Ekaterina79

Investment Thesis: Lindt & Sprüngli (OTCPK:LDSVF) has seen encouraging sales growth, but cost inflation and a rise in cocoa prices may make investors apprehensive of the stock.

In a previous article, I made the argument that I still see further growth ahead for Lindt & Sprüngli on the basis of strong sales growth in the most recent half-year period, as well as a potentially attractive earnings valuation.

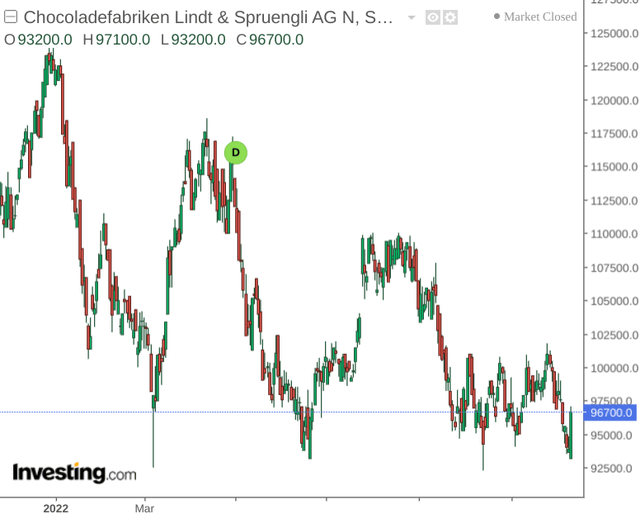

With that being said, the stock has seen downside since my last article and is trading at a lower level overall as compared to the beginning of 2022:

The purpose of this article is to investigate why the stock has been declining in spite of encouraging sales growth and whether the stock could see a revival from here.

Performance and Macroeconomic Factors

As I elaborated on in my last article, Lindt & Sprüngli saw a significant increase in sales and diluted earnings per share from the half period in the previous year.

| Jan – Jun 2021 | Jan – Jun 2022 | |

| Sales | 1799.2 | 1991.7 |

| Total expenses | -1675.7 | -1817.7 |

| Net income | 101.6 | 138.4 |

| Diluted earnings per share | 419.2 | 577.1 |

Source: Figures sourced from Lindt & Sprüngli Half-Year Report 2022.

However, this does not appear to have instilled confidence in investors – with the stock continuing to see an overall decline since the beginning of the year.

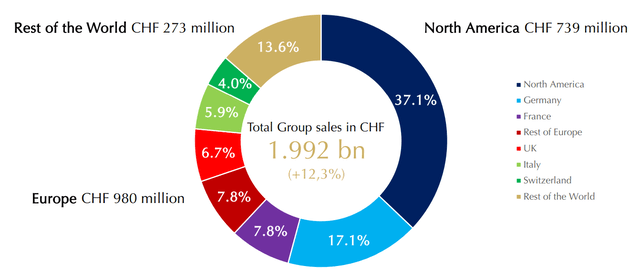

Additionally, it is also notable that North America was the company’s largest market by revenue:

Lindt & Spruengli: Half-Year Results 2022

According to the company, 50% of sales growth has come from volume while the other 50% has come from price/mix.

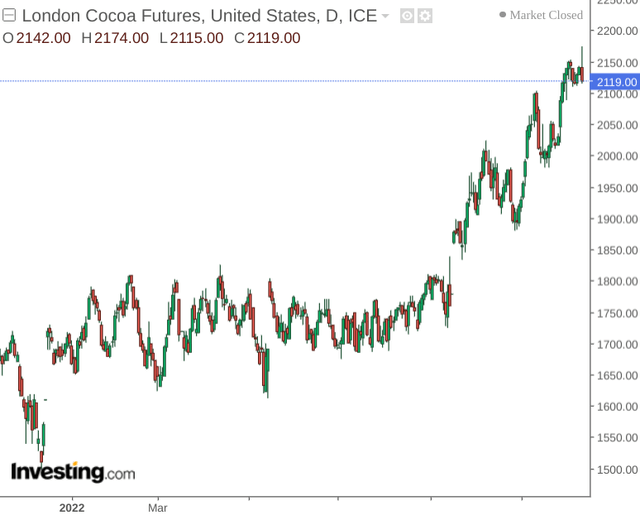

With that being said, cost inflation could stand to be a significant risk for the company due to rising cocoa prices. With cocoa being a primary ingredient that the company uses in its products, London Cocoa Futures (which is a commonly accepted global benchmark for physical cocoa pricing and denominated in GBP per metric tonne) has seen a sharp increase in the latter half of this year:

In this regard, cost inflation could be a risk factor when it comes to full-year results for 2022. While the company might see further sales growth – this could be outweighed by higher operating expenses eating into profitability. Moreover, rising cocoa prices will likely necessitate further product price rises which would be passed on to the end customer.

While Lindt & Sprüngli operates at the luxury end of the confectionery market – the possibility of a temporary decline in customer demand in the face of rising prices cannot be ruled out – particularly if economic conditions become more unstable.

Looking Forward

With full-year results for 2022 yet to be released – it remains to be seen whether cost inflation has significantly lowered profitability in spite of sales growth.

With that being said, I take the view that investors are likely to pay more attention to the company’s balance sheet metrics for the upcoming full-year period.

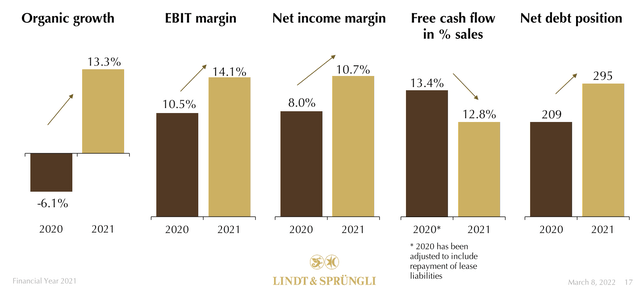

For instance, we saw that for the financial year 2021, organic growth recovered strongly from the decline during the COVID-19 pandemic, but this was accompanied by a significant increase in the company’s net debt and a decline in free cash flow as a percentage of sales:

Lindt & Spruengli: Financial Year 2021 Presentation

Should we see evidence that cost inflation has been eating into revenue growth and resulting in lower cash flow or higher net debt, then this may make investors apprehensive of the stock.

Conclusion

To conclude, Lindt & Sprüngli has seen encouraging sales growth to date, and consumer demand appears to have remained strong in spite of rising prices.

With that being said, cost inflation and particularly rising cocoa prices could raise concerns regarding full-year profitability. Moreover, while sales growth has been rising, free cash flow as a percentage of sales has been falling and net debt has been growing.

In this regard, I take the view that full-year results will be a significant telling point as to whether Lindt & Sprüngli can continue to thrive in the face of cost inflation.

Be the first to comment