Pinterest SeanShot

Editor’s note: Seeking Alpha is proud to welcome Hunting Alpha as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Since its founding in 2010, Pinterest (NYSE:PINS) has steadily grown to amass a healthy base of 433 million monthly active users (MAUs). Now, the business is in a phase where the focus is to increase its average revenue per user (ARPU) by scaling its proven engagement model to other markets. I think the new CEO, William Ready, is a well-qualified leader who should be able to improve user engagement and deepen monetization, leveraging some inherently attractive qualities of the business such as a resilient ad revenue portfolio.

The initial signs of an inflection in user engagement recovery are already present. As the new management executes on the next leg of growth for the company, I anticipate this to continue with better revenue and margin performance, including some upside surprise potential. My DCF (discounted cash flow) shows upside of 26% and, according to my read, the technicals are also pointing bullish – especially relative to the S&P 500 – suggesting alpha potential.

Business Brief

Pinterest helps users start with a vague idea of what they are interested in and, through a process of visual discovery, hone in to discover a more specific form of what they would like to see on their pins. This can help them to potentially make a purchase or spur some other action.

Unlike other platforms, the content users’ discovery experience on Pinterest is driven more by internal user-pull drivers rather than external platform-push drivers. As noted in its recent marketing, the company is differentiating itself from other social media platforms by highlighting this distinction and positioning Pinterest as a more empowering self-expression platform. It is a social media platform where users interact with a more specific intent to act or buy, making them more receptive to advertisements, which is how Pinterest makes money.

With 433 million MAUs, Pinterest has crossed the most difficult hurdle of garnering strong user engagement, especially in the U.S., where it started. The company’s future lies in scaling the user engagement growth model to other markets and mining higher ARPUs from the strong engagement base.

My Story for Pinterest

As an online student of Aswath Damodaran, one habit I have picked up is to view and present investment theses as a combination of narrative and numbers that sync together a story view of the business with modeling and valuation. So, here’s my two-point story for Pinterest:

- Superior value proposition for advertisers will lead to greater resiliency in ad revenue compared to other social media peers.

- User engagement improvements and monetization focus will boost revenues and margins.

I’ll now explain this thesis in more depth below.

Superior value proposition for advertisers will lead to greater resiliency in ad revenue

Pinterest’s user interactions are more closely linked to users’ purchase decision funnels than on other social media platforms. A survey of almost 200,000 social media users by market research company GWI shows their top reason for using Pinterest was to “follow/find information about products and brands.”

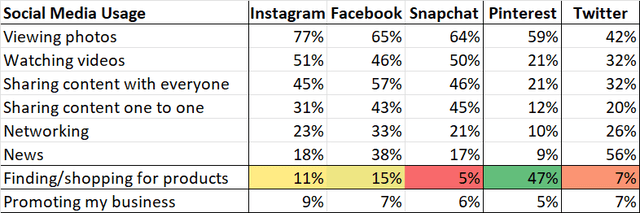

For this particular use case of finding products and brands, the competition is nowhere close. In another survey of over 2,500 respondents in the U.S., 47% of respondents said they use Pinterest to find and shop for products. This compares to only 11% and 15% for Instagram and Facebook, respectively:

2019 Social Media Usage Survey (Statista)

This would make Pinterest a superior destination for advertising conversions. These usage characteristics make Pinterest Trends more valuable for advertisers as the insights on high-frequency consumer interest and demand information help allocate limited advertising budgets more effectively.

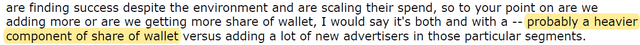

Taken together, these advantages have helped Pinterest register a strong 32% YoY growth in shopping ads in Q2 FY22. Pinterest also saw 25% YoY growth in joint business partnerships with advertisers in the same quarter. Growth in joint business partnerships is a leading indicator of longer-term spending commitments by advertisers. Seeing this growth amid the weak ad spend environment in the sector reflects the strength of Pinterest’s value proposition for advertisers and indicates wallet share growth in ad revenue, as confirmed by CFO Todd Morgenfeld:

Q2 FY22 Conference Call (Pinterest)

All of this is expected to translate into resiliency in ad revenue.

User engagement improvements and monetization focus will boost revenues and margins

The handover of the CEO role from the founder Ben Silbermann to William Ready syncs well with the natural transition in Pinterest’s growth story. Ready has decades of experience in e-commerce, payments, and growth strategy in international markets at leading companies such as Google (GOOG) and PayPal (PYPL). I’ve identified two notable opportunities for Ready to use the same playbook he applied as Google’s president of commerce, payments, and next billion users to his new role as Pinterest’s CEO.

First, Ready revamped the Google Shopping offering for merchants and fueled high growth as a consequence. In a Google company conference presentation in September 2021, Ready noted how:

…we’ve seen merchants really increase their participation in our shopping capabilities… merchants who have enabled both free listings and paid ads on our shopping tab have seen a 50% increase in clicks to their sites

In Google’s May 2022 company conference, it was mentioned how under Ready’s leadership, the retail segment has been the top contributor of growth in Google Search and the ad business for several consecutive quarters. Pinterest faces the same challenge that Google Shopping faced a couple of years ago: how to get more merchants and advertisers to engage and spend on the platform. Ready’s success in driving growth in the ad business at Google gives me confidence that he can do it again at Pinterest.

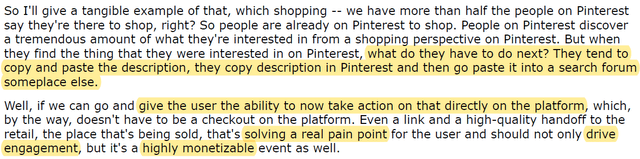

Second, Ready has deep experience in payments and making the user journey simpler and more frictionless en route to the point of sale. At Google, he added the “buy now” feature in product listings, fast-forwarding the user into the merchant’s checkout page in a low friction way. In Pinterest’s September 2022 company conference presentation, Ready highlighted a low-hanging fruit opportunity to improve engagement and monetization via a more seamless sales conversion experience for users:

September 2022 Company Conference Presentation (Pinterest)

Thus, I think Ready will make Pinterest’s payments and sales conversions more seamless, leading to higher ARPU and revenue growth.

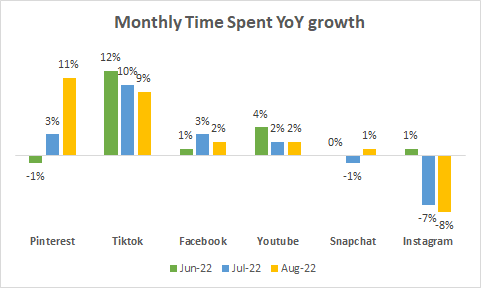

On the user engagement front, Pinterest stands out as a clear leader compared to other social media peers. As of the end of August 2022, Pinterest saw an 11% YoY increase in monthly time spent. Most of the social media platform’s peer group have this figure at 2% or lower. Monthly time spends on Instagram declined at an accelerated pace of 8% YoY. And the TikTok sensation also seems to be tapering off with 9% YoY growth, slower than Pinterest:

Monthly Time Spent on Popular Social Media Platforms (Sensor Tower)

The sharp increase in Pinterest’s monthly time spend in August 2022 suggests an inflection point in user engagement recovery as the company sees its investments in 2022 yield fruits. I expect this to bolster strong growth in advertisers and ad spending. After the 2022 investment year, management expects a 200bps increase in margins in 2023.

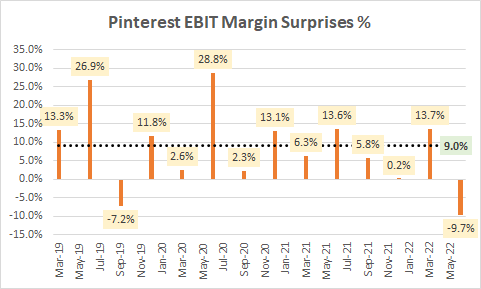

Interestingly, management has a pattern of delivering margin surprises:

Pinterest EBIT Margin Surprises (Own Analysis, Capital IQ)

Pinterest has historically delivered a median positive surprise of 9.0% for EBIT margin expectations. This suggests that management tends to be conservative in its margin guidance. The broadly consistent pattern in surprises indicates that Wall Street is underestimating the reality of the quarterly prints as well. Hence, there could be some upside potential to management’s indicated 200bps margin improvement in FY23.

Valuation

Given my narrative for the stock, these are my key assumptions for a simple DCF valuation for Pinterest.

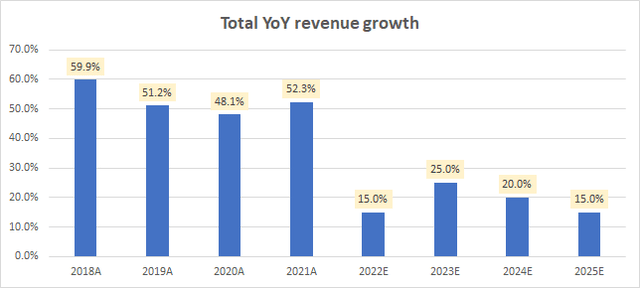

Total YoY revenue growth (Own View)

My revenue outlook for FY22 incorporates management’s Q3 FY23 revenue guidance of mid-single digits and a moderate growth after 2022. In the current period of ad spend weakness, I am not assuming a revisit to more than 30% YoY growth.

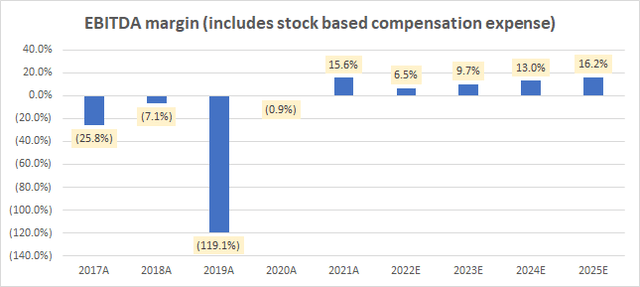

I include stock-based compensation expense in my EBITDA margin calculations as it is a real, regular operating cost to the business most of the time. My EBITDA margin assumptions build in a drop in 2022 due to higher SG&A and R&D costs in this investment year. In 2023, I am baking in a 320bps margin improvement. This is 120bps higher than management’s guidance, which I believe is conservative for the aforementioned reasons. After 2023, I am building in some margin expansion primarily due to operating leverage. By the way, the drop in 2019 figures was due to a one-time jump in stock-based compensation to 121% of revenues.

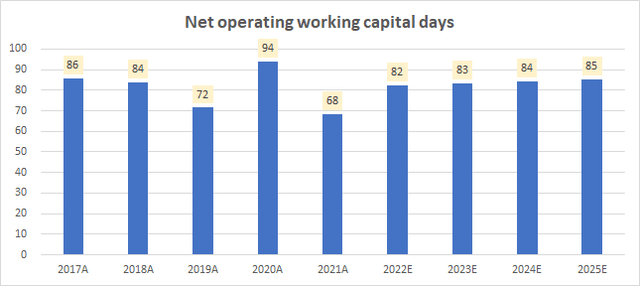

Net operating working capital days (Own View)

There are no structural changes to the working capital trends for the company. I have built in a typical average across the years, accounting for recent quarterly working capital trends as well.

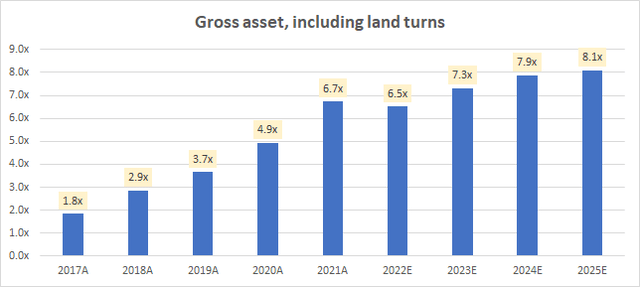

Gross asset turns are falling slightly in 2022, but this is mostly optical, caused by the inclusion of land in FY21’s financials. A steady increase in gross asset turns is expected as the business improves monetization and ARPUs.

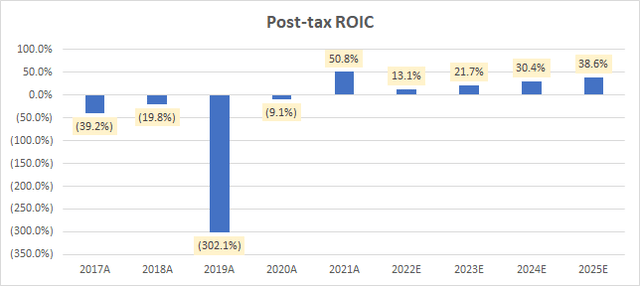

Post-tax ROICs are expected to see a fall in 2022 as investments ramp up for Pinterest. After this, the steady rise in post-tax ROIC is explained by steady margin expansion. The U.S. marginal corporate tax rate of 27% is used for these calculations. Again, note that the sharp fall in post-tax ROIC in 2019 was due to a one-time jump in stock-based compensation to 121% of revenues.

For fundamental valuations, I subscribe to the investing school of thought that a business’s intrinsic value is equal to the present value of its future free cash flows. This is why I’ve done a DCF valuation here for Pinterest.

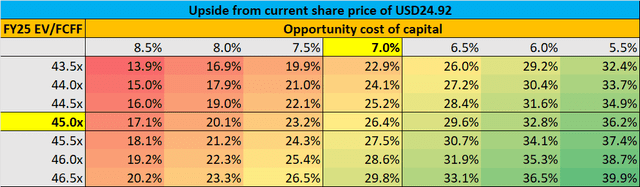

In my investing, if I don’t find any stocks or ETFs that I think will generate outperformance (alpha) over the S&P 500, I invest in the S&P 500. Hence, my opportunity cost of capital for my valuations is equal to my expectations of annual returns for the S&P 500 over the long run. I have assumed this figure to be 7%. This is close to the U.S. cost of equity that the “Dean of Valuation” Professor Aswath Damodaran has in his latest datasets.

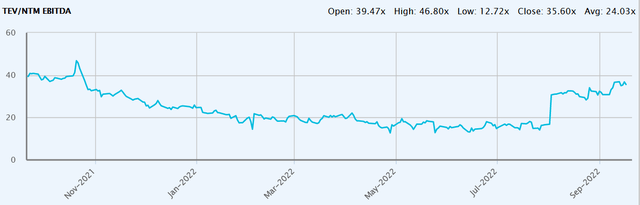

I use enterprise value to free cash flow to firm (EV/FCFF) terminal value multiples as this allows for explicit input of my terminal year (2025) operating assumption views. I was inspired to adopt this valuation approach after I read this Twitter thread on valuation multiples. In this case, a 45.0x FY25 EV/FCFF multiple corresponds to a 26.6x FY25 EV/EBITDA multiple. This seems reasonable considering Pinterest’s historical trading range for the one-year forward EV/EBITDA multiple. The stock is currently trading at a one-year forward EV/EBITDA of 35.6x:

Pinterest 1yr forward EV/EBITDA (Capital IQ)

Overall, with an opportunity cost of capital of 7.0% and FY25 EV/FCFF of 45.0x, I see 26.4% upside in the stock, corresponding to an intrinsic value per share of $31.49.

Technical Analysis

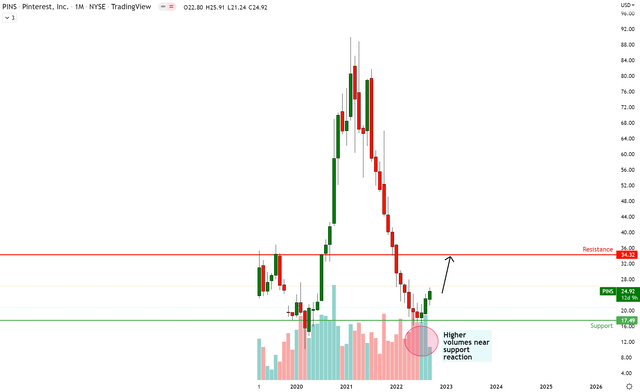

PINS Technical Analysis (Own Analysis using Trading View)

Pinterest is currently reacting off of a monthly support at $17.49. This reaction is accompanied with higher volumes, suggesting genuine presence of buying support. The nearest monthly resistance is at $34.32. This is the direction I think Pinterest is headed toward from its current share price of $24.92.

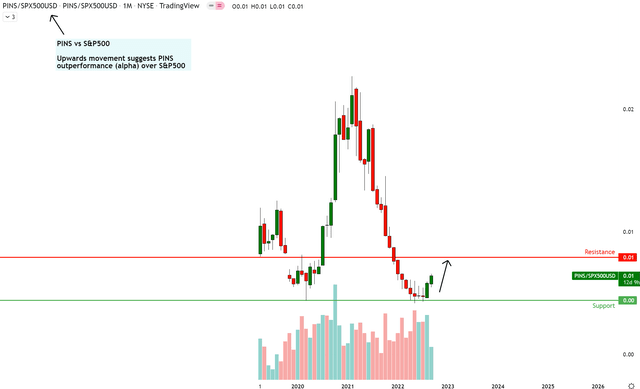

PINS vs S&P500 Technical Analysis (Own Analysis using TradingView)

Since I am “hunting alpha” (pardon the pun), I care more about relative outperformance over my opportunity cost (S&P 500) than absolute outperformance. Hence, I place a bit more importance on the relative chart of PINS/S&P 500.

On the monthly PINS vs. S&P 500 chart, an upward movement indicates PINS’ outperformance vs. the S&P 500. Conversely, a downward movement indicates PINS’ underperformance vs. the S&P 500. Currently, the monthly relative chart is showing signs of support, accompanied by higher volumes, thus increasing confidence in the support area. The relative spread is headed north toward the next monthly resistance zone. I plan to book the alpha (outperformance) generated and exit my positions in Pinterest once it reaches the monthly resistance.

Overall, both the absolute and relative charts of PINS against the S&P 500 show bullish prospects for Pinterest in the medium term.

Risks and Things to Watch

Although Pinterest might have a more resilient ad revenue stream, its business will still deteriorate in absolute terms if the ad spending environment continues to weaken. Hence, the commentaries on ad spending from major companies such as Google, Meta (META), Snapchat (SNAP), Trade Desk (TTD), and others are key things to watch. Engagement metrics, such as monthly time spent on Pinterest compared with other social media platforms, is also something I will be watching. If Pinterest’s bump up in August’s monthly time spent happens to be a mere blip as opposed to a genuine inflection point in user engagement, revenue forecasts might have to be tapered lower.

Finally, management commentary on the progress of monetization initiatives will be the focus of future quarterly conference calls. Any delays or unsuccessful attempts here will also lead to moderation in growth and margin assumptions.

Summary and Positioning

In light of this analysis, I think people aren’t pricing in the positives on Pinterest. I believe the stock is poised to generate alpha over the S&P 500. To be clear, I am not arguing that Pinterest will generate absolute positive returns. This is because if the market falls, Pinterest will fall too, probably to a greater extent since its five-year beta is 1.09 – a little higher than 1. An outlook on absolute positive returns requires one to have a directional view of the overall market (S&P 500). I am not taking any directional view on the market.

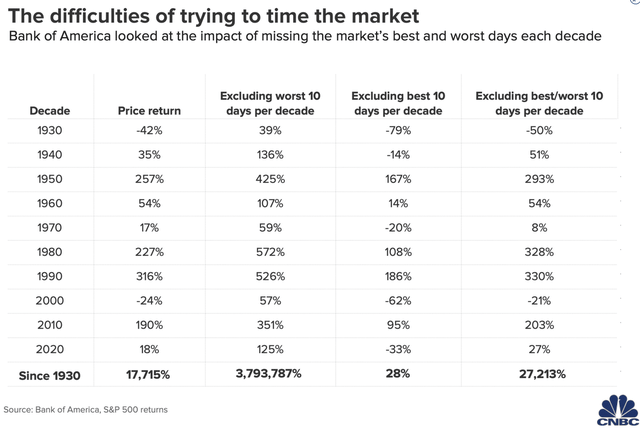

Rather, my view on Pinterest is that it will generate positive relative returns vs. the S&P 500. I focus on alpha as opposed to absolute returns because I believe in being fully invested in the market almost all the time. This is not just because the investing greats such as Warren Buffett and Peter Lynch famously and repeatedly advise us so. Rather, it’s because empirical evidence suggests so:

The difficulties of timing the market (Bank of America)

The market tends to rally the sharpest during the end of downturns. As the table above shows, history shows us that missing those big rally days by being out of the market can seriously impair returns. Naturally, if I am fully invested almost all the time, it is futile for me to worry about absolute returns during a downturn. Hence, my focus is only on hunting alpha.

If you agree with my thesis and also focus on relative performance, then Pinterest looks like an attractive buy. If you agree with my thesis but focus on absolute performance, you have to ask yourself one more important question: Which way will the market go from here?

Be the first to comment