urzine/iStock via Getty Images

Thesis

ZIM Integrated Shipping (NYSE:ZIM) has continued to consolidate along its September lows even though it reported a hugely disappointing FQ3 earnings release. Accordingly, the Street analysts (who were bullish for most of 2022) understated the extent of the freight rates normalization, which impacted ZIM’s contract rates significantly.

Furthermore, ZIM revised its guidance downward markedly to reflect a faster-than-expected slide in contract rates, suggesting a Q4 adjusted EBITDA growth of -58.4% YoY.

Notwithstanding, we highlighted in our previous article that the market has likely reflected significant execution risks through FY23. As such, ZIM continues to show remarkable resilience along its September/October lows. However, there’s no question that the momentum has shifted decisively to sellers, even though a mean-reversion opportunity remains possible.

While we are optimistic that the market has likely de-rated ZIM significantly, we postulate a near-term boost seems increasingly unlikely. The accumulation phase since our previous update has not convinced us that buyers have garnered sufficient momentum to lift its buying upside after a steep capitulation move from its August highs. Hence, the initiative has likely shifted to sellers, and the longer that ZIM stays in the current zone, the more challenging for buyers to try and recover its medium-term bullish bias.

Hence, we no longer view the retaking of ZIM’s August highs as likely in the medium term. Maintain Buy, with a price target (PT) of $30.

However, investors are reminded to take appropriate risk management actions if sellers manage to break below ZIM’s September/October lows decisively, which could portend a more substantial downturn for ZIM moving ahead.

Street Analysts Turned Pessimistic – Good for ZIM

Our analysis of ZIM’s earnings commentary suggests that management attempted to de-risk its execution risks through FY23 while maintaining its capital allocation policy relating to its dividend strategy.

Accordingly, management accentuated that it remains committed to its 30% payout ratio despite the steep normalization in freight rates. CFO Xavier Destriau articulated:

What has been very important to the company is to say what we tend to do and execute on what we said. We’ve been consistent in that approach. We continue to be true to our 30% dividend payout. (ZIM FQ3’22 earnings call)

However, management also maintained that the macro environment remains highly uncertain, likely worsened by a growing order book leading to “supply growth expected to be considerably greater versus demand growth than previously projected.”

We believe management has astutely sandbagged its outlook to reflect increasing uncertainties in the normalization of freight rates. Accordingly, global freight rates have declined significantly over the past three months, down nearly 50%, falling through November.

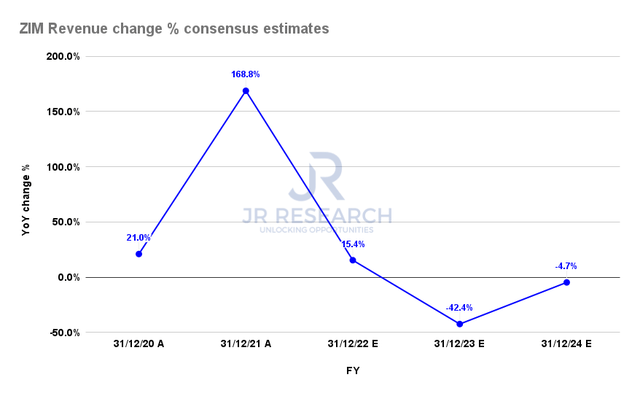

ZIM Revenue change % consensus estimates (S&P Cap IQ)

Hence, Street analysts also turned increasingly pessimistic, with the consensus rating downgraded to Hold after being on Buy for most of 2022.

Analysts have revised their outlook significantly for FY23, seeing a 42% drop in revenue, indicating that investors should expect a highly challenging year for ZIM.

Furthermore, analysts were even more downbeat on ZIM’s implied Q4 adjusted EBITDA guidance. Management revised its FY22 adjusted EBITDA from $8B (midpoint) to $7.55B (midpoint). As such, it implies Q4 adjusted EBITDA guidance of about $982M (down 58.4% YoY).

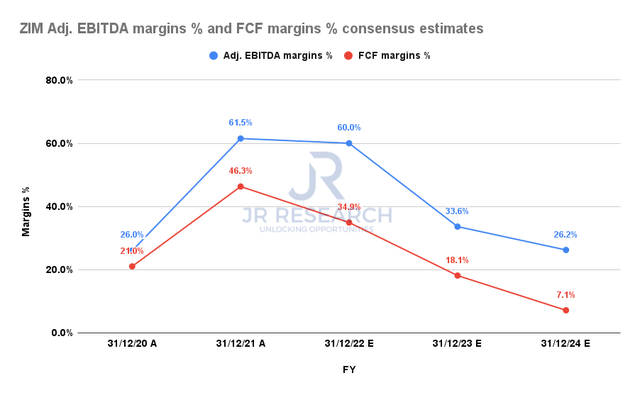

ZIM Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

However, revised analysts’ estimates indicate an FY22 adjusted EBITDA of $7.43B, in line with the lower end of ZIM’s updated guidance range. Hence, we postulate that the Street has likely pulled out its bear case on ZIM over the next couple of years.

Therefore, we believe the Street’s pessimism should help ZIM to outperform the lowered bar if it could execute well on its asset-light model, supporting its robust free cash flow (FCF) conversion relative to more traditional peers.

Is ZIM Stock A Buy, Sell, Or Hold?

ZIM last traded at an NTM EBITDA multiple of 1.2x, below its peers’ median of 2.3x (according to S&P Cap IQ data). Therefore, the de-rating has been appropriate, as the market anticipated a significant cut in its profitability outlook. As such, it has normalized its valuation closer to its all-time average of 1.45x, up from its previous lows of 0.7x (pre-earnings).

We believe the de-rating is necessary to reflect increased risks of further cuts in its forward dividend payout as the Street downgraded its earnings estimates through FY24.

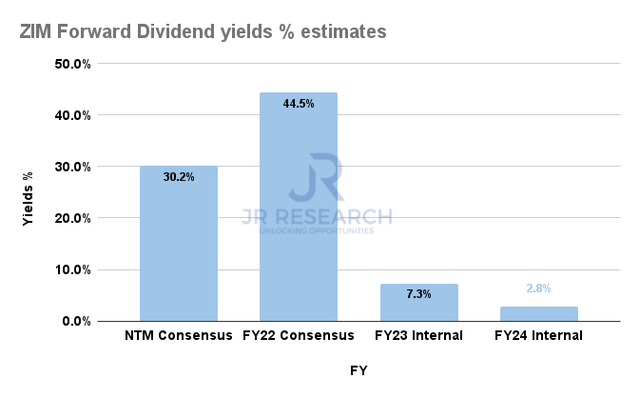

ZIM Forward dividend yields % estimates (S&P Cap IQ)

Based on ZIM’s revised adjusted EPS estimates, we parse that its FY23 dividend yield could fall to 7.3%, with FY24’s yield down further to 2.8%. Our model assumes that ZIM continues to fulfill its 30% payout policy. Hence, we assess that the market has likely priced in the probability that ZIM’s dividend yields could fall significantly relative to the highs seen in 2022.

Moving forward, we urge investors to consider using its EBITDA multiples to evaluate its valuation accordingly.

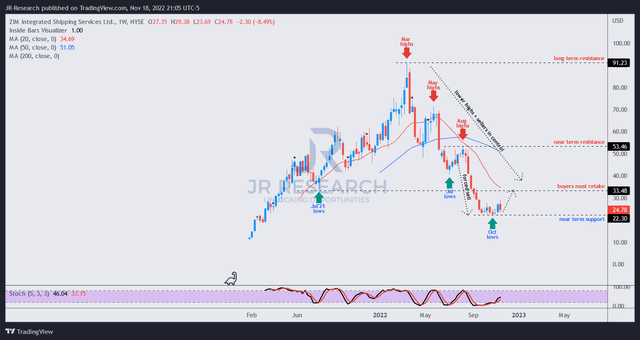

ZIM price chart (weekly) (TradingView)

Despite its robust dividend payout, ZIM is down nearly 40% YTD on a total return basis. Moreover, on a price-performance basis, ZIM is down almost 73% from its March 2022 highs. Therefore, we believe significant pessimism has likely been reflected in its valuation.

Notwithstanding, investors should not expect ZIM to retake its August highs soon. Our analysis suggests that buyers lack conviction at the current levels, despite the panic selloff toward its September lows. Moreover, we had anticipated a sharp mean reversion rally from the steep selldown, which didn’t materialize.

Hence, we assess that the momentum remains decisively with ZIM’s sellers, with the 20-week moving average (red line) moving quickly to form a critical resistance zone.

Hence, we believe it’s no longer viable for investors to expect a quick surge toward its August highs.

Maintain Buy with a PT of $30.

Be the first to comment