S_Bachstroem

While home values have held up relatively well this year compared to stocks, we believe that the forward outlook for the single-family home sector is worse than it is for quality high yield stocks. In this article, we will discuss the growing risks for the single family housing market and share where we are investing instead at the moment.

Why Single Family Housing Is In Trouble

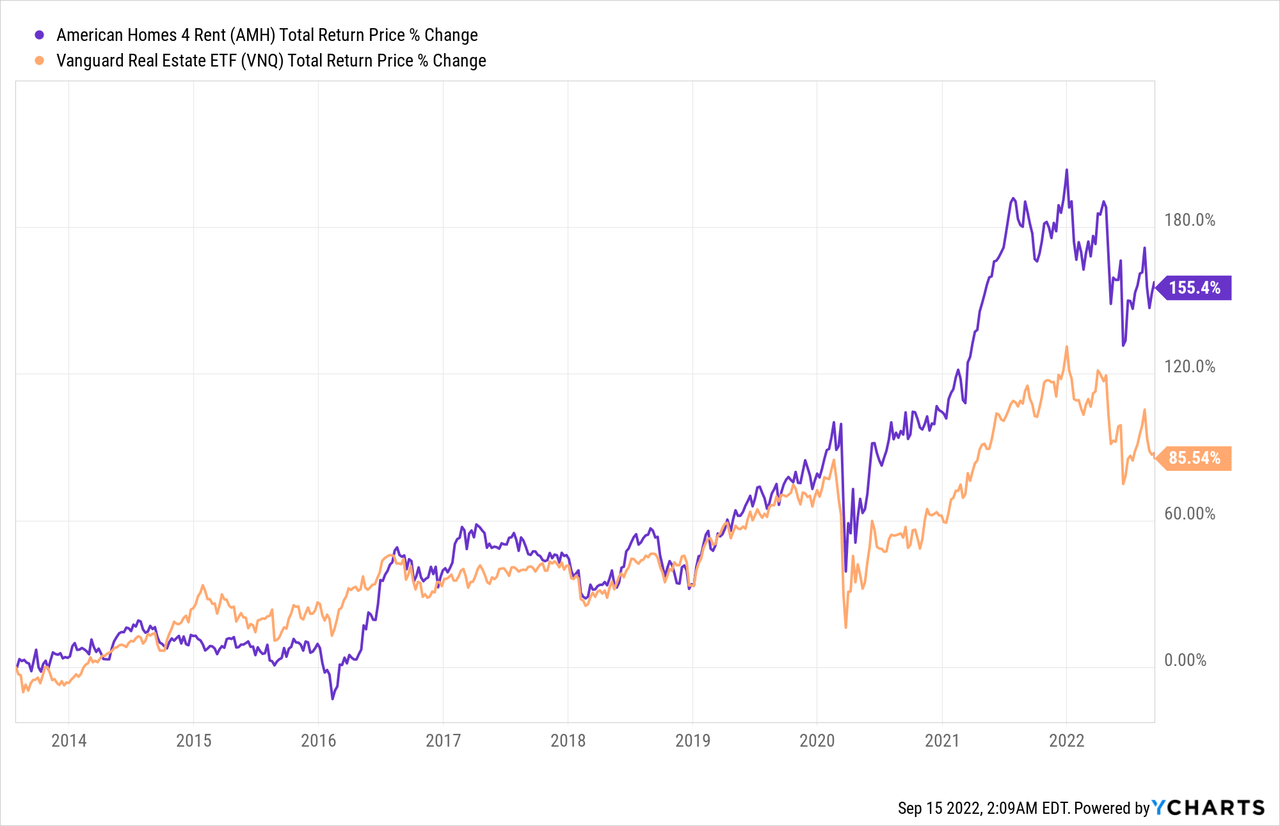

Over the past decade, rental properties (AMH) have generated massive returns for investors, outperforming the broader U.S. REIT sector (VNQ) since 2013:

As a result, many real estate investors have been lulled into a state of complacency, thinking that housing prices and rental rates will continue rising into perpetuity. Furthermore, they have gotten into the habit of using enormous amounts of leverage when purchasing properties, forgetting that with increased leverage comes increased risk. While leverage works great when prices and rents are rising, when the inevitable correction comes, heavily leveraged real estate investors will get most – if not all – of their equity wiped out. This is even more problematic at the moment, as rental property buyers are not only paying premium prices for houses but are also paying much higher mortgage interest rates than have been seen in recent years. As a result, if rents decline and/or vacancies rise, being able to service their mortgages will become even more challenging, leaving them less margin of safety.

On top of that, there are growing indications that the housing market is in a bubble and due to burst at any moment. First and foremost, while stock indexes (SPY) (QQQ) and publicly traded real estate investment trusts are seeing their equity valuations take a hit, housing prices have yet to move much. Typically, equity markets are much more volatile and generally lead private markets, so a sharp correction in REIT equity prices is oftentimes an indicator that physical real estate prices are due for a pullback as well. In fact, single family homes are already seeing prices peak and even begin to pull back across the United States, with demand drying up and homes staying on the market longer. The mortgage lending industry and home builders are also beginning to suffer from plummeting demand, all of which seem to indicate that more meaningful home price declines are imminent.

The biggest two factors driving declining home demand are (1) rising mortgage rates and (2) severe inflationary pressures that are squeezing the budgets of prospective home buyers. In combination, potential home buyer purchasing power is being squeezed from both ends, with the cost of a monthly payment on a 15- or 30-year mortgage soaring from skyrocketing mortgage rates and the budget of available cash to service that mortgage declining given that inflation is outpacing wage growth.

The main culprit for this current predicament of home unaffordability facing so many Americans is the Federal Reserve. Over the past decade it has dramatically distorted the mortgage market (and by extension, the housing market) by pouring trillions of dollars into buying mortgages. As a result, today it owns nearly a quarter of the United States’ outstanding residential mortgages. The end result of this is that mortgage rates have been held artificially low due to the Federal Reserve’s artificially created demand for this financial product. As the Mises Institute reported earlier this year:

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation…Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other…The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world.

With housing inflation leading the broader inflation indexes higher, the Fed is now fighting inflation by letting these mortgages to begin rolling off of its balance sheet. This, in turn, is pushing mortgage rates higher as the artificially created demand for these mortgages has been removed. As this process continues, we expect mortgage interest rates to continue rising and housing prices to ultimately fall considerably as air rushes out of the housing bubble.

Another potential headwind for housing prices is if the recession we are currently in worsens, driving unemployment up. If that happens, the pool of viable home buyers will decline even more, resulting in further downward pressure on home valuations. As this situation accelerates – especially if vacancies increase as renters move to more affordable options like mobile homes or apartments – it is quite possible that some real estate investors will panic or even be forced to sell properties in order to service their massive debt burdens. This will only serve to drive home prices even lower.

What We Are Buying Today

While private real estate markets are not offering investors any meaningful discounts at the moment, they are abundant in the public markets.

Beginning with real estate, investors can buy instantly liquid pieces of diversified, well-managed, high-yielding, and investment grade commercial real estate businesses at discounts to their private market valuation on the public markets. Some of our favorites at the moment include triple net lease REITs like STORE Capital (STOR) and Spirit Realty Capital (SRC). For those willing to go out a little further on the risk spectrum, hospital REIT Medical Properties Trust (MPW) and Class A retail REIT Simon Property Group (SPG) also offer exceptional yields that are well covered by cash flows and run by management teams with excellent track records. All of these REITs trade at steep discounts to the private market valuation of their real estate despite having strong fundamentals and quality management teams.

Another sector that we really like right now is midstream infrastructure, where high yield investment grade businesses abound. Between the likes of Energy Transfer (ET), Enterprise Products Partners (EPD), and Magellan Midstream Partners (MMP), investors have numerous attractive opportunities to pick from with little risk of financial distress, even in a recession.

Investor Takeaway

Rental properties have become wildly popular investments in recent years as prices have soared higher and cheap leverage has been widely available. However, it appears that the bubble is nearing its bursting point, as its main inflator – the Federal Reserve – has reversed course. Instead of artificially suppressing mortgage interest rates by purchasing them hand-over-fist, it is now letting them mature and naturally roll off of its balance sheet.

When combined with its aggressive interest rate hiking cycle, mortgage interest rates are pushing higher. As a result, buying a home with a mortgage is more expensive than ever given how high home prices are right now. On top of that, sky-high inflation, below inflation rate wage growth, and growing risks of a severe recession are squeezing the buying power of potential home purchasers. As a result, we see the likelihood of home prices declining meaningfully in the coming years as much greater than 50%.

In contrast, investors can easily and efficiently build a diversified portfolio of high-quality high yielding REITs and midstream MLPs at very compelling valuations right now. As a result, we are avoiding rental properties right now in favor of buying REITs, MLPs, and numerous other types of quality high yield stocks at High Yield Investor.

Be the first to comment