cofotoisme/iStock via Getty Images

Investment Thesis

In my last article on the Invesco NASDAQ Internet ETF (NASDAQ:PNQI), I discussed how inflation and, ultimately, a rising rates environment was a major risk for high-multiple stocks. Since then, PNQI has lost ~27% vs. a loss of ~9% for the S&P 500 and has underperformed the market. PNQI is now much cheaper than it used to be a few months ago, and many investors have bought the recent dips hoping to get a bargain.

I personally believe that we are now in a bear market rally, and we haven’t yet experienced a bottom in Tech/Internet stocks. A weakening economy coupled with a large number of unprofitable tech stocks will be a drag on the sector over the coming months as liquidity dries up. I believe this will ultimately impact even the best players in the sector.

What Has Happened Since My Last Article

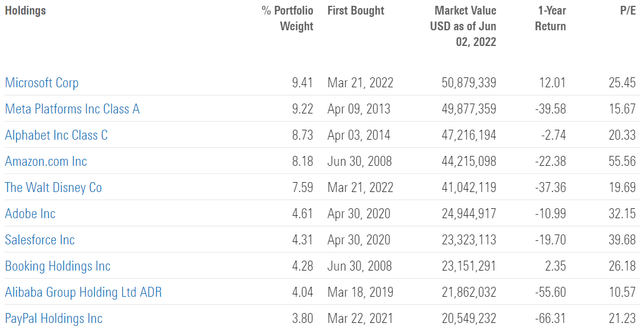

As a reminder, the Invesco NASDAQ Internet ETF tracks the performance of the Nasdaq CTA Internet Index, which provides exposure to companies engaged in Internet-related businesses that are listed in the U.S. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

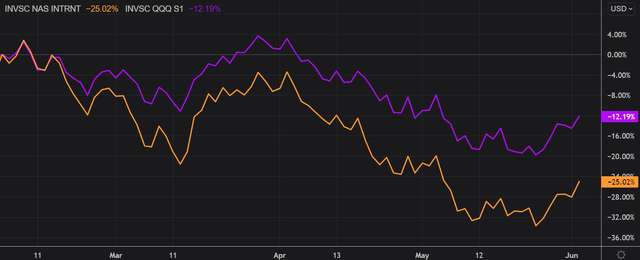

I have compared below PNQI’s price performance against the Invesco QQQ ETF (QQQ) over the last 4 months to assess which one was a better investment. Since my previous article, PNQI has lost 25% and underperformed the tech benchmark by a ~13 percentage points margin. It is interesting to note that PNQI was much more volatile than the Nasdaq 100, especially during the selloff that we had in early March and April 2022.

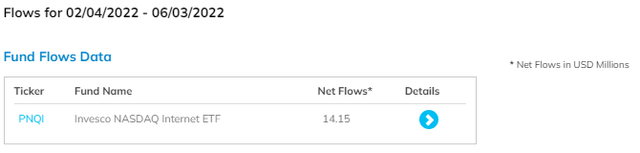

Despite the unattractive returns, investors remain bullish on PNQI, as illustrated by the recent fund flows. The fund registered a total of $14.15 million in net flows since early February 2022, which is remarkable given how poorly internet stocks have performed so far this year relative to other sectors.

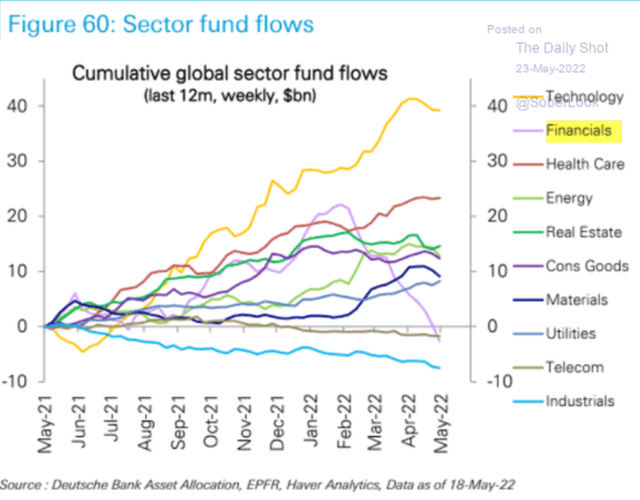

However, this isn’t surprising when we put things into perspective. Tech has been the sector that benefited from the highest inflows in recent months. Investors are buying every tech dip hoping this strategy would eventually pay off as it did in previous years. However, I think we are operating in a very different environment. Low-interest rates and a high level of liquidity have fueled a secular bull market in tech stocks. This trend is now reversing, while investors failed to adjust their strategy to these new changes.

Downside Risks Abound

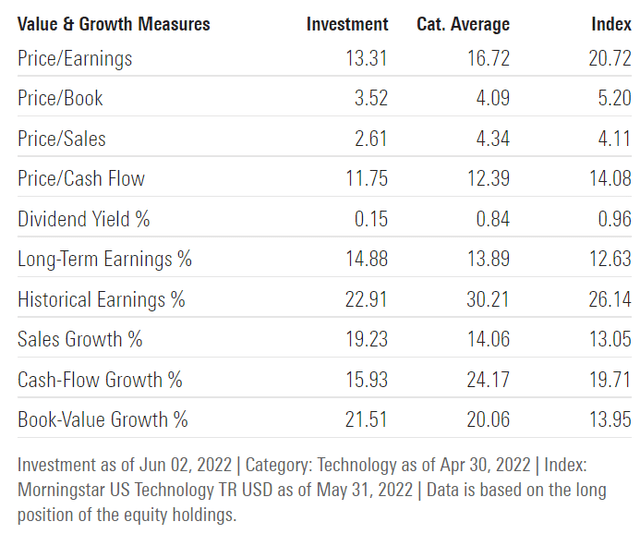

In my previous article on PNQI, I discussed how this strategy was vulnerable to rising rates. Since then, monetary tightening is now in full swing and liquidity is becoming scarcer. If we look at PNQI’s fundaments, it is now much cheaper than four months ago when I first wrote about it. Back then, it was trading at ~18x earnings and had a price-to-book ratio of 4, compared to a PE of 13x and a PB of 3.5 today. It goes without saying that PNQI is a better deal today than it used to be a few months ago, thus many investors are now wondering if it’s a good time to purchase this ETF. I personally don’t believe the bottom is in yet for tech stocks since we are just at the beginning of this tightening cycle and it is still unclear to what extent the Fed will go in its efforts to fight inflation.

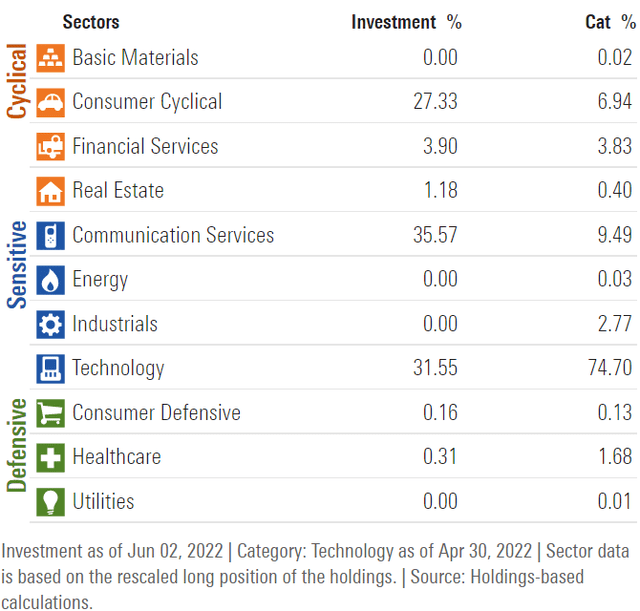

The Fed’s primary objective at the moment is to slow down demand, which has been extremely resilient in recent months despite high energy prices. One of the dangers of doing that today is the risk of engineering a recession. In this context, I think it is important to remind investors that PNQI has a ~32% exposure to cyclical sectors, such as Financial Services, Real Estate, and Consumer Cyclicals. In my opinion, this category is now highly vulnerable to a recession, which adds a layer of risk that potential investors need to consider before purchasing this fund.

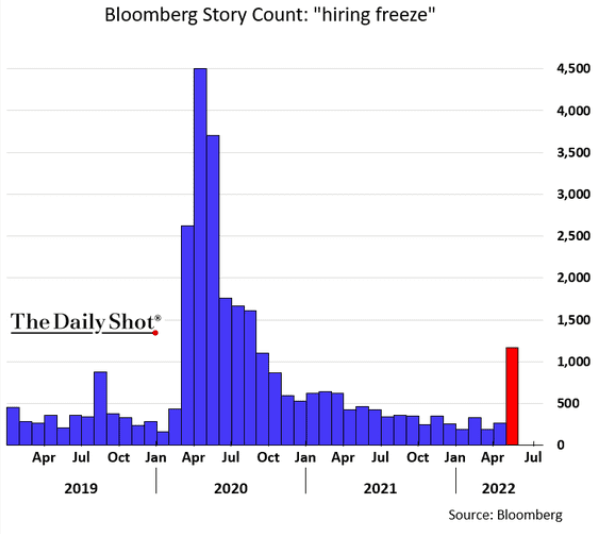

The debate around the potential to have a recession in the next 12 months has grown over the past weeks as many companies have dialed back on their hiring programs. Firms such as Microsoft, Tesla, and Coinbase have decided to pause hiring in recent weeks, in a move that caught many market participants by surprise. In my opinion, this reflects some of the uncertainties that Internet firms are facing in this market environment. On top of that, May 2022 has been notable for being a month where we have seen a peak in new layoffs in the tech sector. Tech layoffs have reached a level last seen in May 2020. For more details on that, you may track the live data here.

Bloomberg/The Daily Shot

It comes without a surprise to see signs of weakness in the market when financing all of the sudden becomes more expensive. U.S. equity markets have been zombified by cheap money over the last decade. The number of money-losing companies in the Russell 3000 climbed to a level similar to the early 2000s during the dot-com bubble. While PNQI isn’t meaningfully impacted by money-losing companies in my opinion since it runs a well-diversified portfolio of quality stocks, I think its performance in the near term can be tarnished by a wave of potential defaults in the tech sector.

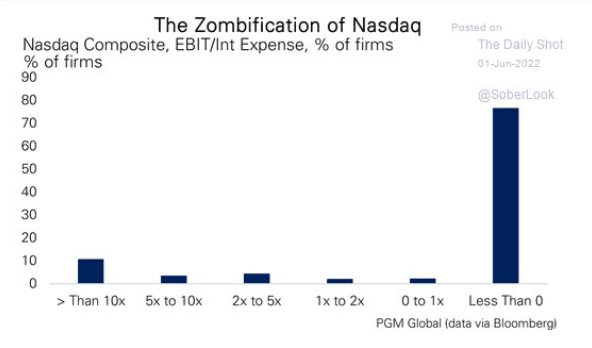

Bloomberg

As a result of low-interest rates for too long, refinancing is becoming a real risk for a large number of corporations at this particular point in the business cycle. This trend is particularly important for Nasdaq constituents, where more than 70% of firms don’t earn enough income to finance their interest expense.

Bloomberg/The Daily Shot

Lastly, the market has been exuberant over the last 2 weeks, believing the narrative that the Fed will hit the brakes and provide a more accommodative policy by year-end. I would argue that we are still not out of the woods yet, despite peaking inflation expectations. If we use the 1970s as a proxy, inflation didn’t linearly disappear but had periods of ups and downs. My thesis is supported by a recent spike in the 5-Year, 5-Year Forward Inflation Expectation Rate, which is one of the metrics monitored by the Fed when adjusting monetary policy.

Key Takeaways

PNQI is now much cheaper than it was a few months ago, and many investors have bought the recent dips in the hopes of getting a good deal. Personally, I believe we are now in a bear market rally and the bottom in tech/internet stocks has yet to be reached. As liquidity dries up, a weakening economy combined with a large number of unprofitable tech stocks facing refinancing risk will be a drag on the sector in the coming months, even for the best players out there.

Be the first to comment