Gwengoat/iStock via Getty Images

Thesis

The China Fund (NYSE:CHN) is a closed end fund focused on Chinese equities. The vehicle was listed way back in 1992, and has a significant amount of track record. As per its literature:

The Fund has an operating policy that the Fund will invest at least 80% of its assets in China companies. For this purpose, ‘China companies’ are (i) companies for which the principal securities trading market is in China; (II) companies for which the principal securities trading market is outside of China or in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets in China; or (III) companies organized in China. Under the policy, China means the People’s Republic of China, including Hong Kong, and Taiwan.

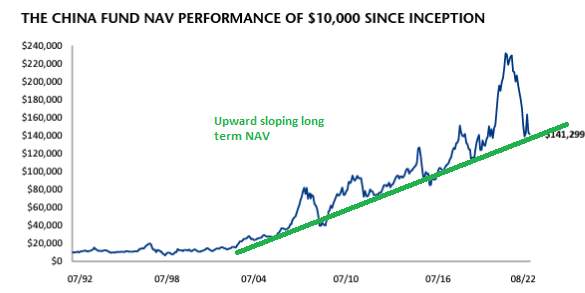

The vehicle aims to achieve long term capital appreciation, and despite being down significantly year to date (-41% to be exact), it does exhibit a nice upward sloping long term profile:

Long Term Performance (Fund Fact Sheet)

As China grew and developed so did CHN. The CEF is a bet on the Chinese economy, and it should be considered in the context of a geographic exposure financial instrument. If there is tension between the United States and China, CHN will suffer. We have seen many iterations of this topic, starting with the de-listing fears for many Chinese ADRs, to the recent sell-off related to technology/political tensions around semi-conductor technology. There will be further events like these and CHN will be impacted.

Despite all the short term negatives, in our view China will continue to grow and develop, albeit at a slower pace than before. CHN will follow that trend. We are currently experiencing the first innings of a global recession, recession which in our opinion China has been experiencing since the start of 2022. No wonder that an economic slowdown led by real estate and compounded by Covid has resulted in CHN being down this much.

The Hang Seng index is now down below the 17,000 mark for the first time in 11 years. While weakness will persist for a couple more months we do think 2023 will see a significant recovery. China will open up again and put Covid behind, with a close eye towards keeping itself fully integrated within the global trade. China is the growth engine of the world economy, and as much as other countries need China for its well-priced goods, China needs the world economy to advance its prosperity and keep its masses of growing bourgeoise employed and content. We are of the firm opinion that Russia has provided a stern lesson in what not to do on the global stage in terms of an economic future, and China has watched that closely. We firmly believe most of the strategically important and global Chinese firms such as Alibaba (BABA) will remain listed in the U.S., with accounting standards solutions that work for both sides to be implemented.

CHN is underweight the hardest hit Chinese sector, namely real estate, and overweight Consumer Discretionary. As a CEF, the vehicle has seen its discount to NAV widen this year to a -13% figure. We expect this discount to narrow in 2023 and for the fund to outperform the unleveraged ETF iShares MSCI China ETF (MCHI) in 2023. We feel that as a CEF the fund “benefits” from two negatives being thrown at it – negative fundamental performance in the underlying equities and investors shunning China risk. We cannot call a bottom and feel the next 6 months will be rough, but for investors looking for that macro China exposure coming out of the recession, CHN is better set up than MCHI via its discount and collateral composition.

Performance

The vehicle is down more than -40% year to date, in line with the Templeton Dragon Fund (TDF) which we discussed here:

YTD Total Return (Seeking Alpha)

It is interesting to note that the ETF version of Chinese equities, namely the iShares MSCI China ETF (MCHI) has outperformed the two CEFs this year. This relative outperformance is due to the discount to NAV widening that has occurred for the closed end funds.

On a 3-year basis CHN outperforms:

3Y Total Return (Seeking Alpha)

We can see the same relative value outperformance for CHN on a 10-year time-frame:

10Y Total Return (Seeking Alpha)

It is interesting to note that most of the outperformance occurred during the zero-rates 2020-2021 period (zero rates in the U.S.).

Holdings

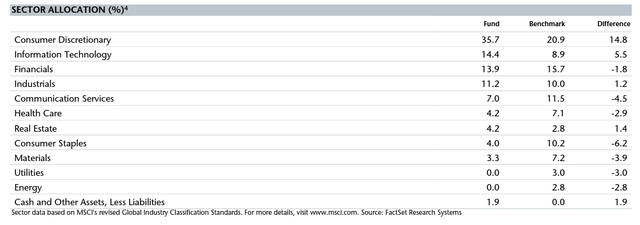

The fund is overweight Consumer Discretionary and Information Technology when compared to the benchmark:

Sector Allocation (Fund Fact Sheet)

We like the fact that the CEF is deeply underweight Real Estate, a sector which has been hit particularly hard.

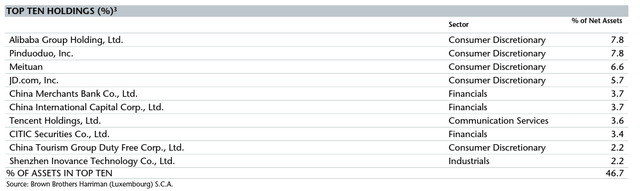

From an individual name perspective the vehicle contains well known large cap stocks:

Top Holdings (Fund Fact Sheet)

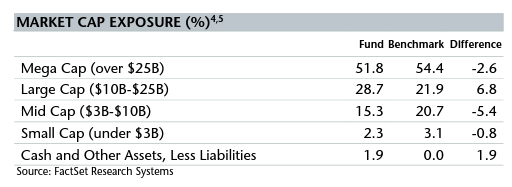

The top 10 equities account for almost half of the fund. Also worth noting the high concentration of Financials in the top holdings. The fund tends to focus on Large Caps and Mega Caps:

Market Cap (Fund Fact Sheet)

Premium / Discount

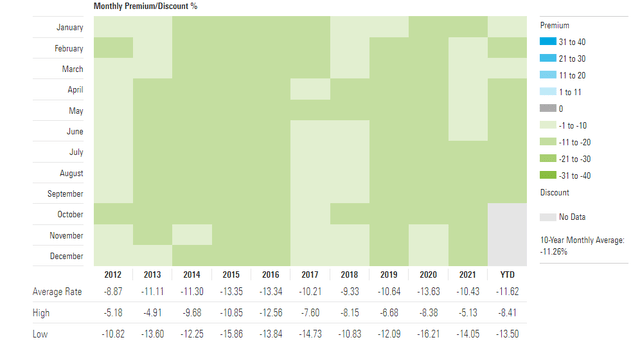

The fund has always traded at a discount to net asset value in the past decade:

Premium/Discount to NAV (Morningstar)

We can see that the discount has ranged from -5% to -16%, with an average of around -10%.

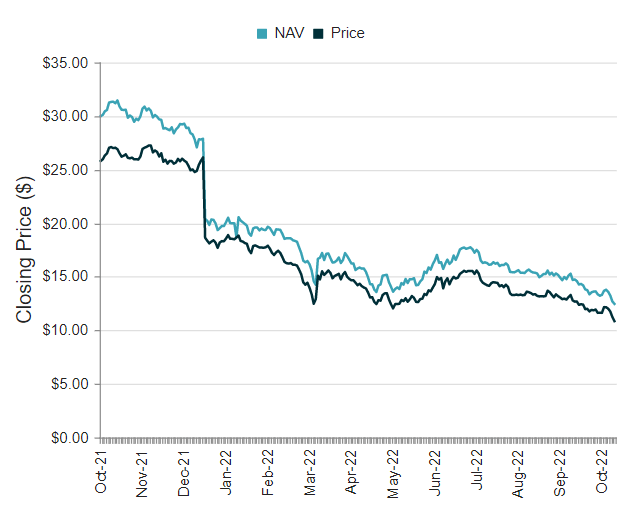

It is interesting to note what the discount has done in a very tough year like 2022:

Discount to NAV (CefConnect)

Just like other normalized CEFs, CHN had a beta to risk-on / risk-off moves throughout 2022. The recent vertical increase in the discount to now -13% has been driven by the Biden administration’s move to curtail China’s ability to produce advanced chips. This decision had a ripple effect through Chinese tech equities.

Conclusion

CHN is a closed end fund that holds Chinese equities. The vehicle has a very long track record, having IPO-ed in 1992. CHN is a macro play on China, and it should be traded as such. Reflective of the economic troubles in the jurisdiction this year, the fund is down more than -40% in 2022. The vehicle is a reflection of the Sino-American tensions as of late, with the discount to NAV widening to -13% on the back of the tensions around semi-conductor technology. We believe 2023 will see the re-emergence of the jurisdiction from its current economic malaise, and the CEF’s portfolio will post a positive performance, concurrent with a narrowing of the discount to NAV.

Be the first to comment