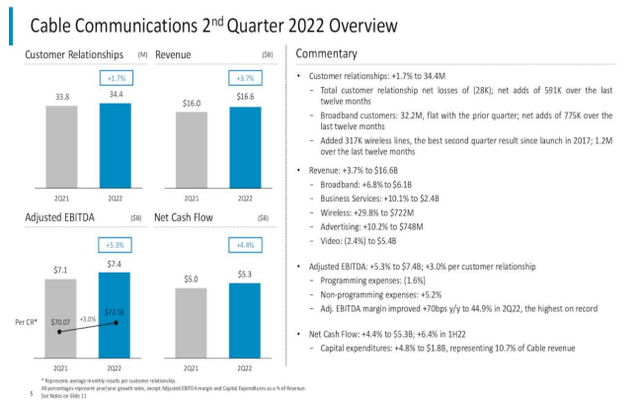

Revenue was up year-over-year to $30.02 billion, providing a 5.2% increase and a $300 million beat over analysts’ consensus. Adjusted EBITDA grew by 10.1% to $9.8 billion, and average monthly adjusted EBITDA per customer rose 3% to $72.18.

CMCSA Investor Presentation

We achieved our highest adjusted EBITDA margin on record even amid a unique and evolving macroeconomic environment that is temporarily putting pressure on the volume of our new customer connects. – Brian Roberts, chairman and CEO

The divisions previously flattened by COVID restrictions are now up and running. With overall revenue growth of 18.7%, NBC Universal’s adjusted EBITDA climbed 19.5% to $1.9 billion.

Studio revenue also surged, increasing roughly 33% to $3 billion. Revenue for the Universal theme parks grew by about 64.8% to $1.8 billion. The park’s division recorded a record EBITDA for a second quarter, with adjusted EBITDA rocketing 187% to $632 million.

That represents most of the positives to be found in the quarterly report. The negatives include a drop in free cash flow, down 34% from a year ago.

Unfortunately, after gaining 4 million subs last quarter, Peacock subscriber numbers were flat in Q2. Furthermore, management guided for up to $2.5 billion in losses for Peacock due to heavy content spend.

The negative side of the ledger also includes reported results for Sky, one of Europe’s leading entertainment companies. Revenues for Sky fell 13.8% to $4.5 billion.

Cable Communications, the last of the five segments, includes subscribers for video, high-speed data, voice, and wireless. Cable generated 53% of 2021 consolidated revenue and 76% of EBITDA, so it’s closely watched.

At first glance, results for the cable segment were fairly good. Revenue of $16.6 billion was up 3.7% year-over-year.

Voice’s loss of 286,000 customers in the quarter was offset by wireless adding 317,000 subs. The number of wireless Comcast customers grew from 3.38 million subscribers at the end of June 2021 to 4.62 million at the end of this June, and wireless revenue was up nearly 30% year over year to $722 million.

Business services also recorded 10% growth to $2.4 billion.

Investors have become somewhat inured to the cable cutting trend as many believed Comcast’s growth in broadband subs more than offset the loss of videos customers. For the last five quarters, CMCSA averaged 300,000 net broadband subscribers.

However, in Q2 2022, broadband subs were flat at 32.2 million. Furthermore, management noted that early in Q3, the company lost 30,000 broadband customers in July.

Comcast also lost 521,000 video subscribers in Q2, meaning the total number of video subs lost in the first six months of 2022 totaled one million.

To sum up the negative side of the ledger, the cable communications segment lost over half a million cable subs and had zero net new broadband customers. Peacock recorded no growth, although management guides for a $2.5 billion loss for the streaming service due to content costs.

If You Want To See The Forest, Quit Staring At the Trees

For some, the fact that there’s an exodus away from cable is all that’s needed to condemn Comcast to stock market purgatory. Yes, cord cutting is a real headwind, but focusing on the loss of cable subs means the many positive aspects of Comcast’s business are ignored.

Consider this: According to the U.S. Census Bureau, only half of US households subscribe to cable. A decade ago, over 80% of American homes were cable subs. Yet Comcast has grown revenue, FCF, and EBITDA at a marked rate during that time frame.

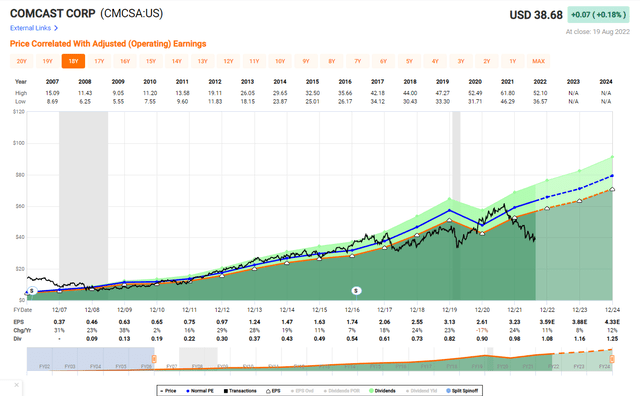

For example, in 2019, Comcast delivered a record year of free cash flow and notched the tenth year of double-digit EPS growth in an 11-year period. In 2021, the company generated record high revenue, EBITDA, adjusted EPS, and free cash flow.

However, rather than pointing to over a decade of growth, I believe 2020 truly serves to highlight the strength of the company.

That year ushered in COVID-19. During the coronavirus surge, Comcast was forced to terminate movie and new content production, delay the launch of Peacock’s new streaming service, shutter the theme parks, and endure waning advertising revenues.

Throw in cable cutting, and you arguably have a worst-case scenario for a company with Comcast’s business model.

The result was a 4.9% decline in revenue. Despite this “Perfect Storm,” Comcast finished with $13.3 billion in free cash flow and increased the dividend for the 13th consecutive year.

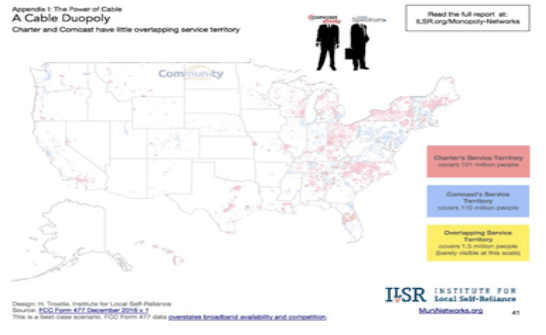

Comcast prevailed because in many respects it’s nearly monopoly-like.

ILSR

Comcast and Charter (CHTR) combined serve 200 million people. Of those, less than two million are served by both companies. Furthermore, there are 30 million customers that have no other broadband provider other than CMCSA.

The Institute For Local Self-Reliance reports that the two giant cable providers have “an absolute monopoly” over 47 million people, and that for 33 million Americans, the only alternative other than Comcast or Charter is a markedly slower and less reliable provider.

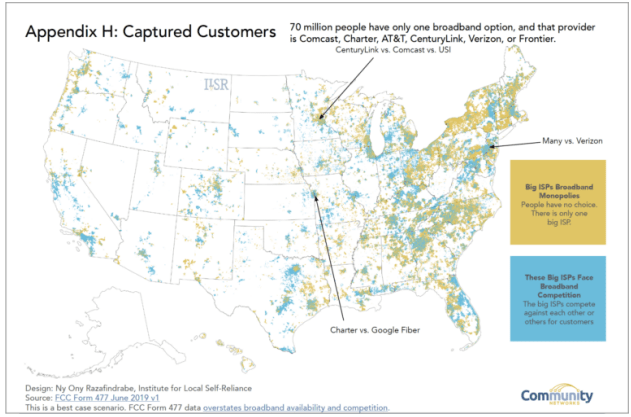

Source: FCC

Even within areas where Comcast competes against AT&T (T), Verizon (VZ), and T-Mobile (TMUS) the company’s broadband service is markedly superior.

Recent tests of internet speeds indicate downloads are more than two-and-a-half times faster for broadband as compared to other competitors.

Broadband has an even larger advantage over wireless when comparing upload speeds.

One trend that is Comcast’s friend is that video gamers have a strong preference for the fastest service provider.

Furthermore, broadband’s advantage is likely to prevail for the foreseeable future. For a decade, Comcast has doubled network capacity every 2.5 years. During that period, the company poured $30 billion into building a fiber-dense network covering 191,000 route miles. That lead will be difficult to surmount.

While the standstill in broadband subs represents a new headwind, even that should not be particularly surprising, or alarming. The recent surge in broadband customers was in part fueled by COVID trends as a portion of the broadband growth in past quarters consisted of demand that was pushed forward.

It’s also true that over the last decade, the second quarter has been the weakest period for broadband customer growth each year.

And last but not least, broadband is a much more mature business than it was years ago. Rather than focusing on additional growth, which by definition has its limits, perhaps we should consider that customer churn is very low.

Debt, Dividend, and Valuation

S&P and Fitch rate Comcast’s debt as A-/stable. Moody’s provides an A3 /stable rating. Comcast expects to maintain net debt leverage near the current level of 2.3x in 2022.

The current yield is 2.79%. CMCSA has a payout ratio just below 30% and a 5-year dividend growth rate of 12%.

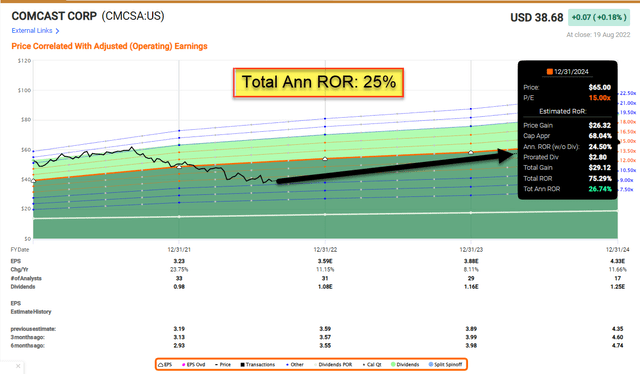

Comcast trades for $38.68 a share. The one-year average price target of the 25 analysts covering the stock is $52.17. The price target of the 9 analysts that rated the company following the most recent quarterly report is $44.56.

Comcast’s forward P/E is 12.52x, well below the stock’s average P/E ratio over the last 5 years of 17.16x. The five-year PEG of 0.93x compares well with the average PEG for the last 5 years of 1.30x, as well as the sector median PEG ratio of 1.42x.

Is Comcast A Buy, Sell, Or Hold?

Cord cutting and stymied broadband growth are viewed by bears as reasons to jettison the stock. Yet the Cable segment, which harbors both of these businesses and provides the bulk of the company’s revenue and roughly three quarters of EBITDA, recorded increases in net cash flow, revenue, and EBITDA in Q2.

Comcast also has other business divisions that are performing well. Xfinity Mobile ended 2Q22 with 4.6 million customer lines, including 317,000 net sub adds.

Since acquiring NBCU in 2011, Comcast has more than doubled that division’s cash flow.

The high margins the company garners with its broadband business should more than counter the loss of cable subs. Of great importance is that Comcast’s vast network can be upgraded for a relatively small cost when compared to the investments required of wireless carriers.

With more than 85% of Comcast’s customers receiving 100 megabits/second service, and the bulk of AT&T, Verizon, and T-Mobile networks incapable of delivering speeds above 20 megabits/second, the wireless carriers simply cannot compete.

Rather than focusing on the negatives, I believe investors should view Comcast’s strengths. I believe the company maintains a wide moat and solid management. CMCSA experiences very low churn and generates robust free cash flow.

I viewed the recent drop in share price as an opportunity to add to my substantial position in CMCSA, and I rate the stock as a buy.

I caution prospective investors in that I would not be surprised if the stock remains range bound for some time. Market sentiment can be slow to turn. However, with a yield nearing 3%, a low payout ratio, and a double-digit five-year dividend growth rate, I’m content to sit on my shares.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment