Deagreez

Lifeway Foods, Inc. (NASDAQ:LWAY) presents a beneficial business model for the sale of Kefir and other food products. With a lot of expertise in the creation of new brands and potential internationalization of the business model, LWAY could be worth much more in the market. In my view, the risks from rapid changes in the price of milk or federal regulation of milk prices don’t represent serious risks. LWAY’s stock price could creep up higher.

Lifeway Foods Is Betting On The Growing Kefir Market, And Does Not Seem To Suffer From Supply Chain Disruptions

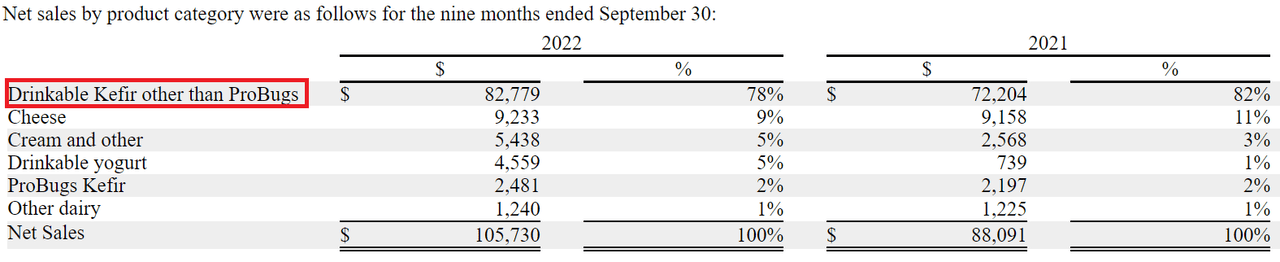

Founded in 1986, Lifeway Foods is a natural foods company based in Illinois. Cheese, yogurt, and cream are among the company’s products, but the most popular product is Kefir. In the nine months ended September 30, 2022, Kefir represented 78% of the total amount of revenue.

Source: 10-Q

If you are in the food industry, I believe that Lifeway Foods would be of your interest. Keep in mind that the global Kefir market is expected to grow at a larger growth rate than other sectors in the food industry.

The global Kefir market size is expected to expand at a CAGR of 6.32% during the forecast period, reaching USD 2220.83 million by 2027 was valued at USD 1537.57 million in 2021. Source: Kefir Market Expected to Raise at 6.32% CAGR by 2022-2027

The global Food Service market size was valued at USD 2858364.4 million in 2021 and is expected to expand at a CAGR of 4.91% during the forecast period, reaching USD 3810793.96 million by 2027. Source: digitaljournal.com

There is another beneficial reason to conduct research about Lifeway Foods. In the last quarterly report, management noted that it was not suffering significant supply chain disruptions or labor supply shortages. Considering that many other companies in the United States complain about these two problems, I believe that Lifeway Foods could offer better financial figures in the coming years.

We have not experienced significant supply chain disruptions or labor supply shortages and have continued to satisfy customer and consumer demand for our products. Management continues to proactively manage the supply and transportation of materials used to make and package our products, staffing, and transportation of our products to customers. Source: 10-Q

It is also worth noting that management does not anticipate manufacturing or staffing disruptions in the near future. In my view, the following two lines from a recent quarterly report are quite optimistic about the future of Lifeway Foods.

The Company has maintained full production capacity available at all locations and does not anticipate manufacturing or staffing disruptions in the near term. Source: 10-Q

The Balance Sheet Is Quite Healthy

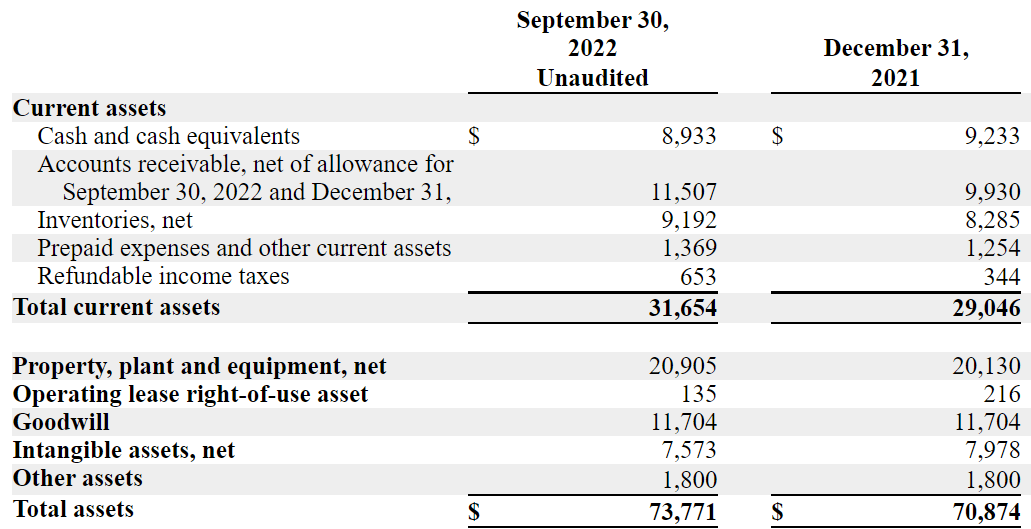

As of September 30, 2022, cash and cash equivalents were equal to $8.933 million, with accounts receivable worth $11.507 million and inventories of $9.192 million. Total current assets were equal to $31.654 million, close to 2x total current liabilities. I believe that the company will likely not suffer a liquidity crisis soon.

Non-current assets include property worth $20.905 million, goodwill of $11.704 million, and intangible assets of $7.573 million. Total assets stand at $73.771 million, about 3x the total amount of liabilities. Hence, I believe that the balance sheet appears in good health.

Source: 10-Q

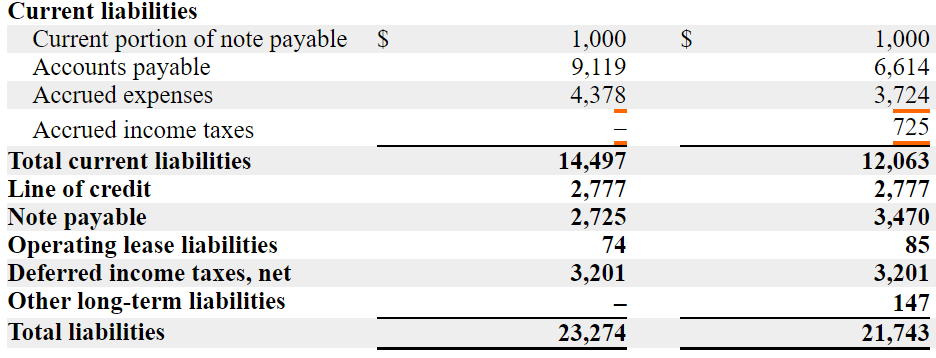

The liabilities include accounts payable worth $9.119 million, with accrued expenses of $4.378 million and total current liabilities of $14.497 million. The line of credits worth $2.777 million, the payable note worth $2.725 million, and deferred income taxes of $3.201 million result in total liabilities of $23.274 million.

Source: 10-Q

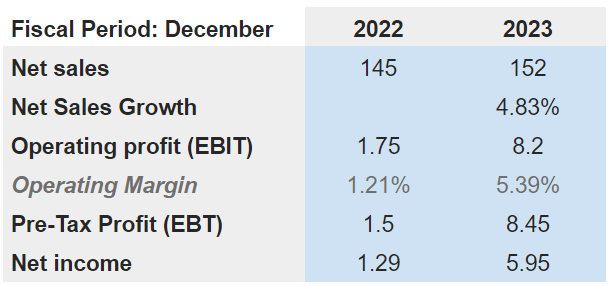

Estimates From Analysts Include Positive Net Sales Growth, And Previous FCF Margin Is Close To 3%

I believe that the market estimates are quite conservative. Analysts forecasts for 2023 include net sales of $152 million and net sales growth of 4.83%. In addition, operating profit would stand at close to $8.2 million, with an operating margin of 5.39%, pretax profit of $8.45 million, and the net income of $5.95 million. Some of my figures in my base case scenario have been taken from the work of other analysts. My DCF model didn’t result in very different figures.

Source: Marketscreener.com

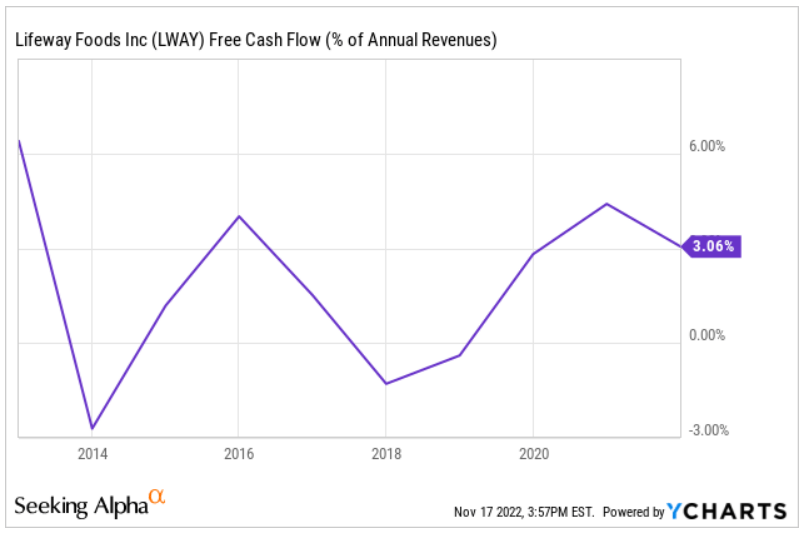

I also assumed a free cash flow margin close to 2%-3% because it is close to the figures reported in 2020, 2021, and 2022. Other analysts may come up with better or worse figures than my estimates, however I wouldn’t expect their figures to be very far.

Source: Ycharts

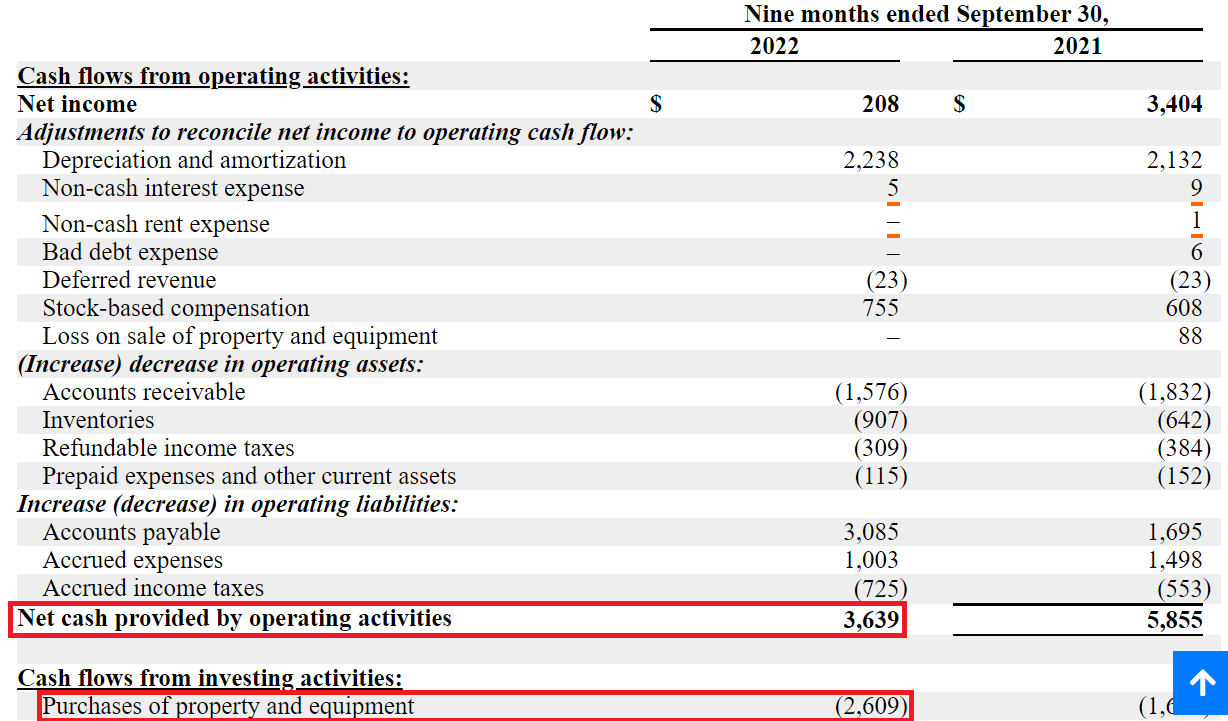

I checked the cash flow statement reported for the nine months ended September 30, 2022. Lifeway Foods reported a net income of $0.208 million, with a depreciation and amortization of $2.238 million and changes in accounts receivable of $1.576 million. Besides, with changes in accounts payable of $3.085 million and changes in accrued expense of $1.003 million, the net cash provided was $3.639 million, and capex stands at $2.609 million. With these figures, I would say that FCF does not exceed $2 million.

Source: 10-Q

My DCF Model Would Imply A Valuation Of $8.51 Per Share Or Higher

In my view, considering Lifeway’s business history, I think that management has expertise in brand creation. I wouldn’t discard that Lifeway Foods decides to launch new brands in the coming years. As a result, I believe that we can expect significant sales growth. In the last annual report, management also noted that future success could include joint ventures and strategic alliances.

We believe that our future success depends, in part, on our ability to implement our strategy of leveraging our existing brands with our new products to maintain our market position in our product categories; drive increased sales; acquire or establish new brands; and create strategic alliances including potential joint ventures. Source: 10-k

I also believe that with substantial know-how accumulated in the United States, Lifeway Foods could be quite successful in Europe or Asia. Let’s keep in mind that Lifeway only sells 1% of the total amount of revenue.

We have co-packer agreements to manufacture drinkable and frozen kefir in Ireland and the United Kingdom, respectively, to serve our European markets. During 2021 and 2020, approximately 2% and 1% of our revenue, respectively, was derived from products manufactured by co-packers.

Sales outside the United States represented approximately 2% of net sales for the year ended 2021. Source: 10-k

I also believe that accumulation of equity from large competitors could generate certain stock demand. Let’s note, for instance, that Danone S.A. (OTCQX:DANOY) holds 22% of Lifeway Foods.

Since October 1999, Danone SA through subsidiaries, has been the beneficial owner of approximately 22% of the outstanding common stock of Lifeway. Source: 10-k

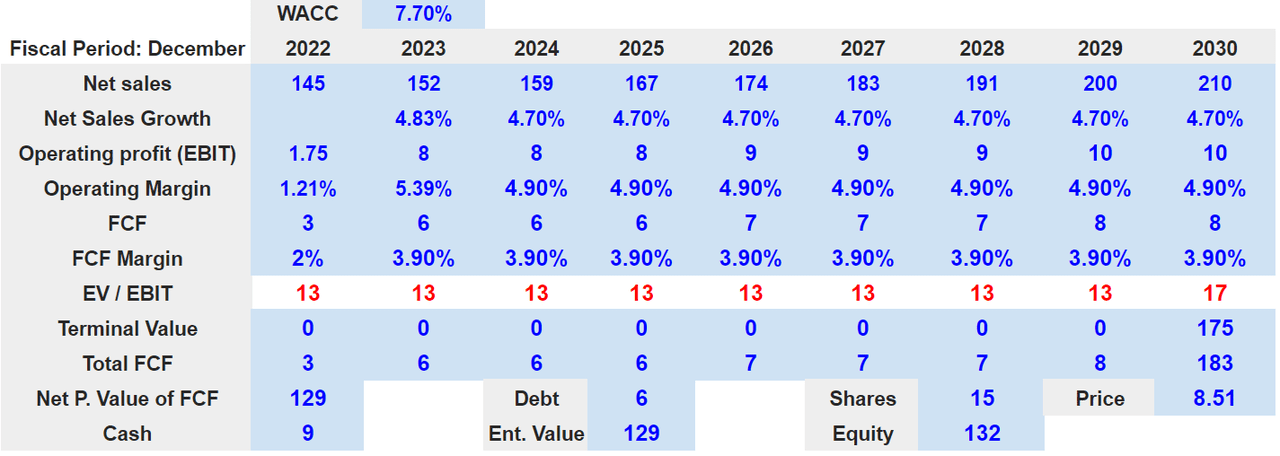

My DCF model includes 2030 net sales of $210 million with sales growth of 4.70%. Operating profit would be close to $10 million with FCF of $8 million and a FCF margin of 3.90%.

With an EV/EBIT close to 17x, the 2030 terminal value would be $175 million, so the sum of future FCF would be $129 million. Also, with cash of $9 million and debt of $6 million, the equity would stand at $132 million. Finally, the fair price would be close to $8.51.

Source: Author’s Work

Concentrations Of Clients, Changes In The Milk Price, or Shortages May Push The Stock Price Down To $6 Per Share

The company works with a few clients that represent more than 21% of the total amount of revenue. Those clients may try to renegotiate prices with Lifeway Foods, which may lower the company’s free cash flow margins. As a result, the implied fair price would decrease.

During the year ended December 31, 2021, two customers collectively accounted for approximately 23% of our total net sales. These customers collectively accounted for approximately 32% of net accounts receivable as of December 31, 2021. Source: 10-k

Lifeway Foods may also suffer from changes in price of milk, shortages, or even regulation from federal authorities. The company was very clear about these risks in the last annual report. Regulation may lower the company’s EBIT margins, and may lower future free cash flow.

Our primary raw material is milk. The federal government establishes minimum prices for raw milk purchased in federally regulated areas. Some states have established their own rules for determining minimum prices. The federal government announces prices for raw milk each month.

The supply and price of raw milk may be impacted by, among other things, weather, natural disasters, real or perceived supply shortages, lower dairy and crop yields, general increases in farm inputs and costs of production, political and economic conditions, labor actions, government actions, and trade barriers. Source: 10-k

Finally, let’s note that a family controls a significant part of the share count. Their interests may be different from the interests of minority shareholders. Hence, certain business decisions could not be in the interest of certain investors.

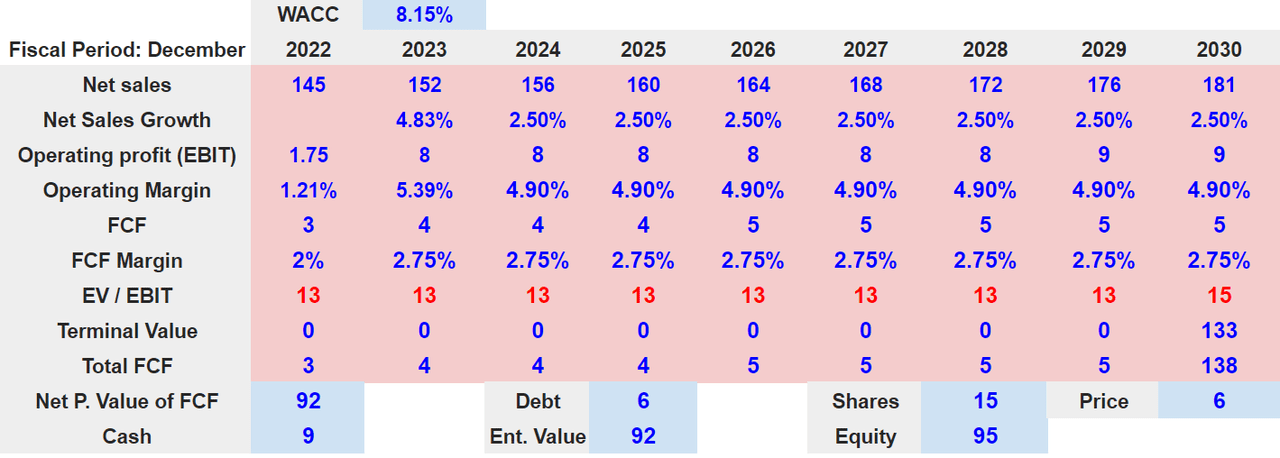

Under this scenario, I assumed 2030 net sales of $181 million with net sales growth of 2.50%. I also expect an operating profit of $9 million with an operating margin of 4.905%. The FCF will likely be around $5 million with the FCF margin of 2.75%.

With an EV/EBIT multiple of 15x, which implied a 2030 terminal value of $133.3 million, the implied NPV of future FCF would be $92.4 million. Finally, the equity would be close to $95 million with a fair price of $6.5 per share.

Source: Author’s Work

Conclusion

Lifeway Foods, Inc. offers a successful product, which is sold in many retail stores all over the United States. The fact that Danone owns 22% of the company says a lot about Lifeway’s products. I see a lot of business potential from the internationalization of the business and the creation of new brands. I also believe that the sum of future free cash flow could imply higher price marks than the current market price. There are obvious risks from milk shortages or federal regulation of prices, but they don’t pose a major problem in my opinion.

Be the first to comment