Darren415

This article was first released to Systematic Income subscribers and free trials on Dec. 4.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of December.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

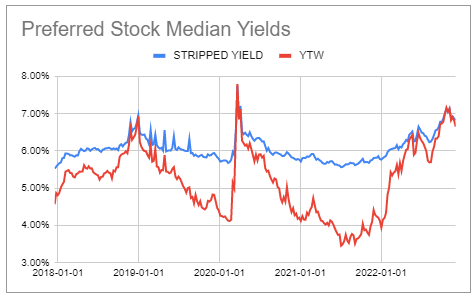

Preferreds had a strong week, supported by a rally in bonds and stocks. Preferreds yields have come off a level north of 7% to around 6.6% as of this writing on the back of lower Treasury yields and credit spreads.

Systematic Income Preferreds Tool

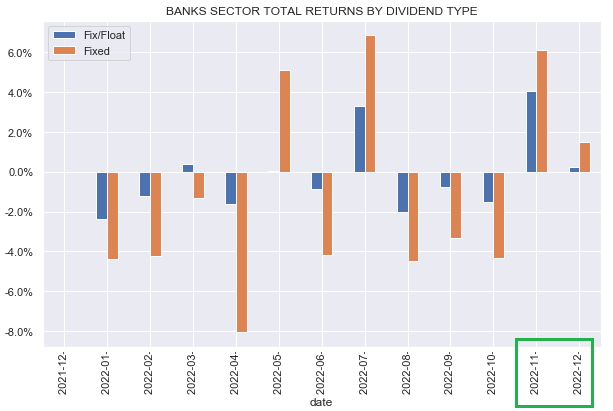

Fixed-rate preferreds have outperformed since November as Treasury yields have fallen on the back of an expectation of an eventual pause by the Fed.

Systematic Income

Market Themes

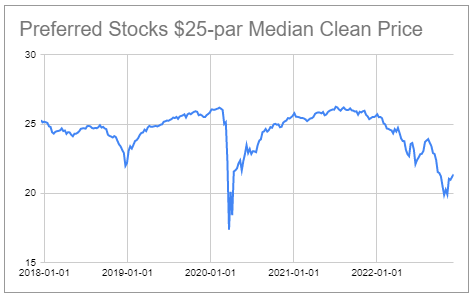

Nearly all preferred stocks are trading below “par” with the median price a bit above $21. This means that many stocks are trading at very high yields-to-call – the yield of the stock if it is redeemed on the first call date.

Systematic Income Preferreds Tool

There is a view that yield-to-call is the best way to look at Fix/Float preferreds because high short-term rates ensure that these securities will be redeemed on the first call date. For instance, a 5% fixed-rate preferred, with a Libor+3% spread would see its coupon increase to 8% with Libor at 5% – a figure that’s now viewed as the consensus floor for the peak policy rate. This sharp increase in coupons from 5% to 8% on the first call date does incentivize the issuer to redeem the preferred. If the stock also trades well below “par” and the first call date is not far away it will also tend to feature a high yield-to-call – often at a double-digit level. This high yield-to-call catches the eye of many investors who assume that the increase in coupons will result in a guaranteed redemption of the stock. This sequence of steps of an increase in coupons leading to a redemption leading to a high yield-to-call for investors sounds intuitive, however there are a few key points to add.

One, many issuers, particularly sophisticated ones like banks, could easily have hedged out floating-rate stocks, swapping them to fixed-rates – this is what many loan issuers do.

Two, an increase in rates shouldn’t be considered in stand-alone terms. After all, issuers like Banks are in a lending business so their income also increases with short-term rates. In other words, when considered along with its assets, a floating-rate preferred does not reduce the net income of the bank since the increase in interest expense is offset by a corresponding increase in interest on the asset side of the balance sheet.

Three, the view that, obviously issuers would redeem a preferred whose coupon increases, assumes that issuers just have idle cash sitting around for the purpose of redemption. Very often a company with idle cash would rather put that cash to work since its ROE should be higher than the coupon of its preferreds so keeping the preferred outstanding could be a better corporate decision.

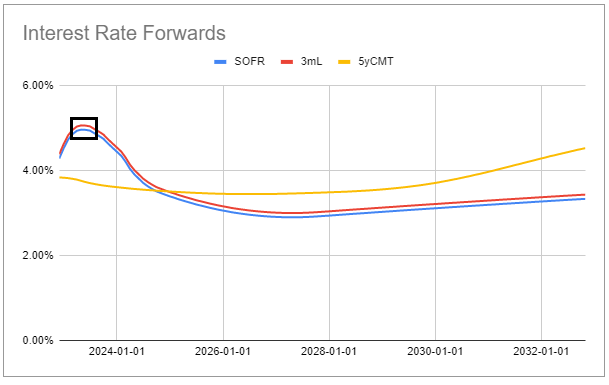

Finally, interest rates could easily fall in the future so chasing the latest move in rates may not be a sound decision by the company. Rather, keeping some fixed-rate and some floating-rate securities outstanding can smooth out the borrowing cost over various cycles.

Overall, yield-to-call is a very useful metric and it’s certainly a good idea to have some high YTC stocks in the portfolios, however, there are more factors at play for a redemption than just the change in the coupon.

Market Commentary

BDC Runway Growth (RWAY) has priced a new bond (RWAYZ) at 8%. The bond is a Dec-2027 maturity, callable in Dec-2024. They have another bond (RWAYL) trading at 7.92% yield with Sep-24, Sep-27 dates. This looks pretty good for 5Y paper. If the BDC sector starts trading at a premium in aggregate which is only 4% away (i.e. average BDC valuation is 96% currently), it will make sense to start thinking about rotating from BDC common shares to BDC bonds.

Stance and Takeaways

This week we rotated from a CEF position in our Core Income Portfolio and added, in part, to our NLY.PF holding. NLY.PF floated at the end of September to a coupon of 3M Libor + 4.993% and declared its first dividend of around 8.75% based on Libor of about 3.75% observed at the start of the accrual period in September. The next coupon will have its Libor set at the end of December and this will likely be more than 1% higher – likely closer to 5% (Libor is already at 4.77% as of this writing). This continued rise in short-term rates will support the stock and increase its already attractive yield. The risk to the stock is an unexpected shift to rate cuts on the part of the Fed. This is not our base case given the strength in the Labor market – however, moderate cuts are already expected by the market in the middle of next year and provide a margin of safety to a Fed pivot.

Systematic Income Preferreds Tool

Be the first to comment