everythingpossible

“Better to die fighting for freedom then be a prisoner all the days of your life.”― Bob Marley

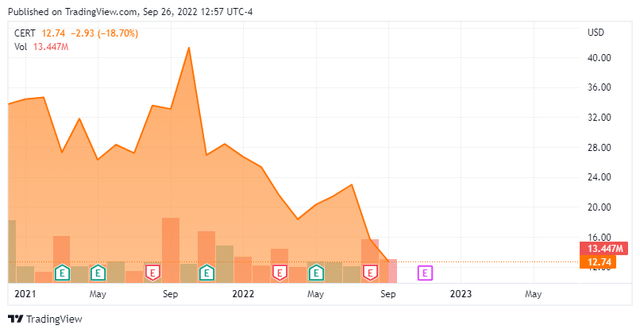

Today, we put Certara, Inc. (NASDAQ:CERT) in the spotlight for the first time. The company is using biosimulation software to help streamline the drug discovery process by enabling virtual trials to predict how drugs might behave in patients. The stock has fallen sharply from its highs last year even as Certara has achieved profitability. An analysis on this intriguing healthcare pioneer follows.

Company Overview:

June Company Presentation

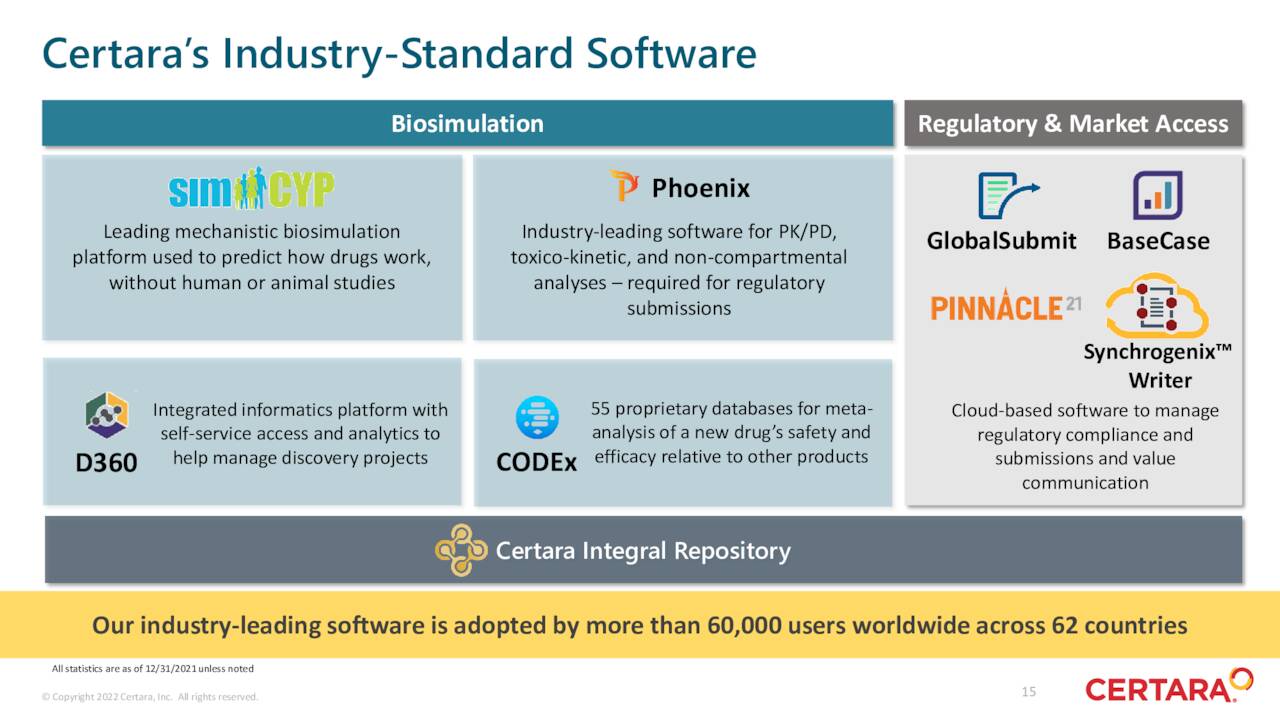

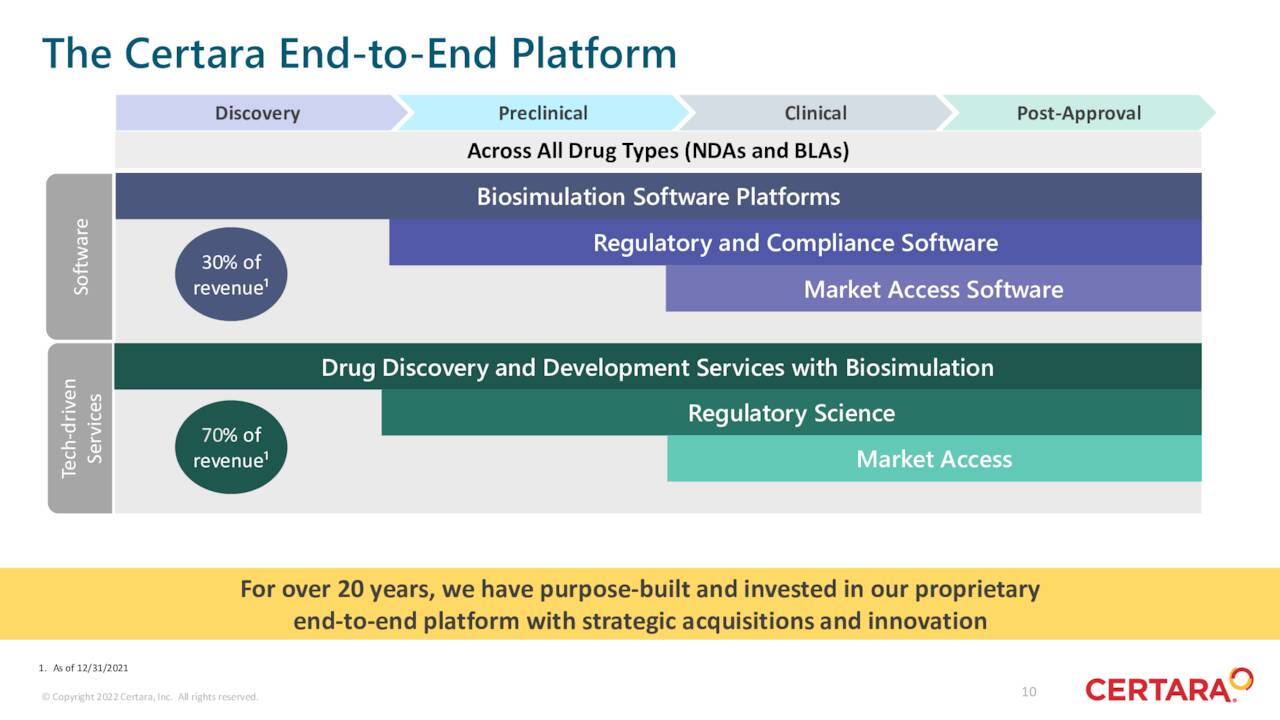

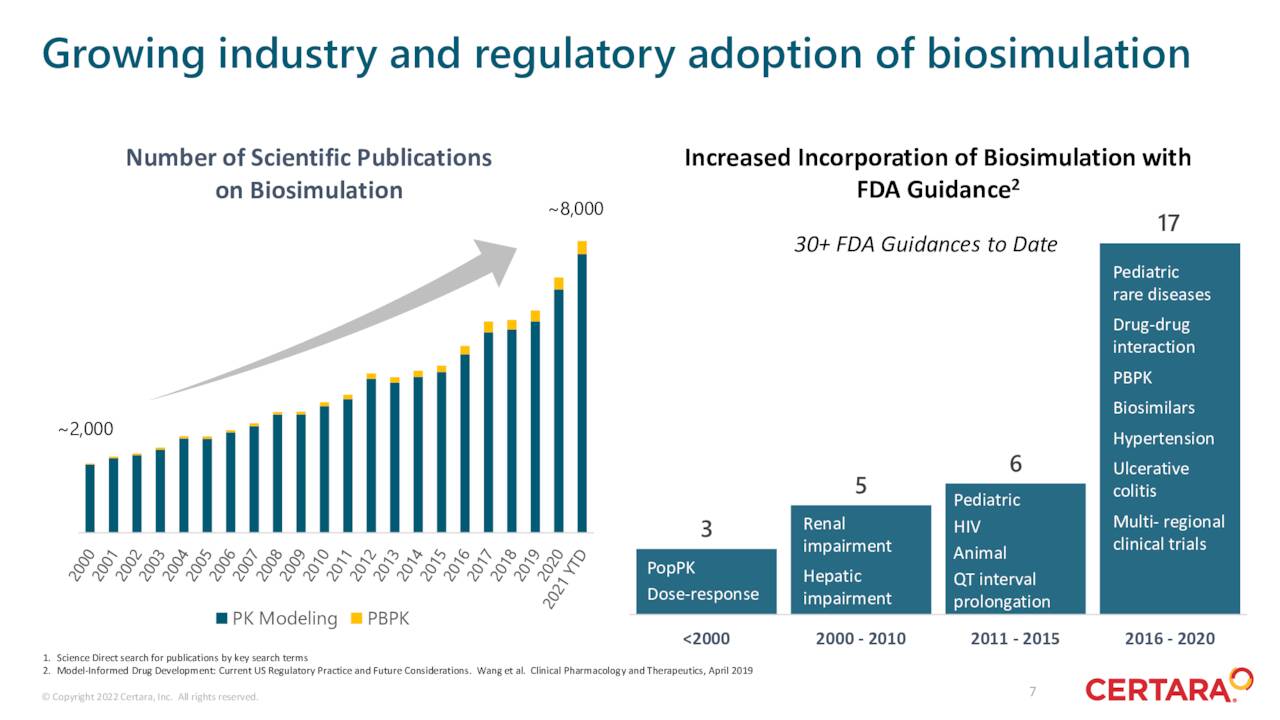

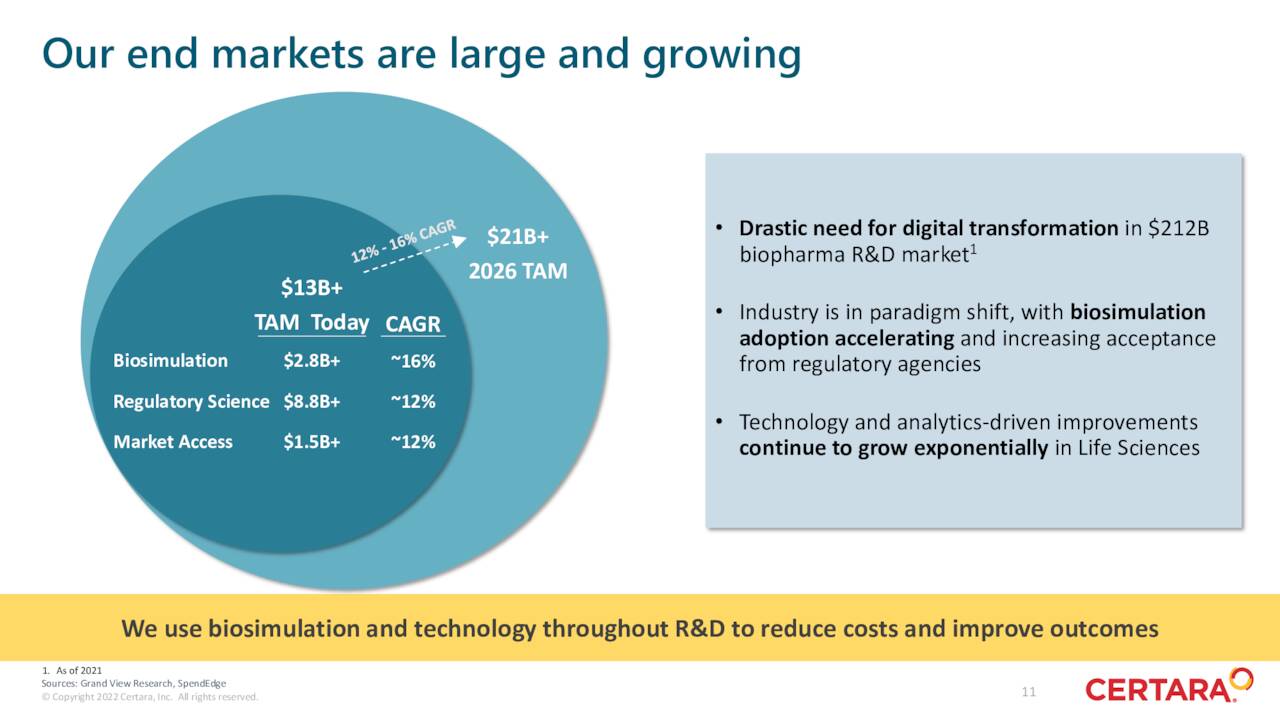

The company is based in Princeton, NJ. Certara provides software products and technology-enabled services to customers for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access. The company also provides biosimulation software, technology, and services to transform drug discovery and development.

June Company Presentation

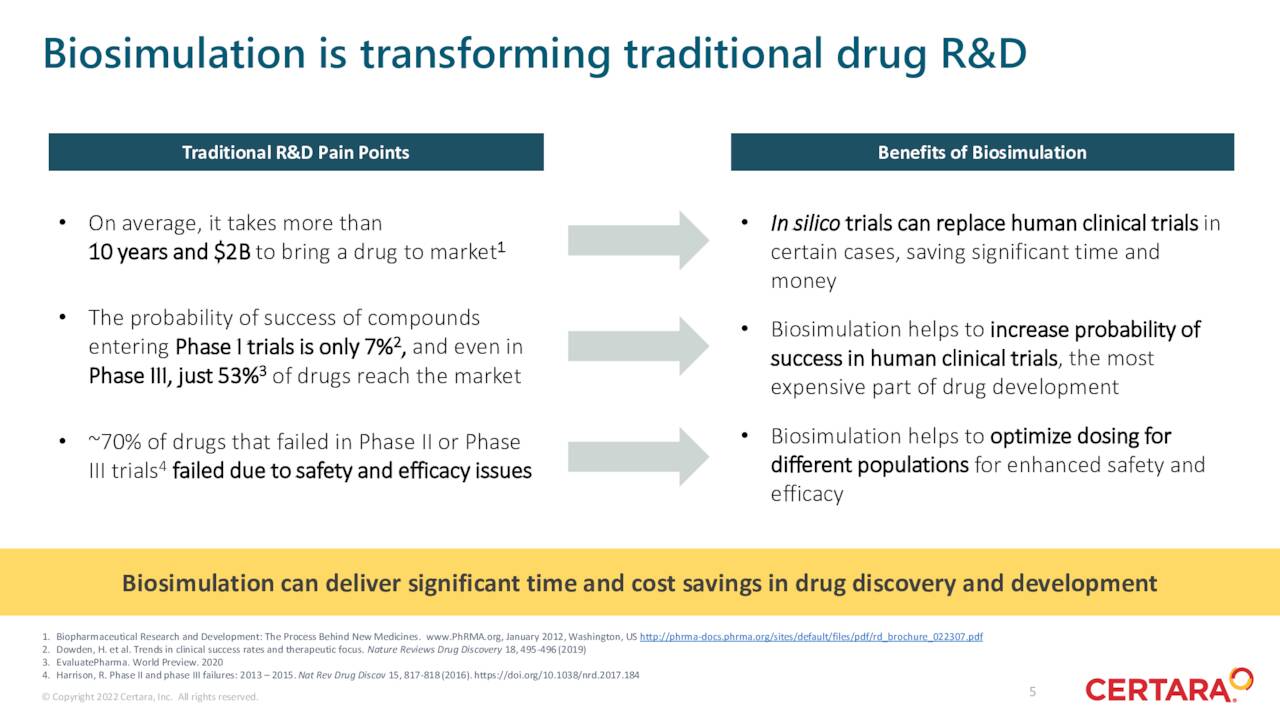

Biosimulation can have several advantages of traditional drug discovery R&D methods. The stock currently trades just below $13.00 a share and sports an approximate market cap of $2.1 billion.

June Company Presentation

Second Quarter Results:

On August 9th, the company posted second quarter numbers. On a non-GAAP basis, Certara had a profit of nine cents a share. This was two pennies a share under expectations. Revenues rose 18% on a year-over-year basis to $82.8 million, more than $2.5 million worse than the consensus. Adjusting for the $7 million revenue from Pinnacle 21, which was acquired late last year, sales were up eight percent. It should be noted that overall revenues would have been higher by $2 million if adjusted for constant currency.

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Key Financials (in millions, except per share data) | |||||||||||||||

| Revenue | $ | 82.8 | $ | 70.1 | $ | 164.3 | $ | 136.8 | |||||||

| Net income (loss) | $ | (0.6) | $ | (2.9) | $ | 1.6 | $ | (1.8) | |||||||

| Diluted earnings per share | $ | (0.00) | $ | (0.02) | $ | 0.01 | $ | (0.01) | |||||||

| Adjusted EBITDA | $ | 28.0 | $ | 25.5 | $ | 55.6 | $ | 49.4 | |||||||

| Adjusted net income | $ | 14.6 | $ | 11.8 | $ | 31.5 | $ | 26.3 | |||||||

| Adjusted diluted earnings per share | $ | 0.09 | $ | 0.07 | $ | 0.20 | $ | 0.17 | |||||||

| Cash and cash equivalents | $ | 194.8 | $ | 267.8 | |||||||||||

Adjusted EBITDA of $28 million was up nine percent from 2Q2021. The company’s net loss for the quarter was just $600,000 compared to a net loss of $2.9 million in the same period a year ago. Management slightly adjusted its previously reported guidance for full year 2022 to a new full year guidance of $325 million to $335 million for revenue with $0.43-$0.48 for adjusted diluted earnings per share.

| FY 2022 Guidance | ||

| In millions, except per share data | ||

| Revenue | $ | 325 – $335 |

| Adjusted EBITDA | $ | 112- $117 |

| Adjusted diluted earnings per share | $ | 0.43 – $0.48 |

Analyst Commentary & Balance Sheet:

Since second quarter numbers were posted, six analyst firms, including Credit Suisse and Barclays, have reissued Buy ratings on CERT. Price targets proffered range from $21 to $26 a share. Morgan Stanley seems the lone pessimist on the shares as it recently retained its Hold rating and $20 price target on the equity.

Approximately two percent of the outstanding float is currently held short. Two insiders including the company’s CFO bought nearly $750,000 worth of stock in total in mid-August. However, other insider sold over $8 million worth of share in June and August. A beneficial owner sold 1.5 million shares at the end of May and just over six million shares on August 16th. The company exited the second quarter with approximately $195 million worth of cash and marketable securities on its balance sheet against approximately $290 million worth of long term debt.

Verdict:

The current analyst firm consensus has the firm earning 44 cents a share in FY2022 as revenues rise 15% to $330 million. They model 53 cents a share in profit in FY2023 on a similar rise in sales.

June Company Presentation

Certara seems to have a nice niche in a growing market. The company’s end markets should see good growth for years to come. The question for investors is if valuations given that growth trajectory are currently compelling at current trading levels. At 30 times this year’s estimated profits and nearly seven times sales with revenue growth in the mid-teens, I don’t think we are quite there yet. This is especially true given the recent rise in global interest rates, which discounts growth stocks. That said, if CERT pulled back to $10 a share or under, I would probably establish a small ‘watch item‘ position in this developing story.

June Company Presentation

“Those who make peaceful revolution impossible will make violent revolution inevitable.” – John F. Kennedy

Be the first to comment