FrankvandenBergh

Wholesale distributor of building and industrial products, BlueLinx Holdings Inc. (NYSE:BXC), has a demonstrable track record of profitable growth. Despite this, fears over the effects of inflation and a recession on its business have led to a steep decline in the company’s share price since the beginning of the year. Those fears are unfounded, ignoring the long-run trends underpinning the business model, trends which will keep demand for the company’s products high, at least in the medium to long term. Results show that even in the near term, the company has performed very well, regardless of what the market is saying.

Background

BlueLinx was formed in 1954, but came into existence in its present form, in May 2004, when senior management bought the lumber distribution division of Georgia-Pacific LLC. The Atlanta, Georgia-based company operates from over 60 locations across the country, serving around 15,000 customers.

The company operates as a two-step distributor, buying products from manufacturers, and then using its distribution network to serve dealers and other suppliers, who go on to sell those products to end users. The company distributes specialty products, such as engineered wood, industrial products, cedar, molding, siding, metal products and insulation, and structural products, such as lumber, plywood, oriented strand board, rebar and remesh, that are either branded or private-label stock keeping units.

2021 Annual Report

The company’s scale allows it to have a thick distribution node and serve customers who might not be able to directly access its suppliers.

Impressive Stock Market Performance

In the last five years, the share price of BlueLinx has had an incredible run, with the stock price soaring some 606%, compared to nearly 13% for the Russell 2000, with much of the company’s stock market performance coming from the stock market bottom in March 2020.

Google Finance

In the year-to-date, the share price has plunged 25.43%, compared to 25.51% for the Russell 2000, giving BlueLinx a marginal edge over the Russell 2000.

Strong Financial Performance

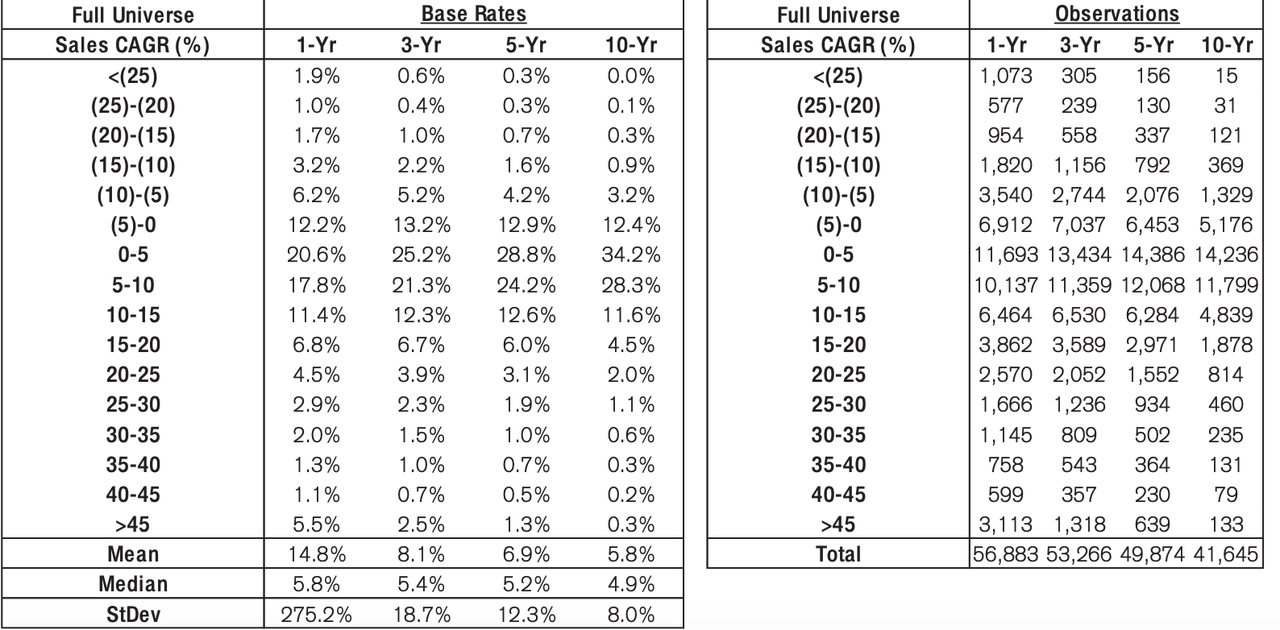

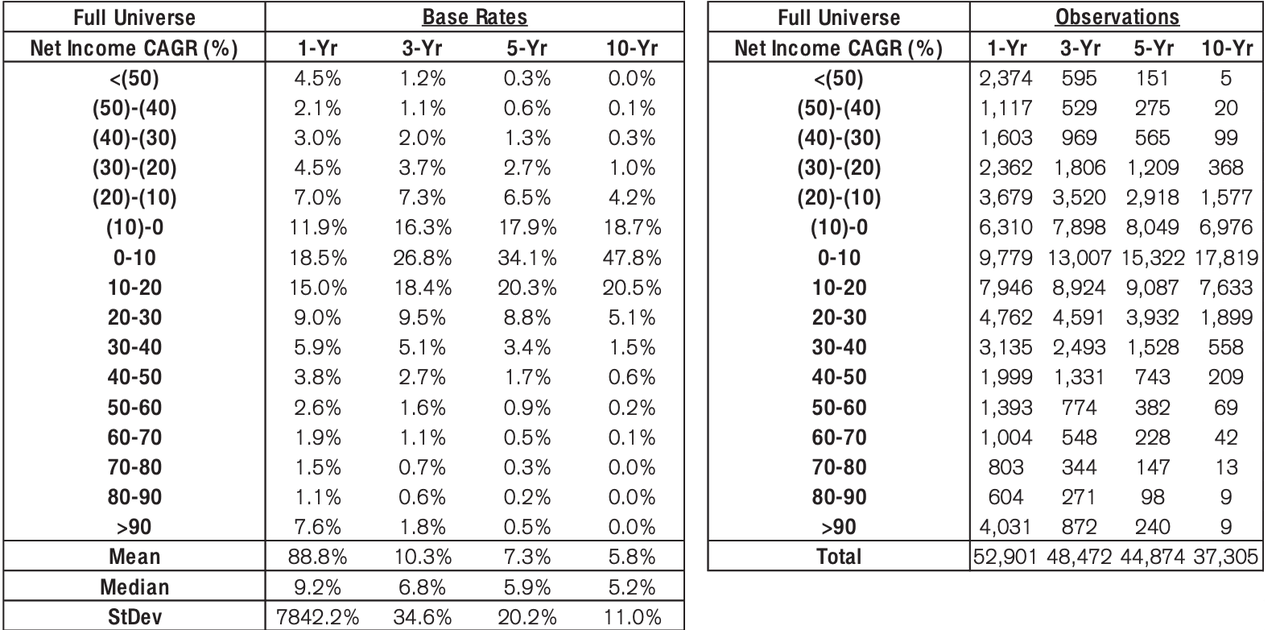

BlueLinx has raised revenues from more than $1.8 billion in 2017 to more than $4.28 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of 18.69%. According to Credit Suisse’s The Base Rate Book, just 6% of firms between 1950 and 2015 earned a similar 5-year revenue CAGR. In the trailing twelve months (TTM), revenue is nearly $4.49 billion.

Credit Suisse

Gross profitability has risen from more than 0.46 in 2017 to 0.59 in 2021, enjoying a gross profitability well above the 0.33 threshold seen as attractive by Robert Novy-Marx’s research. In the TTM period, gross profitability has declined somewhat, to nearly 0.56.

Operating margin has risen from 1.7% in 2017 to 10.2% in 2021, showing a pattern of improving profitability echoed by other metrics. In the TTM period, operating margin has risen to 10.7%. According to The Base Rate Book, the median operating margin for industrials is 9%, and the average is 11%. Operating margin is low, while asset turnover is fairly high, declining from 3.61 in 2017 to 3.41 in 2021. Asset turnover has further declined in the TTM, to 3.23. This suggests that the company pursues a cost leadership strategy in the market.

Net income has risen from $62.99 million in 2017 to $296.13 million in 2021, for a 5-year net income CAGR of 36.28%. That translates to a base rate of 3.4% of businesses between 1950 and 2015. In the TTM period, net income has risen to $325.5 million.

Credit Suisse

Return on invested capital (ROIC) has dramatically risen from 4.6% in 2017 to 28.9% in 2021. The company has been able to earn a very attractive ROIC in order to deliver higher levels of economic profits to its shareholders. In the TTM period, ROIC has continued to rise to 30.4%. There is a positive correlation between ROIC and future stock market performance.

Free cash flow (FCF) has risen sharply from -$3.3 million in 2017 to $140.94 million in 2021. In the TTM period, FCF is $215.68 million.

Housing Is Still A Problem

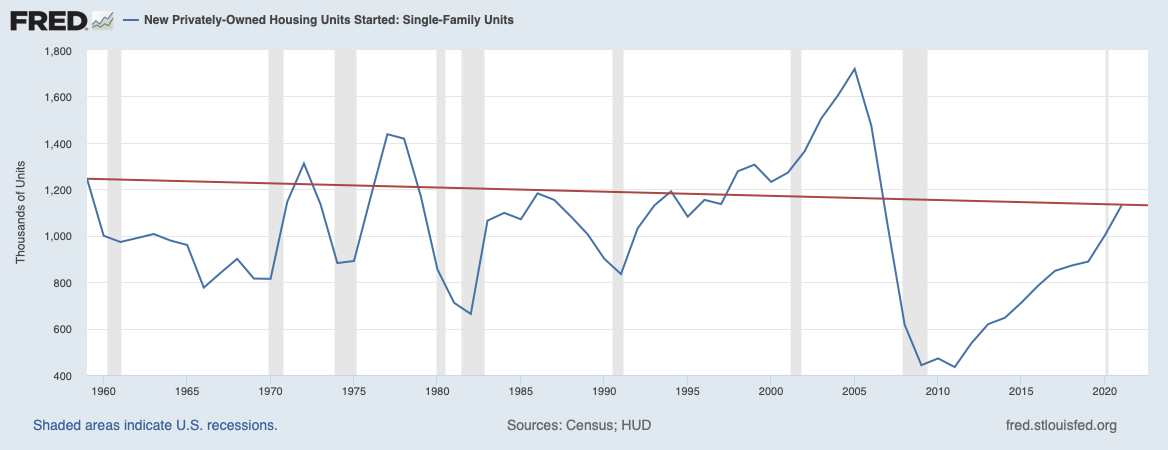

Although the United States has experienced a housing boom over the last decade, that boom has largely been “debtless“, and driven by household wealth recovery in the aftermath of the Great Recession. In other words, the housing boom has not been an artificial creation of the Federal Reserve, but a process driven by real consumer needs. In addition, average single-family housing starts have declined in recent decades, creating a deficit in supply that has helped to drive housing prices.

FRED

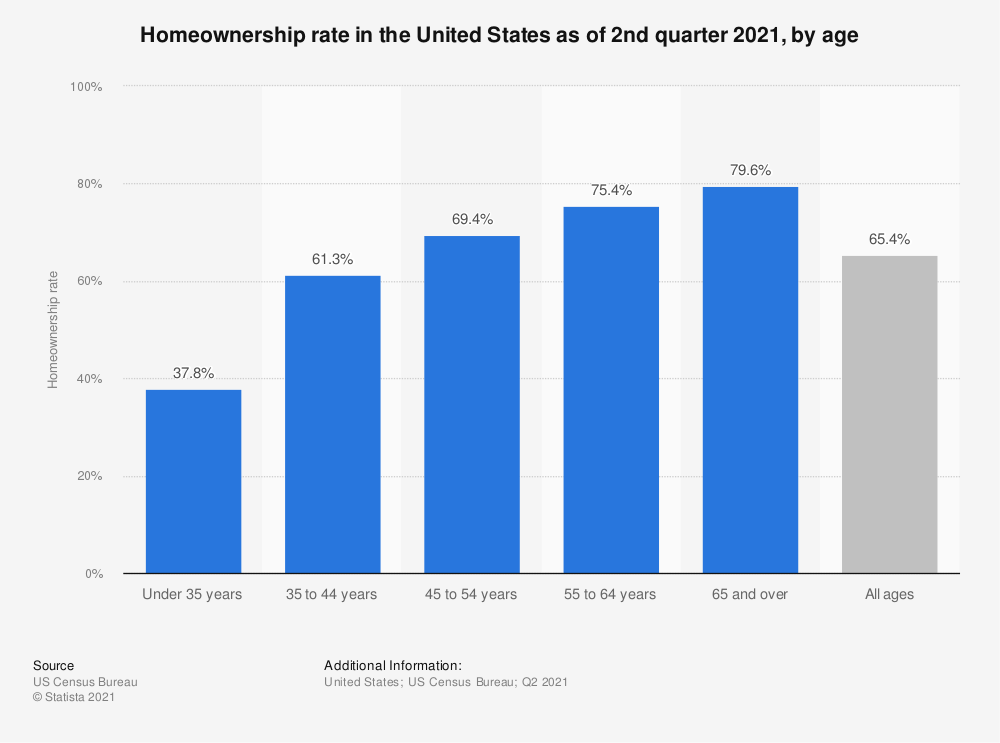

The post-Great Recession housing collapse has led to a buildup of the housing deficit. Last year, FreddieMac estimated that the housing deficit could be as high as 3 million single-family units. In the last year, the housing shortage has gotten bigger. Low supply has resulted in home ownership for people under the age of 35, or between the ages 35 and 44, being much lower than the average for all cohorts.

Statista

For more than a decade, the United States has faced a housing shortage, despite a growth in the population. The housing boom post-Great Recession led to an oversupply of homes, but with population growth, the picture has changed. With millennials demanding more homes, the likelihood is that, despite a softening of the housing market over the last year, in the long run, demand for homes is likely to rise as a result of the housing crisis in America.

The Great Migration To The South And West

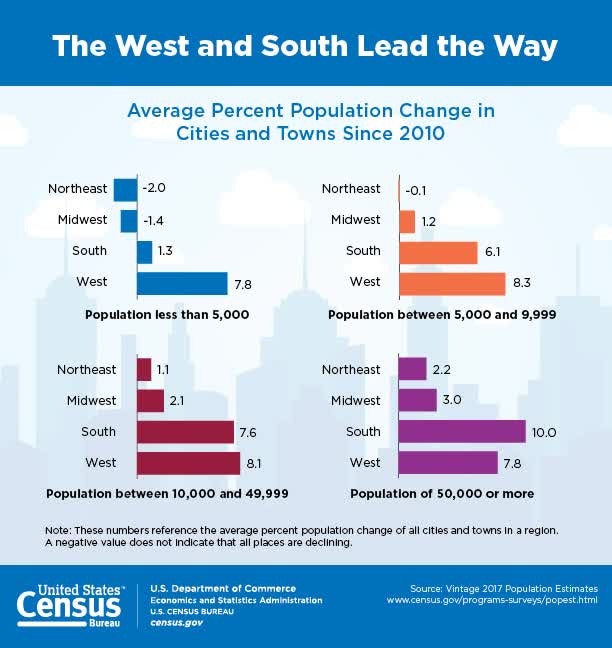

Although the idea of people moving from big cities to suburban and rural America has been linked to the pandemic and the emergence of remote work, that trend has longer roots, as the U.S. population has shifted toward the South and West. These people are moving in search of lower cost of living, bigger homes, and a higher quality of life, and many big businesses are following suit. The secular shift toward the South and West is clear when you consider that, between 2010 and 2018, the fastest-growing cities were in the South and West.

U.S. Census Bureau

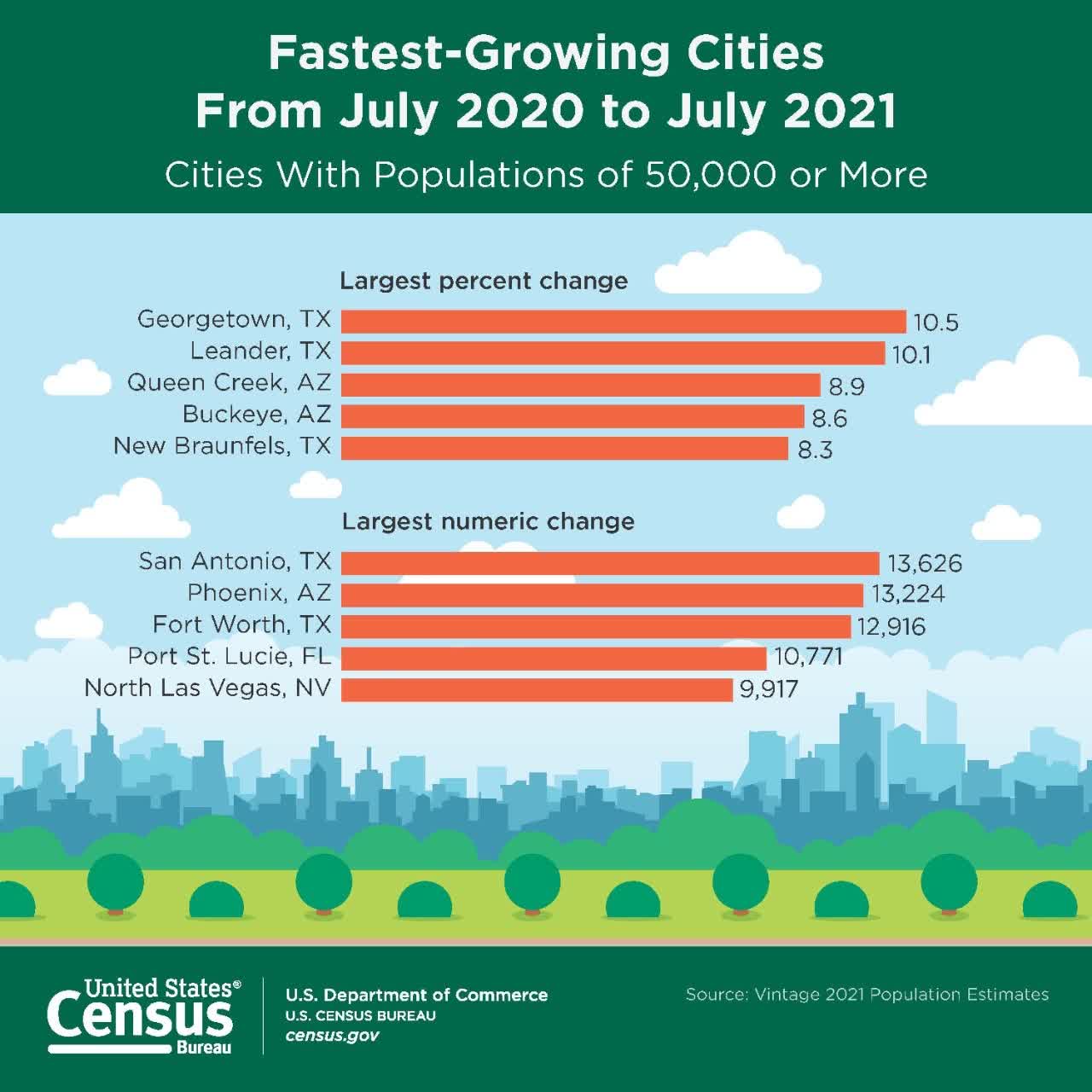

The shift presents an opportunity for firms such as BlueLinx, because of the significant housing deficit in both those regions, given historical migration trends. The South and West still have the fastest-growing cities in the United States.

U.S. Census Bureau

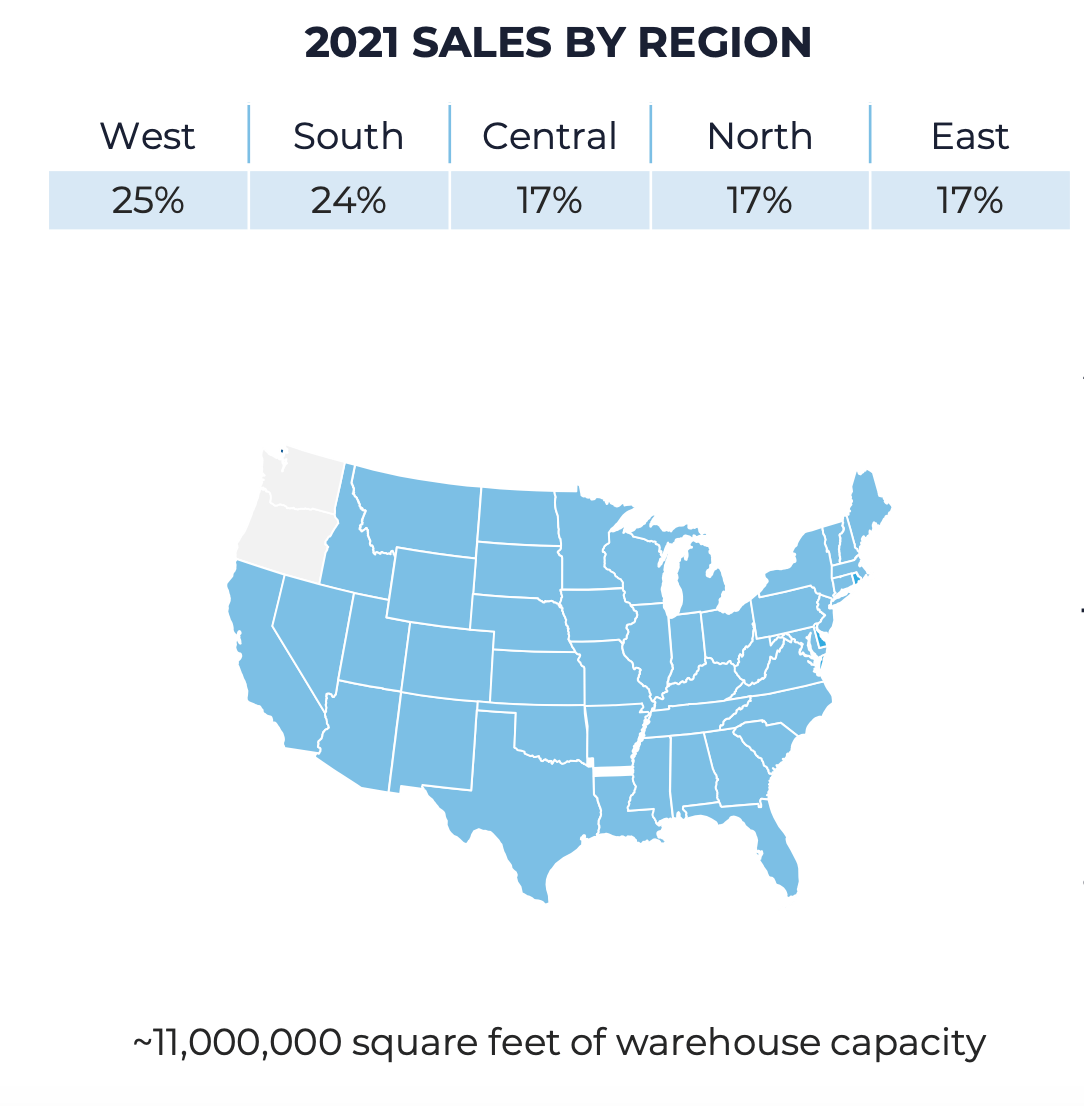

These trends are important because 49% of the firm’s 2021 sales came from the South and the West. The company’s exposure to the region is a significant driver of revenue growth, and, as we have seen, the region is likely to continue to have a rising demand for homes amidst a nationwide housing shortage.

BlueLinx’ D.A. Davidson Industrials & Services Conference September 22, 2022 Presentation

Is BlueLinx A Buy?

With $215.68 million in FCF in the TTM period and an enterprise value of $1.14 billion, BlueLinx has an FCF yield of 18.19%. This is a very attractive FCF yield and is much higher than the 1.5% FCF yield of the 2000 largest companies in the United States, as measured by financial services firm, New Constructs LLC.

Conclusion

BlueLinx has demonstrated an ability to grow profitably over the last five years. Indeed, the company has grown profits and FCF at a much higher rate than it has revenues. Long-run trends underpin the housing market and are likely to endure. This means that, despite any potential softening in the near-term, demand for the company’s products will remain strong. With a clear runway for growth and an undervalued business, BlueLinx deserves to be in any investor’s portfolio.

Be the first to comment