fotokostic/iStock via Getty Images

Introduction

Origin Agritech (NASDAQ:SEED) was founded in 1998 to focus on developing genetically modified seeds for China’s market. The Company established relationships with multiple Chinese agriculture institutes to have early access to technology that it could license and commercialize. It was understood that China would eventually need to allow genetically modified organisms (“GMO”) products into the country. Origin made the early investments to capitalize on that eventuality.

China has been a net importer of food for a long time, and there are no signs of that changing. China has 22% of the world’s population and only 10% of the world’s arable land. As the middle class grows, so does the demand for meat and dairy. The domestic Chinese meat industry has dramatically increased over the last few years, which has resulted in a dramatic increase in the importation of feed corn. In the first quarter of 2021, China imported 6.7 million tons of corn – a 438% increase over the first quarter of 2020.

The Chinese government has made the policy shifts necessary to allow GMO seeds to be grown in China. The government currently allows GMO corn to be imported for animal feed because of the outsized demand that is not able to be locally supplied. At present, the regulatory agencies are in the final stages of allowing GMO seeds to be planted on Chinese soil. When that final hurdle is cleared, Origin stands to be one of three companies to capture the Chinese GMO seed market, expected to be approximately 15.6 billion yuan (US$2.4 billion).

Chinese Regulatory Framework for Seeds

In July 2000, China enacted a Seed Law to cover the development, approval, production and distribution of crop seeds. The law became effective December 1, 2000, and has been amended a number of times. In addition to the Seed Law, China regulates the seed and plants through a series of other laws, including the Plant Quarantine Law, Administrative License Law, Administrative Penalties Law, Plant Varieties Law and Genetically Modified Organisms Safety Law. Local provincial laws may also apply but these vary from province to province. The system is complex and requires local knowledge.

A Seed Production and Operation License is given either at the Provincial level, or the National level, and sets some minimum operating requirements on license holders. Origin is one of a few companies in China that are able to use the Corn Seed Green Pass Test System, which reduces the timeline to market for new hybrid varieties and allows the company to use a government protocol on their own fields to conduct the testing.

The Chinese government published Regulations on Administration of Agricultural Genetically Modified Organisms Safety in 2011, which were updated 2017 (“GMO Regulations”). The GMO Regulations govern the research, experiment, production, processing, marketing, import and export of agricultural GMO in China. The GMO Regulations classified agricultural genetically modified organisms, or GMO, into Classes I, II, III and IV according to the extent of their risks to human beings, animals, plants, microorganisms and the ecological environment. The principal difference among the classes is the reporting obligation to the relevant agricultural administration. The testing of agricultural GMO will normally go through three stages: restricted field testing, enlarged field testing and production testing. Depending on the classification of the GMO, the GMO research entity will differing levels of reporting obligation to the Ministry of Agriculture and Rural Affairs (“MARA”) prior to the commencement of the testing and when the GMO advances from one testing stage to the next testing stage. After the completion of productive testing, the GMO research entity may make an application to the MARA for a safety certificate of the tested GMO.

Origin’s GMO products are classified as Class I. As of September 30, 2019, the Company has received safety certificate for its phytase corn products. Two other products are in the Biosafety certification application stage.

A production license from MARA is required for the production of GMO seeds. A business must obtain a bio-safety certificate of agricultural GMO and pass other standards and conditions provided for by MARA. Origin is in the process of applying for GMO Biosafety certificate and in active discussions with related regulatory authorities to meet the requirements to obtain a biosafety certificate.

As with many industries in China, foreign companies are relatively blocked from entering the market, and entities can only have a limited amount of foreign investment. The Chinese GMO seed market, even when opened up, will be limited to Chinese owned and operating businesses.

Origin Corporate Structure

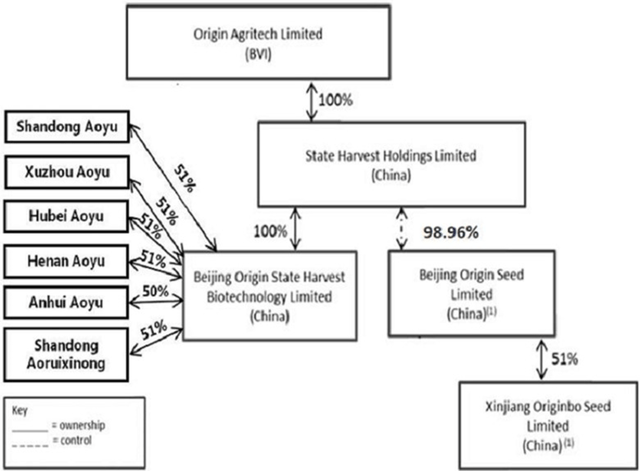

Origin Agritech Ltd. is a British Virgin Island’s company. Origin owns 100% of State Harvest Holdings Ltd., based in China. State Harvest subsequently owns 100% of Beijing Origin Stage Harvest Biotechnology Ltd., which owns a majority state in a number of regional distribution companies, and Beijing Origin Seed Ltd., which owns a majority state in one other regional distribution company.

For the regional distribution companies for which Origin does not have full ownership, the company has Consignment Agreements to hold rights over the portion of the companies that Origin does not have full ownership. These agreements are standard practice in China to help navigate the foreign entity ownership laws.

Origin’s Germoplasm Advantage

Origin has developed, or licensed, over 100 hybrid seeds, and multiple GMO trait seeds.

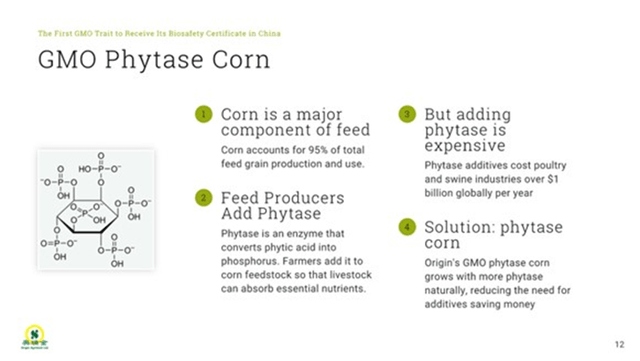

One example that Origin has developed is GMO Phytase Corn. Phytase is added to the diets of livestock to help them absorb nutrients. Over US$1 billion is spent on the additive for chickens and pigs. By modifying corn to produce phytase, the livestock producers no longer need to purchase or administer that supplement to their livestock.

SEED Corporate Presentation – July 2020

Some other key traits that Origin has disclosed are drought resistance, herbicide resistance and pest resistance. Drought resistance is probably the biggest potential product given the effects of climate change. GMO corn seeds have been shown to produce about 25% more corn than standard corn seeds. (Source: Genetic Literacy Project) . Having the ability to resist herbicides like glyphosate allows farmers decrease the invasion of other plants.

The Company has not disclosed additional traits, but have stated that they are actively working on additional GMO traits internally and with collaborators.

Total Addressable Market

China imported 6.7 million tons of corn in the first quarter of 2021. Much of that corn was for animal feed, a large percentage of which was GMO. Annualized, that represents 26.8 million tons of corn per year.

Hypothetically, the initial market for GMO seed corn in China could initially focus on replacing the imported feed corn. Assuming at least 75% of the imported corn was for animal feed, and a cost of seed per pound is between US$1.25 and US$2, then the value of the market for could be between US$900 million and US$1.4 billion. That market math assumes 26.8 million tons of corn converts to 950 million bushels. Production of corn using GMO traits caps at around 28,000 plants per acre and delivers between 180 and 220 bushels per acre – suggesting approximately 140 seeds required per bushel. (Source: Iowa State) Each bushel yields 56 lbs of shelled corn grain. There are approximately 140 seeds per pound. (Source: USDA) These US-farming assumptions would suggest that 950 million bushels requires approximately 950 million pound of seeds be planted over 4.7 million acres.

The actual potential market is likely much, much larger. It will take time for Chinese farms to figure out which seed traits are best for production on their land. It will take time for the Chinese regulatory agencies to trust an expanding portfolio of GMO seed products. Given the higher yields and China’s growing demand, GMO seeds have been recognized as part of the future.

Origin’s corporate presentation points to the GMO corn market in China to be around 15.6 billion Yuan, or US$2.3 billion. At the end of the day, for the purposes of valuing Origin, it does not matter if the market is US$900 million, US$2.3 billion or US$10 billion. Compared to highly competitive hybrid seed market, the GMO market, once open, is a huge opportunity.

Press Releases Announced the Progress of New Feed Corn Business Unit

On February 7th, 2022, the Company announced that it expected its fiscal year 2022 to be 300% of its fiscal year 2021. In the press release, Origin declared that it had sold out of its hybrid seeds for the year, and that it was going to expand its feed corn partnership with BaoDao Feed Ltd.

On March 7th, 2022, Origin announced the creation of a new subsidiary to focus on seed and feed corn production on land on Hainan Island, which has multiple growing seasons. The corn grown would be nutritionally enhanced to reduce to overall cost of feed for stock animals.

On April 7th, 2022, the Company announced that it had signed contracts to sell 50,000 metric tons of corn at market prices, plus a premium for the nutritional additives. The value of the contracts were stated to be approximately 150 million RMB.

On May 23rd, 2022, Origin announced that Yunan Feeding Company agreed to purchase 20,000 metric tons of nutritionally enhance corn for approximately 62 million RMB (~$9.2 million).

On July 27th, 2022, the Company announced an order for 240 million RMB ($35 million) from Muyuan Foodstuff, Co., Ltd., a $50 billion company with large hog farming operations. At current corn prices in China of 2.9 RMB/kg minus some estimated cost for logistics, the 240 million RMB transaction reflects approximately 100,000 metric tons. In the release, they also mentioned that the initial order was part of a 1 million metric ton 5 year order (in the corrected version of the release). At current prices, that could represent a total contract value of approximately 2.2 billion RMB (~$320 million).

At first read, the Muyuan deal sounds good. When I learned that Muyuan is the largest hog producer in China and is twice the size of Smithfield Foods, the largest hog producer in the US, the press release sounds amazing. Doing the math, based on an assumption of the average daily consumption being ~3 kg/day/hog, Muyuan could be using more than 3 million metric tons of feed per year for their hogs. The contract with Origin represents a tiny fraction of Muyuan’s overall feed corn needs. If Origin’s feed corn does indeed reduce the need and cost of additives, it would be hard to imagine that the demand from Muyuan would not grow exponentially.

The addition of the nutritionally enhanced feed corn business unit to the Company is potentially massive. The Company has telegraphed that it has sales of over 600 million RMB (~$90 million) per year in feed corn for the next five years lined up through current relationships, which would be on top of any hybrid seed sales or, if it ever gets approved, GMO seed sales.

Valuation

Based on the six months ended March 31, 2022 6-K, and the recent announcement of 240 million RMB order, Origin is probably going to have an annual run rate of north of 100 million RMB, with a gross margin of 30%. Even though the Company issued guidance of 150 million RMB, there is a fiscal year caveat. The caveat is that the Company’s 2022 calendar end is on September 31, which is in the back part of the growing season. Therefore, some part of the revenue from the most recently announced 240 million RNB initial purchase may come in the next fiscal year in October 2022.

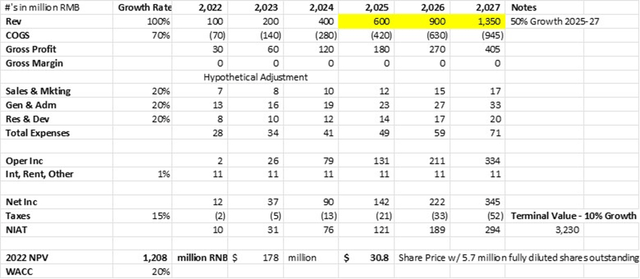

With the addition and rapid growth of the feed corn business unit, and the growth in the hybrid seen business, the Company has projected 2022 to be a 300% increase over 2021. For a valuation model, I used 100% growth from 2022-2024, 50% from 2025-2027 and 10% in the terminal value.

With the shift in business model, and the rapid growth of their feed corn business, one could imagine that the company could actually grow faster. If Origin grows 200% over the next 3 years, dropping to 100% for 2025-2027, then the NPV would be 5.2 billion RMB ($132 share price).

If the Company only grows at 50% for the next 3 years, with a drop to 25% growth for 2025-2027, then the NPV would be 275 million RMB ($7 share price).

As with most revenue companies, the valuation is highly dependent on the revenue growth rate. If Origin is actually able to grow at 100% of more, and maintain its current gross margin, then it is possible for the valuation of the Company to easily exceed a 1 billion RMB.

Comparable Companies

For the GMO side of the business, there are two other major companies in China, Beijing Dabeinong Biotechnology Co., Ltd and Longping Biotechnology (Hainan) Co., Ltd.

Beijing Dabeinong Biotechnology Co., Ltd is a 70% controlled subsidiary of by the Beijing Dabeinong Group. It is Dabeinong Group’s GMO technology research and development subsidiary. Modern Seed Industry Development Fund Co., Ltd. and Central SOEs Investment fund For Poor Area Co., Ltd. together invested RMB 400m in Beijing Dabeinong Biotechnology Col., Ltd. The deal was announced on April 26th. The pre-money valuation is RMB 3.92 billion (US$ 580 million). Modern Seed Industry Development Fund Co., Ltd was set up by Ministry of Finance, Ministry of Agriculture and Rural Affairs and Sinochem Group in 2013. Central SOEs Investment Fund for Poor Area Co., Ltd. is managed by China’s State Development & Investment Corporation. (Source: Baidu link to Chinese newspaper Securities Times)

Interestingly, Dabeinong entered a deal last year with Origin to collaborate on GMO corn seed production. Origin has one of the largest germoplasm databases in China. Currently It has three GMO corn biosafety certificates and one GMO soybean biosafety certificate. (Source: Bloomberg)

Longping Biotechnology (Hainan) Co., Ltd. is 52.34% controlled by Yuan Longping High-Tech Agriculture Co., Ltd. Longping High-Tech is majority-owned by China’s largest conglomerate, CITIC Ltd. CITIC Agri-Fund, backed by CITIC Ltd and Yuan Longping, paid $1.1 billion for part of Dow Chemical’s corn seed business in Brazil last year. Central SOEs Investment Fund For Poor Area Co., Ltd. invested RMB 400 million in the subsidiary, Longping Biotechnology (Hainan) Co., Ltd. The valuation it paid for the original shareholder shares is RMB 1 billion (US$ 140 million). Central SOEs Investment Fund for Poor Area Co., Ltd. is managed by China’s State Development & Investment Corporation. (Source: 助力”种业翻身仗” 央企基金正式对隆平生物进行投资_腾讯新闻)

The valuations of these competitors are 10X and 3X more than Origin.

In the feed corn market, there are probably hundreds of competitors. In the nutritionally enhanced feed corn market, the Company has claimed it is alone in the market. Odds are low that would be the situation for a long time, but it is likely that the only potential competition would be from the same GMO competitors, or their proxies who license the seed to grow the nutritionally enhanced feed corn. Hopefully Origin’s head start, and customer-specific feed corn, creates long term relationships that fuel rapid growth.

Insider Ownership

The Chairman and CEO, and board of directors own approximately 15% of the company.

Liquidity

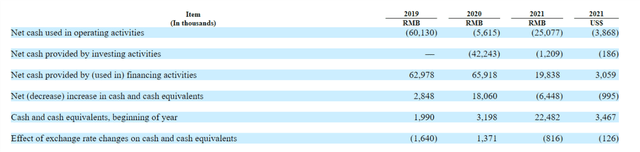

The Company has been losing money since inception and has needed to raise additional funding every year over the last few years as part of their growth strategy.

With the creation of the feed corn business unit, the Company shifts from a development company to a commercial company. In both the feed corn and seed markets in China, the customer pays some portion of the contract up front, and the balance upon delivery. With the size of the recent feed corn contracts, the upfront payments can potentially dramatically change the liquidity metrics of the Company.

In the first half of FY 2022 (ending March 31, 2022), the Company had a net profit of 1.2 million RMB. The operating business lost 1.3 million RMB, but Origin leased out part of its Beijing office building and was able to show a profit for the period. Going forward, given the upfront payments from the recent sales agreements, and the overall cash flow that should be generated through the increased sales, the Company looks to be on the verge of not needing to raise additional capital.

Major Risks

Origin has effectively shifted from development stage waiting on GMO approval to commercial stage, with a development stage incremental upside potential based on the GMO approval. There are risks associated with Company, some of which are as follows:

- Timing of GMO Approval in China: While the rhetoric in China has been generally positive toward the possibility of GMO seeds being approved, the timing of this approval is unknown. “Never” would obviously remove the bonus upside.

- Dilution: Last year, there was an assumption that the Company would need to raise a large round once the GMO authorization was granted. By growing the feed corn business to the level where they will soon be profitable on the operating business, Origin will have more and more funding options available to them outside of equity. There still may be the need for a large equity round in the event they need growth capital for the GMO authorization – but that would be a good problem to have.

- China: The X factor is China itself. Personally, I believe China to be one of the most capitalistic countries on the planet, at least at the micro level. There are some who will never invest in China because of the other baggage associated with the macro policies of the country. I am not sure what general risks apply to this investment thesis other than the regulatory risk of opening the GMO seed market. There is no logical mechanism for a dividend to shareholders in the event the Company becomes a cash machine. The exit plan from an investment would need to be a buyout, or a rotation out of the stock.

Conclusion

Origin Agritech and its management have been busy over the last year. Instead of waiting for the government to grant them an approval to launch their GMO seed product lines, they decided to add a feed corn business unit. This move has effectively opened up a second hyper growth engine. The Company is still not on many radar screens. If Origin grows at even half the Company’s projected 300% growth rate, the Company should be worth 3-13X the current share price. The downside risks suggest a 30-50% decrease in share price if the growth sputters. The dynamic entrepreneurial behavior of the management supports the upside thesis. At the current valuation of approximately US$60 million, I believe SEED is worth a small to medium sized position, and increasing the position if the GMO approval occurs. Management has called its high-growth shot, and still has the ludicrous speed upside if the Chinese government finally approves its GMO business.

Be the first to comment