pixelfit/E+ via Getty Images

On May 24, 2021, I published an article on Seeking Alpha titled Inflation Is Transitory Until It Hits The Jobs Market.

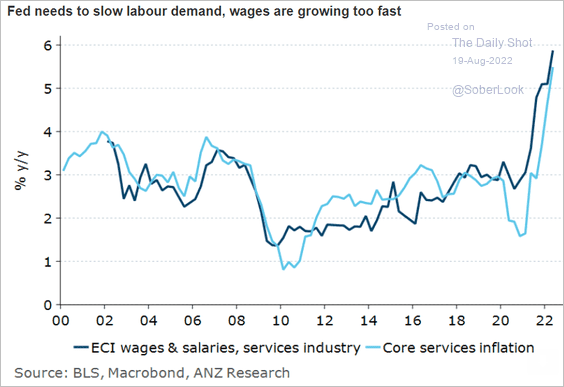

The article distinguished between commodities inflation which tends to revert to the mean and wage inflation which once it gets started can be very sticky and hard to stop.

At that time the Fed was calling inflation transitory and the unemployment rate was relatively high at 6.1%. Since then, the unemployment rate has rapidly dropped to a current 3.5%. That equals the record low unemployment rate reached just before the brief recession in 2020. This happened in just over a year. The fact that we only got about one year of relief from a tight labor market by the last recession is concerning.

The Fed has changed its tune and is now going all out to fight inflation. Inflation is ebbing relatively quickly in commodities and the supply chain but remains entrenched in labor. Based on the secular and demographic trends detailed in this article, it will likely take until 2023 before wage inflation returns to a more normal level. However, that old normal level will likely soon be replaced by a new higher normal the Fed will not be able to tame except by throwing us into recession.

@SoberLook

We are probably stuck with wage inflation going forward except for periods of recession when the jobs market loosens up due to less hiring along with more job cuts. This is due to a number of demographic and secular trends many of which show no signs of slowing down. Eight such trends are detailed below.

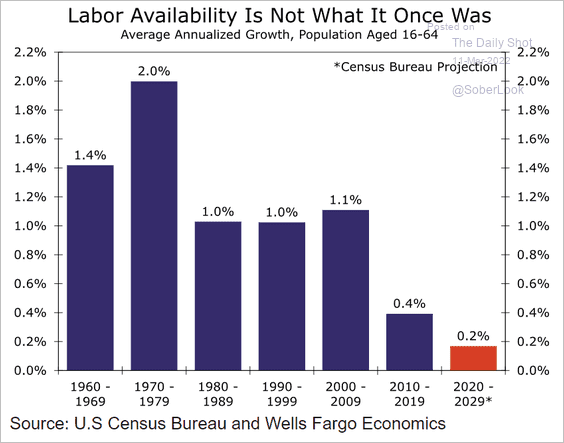

1. Population growth is slowing and may soon decline

This is a demographic trend due to a lower birth rate, and less immigration. Most European nations, China and Japan are already dealing with a declining population. The chart below shows a rapid slowdown in population of working aged people including a census bureau estimate for this decade. This means less supply of labor.

U.S. Census Bureau and Wells Fargo Economics

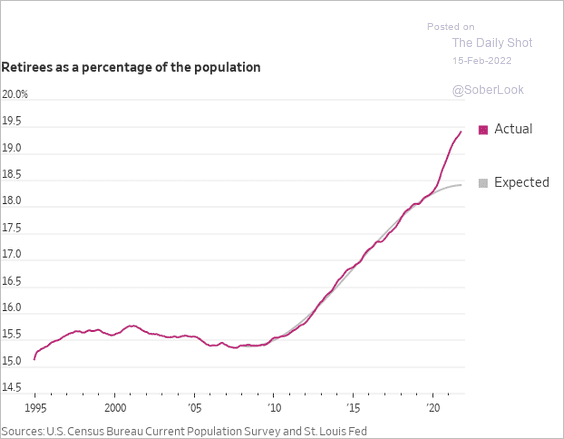

2. Early retirements

As of February, 2022, some 2.6 million people retired earlier than expected since the start of the pandemic. They are not being replaced quickly enough by Generation Z labor.

@SoberLook

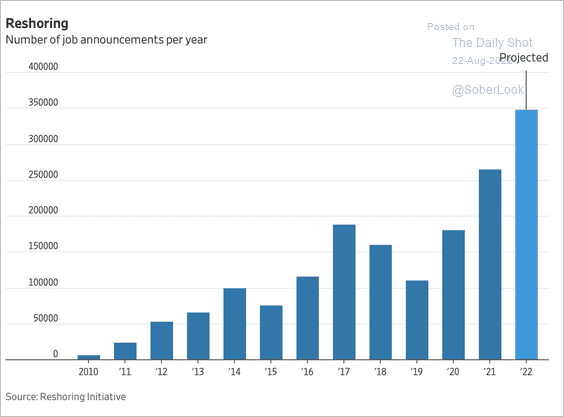

3. Onshoring

If there is one thing both U.S. political parties agree on, it is a need to reshore manufacturing and some service jobs sent overseas. They couldn’t be more wrong. While in some cases that makes sense for national security reasons, for the most part sending those jobs overseas led to tremendous growth and low inflation.

Let’s do the math shall we? We currently have an unemployment rate of 3.5%. That’s 5.7 million people unemployed, well less than the jobs available. Further, over the past two decades we sent tens of millions of jobs overseas and created tens of millions more overseas that never were here. We didn’t have the workers for those jobs! They had to be sent overseas. We don’t even have the workforce for the current job openings after all those jobs were sent overseas. If they hadn’t been sent overseas, we would have had massive inflation and our world class businesses would not have been able to grow anywhere as much as they did. Further still, sending jobs to lower cost areas resulted in almost four decades of low inflation.

Reshoring and onshoring has picked up in the past few years due to supply chain issues, less friendly overseas locations and political pressure. The chart below shows a growing trend in reshoring. It is a trend that is very inflationary for wages. American companies are on pace to reshore 350,000 jobs this year, well up from prior years.

Reshoring Initiative

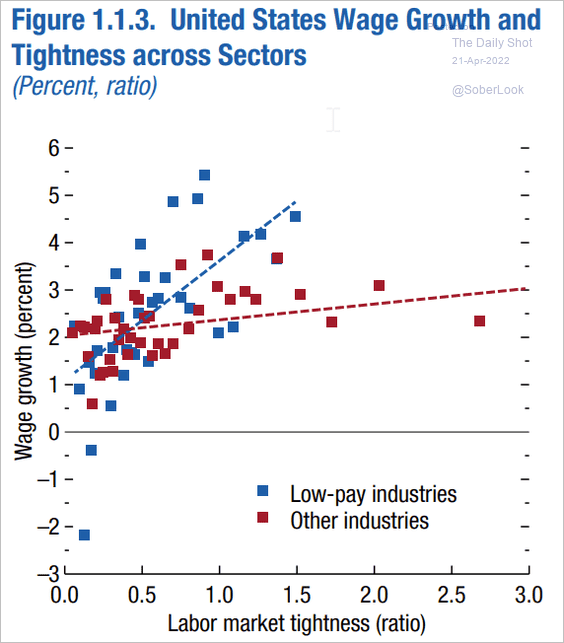

4. Lower paying job vacancies higher than others

Unlike in prior years, wage growth in the past year has been more in the lower end. This is because of higher minimum wages by businesses and some states and also due to lower income workers being pulled up to vacancies in higher paying jobs. I wrote an article about this in January titled The Great Resignation, before that term received widespread use. In the past this was offset by legal and illegal immigration. Legal immigration has been greatly curtailed and due to political pressure, the government is doing everything it can to reduce illegal immigration.

@SoberLook

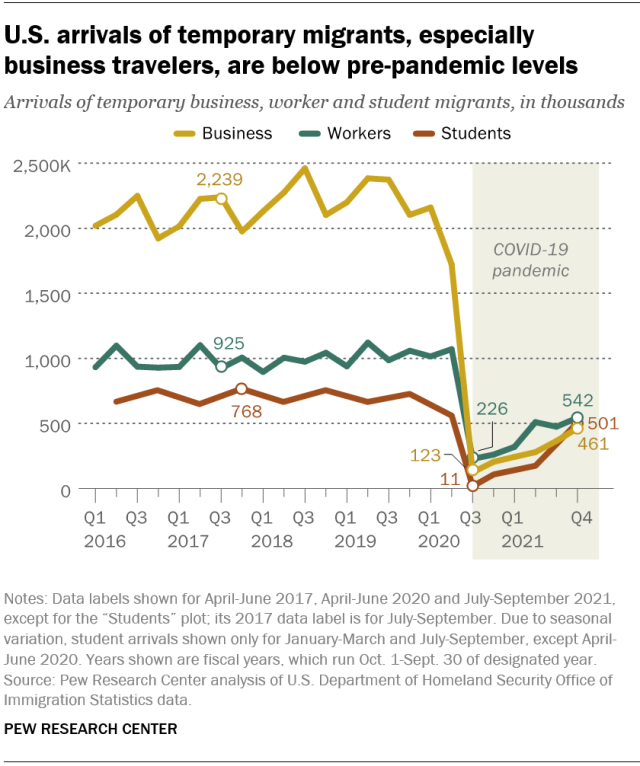

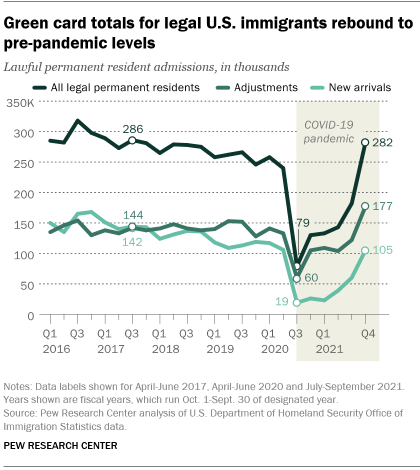

5. Reduced immigration

Immigration has been significantly reduced. Part of this was due to Covid fears, but there is also a major wave of xenophobia in the U.S. right now. While green cards have returned to pre-pandemic levels, they are still well below that of 5 years earlier. More impactful is a large drop off of temporary workers coming to the U.S.

Pew Research Center

Pew Research Center

6. Corporate growth

This, in my opinion, is the biggest secular cause of wage inflation, and one that few people are talking about because we in the U.S. take it for granted.

Despite having 4.3% of the world’s population, U.S. corporations have almost 50% of the world’s market value. How can that be? The reason is corporate America is an innovation and jobs creating machine. U.S. corporations also have over half of the most important inventions in recent years such as the internet, smartphones, social media and massive medical advances. Our corporate growth is the envy of the world.

American large and midsized corporations lead the world in innovation, return on investment and profit margins. There are many reasons for this. We have a corporate culture in this country not matched anywhere else in its strength and depth. We believe in the most powerful factor in economics, the profit incentive. We pay our executives more and in return we get more qualified executives who work harder. Many like Elon Musk and Indra Nooyi immigrated here because of the opportunity. They work longer hours and develop strong communication skills. Our universities teach them critical thinking which they apply to the situations they face.

Our large corporations are strong, deep in executive talent, innovative and motivated to the point that it will be hard for our government to mess it up. However, policies such as limiting immigration, heavy regulation, excessive litigation, and high taxes can all do damage.

We are in a new age of growth. This growth is widespread but primarily focused in two areas, information technology and healthcare.

As noted in trend #1, Europe and Japan have declining populations which have not led to unusual wage inflation. The biggest difference between them and us is this trend, huge corporate growth in the U.S.

7. Higher education levels

More college and high school graduates mean more workers who demand higher pay.

8. Lower workforce participation/aging workforce

The participation rate in the workforce for people 16 years old and older has declined from 67% in 2000 to about 63% now. The biggest reason is an aging of the population. A smaller reason is more younger people are still in school. It is concerning that rising wages has not helped workforce participation much.

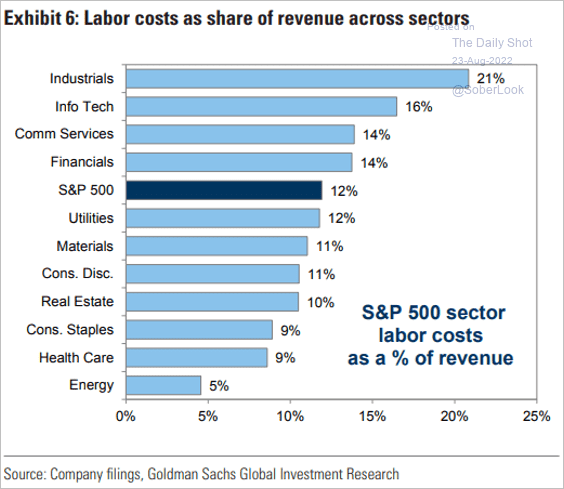

Industries most impacted

The industries most impacted are those with a lot of lower paying jobs and higher labor costs as a percentage of total expenses. Lower paying industries include restaurants, travel, many services and food processing. Industries with higher labor expenses are indicated in the chart below.

Goldman Sachs Investment Research

Solutions

In the short term the solution is to raise interest rates until the jobs market loosens up considerably, enough to stop wage inflation. That will likely put the economy into a recession. Recessions are very good at easing tight labor markets. But we don’t want to stay in one. We need to get back to the two things we were doing that kept our labor market in balance despite huge corporate growth.

Those two are more Immigration and offshoring. We have gotten away from both due to political pressure and need to get back to what worked very well. Due to other trends, such as baby boomer retirements, increased education levels and continued strong corporate growth, these may not be enough. I expect the wage inflation going forward to be significantly above the 2% norm we have had in recent years, except during recessions and a year or two after.

Takeaway

A recession is coming which should temporarily ease labor market tightness. Longer term, prepare for a higher overall level of wage inflation, especially in those industries with more lower paying jobs and higher labor costs as a percentage of revenues. You may want to underweight stocks in those industries if you are an investor with an intermediate or longer term horizon.

Be the first to comment