Baris-Ozer

On the year, shares of Altria Group (NYSE:MO) and the S&P 500 (SPY) have gone in opposite directions. The S&P 500 is stuck in a bear market, and has a total return of -12.5% on the year compared to a 12.5% gain from shares of MO.

Skyrocketing inflation combined with rising rates have put the clamps on much of the overall market, and based on the Federal Reserve’s latest decision to hike rates another 50 basis points, it does not seem as if much will change any time soon.

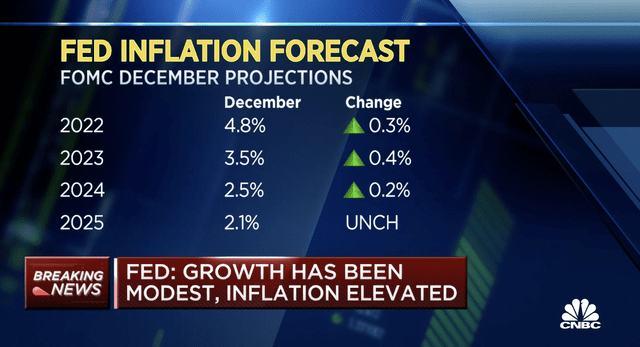

Fed Chair Jerome Powell stated that the Fed, “still has a ways to go” and that inflation is not expected to come down to their 2% target until 2025. Here is a look at the inflation forecast from the FOMC by year.

Inflation seems like it is here to stay for a little while, albeit not at the previous levels we saw this year, which is a welcomed seen. The Fed has attacked high inflation hard with 425 basis points worth of hikes in 2022 alone, which is unheard of.

This tight monetary policy is likely to send the US economy into a recession in 2023, assuming we are not already there.

This has led investors to position their portfolio more to safety, and one of those stocks that investors are moving towards is Altria Group, evidenced by the year the stock has had.

But, I believe there is more potential for the stock in 2023.

Altria To Outperform Again In 2023

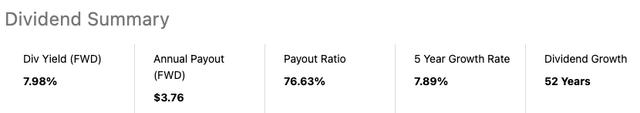

I believe Altria could make for a good investment in 2023 for a couple of reasons. First off, shares of Altria currently pay a very high dividend of $3.76 per share which equates to a dividend yield close to 8%. The company has increased their dividend for 53 consecutive years and counting, making them a Dividend King.

Over the past five years, Altria has increased their dividend at an average annual rate of nearly 8% per year, which is also great for a company that is a dividend king.

Another reason to like Altria going into 2023 and a potential recession in large part is due to a potential increase in volume. Yes, something we do not often talk about when discussing Altria, as cigarette volumes have been in a downtrend for a number of years.

However, studies have shown that when times get tough, such as we saw during the Great Recession, stress levels increase. It could be stress due to work, unemployment, or just life in general. The research has shown that smokers increase their tobacco intake, which equates to more cigarettes. It could also lead to non-smokers looking for ways to calm their stress as well.

In a study by the National Library of Medicine, it showed an increase in tobacco consumption in the unemployed sector of the workforce during the Great Recession.

Altria has had a rough track record when it comes to acquisitions. JUUL and CRONOS were two acquisitions that came very close to one another and neither have planned out thus far.

More recently, Altria accepted a $2.7 billion buyout of its iQOS licensing rights in the US to international peer Philip Morris (PM). This allows PM access back into the US market, but also supplies Altria with a chunk of cash to expand its opportunities and potentially lower its debt levels. The rights do not transfer over until April 2024.

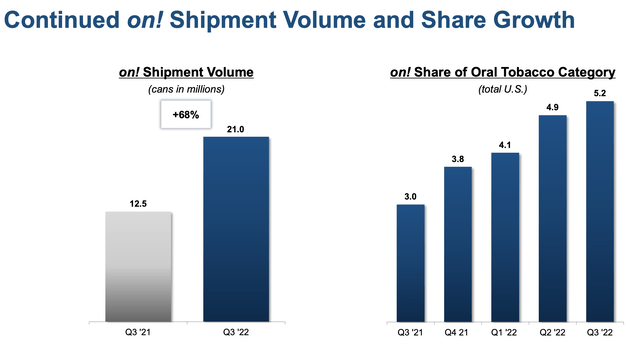

A bright spot for the company has been the growth in their oral nicotine product ON!, which has continued to grow its market share and volume here in the US.

As you can see from the slide above, volume was up 68% over prior year and its market share has been increasing every quarter to 5.2% throughout the US.

MO continues to evolve and diversify its portfolio away from traditional cigarettes. The licensing rights sale to PM is allowing the company to do just that.

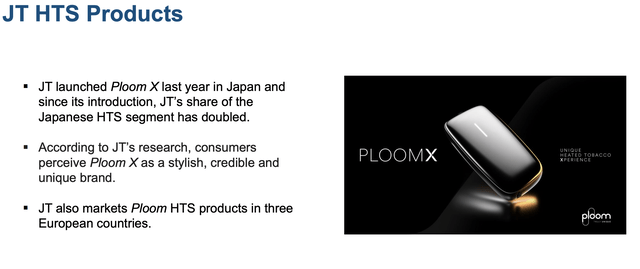

One of those opportunities to expand their portfolio and offerings is through their Horizon JV with JT who launched their own heated product, Ploom X, last year in Japan and since its introduction, JT’s share of the Japanese HTS segment has doubled.

Both parties plan to combine their expertise in order to create their own heated stick product that could gain approval. The parties expect to file a PMTA in the first half of 2025.

This is all just another way that the company is diversifying their portfolio. They also have products within the alcohol space and marijuana space as well, which could benefit as marijuana becomes legalized in the US.

Discounted Valuation

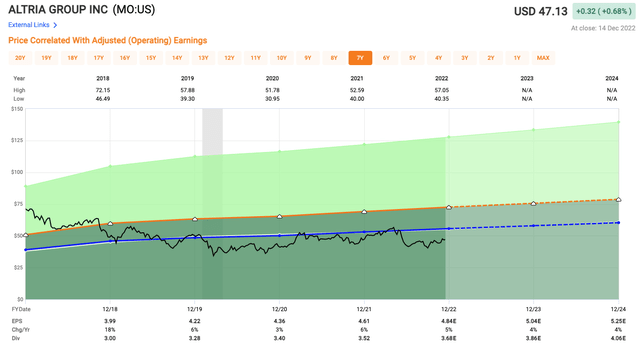

As we touched on above, Altria is doing a nice job diversifying their portfolio, but the valuation is still extremely low, especially when compared to their recent five year historical averages.

Shares of Altria currently trade with a P/E of 9.7x and on a forward looking basis that drops to 9.4x. Over the past five years, shares of MO have traded closer to 11.5x.

Investor Takeaway

Altria is an old age Dividend King, but they are not sticking to their old ways. The company continues to adapt and we believe they have the portfolio that can perform well in the face of a recession in 2023.

Be the first to comment