metamorworks

In February, I wrote an article, “LIDAR: Review Leading to Buy Innoviz Recommendation” the article compared seven Lidar companies and selected three Luminar (LAZR), Innoviz (INVZ), and AEye (NASDAQ:LIDR) as worthy of in-depth consideration. Ultimately, the superior route to market of Innoviz made them my top pick. It was a good decision since the article Luminar fell from $15.60 to $7.53, AEye from $3.13 to $0.95, and Innoviz increased from $4.00 to $4.91.

I follow several new industries analyzing each company involved and trying to pick the likely winners. I have strict criteria under which I examine each company, and those criteria have improved over the last 18 months with the addition of “a validation of the technology” criteria. I want to see a customer buying the tech to use it, not just to test it.

I will consider AEye’s progress in this article, checking if its tech has been validated according to my criteria.

AEye Competitive Strategy

AEye is the only lidar company pursuing FMCW technology that provides 4D lidar. The technology offers speed and position; other lidar systems must calculate speed tracking an object as it moves. The second strategic decision AEye made early on was to concentrate on the software and not the hardware. Theirs is a software-centric approach. The software controls the sensor with two-way communication that can change how the sensor works. Most competing Lidars manufacture hardware that sends raw data to be processed by other software systems. In the recent earnings call, Q3 2022, Blair LaCorte, CEO, compared the competition to a Motorola StarTac flip phone, an analog device without intelligence but able to send information, whereas the AEye system is like a smartphone.

The Route to Market

The tech looks excellent, and AEye provides lots of information about why it is so much better than the competition; however, I have learned (at great expense through poor-performing investments) that all that matters is sales. If no one buys it, it doesn’t matter how good it is or how good you think it is. This was the difference between Innoviz and AEye in February, and my concentration on it meant I had a +23% return and not a -70%.

I believe that AEye now has a customer that validates its tech. Consequently, it is time to build a position in the company with a two-year time horizon.

Manufacturing

In the recent earnings call, AEye announced that Sanmina (SANM), a world-leading supplier of integrated products to global OEMs, is building a high-volume, low-cost production in its Thai manufacturing facility. The line will be in addition to the San Jose facility where Sanmina is currently manufacturing AEye products and will increase AEye capacity from 10s of thousands to hundreds of thousands.

The partnership with Sanmina confirms that AEye has the manufacturing capability to supply its product in volume and from a respected manufacturing partner of potential customers. In the earnings call, Bob Brown said that Sanmina was ramping up production of its commercial products for the industrial markets at the San Jose site and will be ready to scale volumes for the automotive business in 2023 from Thailand.

The Continental Partnership

Continental (OTCPK:CTTAF)) is a top three automotive technology supplier and is the lead customer of AEye for automotive lidar. Continental demonstrated its Class A truck at a recent trade show that featured AEye lidar, and it was awarded product of the year at Autosense. Continental is currently showing the production-intent version and has integrated the AEye sensor into its sensor suite, including radar, camera, and perception software.

Continental and AEye are involved with more than 6 RFQs (the final stage of the tender process). Blair said in his remarks that they expect multiple customer awards in the coming months with Continental.

Unfortunately, the continental deal does not meet my validation criteria; Continental is still buying the product to show customers – they are not yet selling it to customers. They will need a design win for that.

My experience with the Innoviz investment suggests that every customer award or design win, as Innoviz call them, adds 10% to the stock price.

The 4Sight Product

4Sight is the name AEye has given to its newly launched adaptive lidar Platform, which is the product manufactured by Sanmina. AEye claims one design win already for this product in Autonomous hub-to-hub trucking. I have found it impossible to verify this win in the earnings call. Blair said

we have jointly decided not to publicly disclose our partnership today,

AEye signed a deal with Tu Simple last year. They could be the autonomous truck customer referred to, but we will have to wait and see.

As far as I am aware, nowhere in the world currently has Hub-Hub autonomous trucking. The agreement must be testing and validation, so it does not meet my criteria.

The Deal with Intetra

Intetra based in Istanbul, manufactures a range of safety products for highway use. These products include variable messaging systems, lane control systems, and toll booth operations.

Intetra has begun deploying a toll-based system using AEye Lidar after testing it for several months. Integra is not buying AEye products to try but buying them to put in a product they sell to end users.

If AEye lidar is the best product for Integra, it will be the best product for many others and will be much easier to buy now that another company has started buying it first.

I believe the Intetra deal validates AEye Technology and makes them investable.

AEye has a similar agreement to supply lidar to traffic management systems with GridMatrix, but I have been unable to find any orders and sales from this agreement.

Other Markets

AEye has several other industries and partners, such as Nikon exploring AEye Lidar in measuring equipment and Booz Allen Hamilton investigating lidar in the aerospace and defense industries. There are many others, but they are all in the testing and discussion phase. They are buying the product but not for re-sale, just for testing. These partnerships and the one with Continental offer significant future sales.

AEye Finances

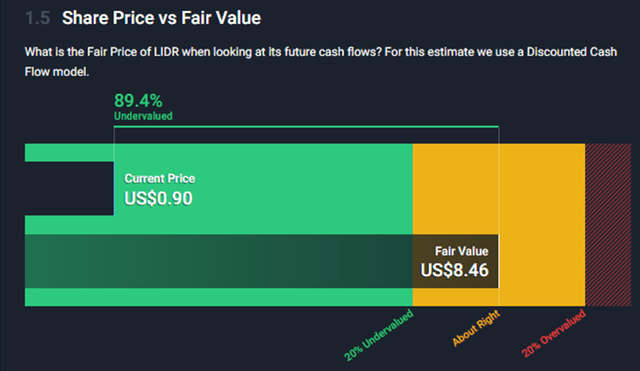

AEye has one Analyst providing revenue forecasts. Simplywall.st has produced the following Fair value calculation using the single analyst forecast.

Fair Value (Simplywall.st)

I do not think I have sufficient information to build my own model at this stage. Without confirmed sales and guidance from management, this is more guesswork than mathematical modeling. However, I include it here because it gives the view of the street, and I try to take account of all information.

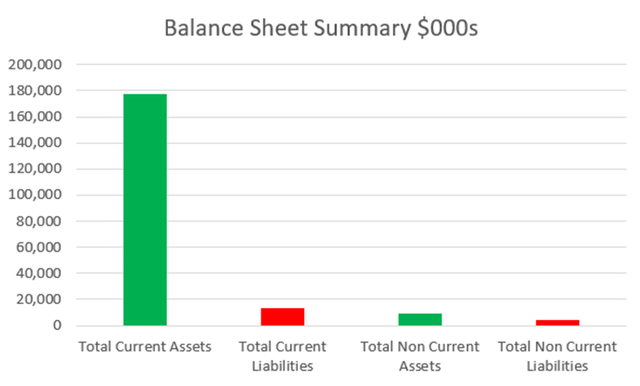

The balance sheet is strong at this point

AEye balance sheet summary (Author, data from 10Q)

Net loss in the third quarter was $23.6 million, down from $26.4 million in Q2; however, net use of cash increased by $5 million to $22 million. AEye had $110 million of cash on the balance sheet at the end of the quarter, suggesting they have a cash runway of over a year. If you total all available liquidity, including 30 million shares they can issue, they have at most $250 million available.

Conclusion

Like most start-up tech companies, AEye has great theoretical technology that could sell well. It has an excellent relationship with Continental, who are manufacturing the product under license and engaging with several major automotive companies.

The relationship with Sanmina means that AEye can manufacture at scale and are in the process of increasing that scale.

AEye has a strong balance sheet and enough available liquidity to last more than two years.

The critical issue driving my investment is a validation of the technology. AEye now has a real customer, Intetra, who uses AEye products in their systems, not just tests them.

I have taken a half-size position in AEye and will look to add to it when the first automotive design win arrives.

Be the first to comment