Artur Nichiporenko

The Rice brothers have been a money-making machine for their early investors, their first venture, Rice Energy multiplied investors’ money by 32, and their second venture, Rice Acquisition Corp. (LFG), increased early investments by 250% in 18 months. The third Rice brothers company is about to launch. I have already invested. I used some of the profits I realized from the sale of LFG to BP (BP) to buy into Rice Acquisition Corp. II (NYSE:RONI) even before I had any idea what they would do.

Having researched the company the SPAC will merge with, and considering how its technology will complement the skills of the Rice brothers, I have trebled my investment.

The Rice Brothers

Daniel, Toby, and Derek started Rice Energy (a shale fracking company) in 2007. They took it to the market in 2014 and sold it to EQT Corp. (EQT) in 2017 for $6.7 billion. Initial investors received a 3,200% return.

In 2021, they launched Rice Acquisition Corp., a blank cheque SPAC that eventually merged with Aria Energy and Archaea Energy to form an RNG company (LFG). In November, BP announced it was acquiring LFG for $4.1 billion. Investors receive a 250% return if they got in early.

In the new SPAC, inventively called Rice Acquisition Corp II, the brothers are sticking with the same industry; they have an incredible track record and proven skills that will likely make this third venture just as successful as the previous two.

NET Power: The Target Company

NET Power, based in North Carolina and founded in 2010, has backing from Occidental (OXY), Baker Hughes (BKR), and 8 Rivers. The company has developed a patent-protected technology that reduces emissions from gas-powered electricity generating stations by more than 90%. The electricity produced is comparable in cost to that from standard Gas power stations. The technology could be licensed, sold as finished goods, or used to produce electricity under contract. I think it is very likely that Rice Acquisition Corp II will do all three of these things. The rice brothers are very good at scaling companies at speed and will likely use every opportunity to scale this new venture.

NET Power has enclosed the entire electricity generating cycle, separating it from the environment completely. The method of power production is unique (and patent protected).

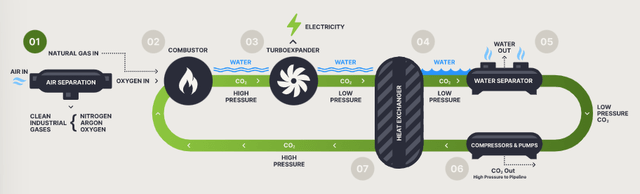

The NET Power process

- Oxygen is separated from air.

- Natural gas is combusted with pure oxygen, producing CO2 and water.

- The CO2 is used to spin a turbo expander, producing the power.

- The CO2 and water are cooled in a heat exchanger.

- Water is removed from the system.

- The CO2 is pressurized and returned to the turbo expander to be used again.

- Some CO2 is captured and sold to industry.

Natural gas and air go in, and electricity and water come out.

The Net Power process (Net power website)

Validation of the Technology

I have found this to be the crucial issue, and I have developed my own rule of tech validation. The rule has served me well this year and saved me from significant losses.

I like to see a real customer buying the tech to make money out of it, not just to evaluate it.

I believe the NET Power tech meets this threshold and is validated.

In 2016, NET power started to build its demonstration site in La Porte, Texas; it began producing electricity in 2018 and conducted tests for three years. In the final quarter of 2021, it was attached to the Texas grid and has since been operational for 1,500 hours.

The electricity produced has been sold for more than ten months. That is the validation; the La Porte site sells electricity through the grid. It is not in a testing phase any longer.

NET Power has already started to build its first utility-scale project in Texas. It will have a 300Mwe capacity and will become operational in 2026.

NET Power’s New Ticker will be NPWR

Danny Rice will take over as CEO; he led Rice Energy and Rice Midstream Partners (total exits greater than $10 billion). In the press release announcing the merger, he said.

Today, around 60% of global power generation comes from coal and natural gas-fired power plants that produce reliable and low-cost power. However, these plants collectively emit nearly 14 billion tonnes of CO2 per year, accounting for approximately 37% of total global emissions. By replacing these plants with NET Power’s proven technology, we can eliminate nearly 100% of these emissions while providing reliable and low-cost power that people deserve. I’m excited to help NET Power deliver the energy trifecta and become the global leader in clean power generation.

One of the reasons the brothers have been so successful is that they can think big. Rice Energy turned EQT into the biggest producer of natural gas in the US. LFG had nearly a dozen projects when the rice brothers took over 18 months later; it had 100 operational sites (including Assai, the largest in the world) and 91 locations in its backlog.

Danny is already talking about NET Power being a global leader and converting every gas and coal power station to NET Power’s technology, consequently removing 37% of the world’s total emissions. I don’t think it is possible to think any bigger.

Conclusion

We do not have the full details of the merged company yet, no prospectus to work from, no capital structure to look at, and no way to analyze cash needs. The company will be small and perhaps years away from profitability.

However, it has a validated technology, and an industry-leading patent-protected method to produce electricity from Natural Gas without any emissions.

It also has the Rice brothers, proven business managers working in the natural gas industry. An industry they know and where they are known and well respected.

I wrote about the first Rice Acquisition SPAC before the merger and did very well from that investment.

I am long at an average price of $10.05.

I will write updated articles as this merger progresses.

Be the first to comment