D-Keine/E+ via Getty Images

Published on the Value Lab 5/9/22

We continue to build coverage in the death care sector with Service Corporation International (NYSE:SCI), probably the largest player in the US. It benefits relative to other geographies from solid US demographics, and the negative effects expected from strong comps were better than expected. The business is cash generative, and with both a strong medium-term and secular-term outlook, as well as a resilient short-term outlook, it looks like a solid value play.

Quick Primer

First, a quick primer on the business. They sell interment rights, so essentially leases, on their cemetery properties to customers on both an at-need and a pre-need basis, meaning either after someone’s death or in anticipation of eventual death. In their cemetery merchandise and services, they floral services for the graves and other graveside services. They also provide funeral services, including cremation in addition to the cemetery arrangements, but also selling caskets or urns. The segment reporting is shown below.

Here are some useful points about the economics of the business. When they sell on a pre-need basis, they create pre-need deferred revenue. This accounts for both cemetery and funeral segments. Naturally, once the services are rendered, revenue is recognised and the deferred revenue liability is nixed. In the meantime, it is a great source of cash flow, but cannot be used for working capital purposes. Much if not all of these pre-need sales are kept in trust funds, seen in the liabilities as deferred receipts held in trust, as per provincial or state law. The rest are deferred revenue, which reduces working capital as normal. If pre-need contracts are cancelled, the amounts retained by the company get recognized as revenue, including gains made on that portion of the funds in trust. This can all be considered a type of backlog, provided by pre-need sales activity.

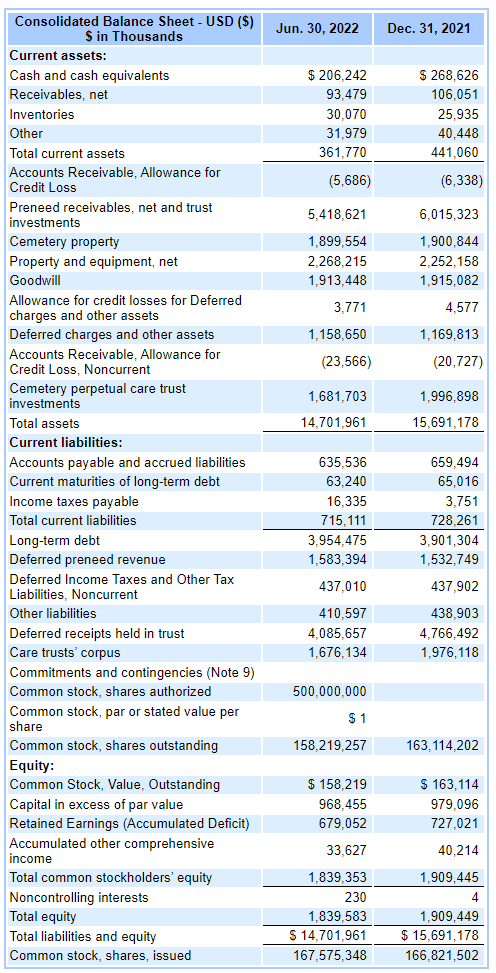

10-Q2 Balance Sheet (sec.gov)

For the cemetery segment, it is basically a real estate business. They own 90% of their cemetery property and lease the rest. They in turn sell interment rights to customers for the place of memorial to remain. These are lump-sum sales that partially go into a perpetual care trust for upkeep of the cemetery according to local law, which is a liability. The part that goes into the trust is not recognized as revenue while the rest is. The trust is also invested in order to outpace the liability of the needs of the interments and to generate a profit. The investment returns from the trusts are recognized as cemetery segment revenue when distributed and help cover cemetery maintenance expenses. So essentially, the business model covers them for maintenance costs. Part of the COGS from cemeteries are property construction costs, in addition to all the other typical COGS-related costs that most other businesses would have, including labor and facility expenses.

The company also sometimes acts as an agent for selling life insurance policies on top of the sale of a pre-need contract. They earn commissions from insurance companies for this, and it comes in as general agency commissions.

Q2 Results

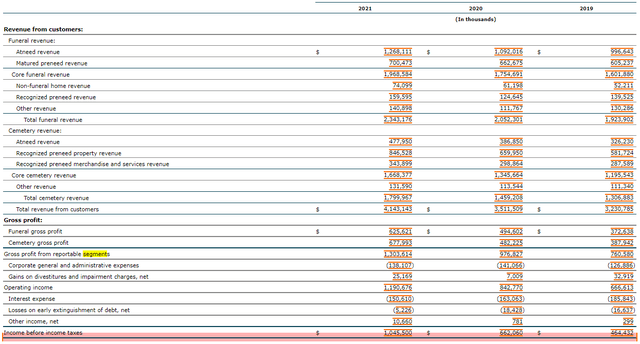

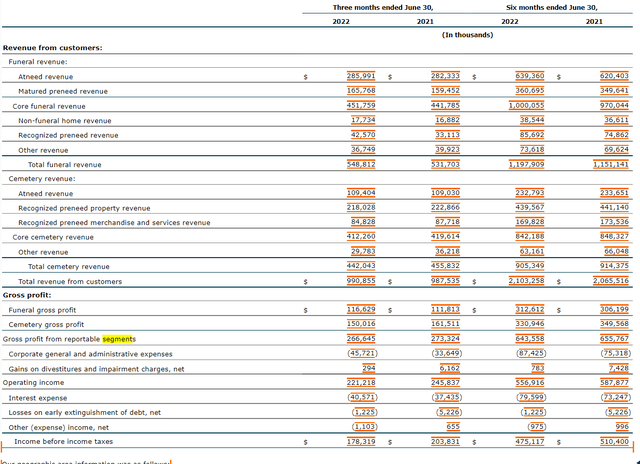

The Q2 Results are demonstrated as above and as follows.

Funeral revenue rises, driven by the cash-generative pre-need segment. A good performance.

The cemetery revenue actually falls. Merchandise and services fall, having an amplified effect on the gross profits as it is a higher margin segment. Pre-need revenues fall slightly, showing a resilience in volumes just not mix.

Volumes, in general, are falling a little, while the average sale price is increasing. This is a key effect that is coming from the mortality pull-forward due to COVID-19, which really strengthened 2021 in particular, especially since funerals were slowed down by lockdowns. The reason the average sale is increasing is because more people are attending a given funeral. So larger rooms are being booked and larger services with more catering. Amusingly, funeral businesses are actually a reopening trade. On top of that, the company is beginning to pass along higher costs to consumers. As far as we’re concerned, they will be able to stay ahead of inflation easily with pricing. On the flip side, cremations are growing, and that tends to be less favourable for the mix.

In general, management thinks that the flattish results are below their expectations and that the volumes being primarily affected are those related to discretionary spending. Funerals overall are not exactly discretionary, but some of the high contributors like merchandise are. To some extent, consumers are beginning to save on their funerals. Large sales are still growing, but it’s in the more discounted services that we are seeing a bit of downtrading.

Another important comment is that the investment trusts have lost quite a bit of value due to the market crash this year. This is going to affect the revenue IV we get from the trusts, which need to grow to distribute nicely revenues above maintenance expenses coming from the part of cemetery sales that got put aside into trusts. Equity market conditions being rough and future returns likely to be muted is not a great thing for the company’s secular revenue.

Conclusions

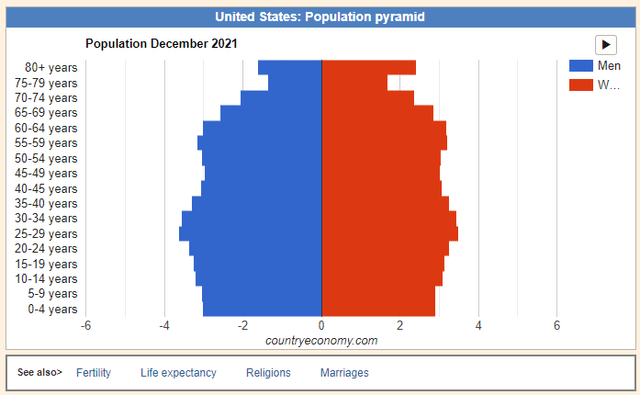

The company trades at 11.5x EV/EBITDA. That’s pretty cheap for a business with this sort of hold on business cash flows. Moreover, the secular outlook is recession resistant and even good from a demographic perspective. The US has one of the best demographic profiles in the western world. The whole of the US is a fine proxy for SCI due to their national footprint and 16% market share.

Population Pyramid US (countryeconomy.com)

Dependency ratios are good, for the economy mainly, and there is a pretty even column for people to graduate by age into the SCI markets, i.e., after 75 where mortality starts to rise a whole lot. It’s like a syringe of people into the higher mortality brackets, and it is loaded for the next 20 years. On that basis, this stock is a buy. The company has a low multiple and a very stable profile, with a great operating model to boot.

Be the first to comment