time99lek/iStock via Getty Images

Investment Thesis

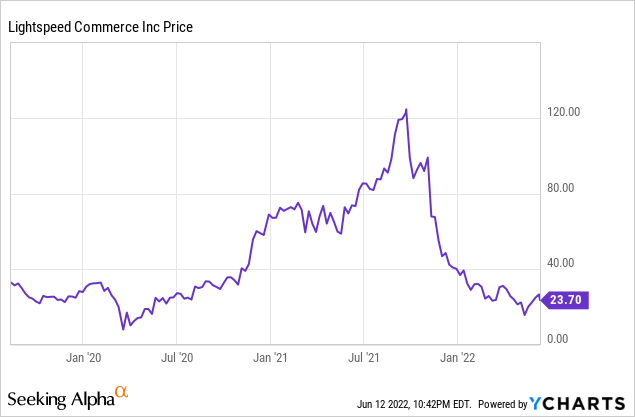

Lightspeed Commerce (NYSE:LSPD) was one of the winning companies of the pandemic. Its stock rose from around $9 back in March 2020 to over $120 last September, representing a whopping 1200% increase. However, the stock has since been plummeting as it got caught in the broad market sell-off, while former CEO/founder Dax Dasilva stepped down. The company is now trading at $23.7, down over 80% from its all-time high last year.

Lightspeed is a Canada-based commerce company founded by Dax Dasilva back in 2005. The company provides POS (point of sale) systems and payment solutions for retail and hospitality companies. It has been growing rapidly as the POS and payment market continues to expand. It is also very active in acquisition in order to increase its capabilities and competitiveness. It is seeing success with top-line growth accelerating in the past year. However, the company is still struggling with its bottom line and failed to post a profit. The current valuation is also not cheap enough for my liking, therefore I rate the company as a hold for now.

Market Opportunity

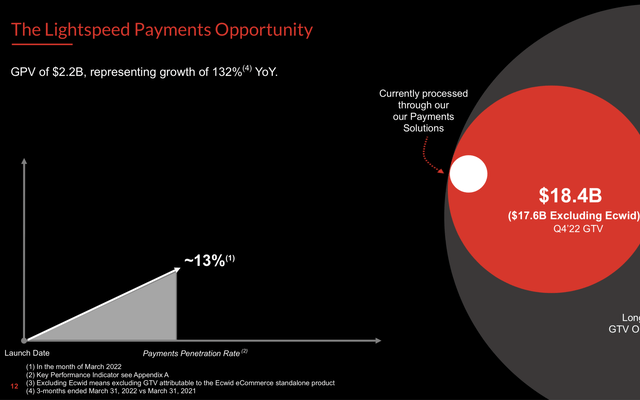

Lightspeed’s market opportunity can be separated into two parts which are POS and Payment. The POS system generally includes basic capabilities like checkout, inventory management, and reports, while more advanced ones include features like loyalty, accounting, and analytics. The retail POS industry is huge. According to Markets and Markets, the market size of POS is $15.8 billion in 2020 and is estimated to grow to $34.4 billion by 2026, representing a CAGR (compounded annual growth rate) of 13.9%. The strong growth is largely driven by physical store sales rebounding after the pandemic, and businesses shifting from legacy hardware to cloud-based POS systems. The company has also expanded its TAM (total addressable market) by offering payment solutions to help businesses process their payments and charge a take rate. Lightspeed estimates the payment opportunity to be around $18.4 billion as its penetration rate is still low, currently only at 13%.

Competition

Despite having a huge TAM, the landscape for the POS industry is very competitive. Some notable competitors of Lightspeed include Block (SQ), Toast (TOST), PAR Technology (PAR), and Shopify (SHOP). Lightspeed is one of the most adaptive POSs that operates both in the retail and hospitality space, as a result, it faces multiple competition on different ends. It competes with Block and Shopify in the SMB space, as they both offer a really easy-to-use POS system. In the hospitality end, it competes with Toast and PAR which both solely focus on serving restaurants. It is currently seeing the most success in the mid to high-end niche which has the least competition. It is trying to grab more market share in other areas by doing strategic M&A and introducing more features. This allows them to strengthen their “land and expand” strategy.

Strategic Acquisitions

In order to increase their market presence. Lightspeed has been very active on the M&A end. The company acquired three companies last year. It first acquired VendLimited for $350 million in March, then acquired Ecwid and NuORDER in June for $500 million and $425 million respectively. These acquisitions have transformed Lightspeed into a much more comprehensive POS platform. Vend is a cloud-based retail management software company, Ecwid is an e-commerce enablement company, and NuORDER is a B2B e-commerce platform for wholesale processes. Ecwid allows retail companies to create an online store for their businesses easily, while NuORDER allows businesses to source and buy their inventory more easily. These capabilities combined create an end-to-end platform that is able to address different customers’ needs. Lightspeed is also able to charge more as customers use more features over time, which helps increase their ARPU (average revenue per user).

Financials and Valuation

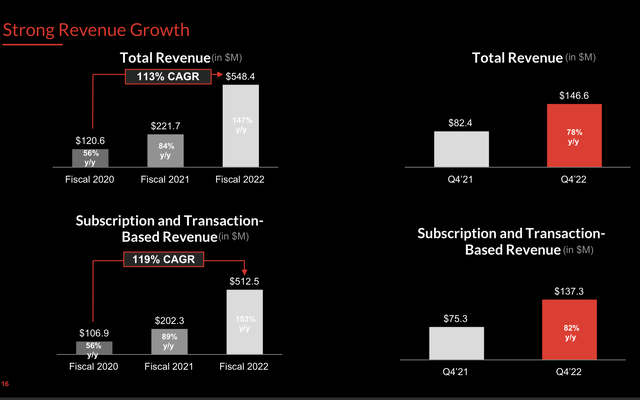

Lightspeed recently reported its fourth-quarter earnings and it is showing strong top-line growth as it finally completed the integration of its acquisitions. The company reported revenue of $146.6 million, up 78% YoY (year over year) from $82.4 million. Subscription revenue increased 77% from $39.7 million to $70.5 million while Transaction-Based revenue increased 88% from $35.5 million to $66.7 million. They now represent 48% and 46% of total revenue (the rest is hardware revenue from the sales of POS hardware). Gross transaction volume was $18.4 billion, up 71% YoY. Customer Locations increased to 163,000 from 159,000 and the monthly ARPU (average revenue per user) of these locations grew by 35% to approximately $270 compared to approximately $200 in the same quarter last year. Which shows the success of its “land and expand” strategy.

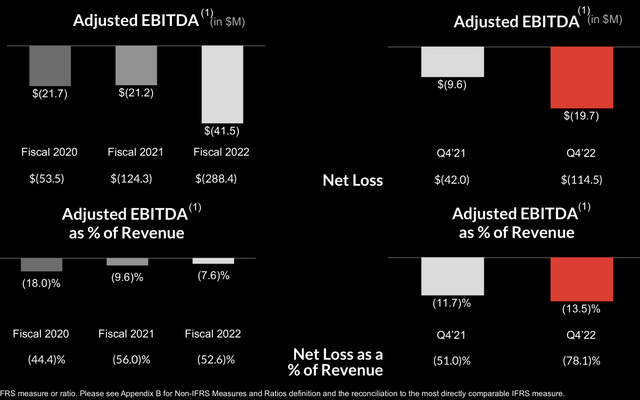

Despite the strong top-line growth, the bottom line remains disappointing. Adjusted EBITDA loss was $(19.7) million. Net loss for the quarter was $(114.5) million, or $(0.77) per share, which widened over 172% YoY from $(42.0) million, or $(0.34) per share. This is largely due to the increase in R&D and S&M expenses, which resulted in total operating expenses increasing over 100% from $87.2 million to $183.5 million. Share-based compensation expense is also concerning, which increased over 200% from $32.7 million to $108.9 million. The company’s balance sheet remains strong with $953 million of cash in hand and only $60 million in debt, which provides a buffer for the cash burn.

Luckily, the company guided an adjusted EBITDA loss of ($16) million for the first quarter of FY23, showing an improvement quarter over quarter. The management team also assured investors that they are expected to achieve adjusted EBITDA break-even for FY24 while showing a long-term growth rate of 35%–40%.

JP Chauvet, CEO, on profitability and outlook:

Finally, based on the strong growth the Company is experiencing, the ongoing integration of the various acquisitions, the trends back toward in-person shopping and dining, and a disciplined approach to investing in the business, the Company believes it is on a natural path toward profitability. Lightspeed expects to reach Adjusted EBITDA break-even for the fiscal year ended March 31, 2024 while still achieving its targeted organic subscription and transaction-based revenue growth rate of 35–40%

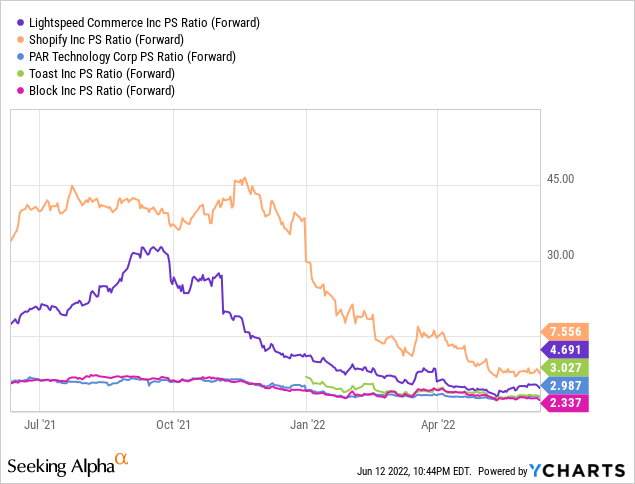

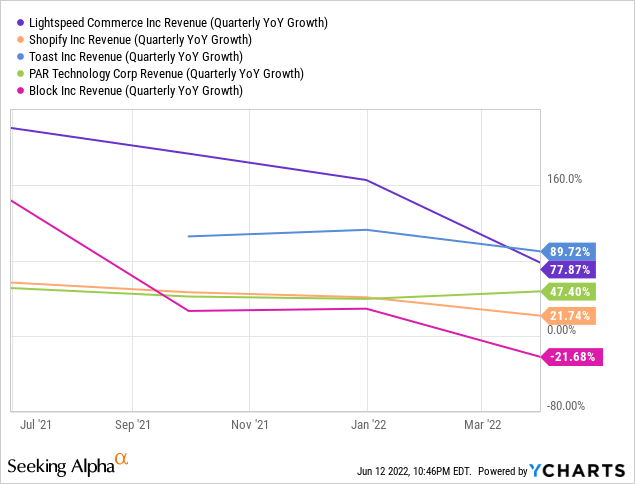

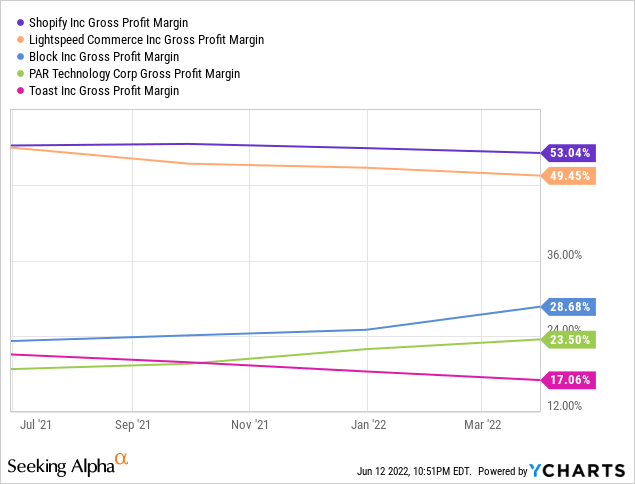

After the 80% drop from its all-time high, Lightspeed is now trading at a more reasonable valuation. If we use an fwd PS ratio (since the company is still unprofitable and still posting negative cash flow), the company is currently trading at a valuation of 4.7x sales. From the chart below, you can see that its valuation is slightly higher than its peers in the POS space. This is largely due to its higher revenue growth (shown on the second graph) and better gross profit margin due to its strong subscription revenue (shown on the third graph). I believe the higher valuation is justified as having a strong subscription revenue gives it a much more stable revenue stream, especially during economic downturns. Therefore the current valuation is fair in my opinion.

Macro Risks

The current uncertainty regarding the macro environment may post significant headwinds on Lightspeed. As supply chain blockage continues Lightspeed may see a shortage of its POS hardware, which will affect its ability to fulfill demand from customers. The POS industry is also extremely sensitive to the economy as it is consumer targeted. Currently, 48% of Lightspeed’s revenue is transaction-based. If inflation were to persist and the economy continues to weaken, consumers will start spending less which will hurt Lightspeed’s revenue. It is also worthy to note that most of the businesses that use Lightspeed POS sell discretionary items rather than essentials, therefore they are also more vulnerable to economic downturns.

Conclusion

In conclusion, I believe Lightspeed is a hold at the current price. The company is operating in a huge POS and payment market with great opportunities. The management team has also been very active in M&A which helped the company increase its market presence and grow revenue rapidly. However, there are still some concerns going forward. The POS market has a relatively low entry barrier which will result in more companies entering the space attempting to take away market shares. The company is also struggling with profitability and it needs to show that it has the ability to grow its top and bottom line at the same time. The uncertainty in the macro-environment regarding supply chain blockage and a weakening economy may also post unprecedented headwinds on the company. Its current valuation is fair when factoring in its growth rate and margin level but it is still not cheap enough for my liking. Therefore I rate the company as a hold and will revisit it when the company is able to show improvement in profitability.

Be the first to comment