edwardolive

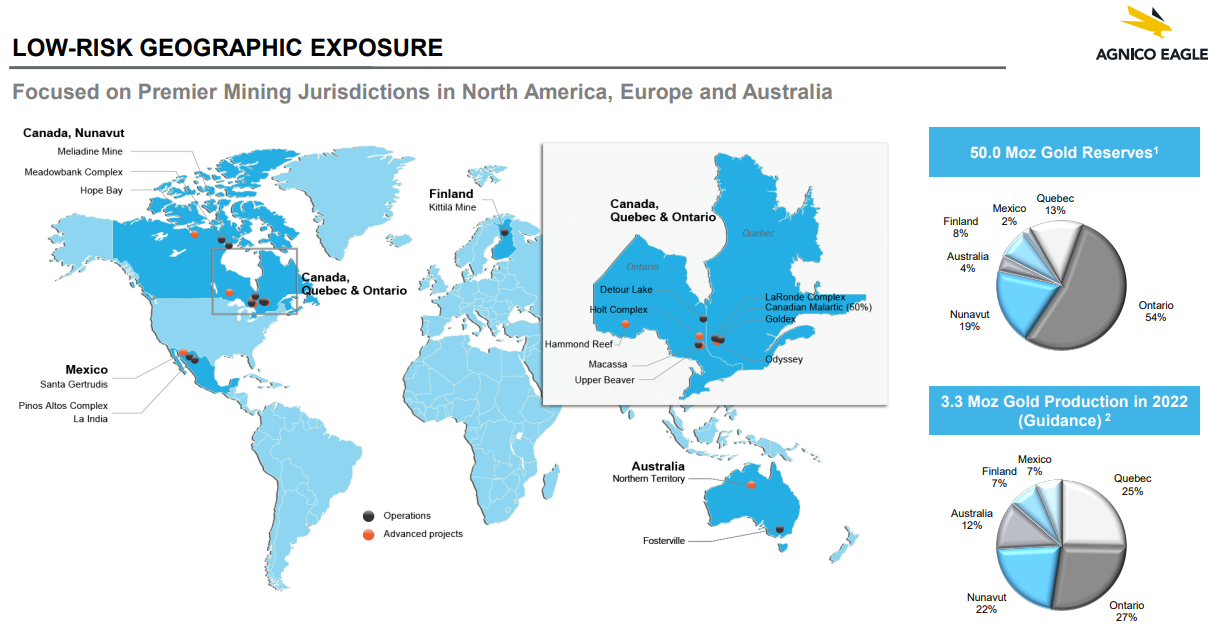

If you are searching for low-risk gold exposure in your portfolio, please consider Agnico Eagle Mines (NYSE:AEM). It is one of the lowest-AISC gold miners in the world, with assets located in the safest political jurisdictions of Canada (74% of 2021 production and 85% of reserves), Finland, Australia and Mexico. The company has quietly been increasing its reserves into a 30-year plan of operation, and sports a conservative balance sheet. Valuations have reached an all-time low in the summer of 2022, and the dividend yield proposition is approaching best in class.

Agnico Eagle – September 2022 Presentation Agnico Eagle – September 2022 Presentation

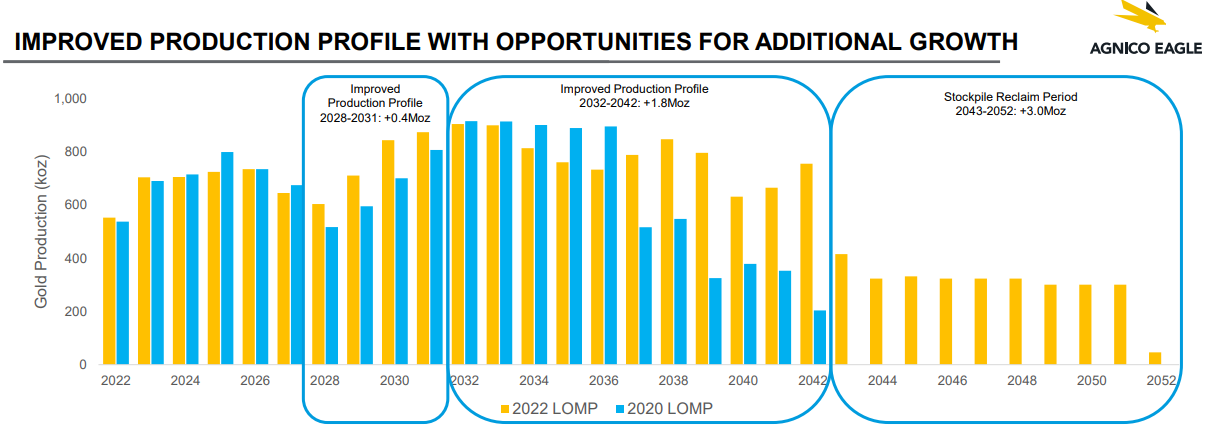

The company has digested the merger with Canadian miner Kirkland Gold (closed in February), and has witnessed amazing success increasing reserves over the past year. To get a clearer picture of drilling results and the jump in economically recoverable reserves, I hope you can read Seeking Alpha contributor Taylor Dart’s latest missive on Agnico posted a few weeks ago here. One of the article’s bullet points summarized his bullish view,

With the stock having industry-leading margins, a flawless track record, meaningful organic growth on deck, and being a top-10 exploration story, I see it as a must-own producer, especially with it now paying a 4% dividend yield.

And, last week the company announced a spend of $580 million to become a 50/50 joint partner with Teck Resources (TECK) developing a copper-zinc asset in Mexico through the San Nicolás project. The unexpected move is an effort to supply the budding and potential exponential electric vehicle [EV] demand for battery and electric motor critical metals. A 15-year mine life, with production beginning in 2026, and $500 million in future capital costs are prorated for Agnico’s development share. Total operating costs are projected below $0.50 per pound of copper, net of credits from other metals mined.

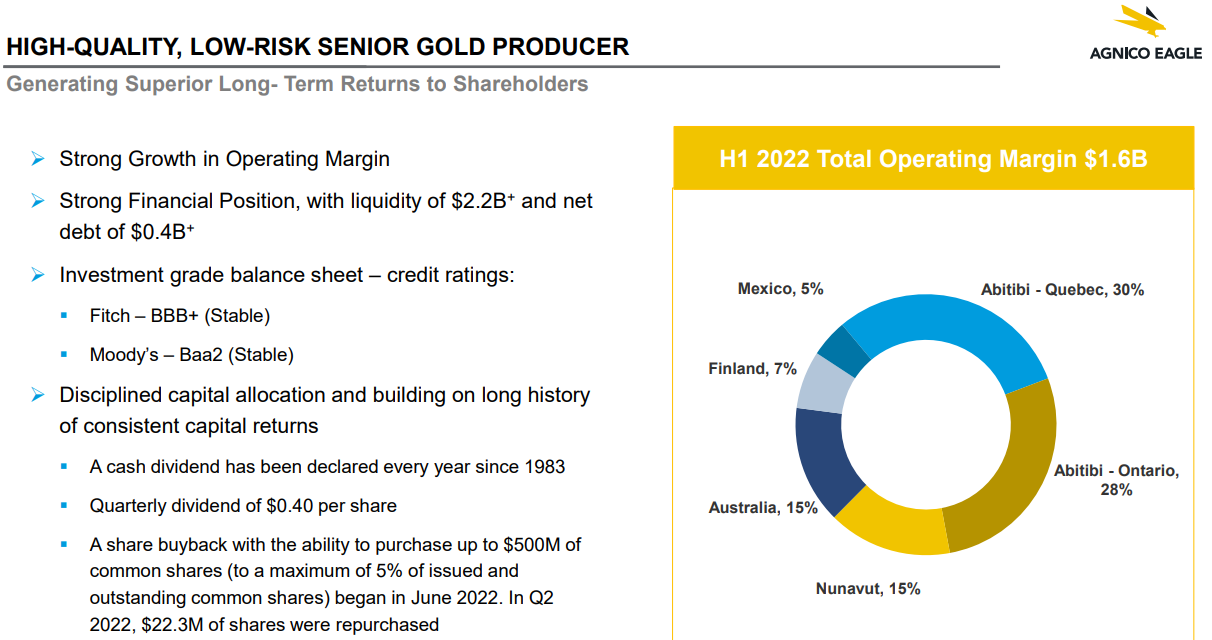

What I like best about Agnico Eagle is its disciplined spending approach to growing the company. Almost no debt exists, net of cash on hand. This low leverage profile is the old-fashioned and conservative way to run a business, which few in the capital-intensive mining business have been able to pull off.

Agnico Eagle – September 2022 Presentation

All-Time Low Valuation

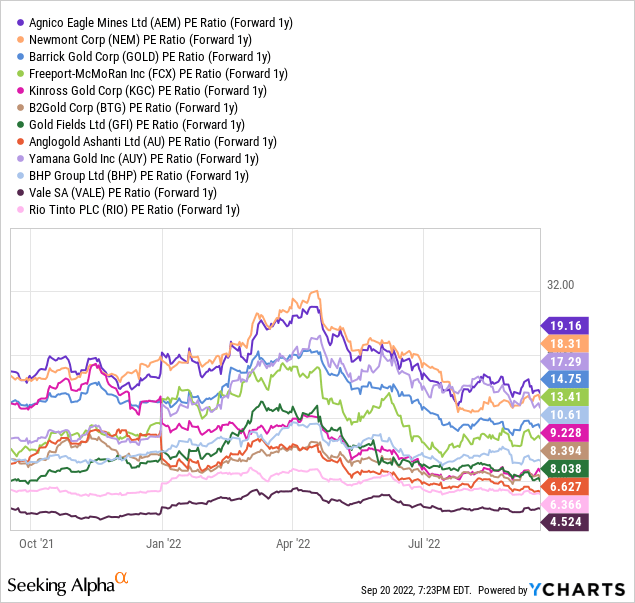

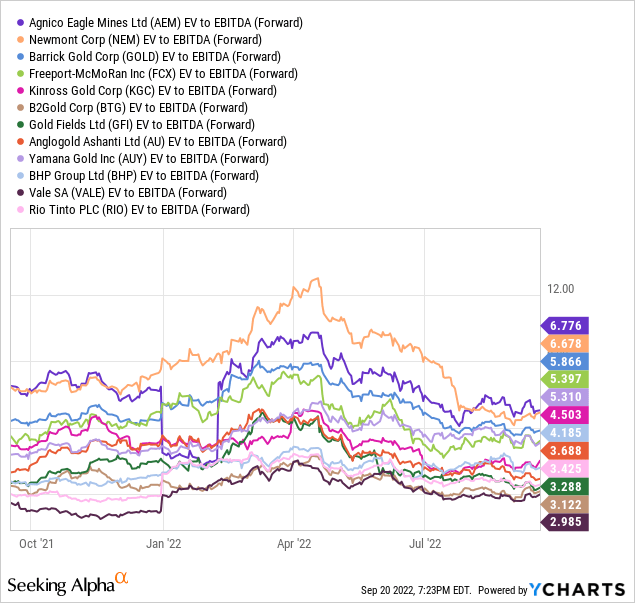

The quality of its assets, including long-life reserves in safer jurisdictions, combined with limited debt means Wall Street values the company on the high end of the spectrum vs. other precious and base metal mining enterprises. You can review this premium valuation vs. a group of leading global miners below. On forward price to earnings and enterprise value to EBITDA, Agnico does not appear to be a bargain at first glance.

YCharts – Gold and Base Metal Mining Leaders, Price to Forward Projected Earnings, 12 Months YCharts – Gold and Base Metal Mining Leaders, EV to Forward Projected EBITDA, 12 Months

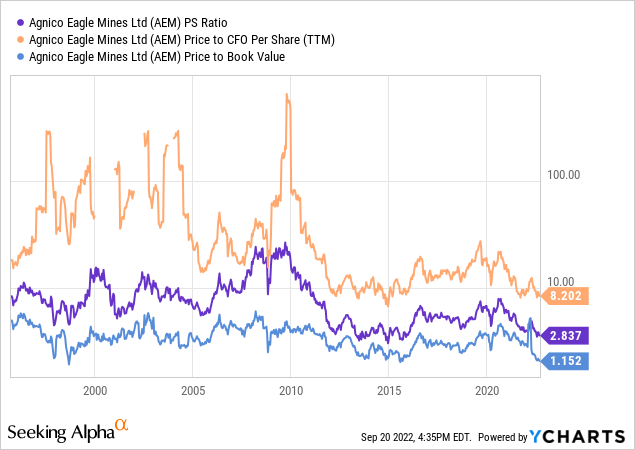

However, simple analysis of basic fundamental ratios on the company’s operations since 1995 pinpoints a record low valuation today. Despite its most diversified setup, massive resource base, positive growth future, and rock-solid financials, you can buy Agnico today at its cheapest price to sales, cash flow, and book value multiples EVER (in combination).

YCharts – Agnico Eagle Price to Sales, Cash Flow, Book Value, 1995-Present

Another smart reason to buy and hold AEM today is found in its highest dividend yield EVER. It’s also the best “relative” yield setting to the overall U.S. equity market in its history. I know plenty of investors are flocking to royalty companies in the mining sector paying 1% or 2% dividend distributions. Why not capture DOUBLE and TRIPLE the yields on royalty setups upfront, with dramatically better leverage to rising gold prices in the future through this “premier” mining security?

YCharts – AEM Dividend Yield vs. S&P 500 ETF, 1990-Present

Bullish Gold Outlook

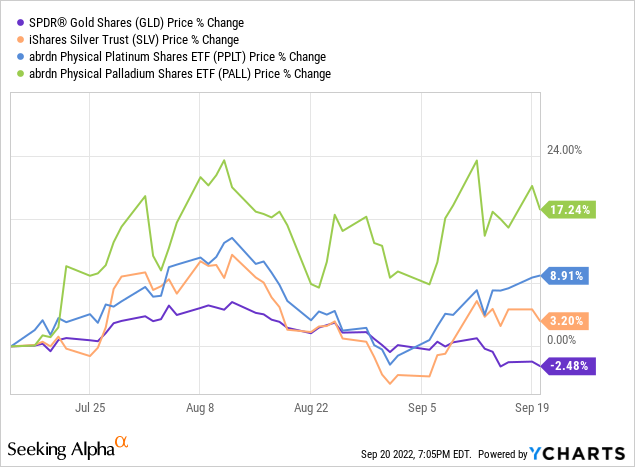

This company represents another great pick in the bottoming gold/silver/platinum/palladium mining sectors of the investment market. I have become increasingly bullish on gold and related mining investments during the course of the year, and near-unanimous sentiment by analysts/investors that gold cannot rise while the Federal Reserve and other central banks are aggressively tightening has pushed long-term valuations into ridiculously oversold and undervalued territory.

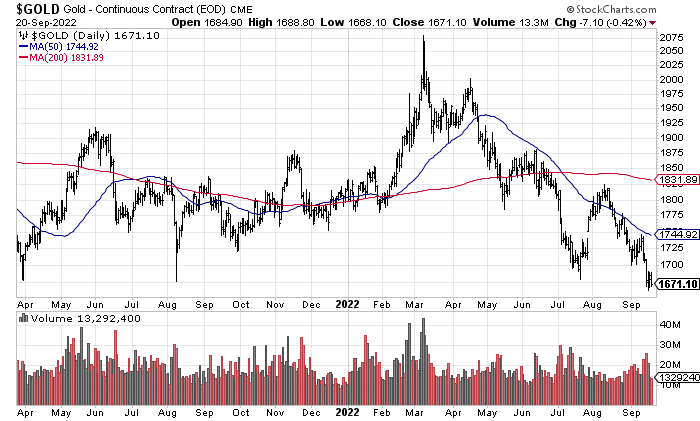

StockCharts.com – Gold Nearest Futures, 18 Months of Daily Changes

With gold reaching a 2-year low price in U.S. dollars last week, while silver, platinum and palladium are holding above their 2022 bottoms, the odds of a reversal higher in all precious metals is growing. Technically, this is the type of divergent action you see at important inflection points. Just as important, the gold price adjusted to fluctuations in the U.S. Dollar Index of paper currency exchange rates is still trading ABOVE its July low point.

YCharts – Precious Metals Pricing, Past 2 Months

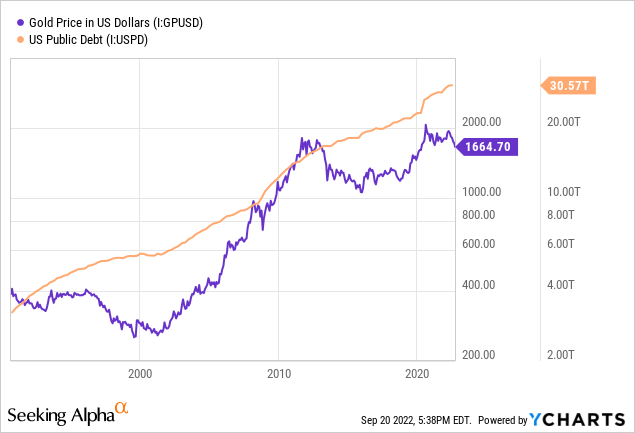

Measured against money printing through the rise in M2 money stock or future requirements for money printing in the total Treasury debt outstanding number, US$1671 an ounce for gold (the ultimate store of value and monetary metal) is just as cheap as $1100 gold in 2018! So, predicting and preparing for $2500 to $3000 gold in a few years is just plain common sense in a world full of record debts. Whose to say a deep global recession in 2023 won’t cause another round of record money printing by central banks, eclipsing even the COVID-19 pandemic shutdown response?

YCharts – M2 Money Stock vs. Gold Price, 1990-Present YCharts – U.S. Treasury Debt vs. Gold Price, 1990-Present

Final Thoughts

The logic to own Agnico Eagle revolves around (1) capturing a record low valuation from a top gold miner in your portfolio, (2) a terrific above-normal dividend yield that can rise substantially with gold prices, and (3) the potential of a double or triple in the stock quote if gold prices are headed to $2500+ an ounce during 2023-24. As a bonus, gold assets have a history of leading the stock market higher after bear markets, and hedging out-of-control money printing. What’s not to like?

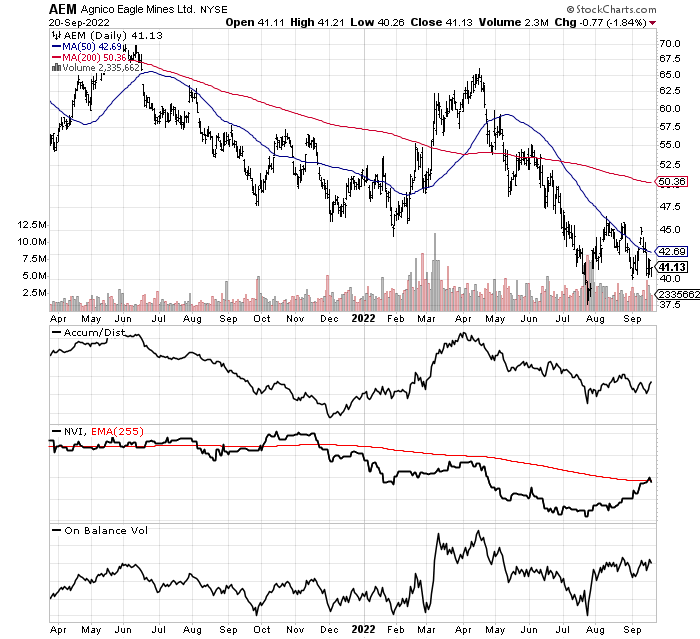

I am a shareholder and contemplating increasing my stake in coming weeks. I rate shares a Strong Buy around $41 per share. The technical momentum picture, which has held up well during 2021-22’s selloff, is starting to reverse higher already. The Negative Volume Index and On Balance Volume readings drawn below, both bottomed in July, and could be leading price higher soon.

StockCharts.com – AEM, 18 Months of Daily Changes

What’s the downside risk? A fair question. The price direction for shares is now almost completely a function of profitability, the spread between costs of mining and the gold selling price. Over the past year costs have gone up meaningfully from inflation in the world’s economy, while gold has languished in price for a variety of reasons. AEM’s stock quote has drifted lower in 2022 as a result. If you feel gold cannot rise into 2023, I understand if you choose to avoid the stock in your portfolio.

But, I will tell you, based on my 35 years of trading precious metals investments, today’s situation of fearful investors in the sector and a Federal Reserve confused on whether it should fight inflation or prevent recession is ripe for a huge move in gold soon. I am forecasting the Fed will soon give up on holding inflation down, in favor of keeping unemployment from exploding higher in 2023. If that decision becomes crystal clear to experienced traders and investors, we could witness a serious dollar confidence crisis and flood of panic buying into gold assets.

The “powers that be” are stuck with a long-term dollar devaluation theme to prevent a depression and hard default on record U.S. debts in my opinion. I discussed this Catch-22 economic backdrop last month here. If the Fed continues tightening past September, I think a severe recession with 10%+ unemployment and a debt crisis are all but assured into 2023. That would be amazingly bullish news for gold as flight-to-safety buying would erupt. Why not just buy premier leverage to gold through Agnico Eagle now, and sleep better at night whatever comes our way economically?

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment