Derek White/Getty Images Entertainment

Liberty Media Corporation owns and operates the 2021 World Series Champion Atlanta Braves baseball team. It also owns the stadium and much of its land, including The Battery, an incredible place to live, work, shop, and dine. The pure play on the Atlanta Braves and their real estate assets in Atlanta via The Liberty Braves Group are the Series A Liberty Braves Common Stock (NASDAQ: NASDAQ:BATRA), the Series B Liberty Braves Common Stock (NASDAQ: OTCQB:BATRB), and the Series C Liberty Braves Common Stock (NASDAQ: NASDAQ:BATRK).

If you’re a Braves fan or just a baseball fan, you might want to consider owning a piece of America’s Team. The Atlanta Braves are the reigning World Series champions. The Braves won the 2021 World Series 4 games to 2 against the Houston Astros, and they’re nip and tuck with the New York Mets for first place in the NL East in 2022. Most fans have been buying Braves World Series bobbleheads, t-shirts, and hats, but did you know you can become a shareholder of the Atlanta Braves for less than the price of Braves merchandise? You can own a part of America’s Team for less than what it costs to buy a t-shirt.

SiriusXM website

Atlanta Braves Tracking Stocks

According to Liberty Media’s most recent 10-Q filed with the SEC, a tracking stock is a type of common stock an issuing company intends to reflect or “track” the economic performance of a particular business or “group” instead of the company’s financial performance as a whole. BATRA, BATRB, and BATRK are all considered “tracking stocks,” according to their SEC filings, which track the performance of specific “groups” within the company, which, in this case, is the Atlanta Braves. Liberty Media has three groups of tracking stocks: SiriusXM Group (LSXMA, LSXMB, LSXMK), Liberty Braves Group, and the Liberty Formula One Group (FWONA, FWONB, FWONK). Each tracking stock has a separate collection of businesses, assets, and liabilities attributed to them, and no group is a separate legal entity. No group can own assets, issue securities, or enter legally binding agreements.

The Braves Group, Liberty SiriusXM Group, and Formula One Group represent the businesses, assets, and liabilities attributed to each respective group and are not separate legal entities. Holders of tracking stocks do not have any direct claim to the group’s stock or assets, so they do not own any equity or voting interest in a public company. Separate boards of directors do not represent holders of tracking stock. Instead, they are stockholders of the parent corporation, which has a single Board of Directors and is subject to all of the risks and liabilities of the parent corporation.

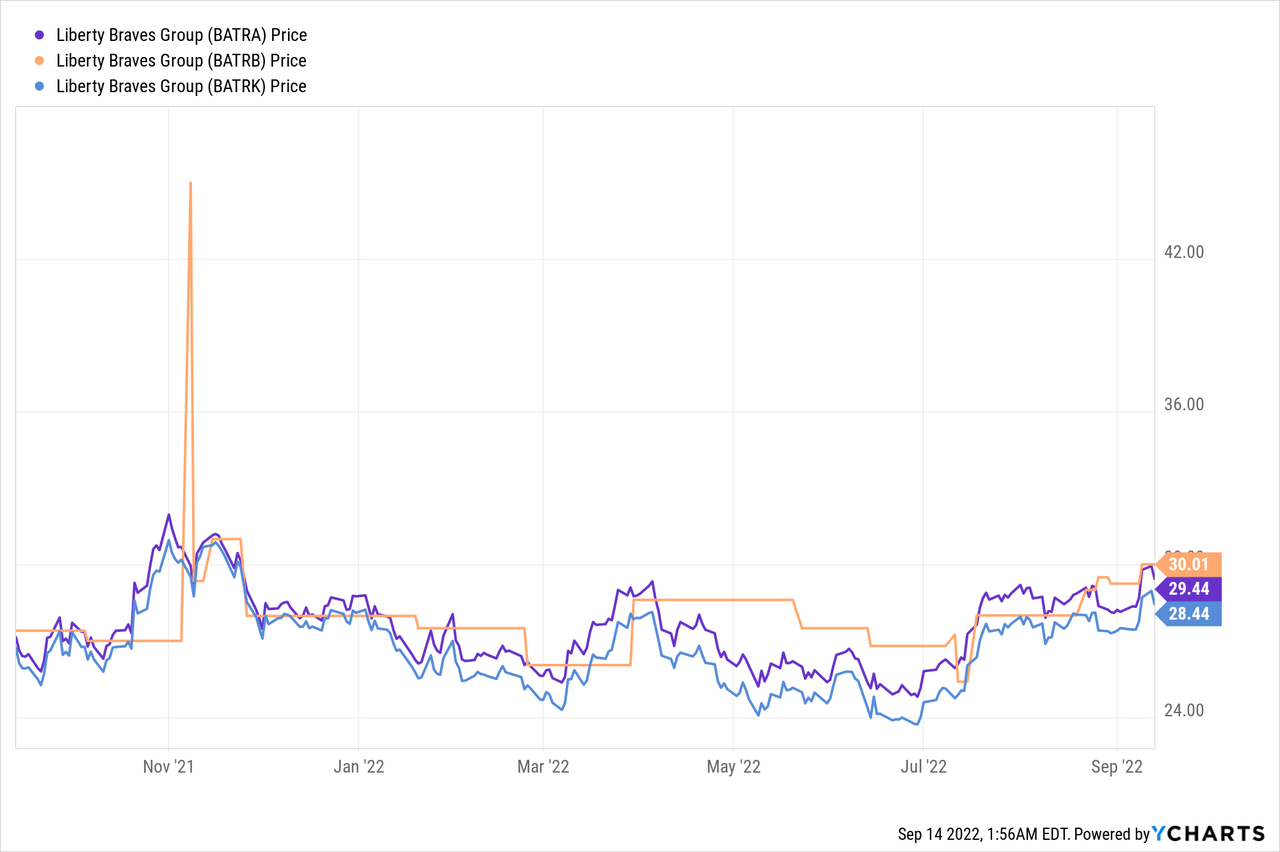

So, which one should you buy? That decision is up to you, but I suggest splitting your investment between BATRA and BATRK, the two most liquid tracking stocks with the most significant number of institutional shareholders. You still own a piece of the Braves regardless of which one you buy. The Series A Liberty Braves common stock that trades under the symbol BATRA and the Series C Liberty Braves common stock that trades under the symbol BATRK are more liquid than the Series B Liberty Braves Common Stock that trades under the symbol BATRB. Institutional investors own BATRA and BATRK. I own BATRA at $25.13 and BATRK at $23.89.

My long-term position is based more on my interest in owning stock in the Atlanta Braves than on investment merits. The holders of Series A Liberty Braves common stock (BATRA) are entitled to one vote for each share of stock held of record. Holders of Series B Liberty Braves common stock (OTCQB:BATRB) are entitled to ten votes for each share of stock they own. The Series C Liberty Braves common stock (BATRK) is entitled to 1/100th of a vote for each share. None of the three groups can enter into contracts on their own or maintain separate assets and liabilities.

BATRA had 10,313,859 outstanding shares as of June 30, 2022, and had 10,313,703 outstanding shares as of December 31, 2021. BATRA has 249 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission. These institutions hold a total of 9,896,573 shares. Largest shareholders include Gamco Investors, Inc., et al., Vanguard Group Inc, Gabelli Funds Llc, BlackRock Inc., VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, EQ ADVISORS TRUST – 1290 VT GAMCO Small Company Value Portfolio Class IA, Shapiro Capital Management Llc, Renaissance Technologies Llc, Morgan Stanley, and IWM – iShares Russell 2000 ETF.

BATRB had 7,500,000 shares authorized and 981,338 shares issued and outstanding as of June 30, 2022, and had 981,494 as of December 31, 2021. Fintel.io shows no institutional shareholders for BATRB.

BATRK has 200,000,000 shares authorized and 41,568,618 shares issued and outstanding as of June 30, 2022, and 41,494,524 shares issued and outstanding as of December 31, 2021. BATRK has 331 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). The largest shareholders include Southeastern Asset Management Inc/tn/, LLSCX – Longleaf Partners Small-Cap Fund, BlackRock Inc., Ci Investments Inc., Broad Bay Capital Management, LP, Shapiro Capital Management Llc, Vanguard Group Inc, Hawk Ridge Capital Management Lp, Gamco Investors, Inc., et al., and Wellington Management Group Llp. These institutions hold a total of 36,092,252 shares.

Atlanta Braves Financials

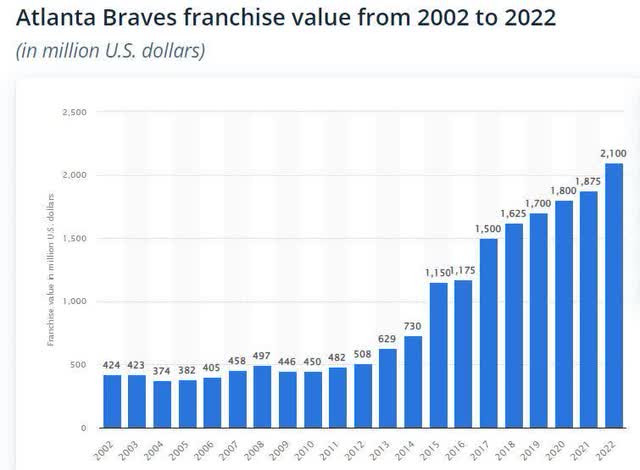

According to Statista, In 2021, the Atlanta Braves had an estimated $2.1 billion U.S. dollars. Liberty Media bought the team for $400 million U.S. dollars in 2007. As of June 30, 2022, the Braves Group has cash and cash equivalents of approximately $207 million, which includes $117 million of subsidiary cash.

Braves Holdings’ revenue is seasonal, with the majority of revenue recognized during the second and third quarters, which aligns with the baseball season. Even though revenues are seasonal, the Liberty Braves Tracking Stocks do not follow the regular season and the off season. I believe the best time to buy the Liberty Braves Tracking stocks is when the overall market is weak.

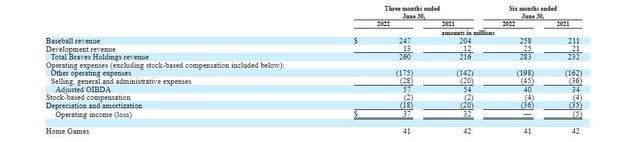

Operating results attributable to Braves Holdings were as follows:

Braves Holdings revenue increased by $44 million and $51 million during the three and six-month periods ended June 30, 2022, respectively, compared to the prior year’s corresponding periods. Increased capacity and ticket demand at regular season and Spring Training games during the three and six months ended June 30, 2022, drove increased ballpark operations revenue compared to the prior year’s corresponding periods. For the three and six months ended June 30, 2022, other operating expenses increased by $33 million and $36 million, respectively, compared to the prior year’s corresponding periods. The increases were primarily due to higher player salaries, more normalized levels of facility and game-day expenses for regular season and Spring Training games, increased revenue sharing expenses, and increases in personnel costs. Selling, general and administrative expenses increased $8 million and $9 million for the three and six months ended June 30, 2022, respectively, as compared to the corresponding periods in the prior year due to increased special event expenses, increased marketing initiatives for the 2022 season, and higher personnel costs.

The business operations of the Atlanta Braves were suspended at the outset of COVID-19. In 2020, the regular baseball season was only 60 games, and the 2021 regular baseball season only included 161 games. Braves Holdings had limitations on the number of fans attending certain games and Events in 2021, thereby reducing revenue associated with fan attendance. Braves Holdings expects a full 162-game schedule for 2022.

Summary and Investment Thesis

Since the Atlanta Braves trade as a tracking stock, there is no public peer group and virtually zero analyst coverage. Over the past five years, shares of BATRA and BATRK have traded in a tight range between $20 and $30. You can see on the above chart there was a spike after the Braves won the 2021 World Series. A 2022 World Series win might have the same impact.

In Field of Dreams, James Earl Jones’s character, Terrence Mann, said:

“America has rolled by like an army of steamrollers. It’s been erased like a blackboard, rebuilt, and erased again. But baseball has marked the time. This field, this game — it’s a part of our past.”

MLB has grown revenues 5-6% on average through recessions and expansions, so revenues should continue to grow.

Atlanta Braves franchise value 2002 to 2022 (Statista.com)

With a current market cap of all three tracking stocks around $1.54 billion, the value of the Atlanta Braves is trading at a discount to the $2.1 billion estimated value placed on the team. Several catalysts include the revenue impact of the new ballpark and mixed-use facility, the difference in valuation multiples between Tier 1 and Tier 2 MLB teams, and how well the Braves do postseason. Liberty Media has ample cash, so it probably does not need to sell the Braves anytime soon. If Liberty Media was to sell the Braves, there is a good chance it would be at a higher valuation. Remember that the Atlanta Braves have locked up a half dozen talented young players with long-term contracts.

If the Braves end up with a dynasty as the Yankees had in the late ’50s and early ’60s, then Liberty Braves shares could trade much higher. We all love making money in the market, but in the case of the Braves, I enjoy being a shareholder. Add BATRA and BATRK to your portfolio and join me as an owner of the Atlanta Braves.

Be the first to comment