Oleksandr Shchus

Investment Thesis

CHPT YTD Stock Price

ChargePoint Holdings, Inc. (NYSE:NYSE:CHPT) has been unfortunately decimated with a -72.06% plunge from its peak levels of $46.1 in hyper-pandemic levels. However, we remain optimistic about its aggressive approach and geographical expansion, since the sales for new vehicles are still robust now. October CPI reports continue to report elevated demand thus far at 0.5% sequentially and 8.4% YoY, with most automakers unable to produce EVs fast enough for the growing backorders. General Motors (GM) has recently guided 1M of EV production capacity by 2025, with Ford (F) more ambitiously pushing for 2M by FY2026. With an increasing number of EVs on the road, it is no wonder that Mr. Market understands the massive value and relevance of CHPT through the next decade.

Bloomberg has also projected that EV annual sales will hit a record high of 20.6M globally by 2025, accounting for 23% of all new vehicle sales then, against 9% in 2021. The EU will also make up a large part of that demand, as the EU government expects to install 1M charging stations by 2025, to cater to the immense 21-fold growth in EVs on the road to 30M by 2030, compared to 2022 levels of 1.4M. Therefore, making sense of CHPT’s aggressive expansion into the EU market, with the ViriCiti B.V. acquisition in August 2021, has•to•be gmbh acquisition in October 2021, and the launch of CP6000 for scalability and flexibility in global charging solutions.

By October 2022, CHPT is already operating over 200K charging points in North America and 16 EU countries, indicating a tremendous increase of 69.49% YoY in the installed base of network ports. Notably, 30% are in the EU, with the management guiding further expansion over the next few years, in order to capture the massive boom in demand once the macroeconomics recovers by 2024. Impressive indeed, since the global EV market is also expected to expand to $823.75B in value by 2030, at an accelerated CAGR of 18.2%.

CHPT Continues To Face Temporary Margin Headwinds

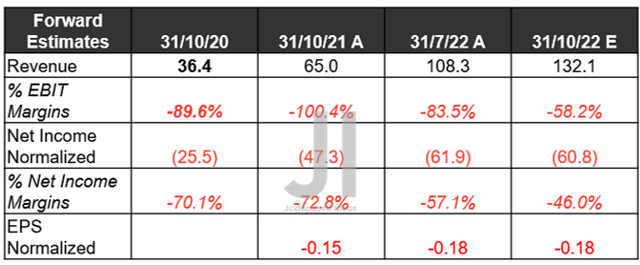

CHPT Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

In its upcoming FQ3’23 earnings call, CHPT is expected to report revenues of $132.1M and EBIT margins of -58.2%, indicating massive QoQ growth of 21.97% and 25.3 percentage points, respectively. Otherwise, an excellent YoY 203.23% and 42.2 percentage points YoY, respectively, despite the tougher YoY comparison.

On the other hand, CHPT’s profitability remains a distance away, with net incomes of -$60.8M and net income margins of -46% in the next quarter, representing minimal improvements QoQ and YoY. Thereby, explaining its projected EPS of -$0.18.

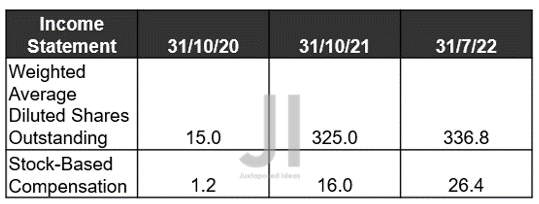

CHPT Total Share Count & SBC Expenses ( in million $ )

S&P Capital IQ

Increasing inflationary pressure negatively impacts CHPT’s gross margins, which is part of the reason for its ongoing unprofitability. By FQ2’23, it reported gross margins of 16.8%, indicating notable declines from FQ3’22 levels of 24.7% and FQ3’21 levels of 19.9%. Furthermore, the company also increased its reliance on Stock-Based Compensation to $73.41M over the last twelve months (LTM), representing a tremendous increase of 89.59% sequentially. Thereby, exacerbating its profit margins and diluting its shareholders by an eye-watering 49.34% since its IPO in March 2021.

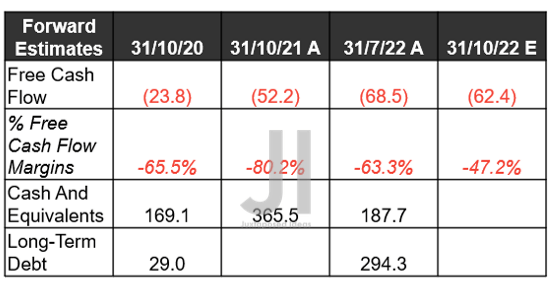

CHPT Cash/ Equivalents, FCF ( in million $ ) %, and Debt

S&P Capital IQ

Combined with its aggressive capital expenditure of $17.5M over the LTM, indicating a sequential increase of 31.48%, it is no wonder that CHPT is not expected to report positive Free Cash Flow (FCF) generation by FQ3’23. Nonetheless, investors need not lose heart, since the company is starting to narrow the gap, as witnessed since FQ3’21. In addition, these investments have also been top and bottom lines accretive, as witnessed above, and will likely continue to be through the next decade.

On the flip side, CHPT would likely raise more capital in the short-term, due to the dwindling cash and equivalents of $187.7M from the last quarter. Especially given the worsening macroeconomics and the Fed’s hike through 2023.

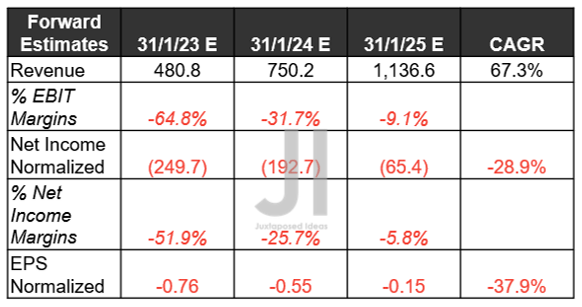

CHPT Projected Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

S&P Capital IQ

In the meantime, CHPT’s forward execution has remained robust for now, with no downgrades from market analysts, since our previous analysis in June and September 2022. It is apparent that Mr. Market remains highly confident about its top-line growth through FY2025, at an impressive CAGR of 67.3%, notably accelerated from pre-pandemic levels of 52.85% and hyper-pandemic levels of 29.14%. Stellar, despite the impact of peak recessionary fears and perceived destruction of demand.

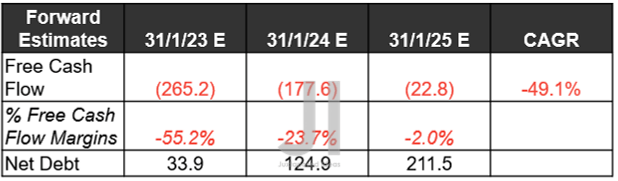

CHPT Projected FCF ( in million $ ) % and Net Debt

S&P Capital IQ

In the meantime, investors should also temper their expectations of CHPT’s profitability, since the company is still at growth at all cost stages. Net income and FCF profitability will remain elusive through FY2025, thereby, indicating the need for possible additional debt leveraging by FY2024 and FY2025, as seen by the increased net debt levels we expect then. However, these sums look reasonable thus far. We’ll see.

In the meantime, we encourage you to read our previous article on CHPT, which would help you better understand its position and market opportunities.

- ChargePoint: This Lightning Charge Will Not Last

- ChargePoint: The Hidden Ace In EV War

So, Is CHPT Stock A Buy, Sell, or Hold?

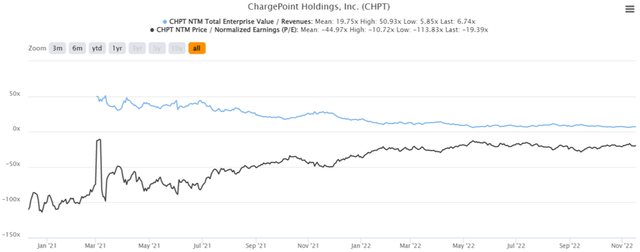

CHPT 2Y EV/Revenue and P/E Valuations

CHPT is currently trading at an EV/NTM Revenue of 6.74x and NTM P/E of -19.39x, lower than its 2Y EV/Revenue mean of 19.75x though massively improved from its 2Y P/E mean of -44.97x. The stock is also trading at $12.88, down -55.15% from its 52 weeks high of $28.72, though at a premium of 51.52% from its 52 weeks low of $8.50. Nonetheless, consensus estimates remain bullish about CHPT’s prospects, given their price target of $24.79 and a 92.47% upside from current prices.

Combined with the factors discussed above, we rate CHPT stock as a speculative Buy, despite the recent 14.69% rally. The S&P 500 Index has already moderately recovered by 10.67% from the recent market bottom in mid-October, indicating Mr. Market’s growing optimism of a soft landing through 2023.

Naturally, CHPT investors who add at these levels must be willing to weather a little more volatility in the short term, depending on the Fed’s speculative pivot in December. Nonetheless, we are a little more hopeful, since the company remains one of the leading global EV charging network stocks in the market, with a massive runway for adoption and growth through the next decade. Furthermore, 85.4% of market analysts are already predicting a 50 basis point hike next, mirroring the Bank of Canada’s recent moderation. Combined with the fact that CHPT is trading attractively below its 50-day moving average, the stock may easily outperform ahead.

Be the first to comment