sefa ozel/E+ via Getty Images

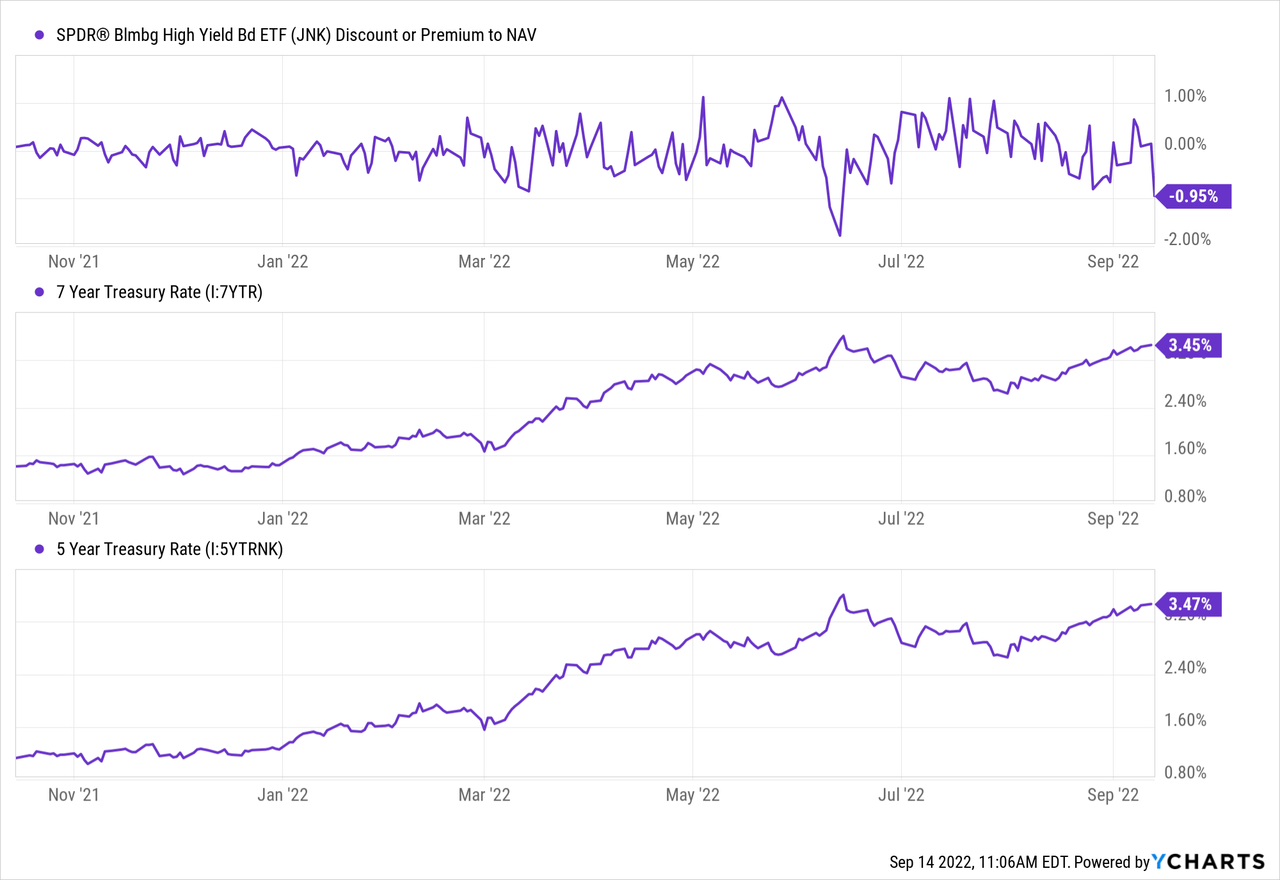

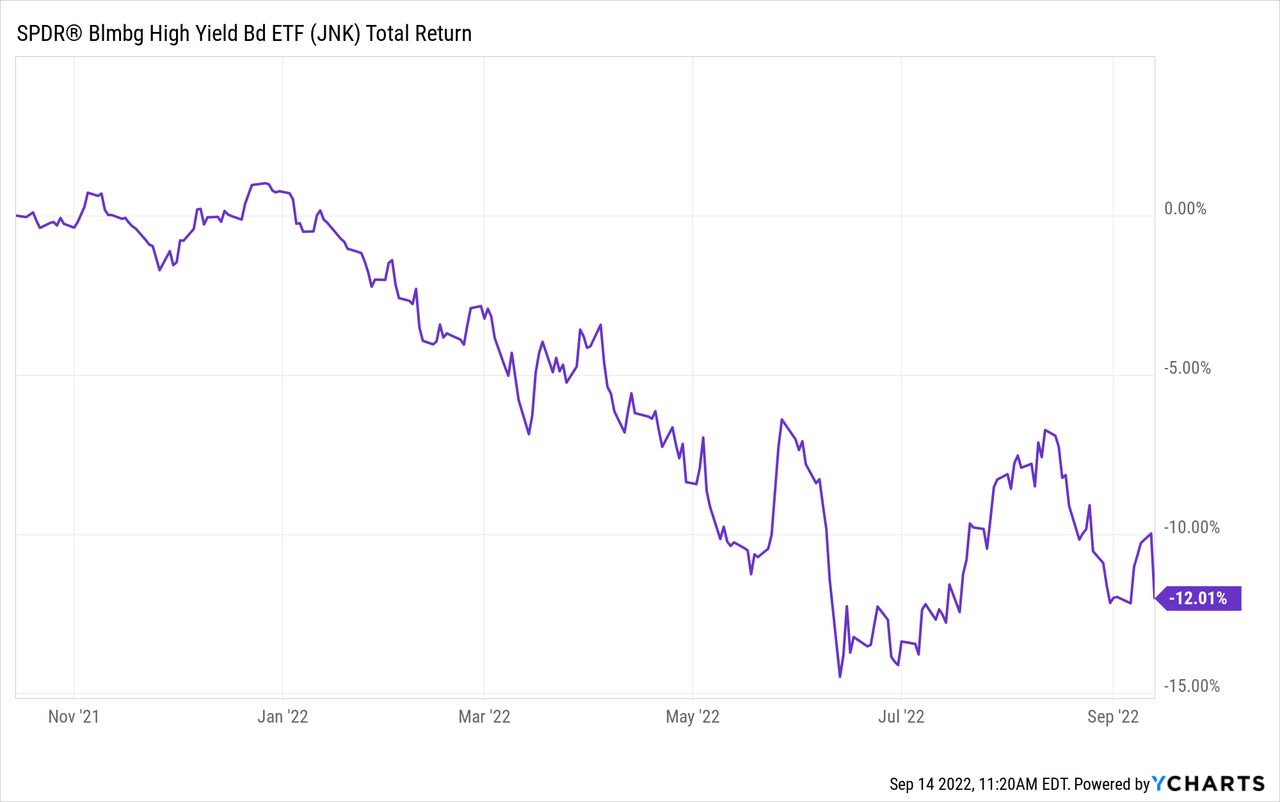

When we last covered SPDR Bloomberg Barclays High Yield Bond ETF (NYSEARCA:JNK) the risk free rate was yielding around 1.5%. JNK comprised almost entirely of junk bonds, and with a 30-day SEC yield of 3.79%, was trading at a slight premium to NAV.

We used the 5 and 7 Year Treasury Rate as a proxy for the risk-free rate as the weighted average maturity of the JNK portfolio at the time was 6.26 years. Granted the ETF had great diversification and scale; however, we recommended our readers stay out as the 229 bps spread did not adequately compensate for the credit risks in the form of defaults and restructurings that came with holding junk bonds. A third of its bond holdings had maturities of 7 years or more and with the interest rate hikes we saw in the horizon, holding such a fund was not worth it.

Last Article Title (Seeking Alpha)

We suggested our readers looking for income instead consider writing put options on quality companies at the right price. We had provided one such example of W. P. Carey Inc. (WPC) and that turned into an exceptional return prospect. With almost 10% returns on the suggested option, it was not even a contest with what JNK returned during this time.

The interest rates have risen since our last visit to this fund and JNK is trading at a small discount to NAV. Is this worth biting on?

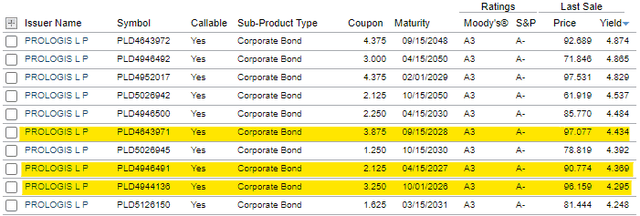

In the current environment we can get over 4% yield to maturity in bonds from A rated companies like Prologis (PLD). Bonds with only 6 years to maturity or less.

FINRA

In light of the above, let’s review the recent numbers and see if JNK now adequately compensates its investors for taking on the credit risk inherent in its high yield bond portfolio.

The Fund Recap and Recent Numbers

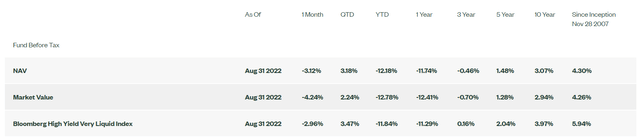

JNK aims to achieve the investment results of the Bloomberg High Yield Very Liquid Index. Of course, an ETF unlike an index has overhead, which in JNK’s case is 0.40%, resulting in a slight handicap for the ETF. All performance comparison with the benchmark should be viewed in light of that.

State Street Global Advisors

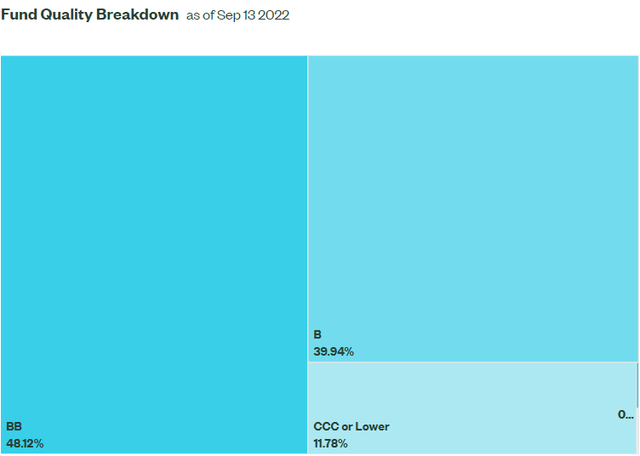

Not much has changed in the allocation of the holdings with about 50% in BB rated bonds. The rounding difference in the figure below is divided equally between unrated and investment grade holdings.

State Street Global Advisors

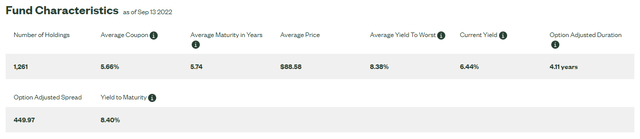

The ETF aims to hold bonds that mature between 1 and 15 years. With most of its holdings maturing in 7 year or less, the average maturity of the portfolio is 5.74 years. This has come down from the 6.26 years from October of last year.

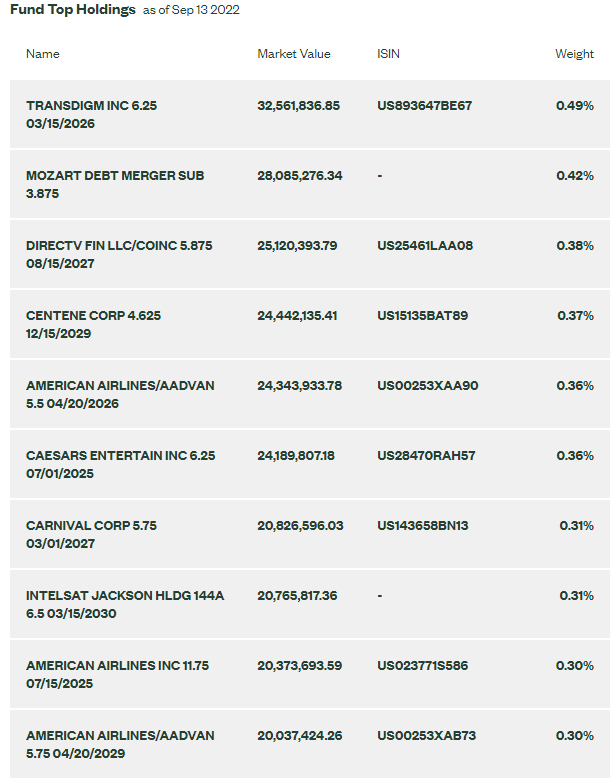

State Street Global Advisors

This is good and helps reduce at least duration risks for investors. Option adjusted duration is even lower at 4.11 years. JNK continues to remain well diversified with 1,261 holdings and the top ten making up just 3.6% of the total.

State Street Global Advisors

The fundamentals we have laid out so far have more or less remained the same with some minor changes noted. JNK’s potential return, on the other hand, has noticed a substantial jump with its average yield to maturity (yield to worst below) coming in at 8.40%.

State Street Global Advisors

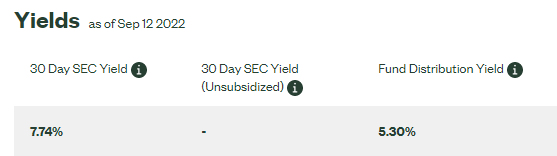

The 30 day SEC yield, which is indicative of the earnings of the fund over the most recent 30-day period also comes in close at 7.74%.

State Street Global Advisors

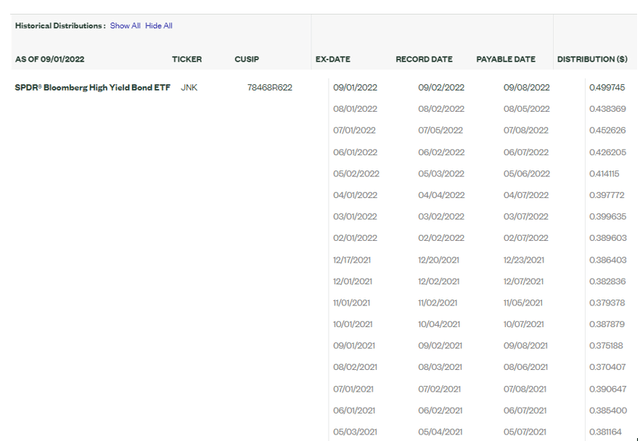

Based on the most recent distribution and price ($0.499746 / $92.18), the ETF provides an annualized yield of 6.5%. The 5.30% reflected in the image above is reflective of the trailing 12-month yield, which takes time to catch up to the recent distribution increases.

State Street Global Advisors

Verdict

Nowadays it is not hard to make 7% using quality preferred shares. We recently identified examples with Enbridge Inc. (ENB) and Pembina Pipeline Corporation (PBA) (see here and here), where you had very little credit risk and minimal duration risk on account of rate resets built into these securities. Those are the ones that we are long for income. JNK is likely to face defaults in the coming 12-24 months and the stated yield to maturity will likely be far lower when we account for that. JNK likely does outperform the CLO funds like Eagle Point Income Company Inc. (EIC), XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) and Eagle Point Credit Company Inc. (ECC) over the next 12-18 months though as the extremely high fee disadvantage for these funds filters through.

That brings us to whether JNK is worth it for non-yield chasing income investors. Investors that are as cognizant of their capital as they are for their yield. Fortunately, we belong to this group and have zero desire to chase bad yields. Yes, the 8.4% yield to maturity is a lot better for buying junk than what we saw a year back when we rated this as a sell. Hence, we are now upgrading this to a Hold/Neutral. But buying a collection of these on the brink of a recession is still not the best bet. We are on the lookout for individual non-investment grade bonds where we feel the yield will compensate us for the risks and plan to release these exclusively to our subscribers.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment