lorozco3D/iStock via Getty Images

Recommendation: Based on the analysis, I am granting a neutral rating for the U.S equity market represented by the S&P 500 Index. The rating will be changed to sell in case of the inflation releases data that is above the market expectations during the summer period.

Overview

The measures undertaken by the Fed officials were effective at supporting the economy in the critical period, particularly during the lockdown. However, the scale of the decisions made was so significant, that it impacted the core of the financial system and economic processes we used to. The changes are described in the article and are now making the government officials vulnerable to the inflationary shock the economy is experiencing currently

The QE Mechanics

The U.S has a two-tiered monetary system, where reserves are used when transacting with the Fed and between Commercial banks, and bank deposits, another type of money, are used when transacting with everyone else.

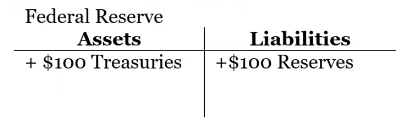

The Fed conducts its QE exclusively through the primary dealers, who are intermediaries and are transacting with all the major financial institutions in the world (non-banks). The simplified process looks as follows: when the Fed conducts its QE, it buys Treasuries from non-banks using Prime dealers as an intermediary. Let’s say a hedge fund(non-bank) bought 100$ worth of Treasuries (lending to the government), the government has now 100$ more money and the hedge fund has 100$ less money (owns a Treasuries instead). Since the hedge fund does not have an account at the Fed, it can’t receive the reserves but instead will receive the deposit. When the Fed purchases the Treasuries from the hedge fund, the Commercial bank that serves the hedge fund creates 100$ worth of deposit liability, at the same time the Commercial bank receives 100$ worth of reserves from the Fed as an asset, and its B/S is now in balance.

At the end of the day, the Fed receives 100$ Treasuries on its balance sheet in exchange for the 100$ reserve liability created from the air for the Commercial bank. The Fed is the only entity whose B/S is not balanced, and this is how the money was created in the system.

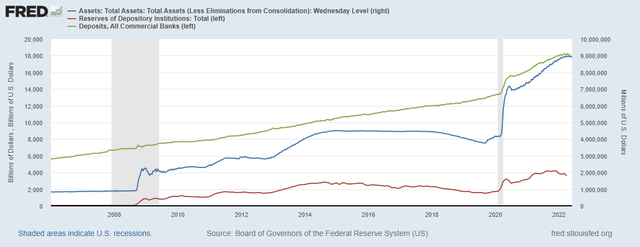

Reflecting the Fed’s balance sheet expansion, the bank reserves grew by more than 10000% from 42$bln in 2007 up to 4.2$tlrn in 2022, changing the way the financial markets are operating.

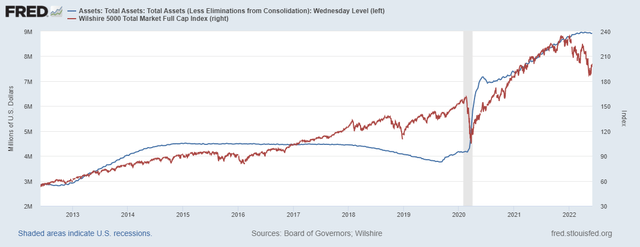

The Treasury swap changes the balance sheet composition of the Commercial banks (more reserves) and non-banks(more deposits) who in turn are using liquidity for speculative purposes. This pushes the equity and bond markets higher regardless of the economic underlying.

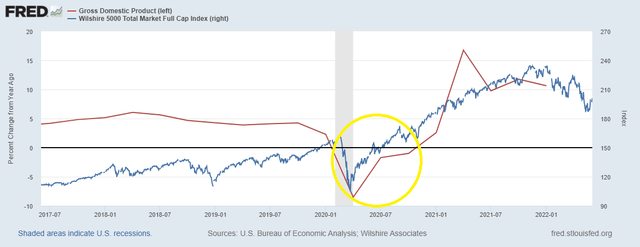

In a classical business cycle theory, an economic expansion consequently rising corporate and household profits are encouraging consumers to distribute their income and savings to the equity market is no longer a key factor for the equity markets growth. The current MMT creates the conditions where the economy can be in a dire situation and corporate profits will be in free fall, while equity markers will be reaching an all-time high, and the chart below is a great example of such a contradiction to the classic business cycle theory. The Wilshire 5000 index was growing and reached an all-time high while GDP was in deeply in contractionary territory. The equity growth helped to boost consumption by raising the wealth of the households, combined with direct government support avoided deflationary movements in the economy.

An appropriate assessment of the Central Bank’s policy decisions will save money by avoiding shorting the market during a period of QE even if the economic conditions are poor. As well, as buying the equity in the period of the booming economy while the Central Banks’ actions are bearish for the equity market like the current situation.

Inflation

After the prolonged period of the Fed’s expectations for the resolution of the supply side issues based on the improvements in the pandemic is over. In addition to the already existing shortage of chips, raw materials, and a tight labor market, the war in Ukraine accelerated the supply crunch by significantly tightening the deliveries in the energy and food industry. This marks the end of the “Transitory inflation” rhetoric era from the Fed officials.

Unable to impact the supply side, the Fed officials accelerated their efforts to cool down the prices through the list of the monetary tightening decisions. The measures are designed to raise the borrowing cost and reduce the amount of liquidity from the Commercial banks and non-bank entities putting pressure on the demand and prices.

While the move is necessary, it might be hard to accomplish the substantial results due to the following reasons:

Liquidity

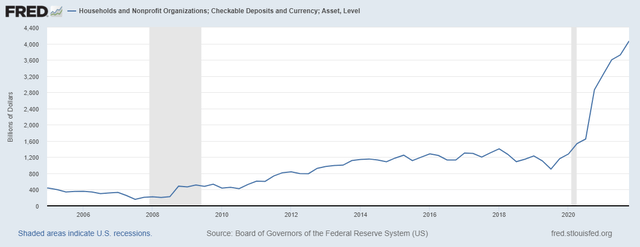

The QE conducted by the Fed created an enormous number of bank deposits in the system from a variety of entities, and in big part from the households. The households’ checking account deposits soared, and are now totaling 4.1$trln, up by 2.7$trln since the beginning of the pandemic. This is due to the significant inflows of government transfers, and PPI loans during the period of economic distress.

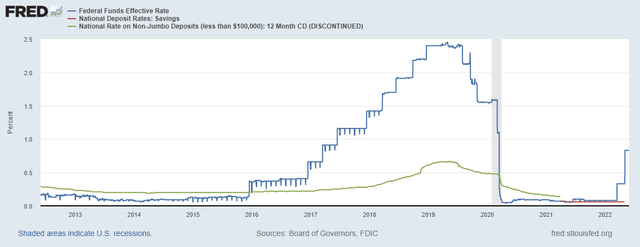

An environment where Commercial banks are flooded with retail deposits eliminates the need for the banks to fight for funding. This creates the situation where the Commercial banks are receiving a significant amount of liquidity almost for free, simultaneously enjoying the growth rates for their lending facilities, eventually expanding interest margins. The chart below shows the discrepancy between the FFR, and the rates the banks are paying for their deposit liabilities. The banks don’t need to compete for the deposits by responding to the growing interest rate environment in the economy with higher interest on their deposit liabilities, because they are flooded with liquidity.

Such a situation might stimulate the credit creation by the banks through easing lending requirements, and this is inflationary.

Opportunity cost

In addition, the inelastic rate on the deposits eliminates the opportunity cost of capital, which is a fundamental factor in the business cycle theory. In response to the rising interest rate environment, the households are getting higher interest on their cash balances, thus cutting their expenses. The chart above contradicts this statement, making households irrelevant between spending and saving decisions. The checking deposits have high velocity and are readily available to be spent in the real sector of the economy. In the period of constantly rising prices, consumers will be looking for ways to save their savings from devaluation by buying real assets, which are inflationary.

Personal Income

In addition to the advanced cash balances, the economy is in strong shape with labor market conditions where two job vacancies for every one person counted looking for a job, a situation never witnessed before. Such a strong underlying reduces the recession and stagflation risks in the economy but makes the Fed’s efforts of combating the rising prices much more complicated.

If the labor shortage will be solved only through the supply of labor without targeting the demand, the effect might be inflationary as well. Growth in the participation rate due to the higher immigration or other government incentives is unlikely will reduce the salary pressure from the market, since the labor force is still scarce, but the hiring will create additional personal income for the households, which will be distributed in the economy, and this is inflationary.

Historical evidence

The inflation-targeting approach requires tightening actions to be undertaken in advance. A neutral rate is just an assumption, nobody knows the exact level of the interest rates required to put downward pressure on the borrowing, and as result the prices in the economy.

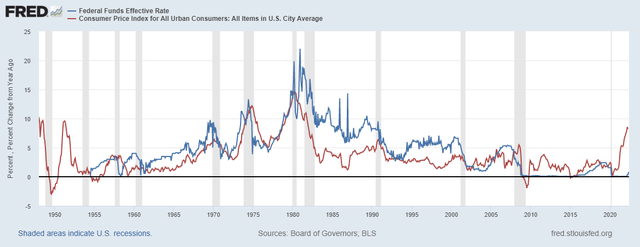

Historically, interest rates were leading the inflation, and rarely the Federal Funds Rate was below the inflation rate persistently as is happening currently.

Following this chart, it’s fair to say that the announced 2.5% neutral rate unlikely will be enough to push the prices down. Just from a historical perspective, the neutral rate is supposed to be much higher, thus additional measures are required.

The tapering decision which started in June will trim 47.5$bln/month of Treasury and MBS from the Fed’s Balance Sheet. The pace will be accelerated up to 95$bln/month starting from September 2022. This means that all the Treasuries which are due, will not be rolled over towards the new issuance. The QT likely will cut around 1$trln of the Fed’s holdings over the next year. However, according to Fed economists, the reduction in the balance sheet will be equivalent to a couple of 25-basis-point rate hikes.

The Market Meltdown

Since QE has a direct impact on the growth in the equity market, it is fair to expect the opposite effect from the QT, however, the process differs. In response to the announced rate hikes and balance sheet tapering, the markets started to price in growth rates across the yield curve, thus reducing the price of fixed-income investments. Since the diversified and risk parity portfolios are structured with the presence of fixed income components, sometimes reaching classical 60/40 composition. A drop in bonds and treasuries prices leads to the portfolio rebalancing through the selling of the equity components, to restore the portfolios towards strategic asset allocation. In addition, investors who pledged treasuries as collateral for purchasing the risky assets were facing haircuts, forcing them to sell the risky assets due to the reduced value of the collateral and inability to roll over the loan.

In a highly leveraged environment, the substantial and consistent price correction triggers the margin calls for other market participants by creating a domino effect among the different types of investors and portfolios forcing the fire sales.

On the opposite side, due to the growth in the short-term borrowing, the costs of Repo facilities along with the rising cost of margin loans reduce the demand for the financial assets, creating a disbalance between the supply and demand sides.

Wealth reversal effect

Due to the financialization of the society, around 58% of the U.S population now owns stocks. The drop in equity value will hurt consumers’ sentiment, and basically will make some people poorer, thus reducing the demand from certain groups of society. The recent correction wiped out around 7$trn from the stock market. The funds will never be distributed in the real sector of the economy, thus the demand is destroyed. An example illustrates how the Fed can impact consumption not only through borrowing but also through the wealth channel on which it has a direct and meaningful impact.

Another possible outcome of the wealth reversal is a higher participation rate, bringing some portion of retirees back to the labor market along with others whose wealth was reduced and now looking for income. These factors may improve the situation in the labor market and reduce some price pressure, but the scale of return to the labor market should be significant, as opposed to the current.

What’s next?

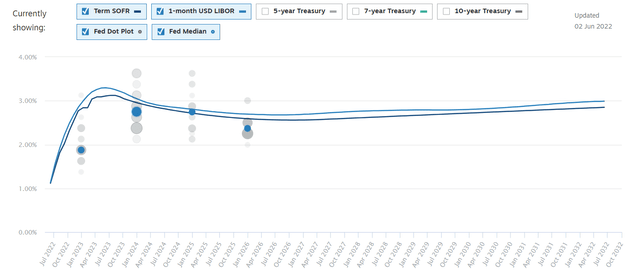

The good news is, that the market already priced the announced 2.5% neutral rate, thus, the Jan 2023, 1-month LIBOR rate which is a good proxy of the future Fed funds rate now stands at 2.99% reflecting the market expectations for the Federal Funds rate by the end of 2022 and tapering effect.

( Source: Chatham Financial )

In my mind after the recent financial assets correction, the market and the Fed officials will be in the steady mode of analyzing the impact of the rising interest rate environment and QT on the financial system. Along, with precisely accessing the impact on the consumption and prices in the U.S economy during the summer period.

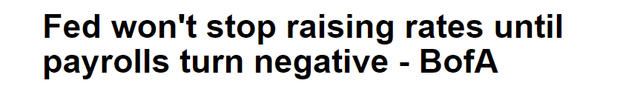

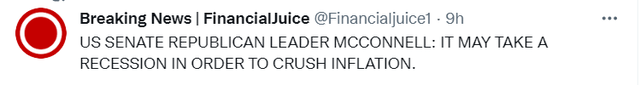

The price stability is one of the Fed’s mandates along with full employment which was accomplished. The “Fed put” is no longer relevant when there is a consensus among political elites to use all available measures and put the prices in the economy under control.

If the arguments presented in this article will be proven true, the tightening impact at the announced level likely will be subdued in reducing the aggregate demand. Thus after the period of negative inflation-related data during the summer period, the Fed officials will have to accelerate the pace of the interest rate hikes, presumably closer to 4%-5%, which implies more market meltdown ahead.

Be the first to comment