Kemter/E+ via Getty Images

Intro

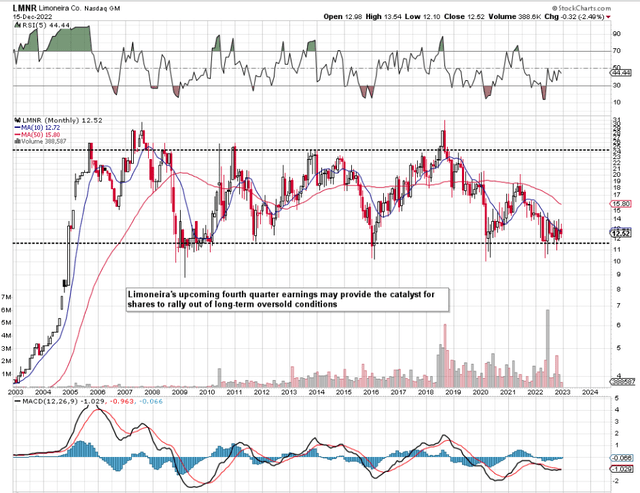

If we pull up a long-term chart of Limoneira Company (NASDAQ:LMNR) (lemon and avocado grower), we see that shares are trading very close to their multi-year lows. In fact, every time, over the past 13 years or so when shares dropped to these levels, support has always held firm with a rally taking place soon thereafter. The great benefit of longer-term charts is that the use of support and resistance levels enables them to be used for long-term forecasting purposes. Due to the sizable amount of information that is available on longer-term charts, they are a good read on market psychology, which is something that in the main does not change.

Therefore, unless something is fundamentally amiss in Limoneira at present compared to yesteryear, the risk/reward ratio looks very attractive if indeed we can get a convincing swing-low around these levels. Suffice it to say, the company’s upcoming fourth-quarter earnings numbers, which are due to be announced next week could indeed be the catalyst to drive shares higher once more. What we are looking for after the announcement would be a sustained move above Limoneira’s 10-month moving average, as this would coincide with the stock’s histogram moving into positive territory.

Limoneira Long-Term Chart (StockCharts.com)

Suffice it to say, what we are looking for here is whether the relationship between the stock’s valuation and profitability remains compelling at this juncture (igniting a sustained up-move) or if it could be possibly breaking down.

Q3 Profitability

In the company’s most recent third quarter, for example, we witnessed a convincing earnings beat ($0.40 per share) on sales of almost $59 million. Avocado & Lemon numbers were very encouraging in Q3, despite the pressure on Lemon pricing due to a continuing worldwide surplus of this fruit. From a growth standpoint, net earnings ($7.3 million) were almost 100% higher over the same quarter 12 months prior, so profitability trends are definitely on the rise. Although the fourth quarter bottom-line estimate at present is a lower $0.10 per share, this was always to be expected given seasonality weakness at the end of the year.

In fact, given the company’s seasonality weakness in Q4, Limoneira is still expected to be profitable this year (+$0.02 EPS expected in Fiscal 2022). Furthermore, an expected 10% top-line growth rate next year is expected to drive profits above $0.20 per share. Therefore, we recommend that investors monitor what is coming down the track (the Q4 report is expected on December 22) here instead of past quarters (where Limoneira actually is in negative earnings territory over the past four quarters). We state this because the absence of a positive price-to-earnings ratio many times can make many investors steer clear of opportunities, but there is more to meet the eye here when one digs deeper.

Unlocking Of Value

Limoneira’s book multiple of 1.28 and sales multiple of 1.23 are well below the company’s 5-year averages (1.66 & 1.99) and the company’s move to a more asset-light model is expected to unlock more value for shareholders, as that cash will be put to good use. To achieve this, management will begin to liquidate assets from its balance sheet and going forward will use a bigger percentage of grower partner fruit in order to streamline sales more effectively.

Reducing the dependency on Limoneira assets is expected to increase cash-flow generation, reduce pricing volatility whilst also tackling the company’s high debt load. Furthermore, this influx of cash can then go to places that clearly have been working for Limoneira. These include more investment in technology and Limoneira’s supply chain to ensure sales can be turned over at faster rates. Moreover, more investment is destined for the Avocado segment from both a production and marketing standpoint as Avocados’ margins were to the fore in Q3.

Suffice it to say, the goal is to generate sufficient sales and earnings growth from internal cash flow as well as the cash which will come from the deleveraging of the balance sheet. The plan is bold, but management is merely doubling down on what has been working up to this point.

Conclusion

Therefore, to sum up, there is nothing of note in Limoneira’s recent third-quarter earnings numbers to denote that the company is fundamentally impaired for whatever reason. In fact, the transition to a more asset-light model has the capacity to transform the financials, and recent forward-looking earnings revisions seem to confirm this thesis. We look forward to continued coverage.

Be the first to comment