We Are

Millennials.

There’s been a whole lot said about them since they first arrived on the professional scene – some good, some bad.

Isn’t that always the case, though?

On the negative side, especially when millennials were in college and first joining the workforce, the main criticism was that they were entitled. They couldn’t handle life unless it was catered specifically to them.

I’m sure some of those complaints were accurate. Just like, again, there are things said about everyone else. But let’s focus on the positive today – like how much money millennials can retire with a few decades down the road.

Now, they’re not in as good a position as Gen Z, which I wrote about last week. That’s the generation my kiddos are part of, including my two oldest who are part of the workforce.

And killing it too, for the record. My oldest is a rock star report (just google her name and you’ll find out).

I can’t tell you how proud I am!

But back to millennials… There are different ideas of exactly when that generation began and when it ended. For our part, let’s go with the earliest start possible (or as far as I’ve seen), which is 1981. And if we take that then to 1996, we have a 26-41 year-old range.

In which case, they’re still looking at more than two decades ‘til retirement.

Two decades to add up dividend payment after dividend payment after dividend payment. Which can add up intensely.

You’re Getting Up There in Age

I started this series because of a message I got from a 20-year-old on Twitter. Here’s how the resulting article began:

“I’ve been fairly active these days on Twitter Inc. (TWTR) lately.

“I figured it was time for me to explore this platform, to gain more followers, in an effort to connect with the Gen Z crowd.”

Well, it apparently worked out to some degree since a Gen Z-er reached out asking about the top 10 REITs for a 20-year-old. So here’s a bit more of that article (don’t worry, millennials. We’re getting back to you. I promise):

“When I was in my 20’s, I took substantial risks. And perhaps I’ll write an entire article on the lessons I learned in my younger days.

“It’s actually normal to take elevated risks in your 20s because your time horizon is much longer, which means volatility has more time to recover. However, a word of caution here, as principal preservation should always be top of mind.”

And the older you get, the larger that “top of the mind” allocation should be. So, millennials, I’m not calling you old.

I’m just calling you older. As such, you need to be more cautious about what you do with your money.

Them’s just the breaks.

A REIT in Every Millennial Portfolio

For the record, I’m not going to start lecturing about the traditional 60/40 strategy. If you don’t know about that – and you might not if you’re a millennial – that’s the old rule of thumb that said retail investors should have 60% of their investments in stocks and the remainder in bonds.

There’s a lot of debate these days about whether that still works.

Maybe it does. Maybe it doesn’t. I’m not going to take a stance on that today one way or the other.

But real estate investment trusts (REITs)? I can’t say they’re always going to be an excellent investment category…

I just haven’t seen a time yet when buying them – intelligently – and holding them hasn’t paid off. And I don’t expect to see one anytime soon.

Of course, REITs are a diverse group. Some of the individual companies are riskier than others, but some people can afford a little more risk.

Note the “little” in that sentence.

That’s why I recommended Innovative Industrial Properties (IIPR) to my Gen Z readers. Whereas I suggested Highwoods Properties (HIW) to baby boomers, those born between 1946 and 1964.

The former is a cannabis REIT, which makes it a much newer category in a growing but still controversial category. The latter is an office landlord, with properties in places where businesses are flocking to – including Orlando and Tampa, Florida.

Nobody’s questioning that focus.

So how about millennials? What kinds of REITs might very well belong in their portfolios?

Without further ado, let’s take a look.

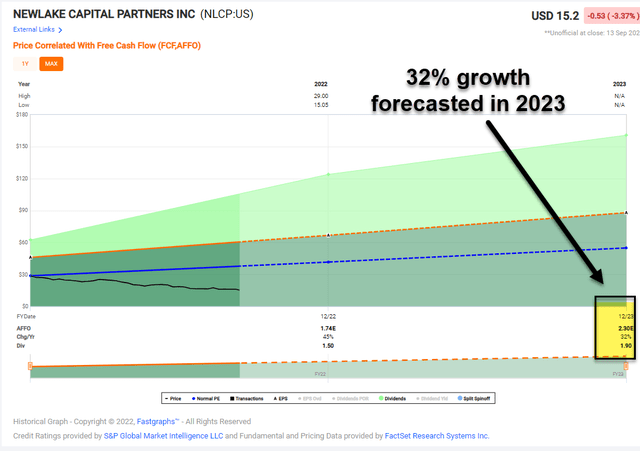

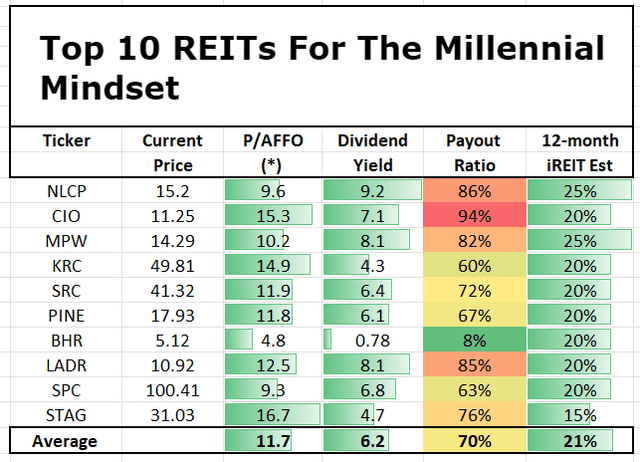

Millennial Pick #1: NewLake Capital Partners, Inc. (OTCQX:NLCP)

NLCP is a cannabis REIT that owns 31 properties (1.7 million square feet) in 12 states. The company listed OTC in 2021, and although fairly new to the REIT sector, the company is 100% leased and has experienced no defaults or deferrals to date.

The platform is 92% cultivation-focused and 8% retail-focused. The average lease term for the portfolio is 14.5 years, with a weighted average yield of 12.2%.

I spoke with the CEO, Anthony Coniglio, last week and he informed me of the extraordinary growth prospects for the cannabis industry in which 82% of the U.S. population (268 million people) reside in medical cannabis markets. Back in March, the company boosted its quarterly dividend by 6.5% to $.33 per share.

Shares are now trading at $15.20 per share with a P/AFFO of 9.6x. That’s cheap, especially when compared to peers like IIPR (trading at 11.6x) or industrial REITs like STAG Industrial that trade at 16.7x (also a millennial pick, as you will see below). NLCP is now yielding 9.2%, and our conservative total return forecast is 25% over the next 12 months.

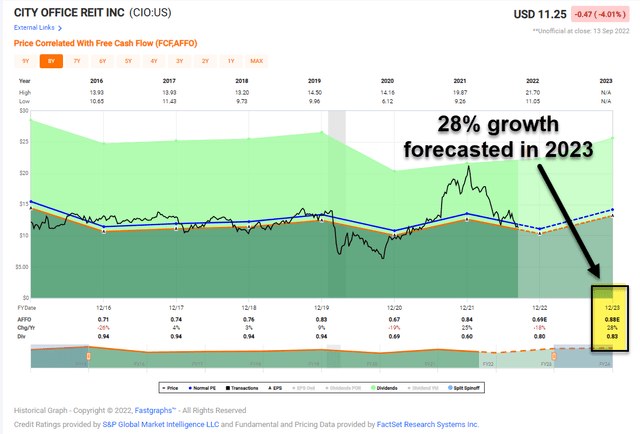

Millennial Pick #2: City Office REIT, Inc. (CIO)

CIO is an office REIT that owns high-quality office properties in 18-hour cities in the Southern and Western United States. The portfolio is spread across these markets: Orlando (8%), Tampa (13%), Raleigh (18%), Dallas (15%), Denver (9%), Phoenix (23%), Sane Diego (5%), Portland (4%) and Seattle (5%).

We like the CIO model because of the fact that most properties are located in low or no-state taxed markets that drive a diverse employment base with national and international employers. Covid-19 served as a catalyst for CIO, as the company has focused on value-enhanced leasing, rent collection, and growing property cash flow.

The company has maintained a conservative risk profile that includes 3.7% weighted average interest rate, 5.8x Net Debt to Annualized Adjusted EBITDA, and 75.4% fixed rate debt. While the company did cut the dividend during the pandemic (from $.94 to $.60 per share – annually), the dividend appears safe.

Recognizing this REIT is a small cap ($487 mm m-cap), we consider this a perfect millennial pick. Shares are cheap, trading at $11.25 with a P/AFFO of 15.3x and a dividend yield of 7.1%. The analyst growth estimates for 2023 are impressive at 28%, which provides plenty of rocket fuel for total returns.

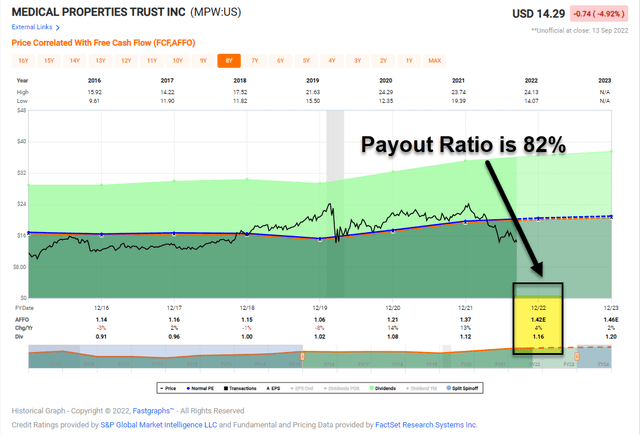

Millennial Pick #3: Medical Properties Trust, Inc. (MPW)

MPW is not for weak stomachs, but I’m certain that most millennial investors can handle the volatility with this “pure play” hospital REIT. The Alabama-based landlord owns a global portfolio of 447 properties leased to 54 different operators.

MPW has been underperforming the broader market and REIT market so far in 2022 by a large margin, primarily because of its tenant Steward, the top operator for the company which accounts for 27.8% of Q2 revenues.

The exposure is high, and investors have a right to be concerned. If the exposure was in the low single digits, we might be having a different conversation, but given that over a quarter of the company’s total revenues comes from this tenant that has shown cash flow issues in the past, investors have a right to be concerned.

We provided iREIT investors with a deep dive related to the Steward properties, and this report confirmed our conviction that hospitals are “mission critical.” If Steward were to default, the master lease provides added security for MPW stakeholders.

MPW shares are a bargain right now, trading at $14.29 with a P/AFFO of 10.2x. The normal valuation range over the last 5 years is 14.4x. The dividend yield is 8.1%, and although growth is modest (4% in 2022 and 2% in 2022), we’re perfectly content waiting on shares to reprice to the upside.

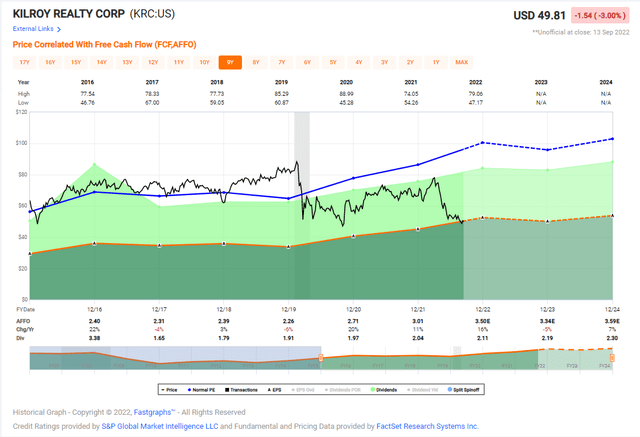

Millennial Pick #4: Kilroy Realty Corporation (KRC)

KRC owns an office portfolio comprised of many familiar Gen Z and Millennial names such as Amazon, Stripe, LinkedIn, Adobe, salesforce, DoorDash, DIRECTV, Netflix, Boc, Synopsys, and Riot Games.

In addition, KRC has tapped into the Life Science sector with a portfolio of ~3.2 M SF of existing, redevelopment and under construction projects, and ~2.2 M SF of future entitled land pipeline. Shares are a bargain right now, trading at a 50% discount to normal valuation metrics.

One key risk for KRC has to do with the company’s significant tech exposure, as well as large development risk, given tech companies have been leading in expansionary space.

Although we remain cautious on the office REIT sector given the pullback in hiring, particularly within the tech industry, we believe KRC’s balance sheet is positioned to weather the storm.

Liquidity stands at $1.2 billion, including roughly $120 million in cash and full availability of the $1.1 billion revolver (no debt maturities until December of 2024). KRC recently announced a 4% quarterly dividend increase from $.52 per share to $.54 per share.

Shares are now trading at $49.81 with a P/AFFO multiple of 14.9x (compared to the 5-year average of 28.7x). The dividend yield is 4.3% and analysts forecast growth of 22% in 2022, followed by -5% in 2023 and 7% in 2024).

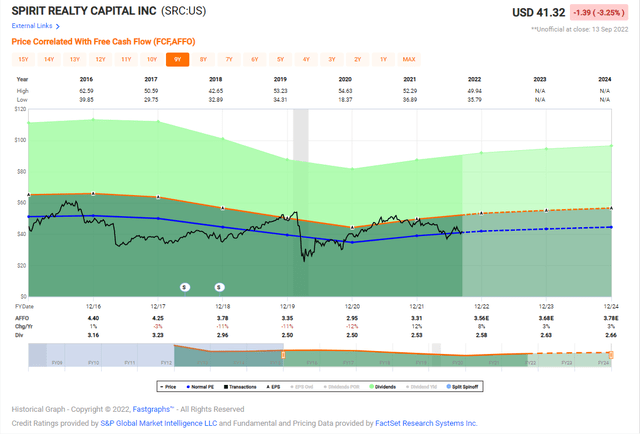

Millennial Pick #5: Spirit Realty Capital, Inc. (SRC)

SRC of 2,078 net lease properties that generate over $647 million in annual rent. The portfolio is broken down as follows: service retail (43.9%), industrial (19.9%), discretionary retail (15.2%), non-discretionary retail (11.8%), office (2.7%) and other (6.5%).

SRC focuses on tenant credit quality, industry relevance, and the relative strength of their assets, and the company also has more industrial tenants and works with a strict industrial portion of its portfolio.

SRC is an absolutely stellar COVID-19 performer – it lost only 0.03% in rent during the entire period and maintained a 99%+ occupancy rate throughout COVID-19. On the basis of this, SRC is often compared very favorably to Realty Income (O), and we believe it is an apt comparison.

SRC is BBB rated, and also carries a yield over 6%, currently 6.40%, and the yield is very well-covered on the basis of FFO (funds from operations) and AFFO (adjusted FFO). Even based just on a reversion to a discounted 13.4x P/FFO, the upside here is nearly 40% in less than 3 years.

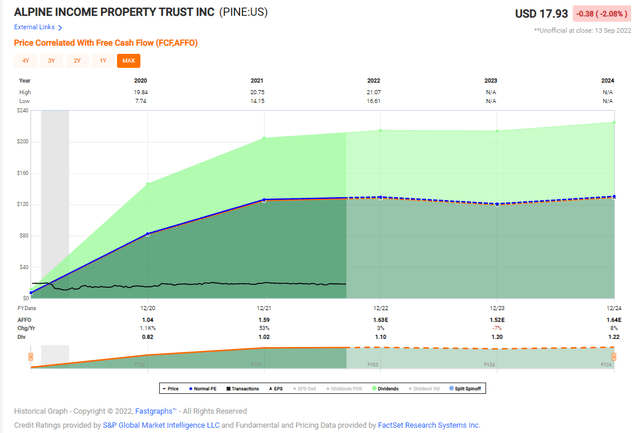

Millennial Pick #6: Alpine Income Property Trust, Inc. (PINE)

PINE is a net lease REIT that owns a portfolio of 143 properties located in 35 states. Around 84% of ABR (annualized base rent) comes from tenants or the parent of a tenant that are publicly traded or publicly rated and 77% of ABR comes from tenants or the parent of a tenant that are credit rate.

Several of the top tenants include Walgreens, Lowe’s, Dollar General, Family Dollar, LA Fitness, Walmart, and Hobby Lobby. PINE has demonstrated an improved and thoughtful approach to accessing capital and has an efficient cost of debt with a weighted average interest rate on its debt outstanding of 3.0%.

Also, around 7% of ABR comes from ground lease assets where PINE owns the land, and the tenant has a meaningful investment in the improvements.

PINE has a low payout ratio – of just 66% 2022E FFO per share – and the company has increased the dividend 6x since the IPO, and 5 increases in the last 2 years. A 35% increase in the quarterly cash dividend since the beginning of 2020.

PINE trades at a 4.8x valuation discount to the peer group average, implying significant upside. The price is $17.93 per share with a P/AFFO multiple of 11.1x and dividend yield of 6.1%.

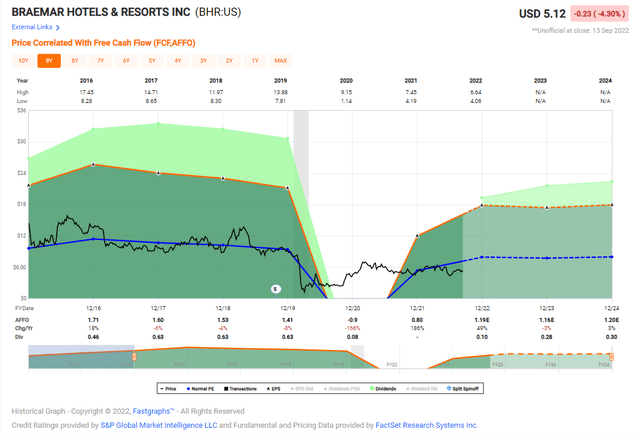

Millennial Pick #7: Braemar Hotels & Resorts Inc. (BHR)

BHR is a Lodging REIT that owns a portfolio of 16 high-end luxury hotels (3,971 rooms). This luxury resort portfolio continues to outperform and drives comparable hotel EBITDA of $57.4 million for Q2-22, an increase of 42.7% versus Q2-21.

BHR generates strong cash flow with approximately $27 million of cash flow generated in Q2 after CapEx and preferred dividends. The portfolio is well-positioned to continue to outperform with very strong forward bookings as corporate transient and group business continue to accelerate.

BHR’s balance sheet is in good shape with no remaining final debt maturities in 2022. In Q2, BHR reported net income of $10.3 million (or $0.12 per diluted share) and AFFO per diluted share was $0.37, compared to AFFO of $0.20 per share in Q1-22.

BHR’s externally managed shares are now trading at $5.12, with a P/AFFO multiple of 4.7x. The dividend yield is less than 1%, but we believe this lodging pick is poised to outperform over the coming quarters.

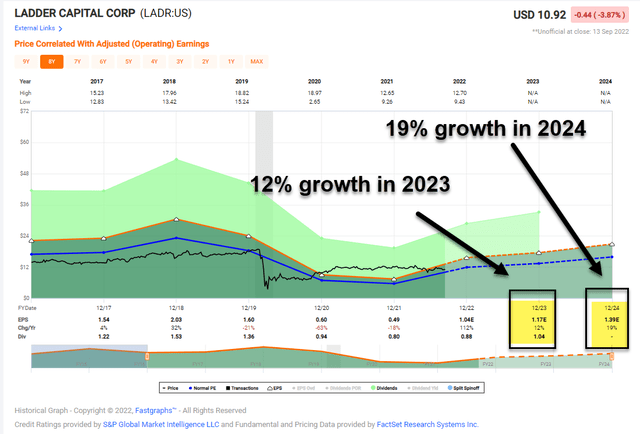

Millennial Pick #8: Ladder Capital Corp (LADR)

LADR is an internally managed commercial mREIT that has made over $44 billion of investments since its inception in 2008. Total assets today are approximately $6.0 billion. Insider ownership is high, with management owning 11% of shares worth over $160 million.

Leverage is below average, and LADR’s material exposure to physical commercial real estate is also relatively rare for the sector (Starwood Property Trust (STWD) being a notable exception).

LADR’s 68% loan-to-value (“LTV”) indicates a healthy ~32% of equity needs to be erased before principal value is at risk. That’s in line with or slightly better than the quality peer average. The loans are well diversified and generally less than $25 million in value.

LADR’s geographical exposure is excellent, and the portfolio is now most heavily weighted to multifamily (26%), office (25%), and mixed-use (24%). It has among the lowest exposure to the more cyclical retail (6%) and hotel (5%) sectors of any mREIT.

LADR carries sector leading BB+/Ba1 credit ratings from Fitch and Moody’s, which is only one notch from investment grade. The conservative leverage ratios, coupled with the favorable debt maturity scheduled captured below, are major reasons for the comparatively strong credit ratings.

LADR is currently trading at $10.92 per share with a P/E multiple of 12.5x. The dividend yield is 8.1% and well-covered. Analysts are forecasting 12% growth in 2023 and 19% growth in 2024, which should provide meaningful growth to the already juicy dividend yield.

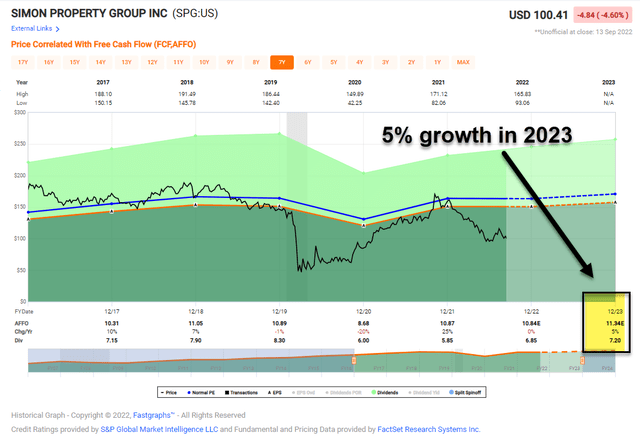

Millennial Pick #9: Simon Property Group, Inc. (SPG)

SPG is a mall REIT that has an interest in 231 properties comprising 186 million square feet in North America, Asia, and Europe. The company also has an 80% stake in The Taubman Realty Group, which owns 24 regional, super-regional, and outlet malls in the U.S. and Asia.

Additionally, the company also has a 22.4% ownership interest in Klépierre, a publicly traded, Paris-based real estate company, which owns shopping centers in 14 European countries.

SPG is the highest-quality REIT in the world today, but a recession typically does not bode well for its customers. The company has a portfolio of A-rated malls, meaning their sales per square foot is extremely high when compared to other malls.

Prior to the Q2 earnings release, Simon Property’s board increased their dividend yet again by 16.7%. Here at iREIT, we often discuss the confidence it shows when a company increases its dividend, especially when facing a recession.

Management even raised its 2022 FFO guidance from $11.60-$11.75 to $11.70-$11.77, the second consecutive quarter it has done this. A management team showing improving results, increasing guidance, AND a huge dividend raise isn’t one that seems too concerned about the economic downturn.

Shares of SPG currently trade at a P/AFFO multiple of 9.3x, and over the past five years that number has averaged 15x, indicating shares are very undervalued at current levels. The dividend yield is 6.9% and well-covered based on a payout ratio of 63%.

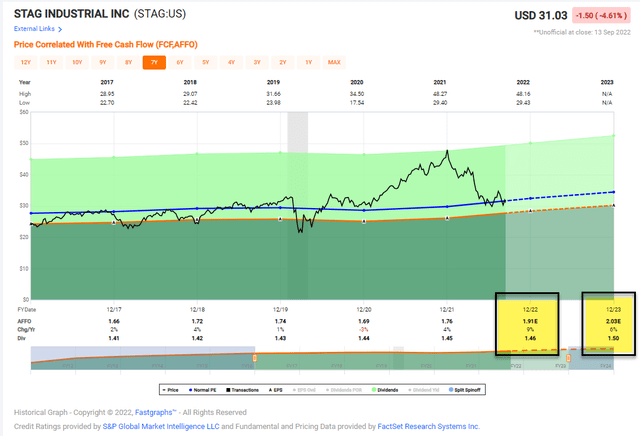

Millennial Pick: #10 STAG Industrial, Inc. (STAG)

STAG is an industrial REIT that own 551 properties within 40 states all here in the U.S. Those 551 properties are made up of 110.1 million square feet of industrial space.

The growth we have seen from the company has been staggering. Since going public back in 2011, the company has gone from 93 properties to 551 properties.

Since the IPO, the portfolio had 21% of its annual base rent attributable to Flex/Office type properties, whereas today that is down to 0.1%, making STAG a pure-play industrial REIT.

STAG’s top 10 tenants make up 10.8% of total ABR, with the top 20 tenants making up 17.5% of total ABR. You can see that the company is very well-diversified amongst its tenant base, as the largest tenant, Amazon (AMZN), only makes up 3.2% of total ABR.

Another tailwind for the company is the fact they have 11.4% of their leases coming due in 2023. This will again provide the company an opportunity to bump those leases up to be more in-line with market rates, which will be beneficial to the business.

STAG has plenty of room for growth between the growing demand and lack of supply for industrial real estate combined with the opportunity to remarket some of these leases that are coming to an end.

Like to the REITs referenced above, STAG also has a strong balance sheet, with investment grade ratings from Moody’s (Baa3) and Fitch (BBB). The company has around $412 million of liquidity and a Net Debt to Run Rate Adjusted EBITDAre of 5.1x.

STAG shares are trading $31.03, with a P/AFFO multiple of 16.7x (compared with the 5-year average of 16.4x). The dividend yield is 4.7%, and 2022 growth estimates are 9% and 6% in 2023.

In Closing…

I hope you’re enjoying my “generational” series that includes Gen Z, Baby Boomer, and Millennials. Next up is Gen X, which is where I fit, although my wife oftentimes tells me that I’m more of the Gen Z type.

At any rate, I hope you’re “thirsty” (millennial term) for REITs and hopefully no trolls (another millennial term for “jerks who say nasty things about strangers”). Only those who want to “slay” my work, in the millennial sense that means to do an exemplary job.

Go buy some REITs, as millennials have upgraded to the next-best emotion. Instead of FOMO it’s the joy of missing out, or JOMO.

Be the first to comment