Iurii Garmash

Investment Thesis

Cheniere Energy (NYSE:LNG) seems like a very obvious investment. At least that’s what I’ve been telling myself for months now.

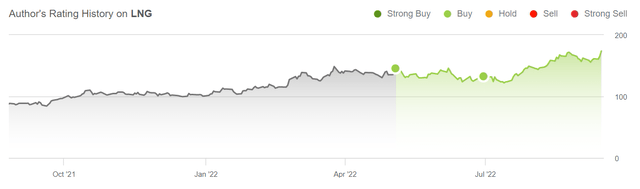

But as you can see above, despite the bull case seeming obvious, the stock is only up 20% since I first highlighted it. That’s really not that much when the underlying fundamentals have been incredibly alluring for what feels like a lifetime.

How has the story recently changed? Well, this is where it gets a bit odd. I don’t believe that its recently raised guidance is a huge change from what many, including me, were already expecting to see. Perhaps my expectations were too high.

In any case, the market now seems to be paying attention.

I continue to rate this stock a buy.

Discussing Cheniere Energy’s Updated Guidance

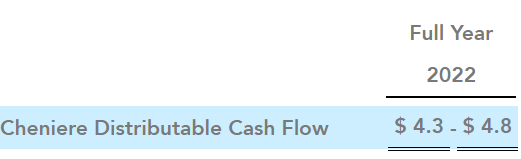

Let’s get some perspective. Back in Q4 2021, when LNG guided for the full year 2022 this was its guidance for distributable cash flows. This is a rough approximation for free cash flow.

Cheniere Q4 2021 press release

At the high end of its estimates, distributable cash flows (”DCF”) pointed to $4.8 billion. Then, when LNG announced its Q1 2022 results this figure was raised to $6 billion at the high end.

After that, LNG raised its full-year guidance at the back of Q2 2022 to $7.4 billion. And now?

Earlier this week it raised its guidance yet again, this time to $8.6 billion. This means that since the start of the year, LNG has increased its 2022 DCF guidance by approximately 80%. And the year is not even out!

Incidentally, compared to pre-invasion prices, the stock has barely moved up by 35%. This strikes me as an absurd dislocation from intrinsic value!

Share Repurchase Program Discussed

In my previous article, I said:

Cheniere’s balance sheet carries $26 billion of net debt as of Q1. Consequently, even if Cheniere sought to exhaust its share repurchase program in 2022, in the best case, its combined total yield via repurchases and dividends would only be annualized at 5%.

And that had been one consideration that had been weighing back the stock. The fact that Cheniere’s levered balance sheet meant that its cash flows would be siphoned away to debt holders before shareholders.

And on this point, this is what Cheniere said this week:

You can see that Cheniere is now going to ramp up its capital allocation policy.

At the end of Q2 2022, Cheniere was going to repurchase $1 billion worth of its equity. And this has been raised by $4 billion, so that over the next 3 years, Cheniere will repurchase 10% of its market cap at current prices.

And while the share repurchases and dividends are ok, that’s not where the bull case is.

LNG Stock Valuation – 5x Cash Flows

My bullish case is focused on this, more than 90% of Cheniere volumes are contracted out in advance. There’s really not going to be a lot of bad news coming down the pipe if natural gas prices were to turn lower.

Meanwhile, the stock is now priced at approximately 5x this year’s distributable cash flows.

As seen from a different perspective, Cheniere is guiding for $20 billion of cumulative cash flows over the next 4 years. This implies that its total cash flows over the next 4 years will equal 50% of its market cap.

And knowing how Cheniere operates, this is probably going to be raised again in the coming months.

The Bottom Line

Cheniere is delivering a very compelling narrative for investors, as every few months it reports little bits of positive news.

Meanwhile, as discussed throughout the stock is clearly cheap as investors shy away from Cheniere on the wrongful assumption that the company’s prospects are highly cyclical.

I maintain that ironically, investing in a US-based natural gas company could actually be a lot more of a secular growth story than investing in tech companies! Why?

Because with tech companies investors are paying very rich valuations on the ”idea” that their growth prospects are immune to a slowing economy.

While with Cheniere I argue that investors are paying too low a valuation for a business that has strong fundamental support, with the demand for natural gas likely to remain higher for longer.

Thus, I maintain my buy rating on this name.

Be the first to comment