Deagreez

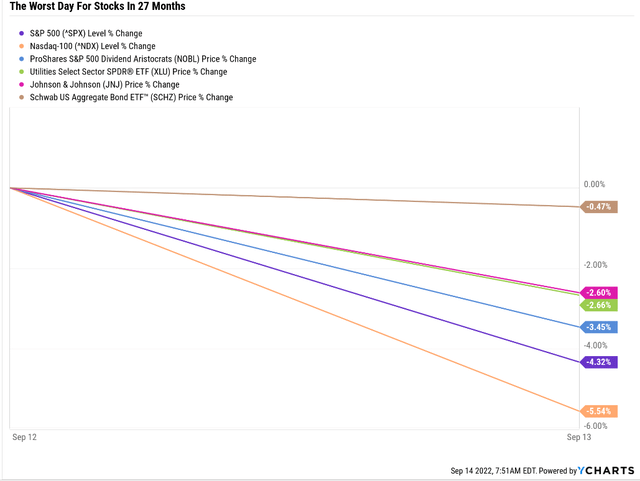

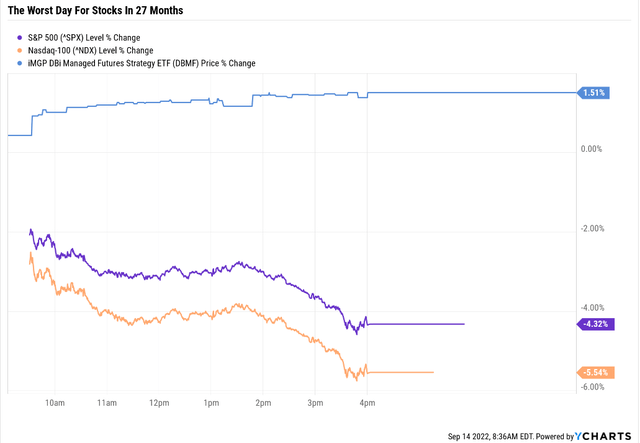

The stock market just suffered its worst year since June… of 2020, with the S&P plunging 4.3% and the Nasdaq a spectacular 5.5%.

Nothing was spared on September 14th, not bonds, stocks, or even low volatility aristocrats or utilities. Even JNJ, one of the lowest volatility blue-chips on earth, fell 2.6%.

- The S&P fell 5% intraday off pre-market highs

- the Nasdaq fell 6.5% intraday off pre-market highs

Why The Market Crashed…

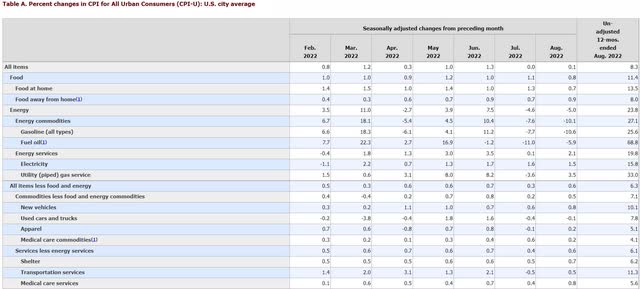

The Consumer Price Index or CPI report measures inflation came in hotter than expected.

- -0.1% Month over Month consensus

- 8.1% YOY consensus

- Core (non-food and fuel) +0.35% expected

- Core 6.1% YOY expected

The actual results were worse than expected across the board.

- Core CPI was up 0.6% MOM and 6.3% YOY

- headline CPI was up 0.1% MOM and 8.3% YOY

But aren’t these pretty close to what was expected? Why on earth would inflation coming in 0.2% higher than expected cause the market to crash 4.3% in a day?

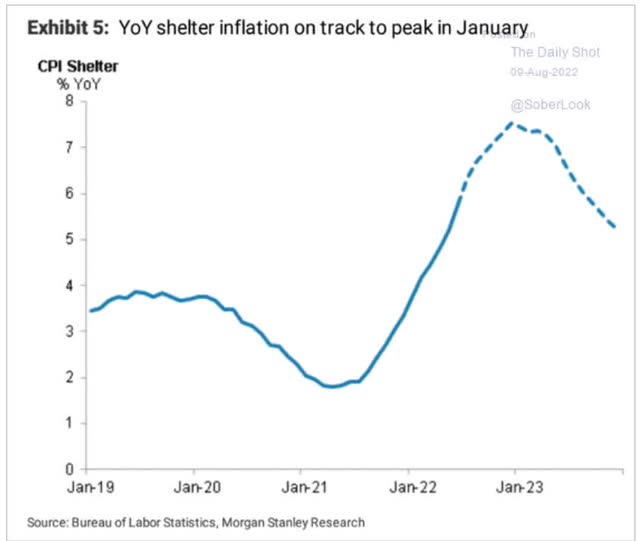

The answer is that core inflation, which is 42% driven by housing costs, is still rising, and helping to make core inflation sticky.

Here’s why that matters to the Fed, investors, and the economy.

…And The Worst Might Still Be Yet To Come

Housing costs aren’t expected to peak until January, at the earliest.

Some economists think housing costs might keep climbing until mid or even late 2023 and peak at closer to 10%.

That means that core inflation from housing alone might be as high as 4.2% well into next year.

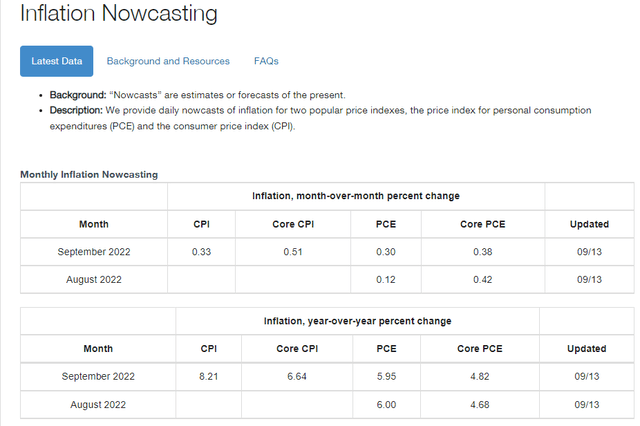

The Cleveland Fed’s inflation model forecasts that core PCE, the Fed’s official inflation metric will rise next month to 4.8%.

Why does this matter? Because since 1954, no Fed hiking cycle has ever ended without the Fed Funds Rate or FFR, going above core PCE.

If core PCE keeps rising, even for a few more months, then the Fed will have to keep hiking much higher than the stock and bond markets had previously expected.

Bond Market Fed Futures

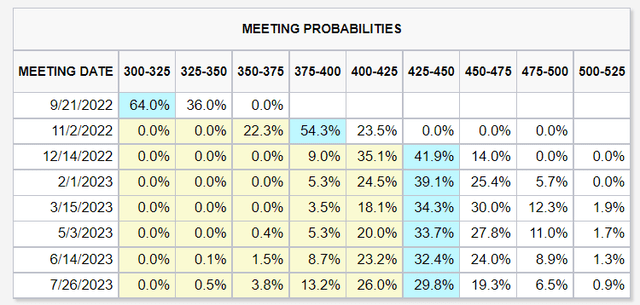

The bond market is now pricing in a 100% chance of the Fed hiking at least 75% on September 21st and a 36% chance of a 1% hike.

In November, the bond market is pricing in a 78% chance of a 75% hike and expects the Fed will pause and hold at 4.5%.

- Minneapolis Fed President Kashkari has been saying he wants to go to 4.5% for months

- he is the formerly most dovish Fed member

But won’t the Fed hiking another 2.25% (double the current rate) cause a recession?

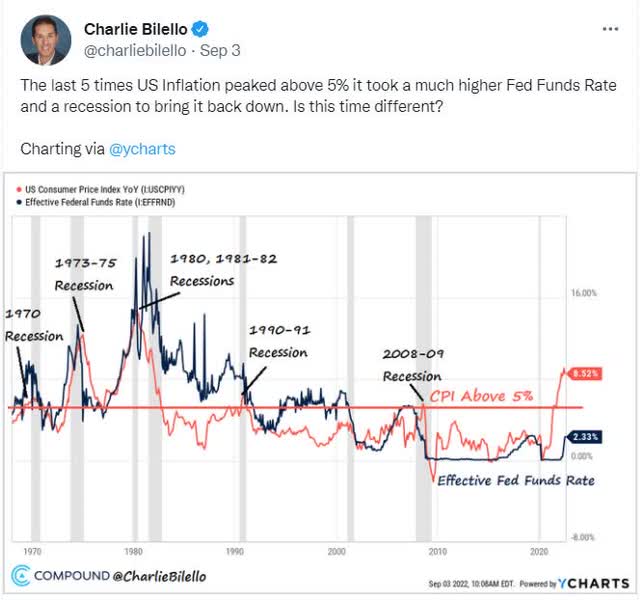

That’s been true historically. We’ve never had 5+% inflation without a recession curing the problem within a year or two.

Bond Market 13-Month Recession Probability

| Date | 3 Month Yield | 10 Year Yield | 3m-10Yr Curve |

13-Month Recession Risk |

| 8/31/22 | 2.957 | 3.133 | 0.176 | 81.57% |

| 9/1/22 | 2.953 | 3.258 | 0.305 | 68.17% |

| 9/2/22 | 2.920 | 3.195 | 0.275 | 71.29% |

| 9/7/22 | 3.037 | 3.267 | 0.230 | 75.96% |

| 9/8/22 | 3.023 | 3.317 | 0.294 | 69.31% |

| 9/9/22 | 3.064 | 3.315 | 0.251 | 73.78% |

| 9/12/22 | 3.191 | 3.35 | 0.159 | 83.34% |

| 9/13/22 | 3.255 | 3.412 | 0.157 | 83.55% |

| 9/14/22 | 3.279 | 3.464 | 0.185 | 80.64% |

(Source: DK S&P 500 Valuation And Total Return Potential Tool, New York Federal Reserve, CNBC)

The bond market is currently pricing in an 81% chance of a recession beginning by October 2023.

But wait a second? If the stock market is crashing because rates are rising, and rates are rising due to inflation, and recessions cure recessions, then isn’t recession a good thing for stocks?

Why Bad News Isn’t Actually Good News For Stocks

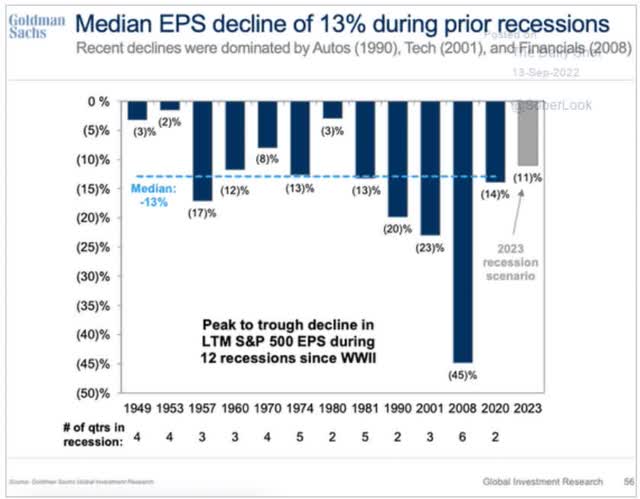

According to Bloomberg, Goldman Sachs, one of the most accurate blue-chip economists in the world, is now forecasting an 11% EPS decline in 2023, should we get a recession next year.

That’s actually mild by historical standards, courtesy to the mild recession that Goldman, Deutsche Bank, and Bank of America all expect (all blue-chip economists).

What does an 11% EPS decline next year mean for stocks? According to Goldman, the S&P 500 will likely bottom at -35% from its record high.

- the historical recessionary bear market bottom

- 21% lower than current levels

- Morgan Stanley thinks stocks bottom at -38% (25% lower than current levels)

OK, so that might be very painful for stocks, BUT if inflation comes down and we get a recession doesn’t that mean that bonds should do well?

- since WWII bond have gone up 92% of the time stocks have fallen

- 8% of the time rising interest rates (inflation shocks) cause both to fall together

The blue-chip economist consensus is that 10-year Treasury yields will peak at 3.5% to 3.6%, not much higher than they are today.

What does the consensus expect if we get a recession?

- 10-year yields to fall to 1% to 2%

- 1.4% to 2.4% lower than they are now

- potentially resulting in long bond ETFs (EDV and ZROZ) rallying 37% to 68% from current levels

OK then, what’s the problem? If you want to hedge against a potential 21% to 25% further market decline, then just some long bond ETFs and ride out the bear market in comfort and style, right?

Except that Pimco, the world’s leading bond manager, thinks that inflation could remain high for the next few years, causing bonds to suffer and not act like hedges at all.

If the world’s best economists and bond experts can’t agree, what’s a prudent investor trying to hedge against stagflation and this bear market to do?

How To Fight Stagflation… And Win

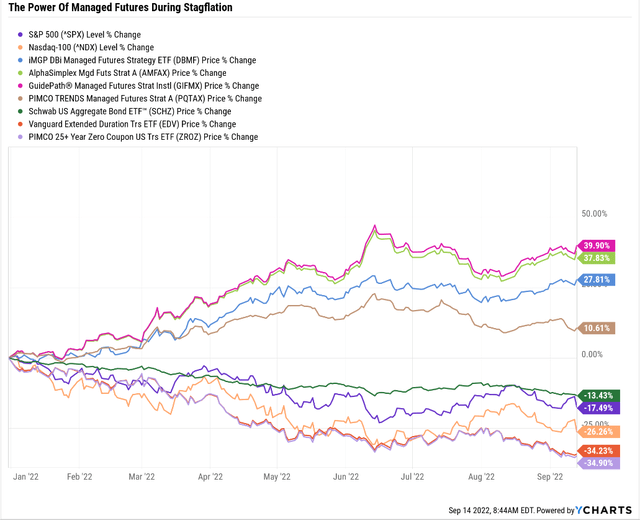

Here is a deep dive intro to the Dynamic Beta Managed Futures (DBMF) ETF, the Vanguard of hedge funds, and my favorite way to beat stagflation and this bear market.

On September 13th, DBMF was up 1.5%, thanks to its potent combination of being long the dollar and short bonds.

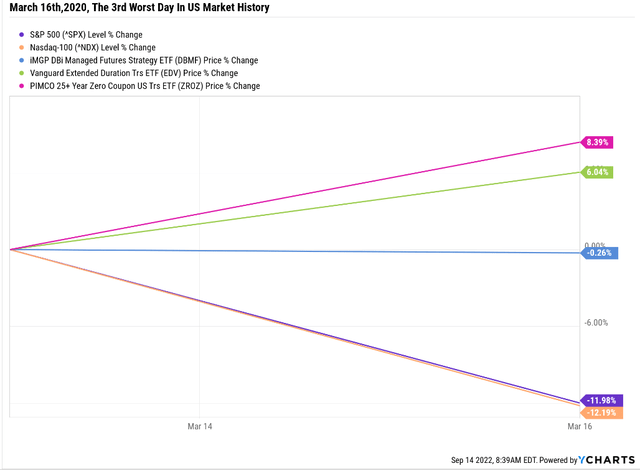

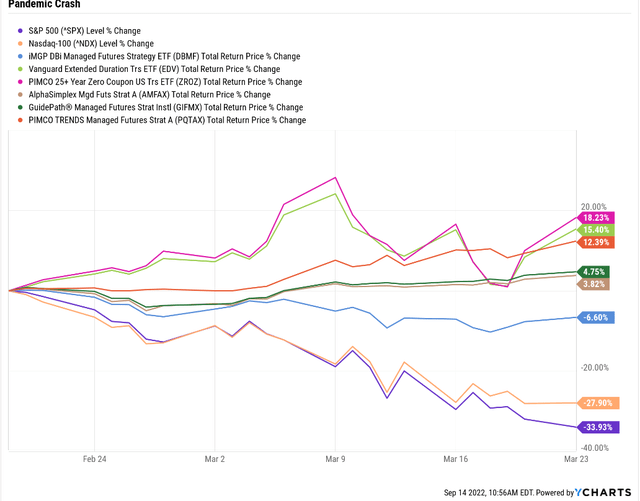

During the 3rd worst day in US market history, when the S&P fell 12% in a single day, bonds soared 6% to 8%, and DBMF was flat.

- in most times of market panic, long bonds are the most powerful hedge

- unless soaring interest rates are what’s causing the market panic in the first place

- in which case managed futures tend to be the best hedges

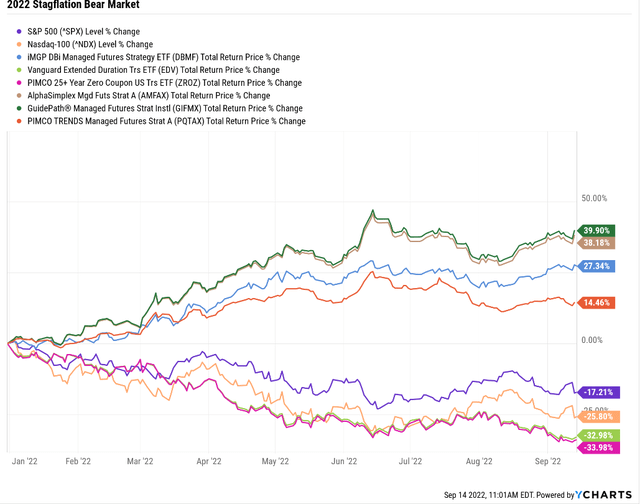

In the 2022 bear market, bonds are being hammered (worst bond bear market in history), and stocks are too.

Managed futures, at least those run by the highest Morningstar-rated firms, are crushing it, up 11% to 40%.

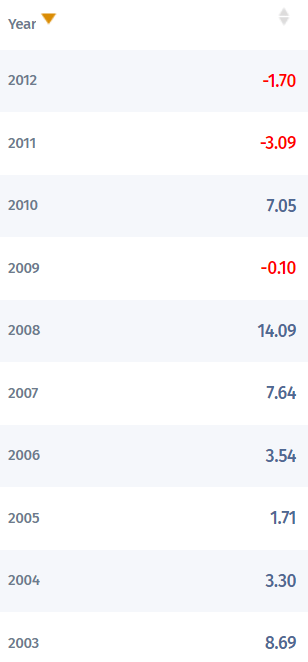

Managed Futures Returns Since 1980

Barclays Barclays Barclays Barclays Barclays

Since 1980 managed futures have acted as a wonderful hedge during both stagflation (the early 80s and 2022) as well as most periods of market turmoil.

- up 57% in 1987 (Black Monday Crash)

- up 21% in the 1990 recessionary bear market

- up 22% during the tech crash (when the S&P was cut in half and the Nasdaq fell 82%)

- up 14% in 2008 (Great Recession, S&P -37%)

- up 20% in 2022

Does that mean that managed futures are perfect? There is no such thing as a perfect asset.

Should this be the only thing you own in a bear market? Heck no!

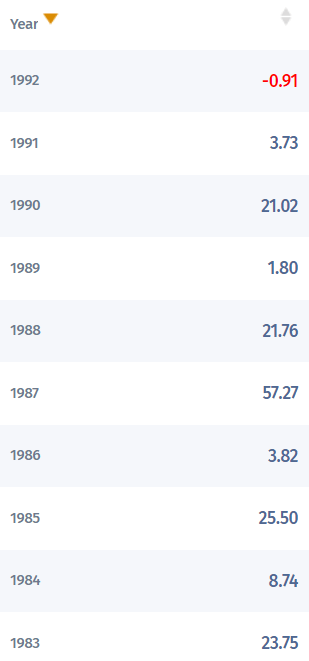

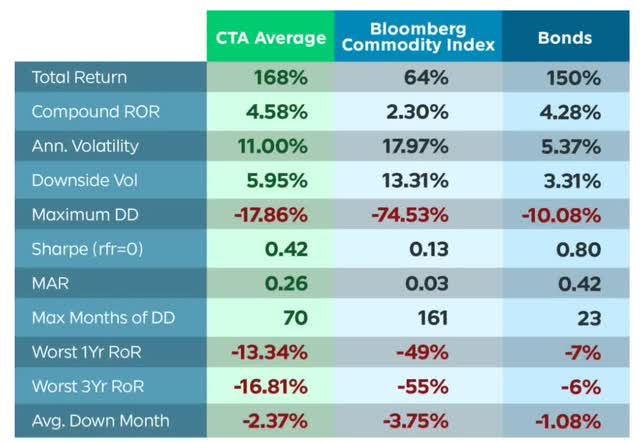

Managed Futures Returns Since 2001

Managed futures usually focus on commodities, currencies, and going long or short the stock market.

Compared to commodities, they are far better performing and less volatile hedges.

Compared to bonds they are more volatile but slightly better performing over time.

- managed futures (aka hedge funds) have zero historical correlation to stocks or bonds

- thus the diversification benefits

- especially during the 8% of times stocks and bonds fall together

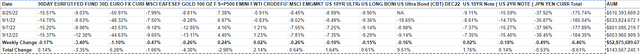

DBMF remains my favorite way to gain exposure to managed futures, and here’s why.

Why DBMF Is Still My Top Recommended Managed Futures (Hedge Fund) ETF

- uses an algorithm to estimate the asset allocations of the top 20 hedge funds

- and then replates their core positions

- it rebalances (changes positions) every Monday

- and its exact portfolio is public for anyone to see

DBMF only uses the most liquid futures on the 10 or so core positions of the 20 hedge fund blue-chip consensus.

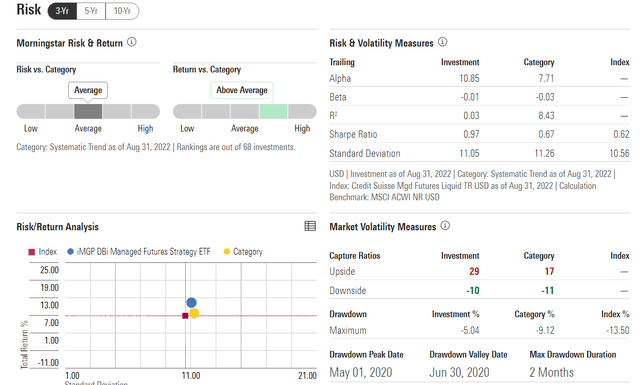

It has the lowest costs (0.95%), and while its 3 years of returns aren’t statistically significant, they are in the 85th percentile of its peers.

Hedge funds average 5% fees over time. Managed futures funds that retail investors can buy, can cost as much as 3.24% per year.

An 0.95% expense ratio, 80% lower than the hedge fund industry, is why DBMF has outperformed 85% of its peers by 5% annually so far.

- 4% lower fees

- and 1% better returns through tracking the 20 hedge fund blue-chip consensus (the top 20 funds are better traders than the rest)

DBMF’s strategy, of basically tracking the blue-chips hedge fund consensus, is the most likely to deliver consistent results over time.

- the top 20 hedge funds have thousands of researchers and dozens of managers

- if one retires DBMF won’t be affected

- all other managed future funds come with greater manager risk

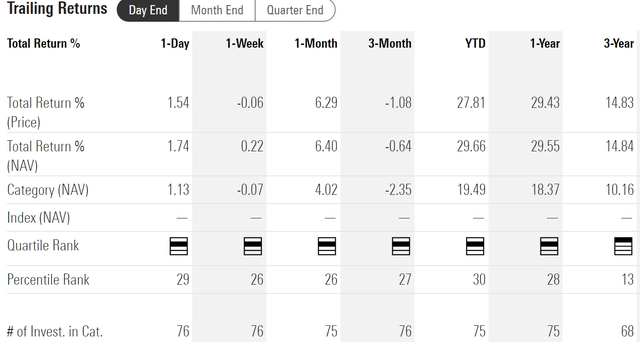

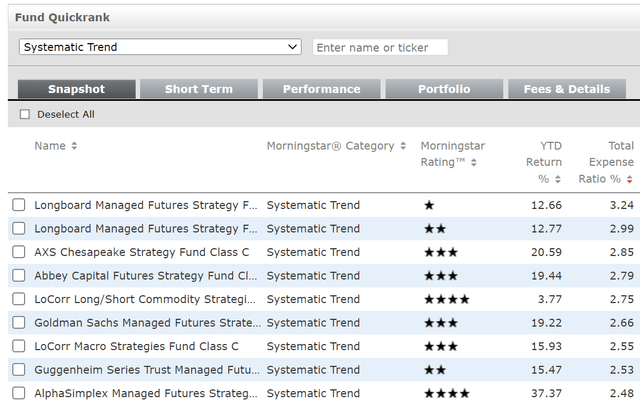

DBMF Returns Vs. Peers

Morningstar (note that Morningstar Percentiles are inverted, 13th = Top 13% of peers)

In contrast, DBMF, which has been around for just over 3 years, has delivered 15% CAGR returns, 50% more than its peers, putting it in the top 13% of hedge funds.

In 2022 its 28% returns put it in the top 25%.

Over the last three years, DBMF’s correlation to the stock market has been -0.01, very bond-like.

Its volatility-adjusted returns (Sharpe ratio) have been 45% better than its peers, thanks to higher returns and slightly lower volatility.

That includes only falling 5% at its peak, half as much as its peers.

But didn’t I promise you 3 amazing ways to beat stagflation? Indeed I did.

3 Amazing 5-Star Rated Funds To Beat Stagflation And This Bear Market

I’ve had several Dividend Kings members ask me something:

I’d like to diversify into managed futures, but I’m nervous that DBMF only has a track record of 3 years….

and is run by just 2 people and an algorithm…

isn’t there a relatively low-cost alternative you can recommend…

One run by a proven team of experts?

This is where I get to work looking at 3 of Morningstar’s top-rated hedge funds (systematic trend following funds).

- AlphaSimplex Managed Futures Strategy A (AMFAX)

- GuidePath® Managed Futures Strategy Institutional (GIFMX)

- PIMCO TRENDS Managed Futures Strategy A (PQTAX)

So let’s take a look at all three and why they are a reasonable alternative to DBMF for anyone wanting to diversify beyond stocks and bonds, including how to use them in your portfolio safely.

AlphaSimplex Managed Futures Strategy A

- 5-star bronze rating from Morningstar

- 1.72% expense ratio

- $2,500 minimum investment

- yield: 4.5% (TTM)

AlphaSimplex uses a team of 44 quant traders to manage its futures portfolio, which includes 80 holdings over time.

- compared to 2 managers at DBMF and 10 core holdings

A skilled and well-organized team of researchers at AlphaSimplex Group manages this strategy. CIO Alex Healy, who has been with ASG since 2007, oversees the research team and leads the implementation of the managed-futures program. The firm’s research scientists report to Kathryn Kaminski, an experienced industry veteran the firm added in 2018. Five portfolio managers work closely with the researchers, and a strong academic culture underpins their work. – Morningstar

The team at AlphaSimplex includes some truly excellent quant managers with long track records of successfully navigating the complex world of commodities, currencies, and going long/short global stocks and bonds. The quant team reports to Kathryn Kaminski, a former MIT researcher specializing in quantitative trend-following trading strategies.

Because of its well-defined research process, this systematic trading strategy, which aims to deliver gains with a low correlation to traditional markets, should be able to stay ahead of many trend-following peers. It buys long futures contracts across roughly 80 markets with prices that are trending positively and shorts assets that are trending negatively. – Morningstar

Like most managed futures funds, it’s a trend-following strategy, so basically, betting that momentum will continue in whatever direction is currently working.

As you’d expect from a $3 billion fund run by a team of 44, it’s a lot more complex than DBMF’s algorithm, which just tracks the blue-chip hedge fund consensus index.

The research process supports the program’s ongoing improvement. The firm’s investment committee meets weekly to assess potential new signals or data sets to add to the trading program. It is an iterative process designed to rigorously test new ideas, including extensive peer review and paper trading before a new signal is added to the live portfolio. – Morningstar

AlphaSimplex is like the TROW Price of hedge funds, a rock-star team of experts who make decisions by committee.

The strategy trades more than 80 futures contracts across equities, fixed income, currencies, and commodities. Position sizing depends on the composite score of the underlying signals. When the three distinctive models agree on an asset’s trend direction, the greater risk is assigned to that asset. For example, if more models agree on a long position in fixed income, that asset class gets a higher weight subject to various risk constraints like maximum trade size and asset-class exposure limits. Single asset-class risk allocation, which can be a significant performance differentiator, can vary from 0 to 50%; that upper limit is on the high side for a typical systematic trend-follower. – Morningstar

It is a very reasonable (and highly effective over time) approach that balances high conviction ideas with prudent risk management.

AlphaSimplex runs a punchy program. Gross notional exposure varies depending on market volatility and correlations, decreasing when markets are more erratic. Gross exposure was 610% as of Sept. 30, 2021, but has ranged from 284% all the way up 1941%. These levels might seem exceptionally high, but much of the notional exposure comes from short-duration fixed-income rates trades, which have limited volatility. It invested 38% of its risk allocation in commodities, 32% in equities, 13% in fixed income, and 18% in currencies. Top long positions were in natural gas, the S&P 500, and copper futures, while top short positions included Japanese yen and silver futures. – Morningstar

AlphaSimplex isn’t afraid to use a lot of leverage with its strategies, with a range of 284% to 1941% gross exposure (most positions cancel out) over the years.

The researchers at AlphaSimplex are about 50% quants and 50% fundamentals-driven experts in economics.

Risks To Be Aware Of

AlphaSimplex has been crushing it in 2022, with an industry-leading 40% gain. That’s courtesy of massive concentrated and levered bets on some of the top trades of this year.

- long the dollar

- especially short the Yen (down 25% this year)

- short US and global bonds

- short stocks

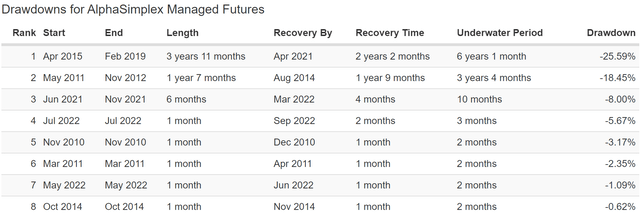

But that doesn’t mean that AlphaSimplex is always a great hedge.

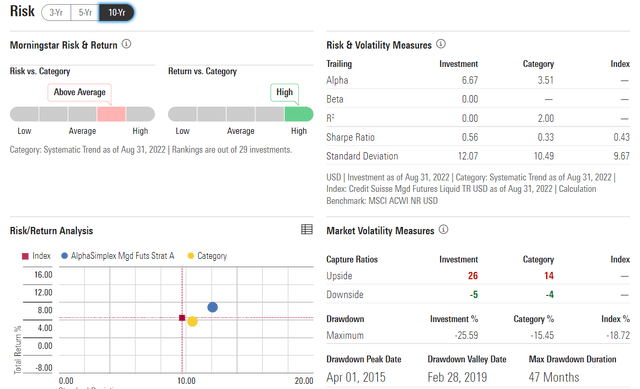

Its peak decline was 25%, and it badly lagged behind its peers from April 2015 to February 2019.

Alpha’s higher tolerance for volatility means that when the market inflects and pivots hard, it can be caught offside (often the case with trend-following strategies).

But over time, especially since July 2010 (one of the oldest managed futures funds), it’s performed very well.

- 4.5% CAGR Vs. 0.9% CAGR ahead of its peers

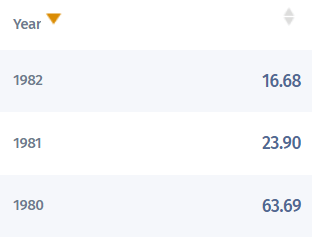

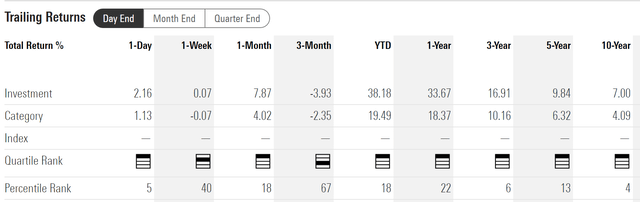

AlphaSimplex Returns Vs. Peers

Morningstar (note that Morningstar Percentiles are inverted, 4th = Top 4% of peers)

Over the last decade, AlphaSimplex delivered 10% CAGR total returns, 75% more than hedge funds, putting it in the top 4% of its peers.

Over the last five years, it delivered 9.8% returns, 50% more than its peers, putting it in the top 13%.

Over the last three years, returns of 16.9% CAGR were 70% better than its peers, putting it in the top 6% of all hedge funds.

Over the last decade, AMFAX has been more volatile than other hedge funds but delivered 67% higher volatility-adjusted returns.

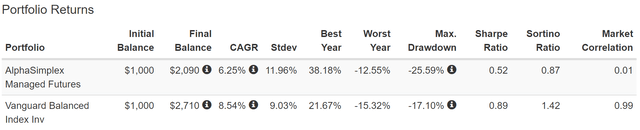

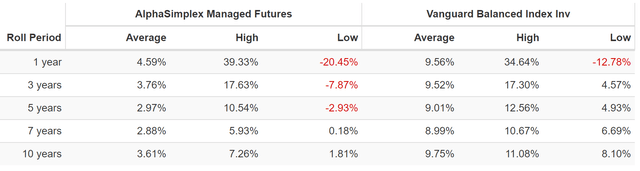

Historical Returns Since August 2010 (90% Statistically Significant)

The future doesn’t repeat, but it often rhymes. – Mark Twain

Past performance is no guarantee of future results. However, over sufficiently long periods of time, this is the best method we have of estimating the skill of a fund manager or a given investment strategy.

AlphaSimplex is one of the oldest managed futures funds, launched 13 years ago.

- thus we can say with 90% statistical confidence that its past performance is a reasonable approximation of its management skill and investment strategy

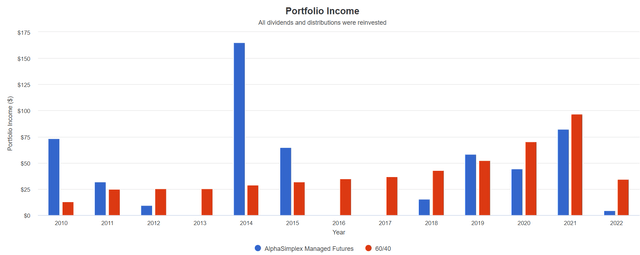

(Source: Portfolio Visualizer Premium)

AlphaSimplex actually outperformed its peers by a very healthy margin.

- managed futures historically deliver 4.5% CAGR returns with 11% annual volatility

- a Sharpe ratio (returns/volatility) of 0.41

- AMFAX beat its pears by 27% on a volatility-adjusted basis

The 60/40 is the simplest and lowest cost hedge fund ever devised, and historically has delivered 6.7% returns, exactly what analysts expect from it over the long-term.

- Other than DBMF, I don’t expect any managed futures fund to beat a 60/40

- that’s not its role in your portfolio

- low correlation to stocks is the goal

- AMFAX delivered a 0.01 correction to the S&P 500 over the last 13 years

(Source: Portfolio Visualizer Premium)

Managed futures are NEVER MEANT to rebalance a 60/40 portfolio but to be an alternative diversifying bucket.

- individual stock bucket

- bond bucket

- cash bucket

- ETF bucket

- alternative bucket (such as managed futures or commodities)

(Source: Portfolio Visualizer Premium)

AMFAX’s big leveraged bets can sometimes result in LONG bear markets when its positions prove incorrect.

(Source: Portfolio Visualizer Premium)

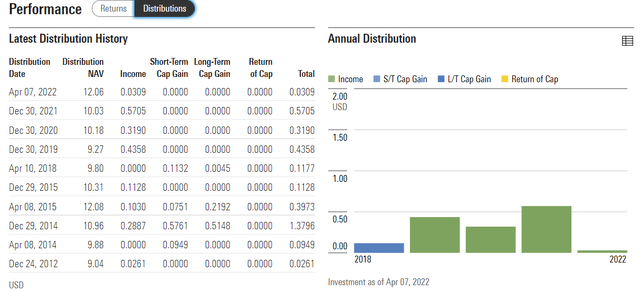

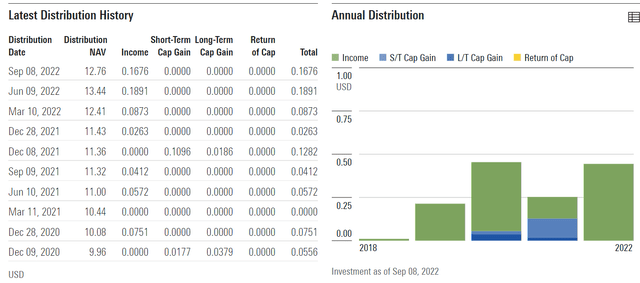

The income AMFAX pays out is highly variable and doesn’t necessarily grow over time, like a 60/40’s.

The income is a mix of futures contract income and short and long-term capital gains; just like DBMF, AMFAX tends to make one or two distributions per year.

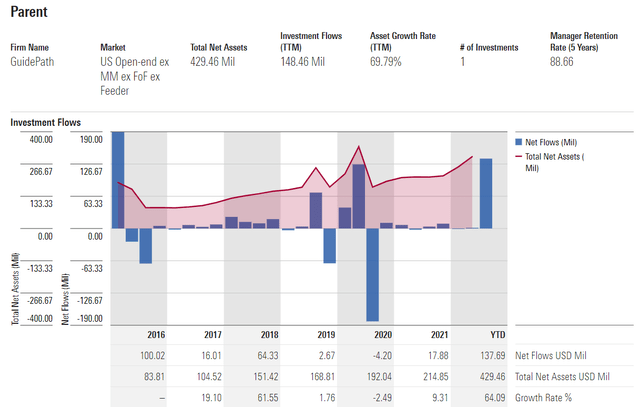

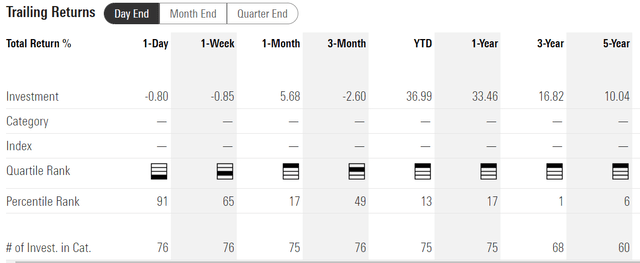

GuidePath Managed Futures Strategy Institutional

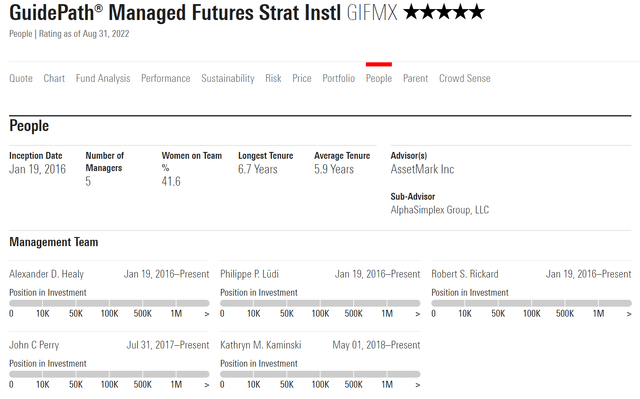

- 5-star rating from Morningstar

- 1.19% expense ratio

- $0 minimum investment

- yield: 2.12%

GIFMX is one of the lowest-cost managed futures funds on Wall Street.

- Though still more expensive than DBMF’s 0.95%

- DBMF strives to be the Vanguard of hedge funds

There is no qualitative information available on GuidePath, not even a website. Thus I have to do a purely quantitative analysis.

Guess who manages GIFMX? AlphaSimplex, including the same rockstar team running AMFAX.

GFIMX has been growing pretty steadily (for a hedge fund in a raging bull market).

That’s not surprising given the management team has replicated its 5-star returns, but at a fraction of the cost.

Just like AMFAX, GIFMX is in the top 6% of hedge funds, potentially because it’s using an almost identical strategy.

- Run by the same managers that would seem logical

- almost identical returns in 2022

- most likely, it has very similar positions

Over the last 3 years, it was in the top 1% of hedge funds with 17% annual returns.

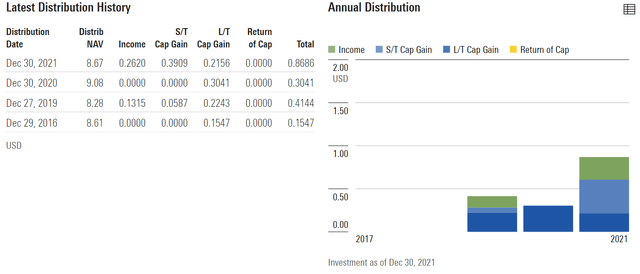

And just like AMFAX and DBMF, variable payouts, once per year in this case.

- a very fat distribution likely coming this December

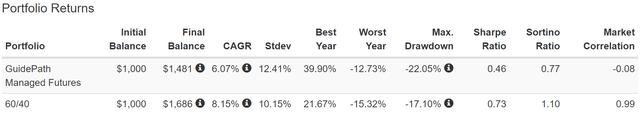

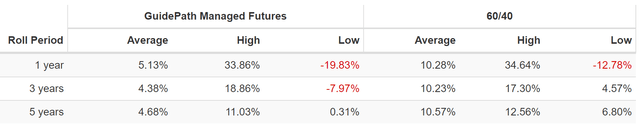

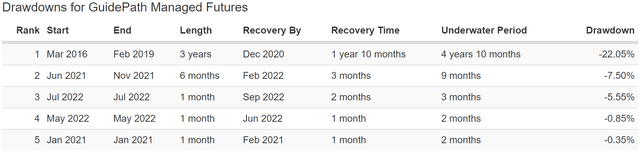

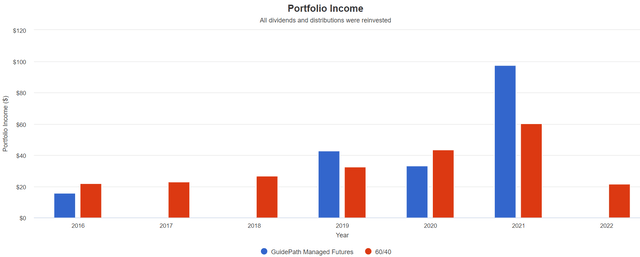

Historical Returns Since February 2016 (90% Statistically Significant)

(Source: Portfolio Visualizer Premium)

GIFMX is an industry-leading hedge fund run by some of the smartest managers in the industry. But it’s not designed to replace or keep up with a 60/40 portfolio.

- its goal is to be negatively correlated to stocks

- while providing positive returns over time

- -0.08 correlation to the stock market shows it’s doing its job

(Source: Portfolio Visualizer Premium)

GIFMX has delivered very consistent returns on par with the long-term returns of the hedge fund industry (since 2001).

But it does so at about 80% lower cost.

(Source: Portfolio Visualizer Premium)

Other than the major bear market created by AlphaSimplex’s concentrated positions going wrong from 2015 to 2019, GIFMX tends to experience very small declines.

- note that these are not occurring at the same time as the stock market’s corrections

- the entire point of owning hedge funds

- they zig when the market zags

(Source: Portfolio Visualizer Premium)

Remember that managed futures funds tend to pay out all of their gains as distributions once or twice per year.

- thus the likely long-term yield is 4.5% CAGR

- except for DBMF, which could deliver 9% to 10% returns and 9% to 10% long-term yield

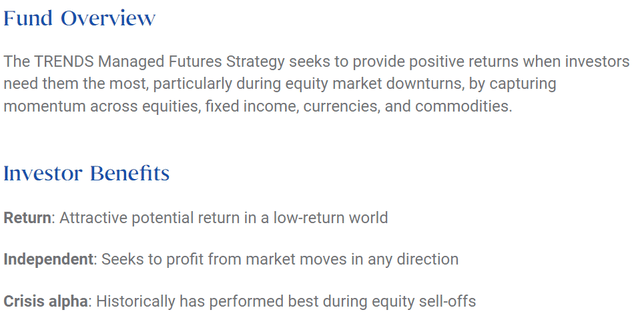

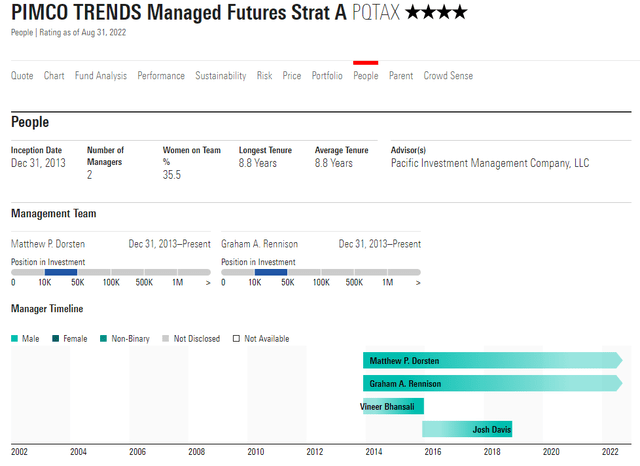

PIMCO TRENDS Managed Futures Strat A

- 4-star rating from Morningstar (Institutional version is 5-star rated)

- 1.81% expense ratio

- $1,000 minimum investment

- yield: 2.65%

Like most managed futures hedge funds, PQTAX goes long or short stocks, bonds, currencies, and commodities, depending on the latest trends.

Pimco is the BlackRock of bond managers, and they bring a team of skilled risk managers and quants to PQTAX.

Who are the managers running this? There are two.

- Matt Dorsten, Portfolio Manager, Quantitative Strategy

- Graham A. Rennison, Quantitative Portfolio Manager

Prior to joining PIMCO in 2006, he received his Ph.D. in theoretical particle physics from the California Institute of Technology, where he was a National Science Foundation Graduate Research Fellow. He has 16 years of investment experience and holds undergraduate degrees in mathematics and physics from Ohio State University. – Pimco

A theoretical physicist from CalTech with 16 years of experience in advanced quantitative trading handles the quant trades.

Prior to joining PIMCO in 2011, Mr. Rennison was a director and head of systematic strategies research at Barclays Capital in New York and also spent five years at Lehman Brothers. He has 20 years of investment experience and holds master’s and undergraduate degrees in mathematics from Cambridge University, England. – Pimco

The other manager holds a masters in mathematics from Cambridge and has over 20 years of experience with quantitative trading.

Both of the current managers have been there since the start of the fund, with nine years of experience with PQTAX specifically.

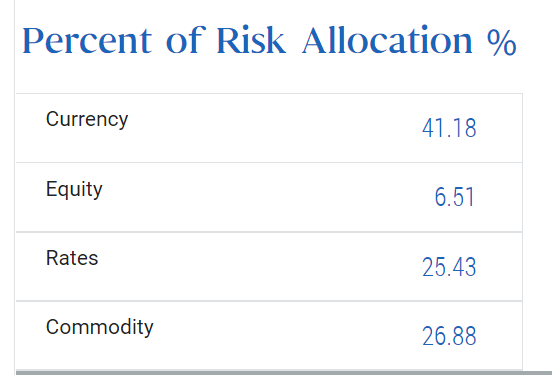

Pimco

PQTAX is mostly focused on currencies, commodities, and betting on interest rates.

- they have a total of 938 positions totaling almost $4 billion in exposure

Pimco’s hedge fund is the most diversified by far, and that means lower returns in a year when concentrated bets are paying off.

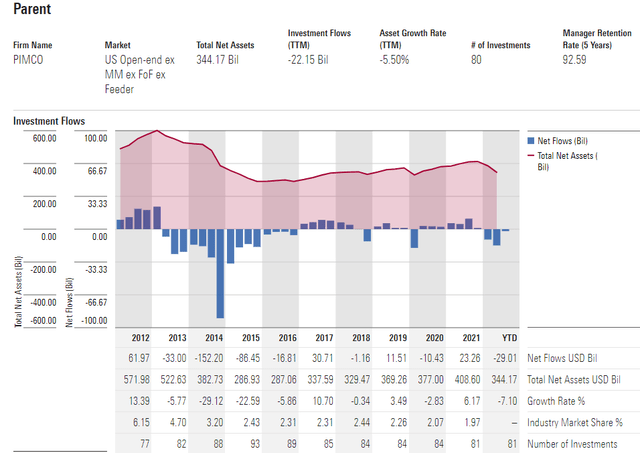

Pimco has struggled in recent years, especially with the exit of Bill Gross (arguably the best bond trader in history).

But it still has $344 billion in assets, and you don’t have to worry about this being run by a fly-by-night operation no one has heard of.

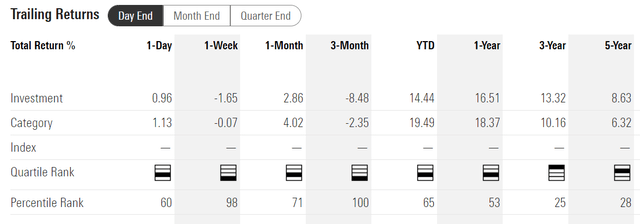

In 2022 PQTAX is in the bottom 35% of hedge funds, but it’s highly diversified approach has put it in the top 28% of powers over the last five years.

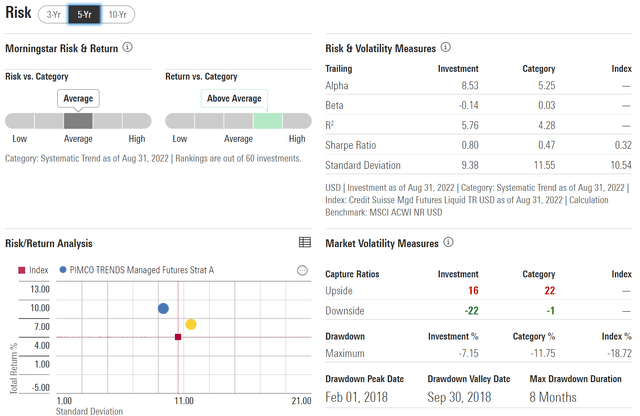

PQTAX has very small declines due to owning almost 1,000 futures contracts.

It’s correlation to the stock market (beta) has been -0.14 over the last five years.

- Almost identical to the beta of long-duration bonds (-0.16)

PQTAX has beaten its peers by 3.25% annually and with a 2% lower annual volatility.

- 70% higher volatility-adjusted returns

The nice thing about PQTAX is that the distributions are quarterly. They are also 100% income which isn’t that great from a tax perspective.

- option income is taxed as normal income

- your top marginal tax rate

- as high as 54% in NYC

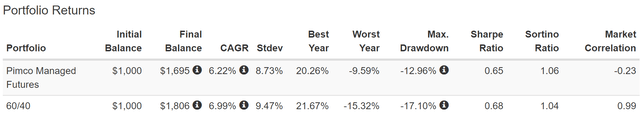

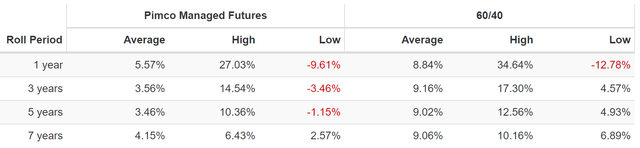

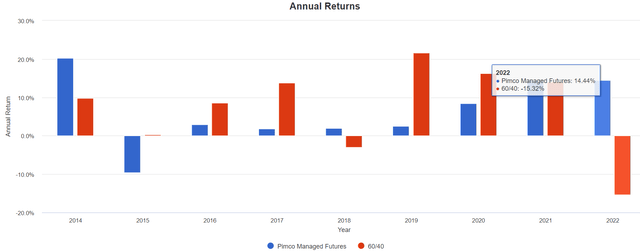

Historical Returns Since January 2014

(Source: Portfolio Visualizer Premium)

PQTAX has done a fantastic job of nearly matching a 60/40 over the last eight years, and with lower volatility (thanks to PIMCO’s risk-management prowess and a super diversified portfolio).

Its volatility-adjusted returns are nearly identical to the 60/40’s but with a -0.23 correlation to the stock market.

- better negative correlation to long bonds

- or almost any other asset class

(Source: Portfolio Visualizer Premium)

Notice how PQTAX’s average returns are lower than its historical return, though very consistent.

Why is that? Because like most hedge funds it shines brightest when the market is freaking out.

(Source: Portfolio Visualizer Premium)

PQTAX doesn’t always keep up with a 60/40, but it’s had just one down year in its first eight.

(Source: Portfolio Visualizer Premium)

Remember how managed futures really struggled through the 2015 to 2019 industry bear market? The 6-year bear market for AMFAX?

Well, Pimco’s bear market lasted 2.5 years and it only fell 13% at its peak during that.

Outside of that, extreme bear market declines are very mild, including a 2022 peak decline that’s just 4.5%, 1/4th as much as a 60/40’s.

- Note that the 60/40 bottomed in June, just when PQTAX’s current pullback began

- hedge funds aren’t supposed to go up all the time

- they are meant to zig when the market zags

How To Safely Incorporate These Funds Into Your Retirement Portfolio

I can’t stress this enough; HEDGE FUNDS ARE NEVER THE ONLY THING YOU SHOULD OWN.

- they are insurance for your portfolio

- but insurance that pays you over time instead of the other way around

- just like bonds

- and unlike shorting the market on your own through options

For most investors, a 5-15% allocation to managed futures may offer a good balance of diversification and volatility. Over the long term, the volatility of most managed futures strategies will be closer to that of equities than that of core bonds, and this size of allocation generally may be enough to “move the needle” positively in most portfolio allocations. – Pimco (emphasis added)

Andrew Beers, cofounder, and co-manager of DBMF, recommends a 5% to 20% allocation to managed futures for most blue-chip portfolios.

- These hedge funds are meant to replace a portion of the bonds you own

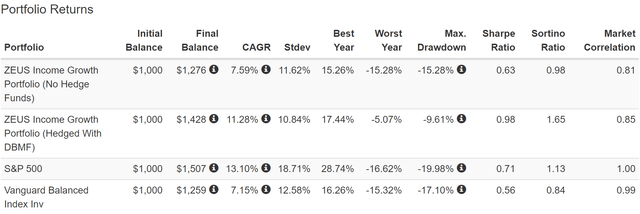

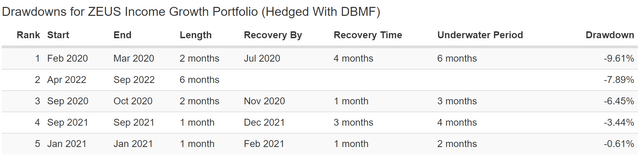

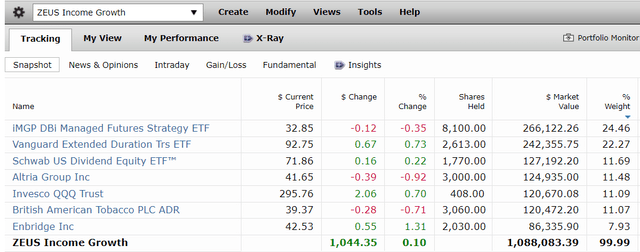

Let me show you a concrete example of how managed futures can benefit you by using my Uncle’s $1 million ZEUS Income Growth Portfolio.

When I helped my uncle rescue his life savings after losing $1 million in the great 2022 crypto crash, I wasn’t aware of DBMF or the diversification benefits of managed futures hedge fund ETFs.

When helping Rose (a family friend) build her $3 million ZEUS High-Yield Ultra-Low-Volatility portfolio, we incorporated DBMF as part of her 33% hedging bucket.

My uncle recently put the rest of his cash to work and hedged aggressively against the likely 2023 bear market (80% probability, according to the bond market).

Most people wouldn’t be comfortable with a 25% allocation to hedge funds, but my Uncle is.

- He’s a quant at heart and really loves DBMF’s strategy and transparency of its holdings

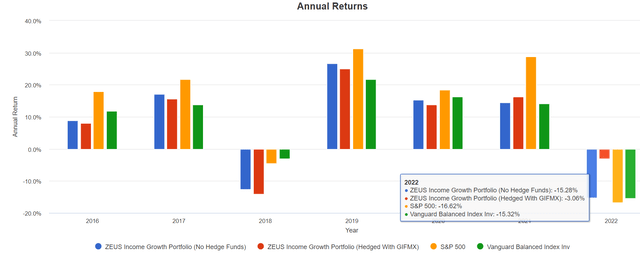

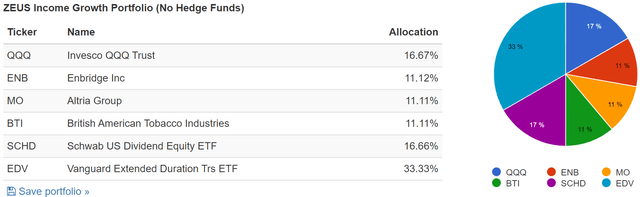

But let me show you what his ZEUS portfolio looks like with and without managed futures funds.

This was the original asset allocation of my uncle’s ZIG portfolio.

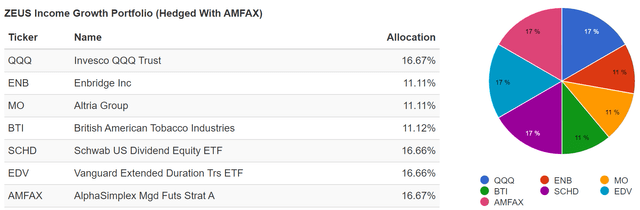

Now let’s see what it looks like with half the bonds replaced with AMFAX.

This is a more diversified portfolio with more negatively correlated assets. That means we should expect similar total returns to the non-hedged version.

- Because hedge funds historically deliver 0.5% better annual returns than bonds

And due to more negatively correlation, we should get lower volatility in the stagflation crash.

- overall volatility should be roughly similar or slightly less

- because AMFAX is a relatively volatile hedge fund

So that’s what the theory says; now let’s look at the results.

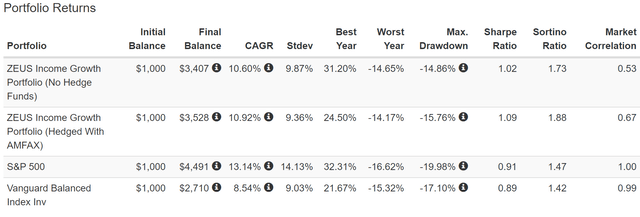

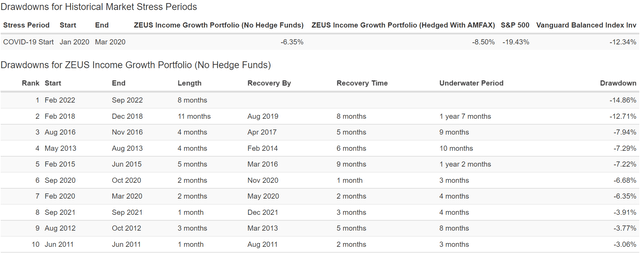

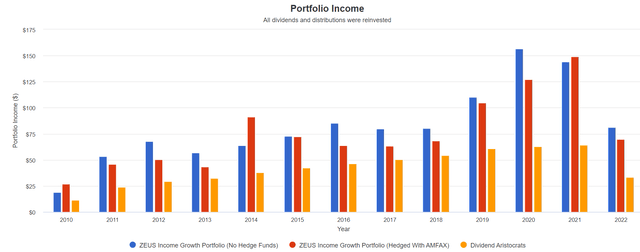

Historical Returns Since August 2010 (Annual Rebalancing)

(Source: Portfolio Visualizer Premium)

My Uncle’s goals with ZIG include:

- high safe yield (4.5% or 3X that of a 60/40 and S&P 500)

- better returns than a 60/40 over time

- and minimal volatility

- especially in bear markets

- in other words, maximizing negative-volatility adjusted total returns (Sortino ratio)

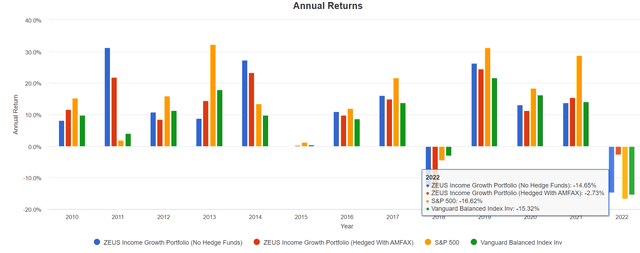

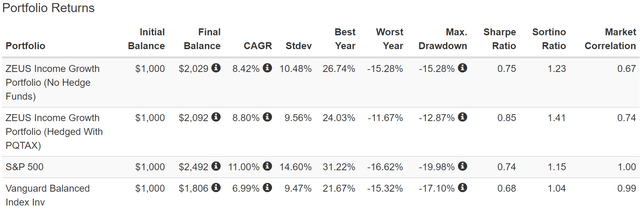

ZIG without hedge funds (just bonds) delivered solid 10.6% CAGR returns over the last 12 years.

ZIG, with AMFAX hedging, delivered 10.9% CAGR returns, slightly better.

- 28% better annual returns than a 60/40

- annual volatility almost matching a 60/40

- But a smaller decline in bear markets

- and thus a Sortino ratio that’s 32% better than a 60/40

- and 8% better than his original portfolio

(Source: Portfolio Visualizer Premium)

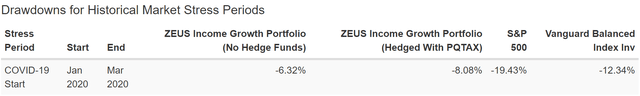

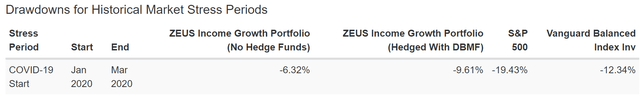

In 2022’s bear market, 50% of the unhedged portfolio fell off a cliff.

- Yet its peak decline was less than 15% Vs. 17% for a 60/40 and 20% for the S&P (monthly closing prices)

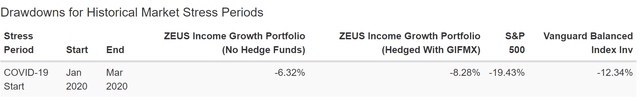

In the Pandemic crash, it fell 6%, half that of a 60/40.

Now here’s ZIG with AMFAX as a hedge.

(Source: Portfolio Visualizer Premium)

A peak decline in 2022’s bear market of 7%.

- 60/40 -17%

- S&P -20%

- Nasdaq -30%

So far, the largest decline was a 16% decline in the 2018 bear market versus a 20% decline in the S&P 500.

- AMFAX was in its worst-ever bear market at the time

- and yet the portfolio still did its job by being less volatile

- the power of diversification and prudent asset allocation

(Source: Portfolio Visualizer Premium)

33% of this portfolio has variable-paying bonds and hedge funds. And yet the annual income is relatively stable.

- And grew to 14.5% yield on cost by 2021

- 12.5% CAGR income growth for 10 years

This portfolio today also yields 4.5% (as it did in 2011), and analysts expect it to keep delivering similar 10% to 11% long-term returns just as it has historically.

- With similar 12.5% CAGR income growth as well

3X the yield of a 60/40? Far better long-term returns (3% more per year)? And with lower volatility and smaller declines in bear markets?

(Source: Portfolio Visualizer Premium)

In 2022’s stagflation bear market, the hedged version of ZIG is doing great:

- -3%:

- 60/40: -15% (5X as much)

- S&P 500 -17% (6X as much)

Zig with hedges has beaten a 60/40 in 8 of the last 13 years.

So AMFAX works well with this portfolio, but what about the others?

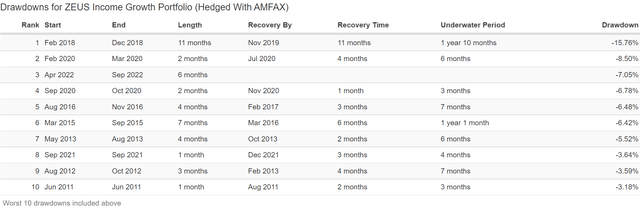

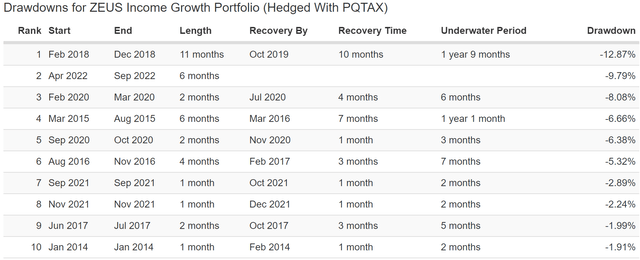

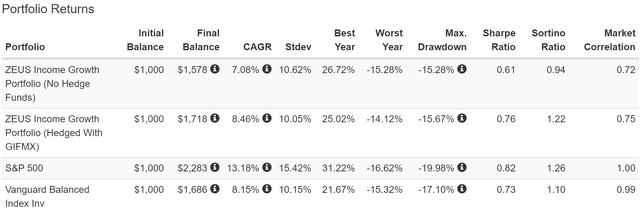

Hedging With PQTAX Total Returns Since January 2014

(Source: Portfolio Visualizer Premium)

Better returns than a 60/40 in both versions of ZIG? Check.

Better returns with Pimco’s hedge fund than without? Check.

Lower volatility with Pimco’s hedge fund? Check.

Higher negative-volatility-adjusted total returns (Sortino)? Check

- 36% better Sortino than a 60/40

- 23% better Sortino than S&P 500 (whose 30-year Sortino is 0.8)

- 15% better Sortino than the unhedged version of ZIG

Smaller peak declines with Pimco’s hedge fund? Just 13% over the past eight years.

(Source: Portfolio Visualizer Premium) (Source: Portfolio Visualizer Premium)

During the 2018 bear market, the market fell 20%. Pimco hedged ZIG fell just 13%.

During the Pandemic, it fell 8%, 4% less than a 60/40, and 12% less than the S&P 500.

And its largest decline so far in this bear market is a 10% decline, half that of the S&P 500 and 7% less than a 60/40.

(Source: Portfolio Visualizer Premium)

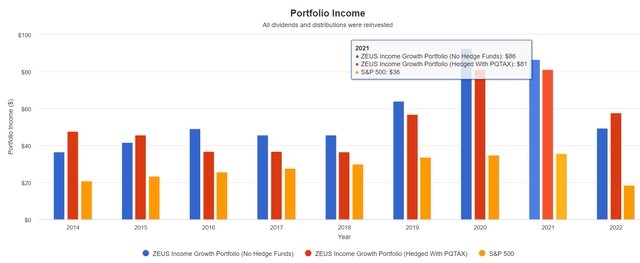

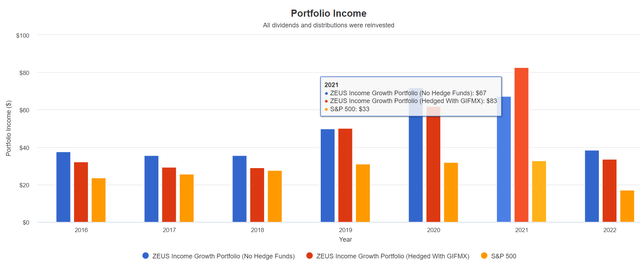

Now let’s look at the income over time.

- 4.8% yield in 2011 (Vs. 3.7% without hedging)

- 8.1% yield on cost in 2021 (8.6% without hedging)

- 7.8% CAGR annual income growth

Hedging With GIFMX Total Returns Since February 2016

(Source: Portfolio Visualizer Premium)

33% of this portfolio was in a historically terrible bear market (BTI, ENB, and MO) by 2016.

And yet even the unhedged version of ZIG delivered solid 7% returns and lower peak declines than a 60/40.

But look at what happens when we put the master hedge fund managers at AlphaSimplex (who run GIFMX) to work for us.

- 1.4% better annual returns

- and negative-volatility-adjusted returns that are 30% better than the unhedged portfolio

(Source: Portfolio Visualizer Premium) (Source: Portfolio Visualizer Premium)

Down 10% less than a 60/40 in 2022’s bear market and 13% less than the S&P 500.

(Source: Portfolio Visualizer Premium)

Down just 3% in 2022, 5X less than a 60/40 and almost 6X less than the market.

(Source: Portfolio Visualizer Premium)

What about annual income growth?

- 2016 yield: 3.2% hedged, 3.8% unhedged

- 2021 yield on cost: 6.7% unhedged, 8.3% hedged

- hedged ZIG delivered 21% CAGR income growth over the last five years

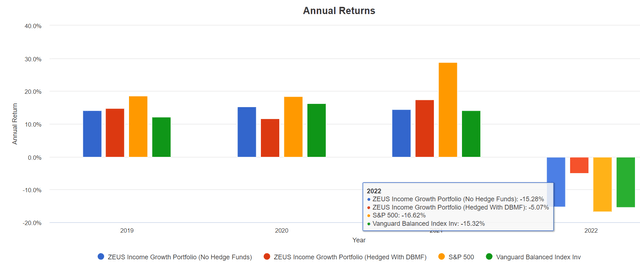

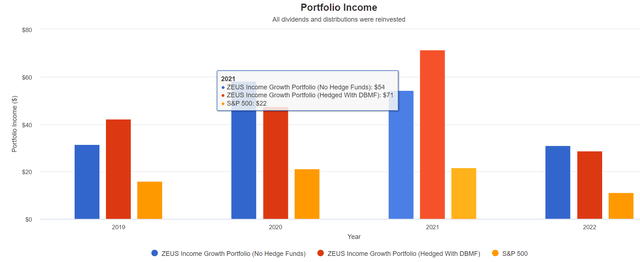

Hedging With DBMF Total Returns Since June 2019

(Source: Portfolio Visualizer Premium)

Even without hedging and with 33% of the portfolio in a terrible bear market (ENB, BTI, and MO), ZIG beat a 60/40 in absolute and negative-volatility-adjusted terms.

But with DBMF (my favorite hedge fund) it saw explosive growth in returns that ran circles around a 60/40.

- and with far lower volatility and a smaller peak decline

- a Sortino 2X that of a 60/40

- and 68% better than the unhedged portfolio

- and 46% better than the S&P 500

(Source: Portfolio Visualizer Premium) (Source: Portfolio Visualizer Premium)

Half the market declines in the Pandemic, and 2% less than a 60/40.

An 8% peak decline in 2022, 12% better than the S&P, and 9% better than a 60/40.

(Source: Portfolio Visualizer Premium)

Look at how smooth those returns are! Even during the hedge fund bear market, ZIG with DBMF hedging delivered exceptional returns.

| Year | ZIG (No Hedge Funds) | ZIG (DBMF Hedging) | 60/40 |

| 2019 | 14.1% | 14.8% | 12.1% |

| 2020 | 15.3% | 11.6% | 16.3% |

| 2021 | 14.5% | 17.4% | 14.1% |

| 2022 | -15.3% | -5.1% | -15.3% |

| Average | 7.2% | 9.7% | 6.8% |

| Median | 14.3% | 13.2% | 13.1% |

(Source: Portfolio Visualizer Premium)

If you can’t stick with a portfolio strategy over time, it’s useless to you, no matter how great it might be on paper.

- your retirement portfolio needs to help you sleep well at night in the bad times

- but not go crazy with jealousy during the good times

That’s exactly why my uncle added DBMF to his portfolio because, long-term, the Vanguard of hedge funds makes ZEUS Income Growth better in all market conditions.

(Source: Portfolio Visualizer Premium)

Finally, let’s consider the annual income.

- 2019 yield: 3.1% unhedged, 4.2% hedged (today 5.1% hedged)

- 2021 yield on cost: 5.4% unhedged, 7.1% hedged

- 32% CAGR income growth unhedged, 30% CAGR hedged

This is the power of a diversified blue-chip portfolio that includes one of the top 15% hedge funds in the world.

Bottom Line: For Those Looking To Hedge Stagflation, These World-Beater Hedge Funds Are Reasonable Alternatives To DBMF

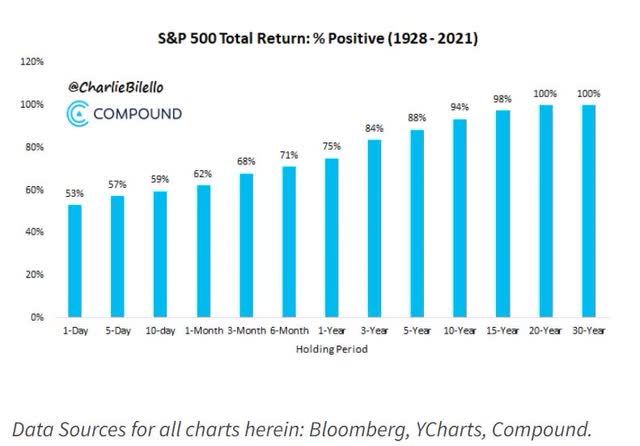

On paper, as long as you have a 20+ year time horizon, you don’t need to hedge your portfolio at all. Why?

Because blue-chip portfolio will go up over time and without hedges, you can, theoretically, maximize both income and total returns.

But are you a robot? Can you personally stomach 30%, 40%, or even 50% bear markets? Can you ignore the crashing market and not look at your portfolio until it’s time for annual rebalancing? That’s also the optimal strategy, and most people can’t.

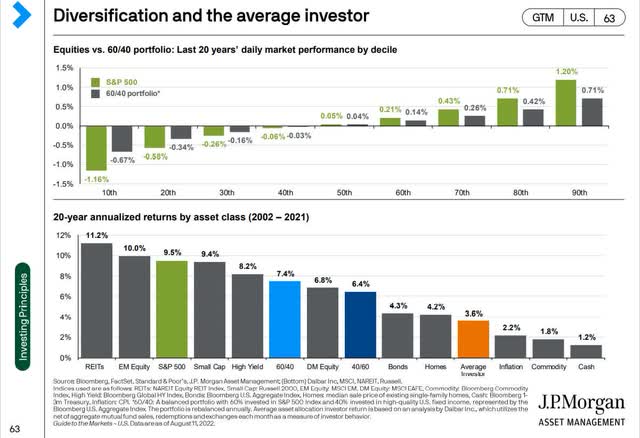

This is what real people do during bear markets. They try to time the market. They succumb to FOMO (fear of missing out) in the good times, and panic sell in corrections.

And that’s why the average retail investor underperformed even a 60/40 by 4% per year…for the last two decades.

- beating just inflation, commodities, cash, and the world’s worst hedge fund managers (like John Hussman)

The point is that the perfect strategy isn’t what you need, but the perfect strategy you can live with for decades. Not just in good times, but bad times as well.

You need an all-weather bunker portfolio to help you ride over the market’s potholes with Rolls Royce levels of comfort and zen-like calm.

And that’s where hedging assets like cash, bonds, and hedge funds can help.

I remain convinced that DBMF is the best hedge fund the average investor can buy, thanks to its focus on:

- low costs

- a consistent long-term strategy (copying the 20 biggest hedge fund blue-chip consensus)

But is there potential value in actively managed hedge funds? You bet.

During the Pandemic, here were how these assets performed:

- S&P -34%

- Nasdaq: -28%

- DBMF: -7%

- AlphaSimplex: +4%

- GuidePath: +5%

- Pimco Managed Futures: +12%

- EDV: +15%

- ZROZ: +18%

When interest rates are not soaring (92% of recessions), long-duration bonds are the most powerful hedge you can own.

- hedge funds own a diversified portfolio of assets

- thus diluting their hedging power relative to pure assets like long bonds

But when inflation is high and rates are rising, bonds stop working and managed futures hedge funds shine.

So if you’re interested in adding a 5% to 20% allocation of hedge funds to your portfolio, DBMF, AMFAX, GIFMX, and PQTAX are four of the best options I’ve found.

- DBMF is the best low-cost option and is likely to generate the highest income over time (9% to 10% long-term annual dividends and total returns)

- PQTAX is best for conservative investors who want the most diversified portfolio (almost 1000 futures contracts), and the risk management expertise of Pimco

- AMFAX is best for those seeking maximum hedging power from AlphaSimplex’s rock-start team of 44 quants and researchers

- GIFMX is best for those who want to replicate AlphaSimplex’s aggressive hedging style but with a far lower cost

You don’t need to hedge your portfolio; you don’t need to use hedge funds to do it. But if you want to beat stagflation in 2022 and possibly 2023 and own something that goes up when stocks and bonds don’t, these are the best world-beater blue-chip options I can recommend.

Be the first to comment