chonticha wat/iStock via Getty Images

Introduction: why do we own gold?

Ever since Oyat’s establishment as a family office in 2015, we’ve been staunch advocates of having a certain level of exposure to precious metals as an integral part of our asset allocation.

This has been motivated by two main considerations. First, to own a hard currency in reserve that adequately acts as a store of value. And second, to create a potential hedge against the myriad risks facing investors today. This includes the frailties of the global monetary and financial system, of which inflation is a manifestation; as well as geopolitical turmoil.

Over the years, we’ve become increasingly convinced that gold is arguably the most compelling form of hedge against such risks, as evidenced throughout history. This is due to its inherent characteristics, which can be summed by the notions of scarcity, permanence, and independence [1]. In various ways, these properties enable gold to preserve its purchasing power over the long-term, and tend to make its price dynamics countercyclical.

As a result, we see gold as both a hard currency that we can hold in reserve and exchange for other assets as opportunities arise, as well as a permanent stabilizer and counterbalance to our portfolio. The vast majority of our exposure to precious metals takes the form of physical gold, which we complement with a much smaller amount of physical silver; as well as precious metals royalty & streaming and mining companies.

Polymetal International PLC (OTCPK:POYYF) (OTCPK:AUCOY) has been one of our portfolio holdings since early 2022, when we had the unfortunate timing to acquire a participation in the Company just a month prior to the start of the armed conflict that is currently raging in Ukraine. Since then, the stock price listed on the London Stock Exchange has declined by more than a staggering 80%.

In this article, we aim to take stock of the manner in which the current situation is impacting, and will likely impact Polymetal going forward. We then relate this back to the current valuation level, and offer some initial conclusions about whether the current stock price adequately reflects the company’s underlying fundamentals, as well as risks and uncertainties.

Polymetal at a glance

Polymetal was founded by the ICT Group (Alexander Nesis) in 1998 with the objective of reviving a number of inactive assets left over from Soviet era exploration, using cutting edge mining & refining technologies. In order to do so, the company grew its portfolio of operating assets predominantly via acquisitions, as described in more detail below. Polymetal went public with 24.8% of its capital in 2007 on the London and Russian Stock Exchanges, and in 2011 the company completed a Premium Listing on the London Stock Exchange and entered the FTSE 100 index, raising US$ 763 million from the IPO.

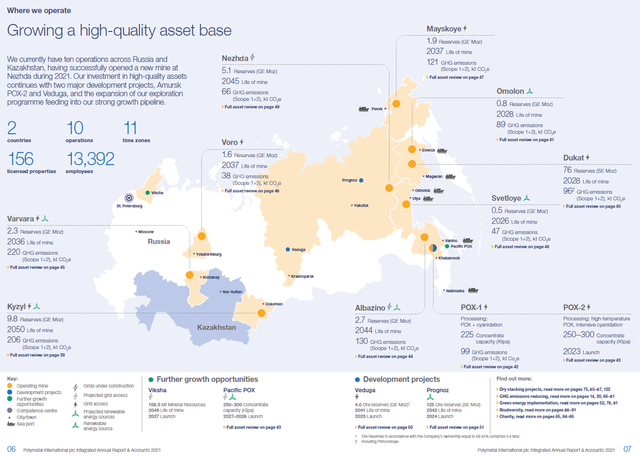

The map below displays Polymetal’s operating assets, which currently consists of ten operations across Russia (8) and Kazakhstan (2):

Source: Annual report 2021

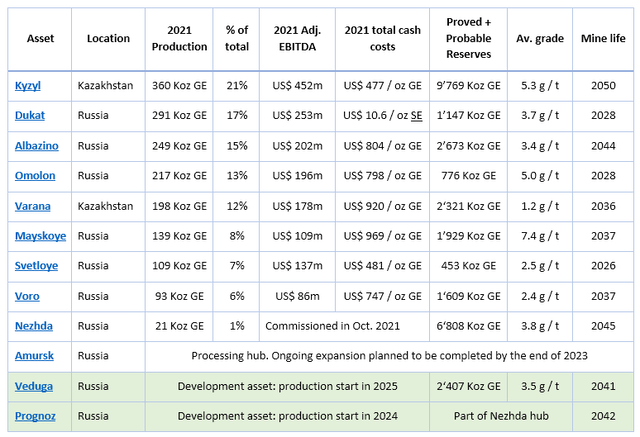

In the table below, we summarize some of the key figures for Polymetal’s operating assets. A more detailed description of each of these can be found by clicking on the respective hyperlinks, and by reading the company’s latest annual report.

Acronyms: K – thousand; Oz – ounce; GE – gold equivalent; SE – silver equivalent; g – gram; t – ton

Source: Annual report 2021, Polymetal datapack 2021

A 10-year journey since listing on the London Stock Exchange

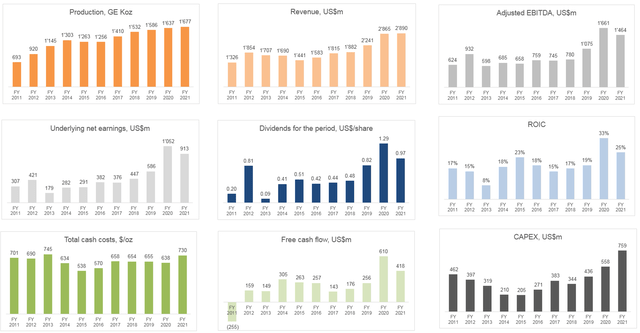

The charts below highlight some of the company’s key operational and financial metrics since 2011:

Source: Polymetal datapack 2021

From these charts and various company reports, we can make the following high-level observations:

- Polymetal is a top-10 global producer of gold and silver, and the 2nd largest in Russia.

- The company has increased production by 2.4x since 2011, to 1,677 Koz last year.

- Ore reserves have increased by 2.1x since 2011, to 29.9 Moz GE (proved + probable) as of the end of 2021.

- Polymetal has a below-average position on the global cost curve.

- Revenues have more than doubled to US$ 2.9 billion since 2011, increasing at a CAGR of 8%.

- Adjusted EBITDA has increased at a CAGR of 9% to US$ 1.5 billion since 2011.

- Polymetal has had one of the most shareholder-friendly capital allocation policy among peers, with a dividend policy to payout min. 50% of earnings, and max. 100% of free cash flow. The average dividend yield over the past decade has been approx. 4.5%.

Impact of armed conflict in Ukraine

Let us now get to the crux of the matter, which concerns the manner in which Polymetal has been impacted by the armed conflict that started in Ukraine a month ago.

According to a press release by the Company dated March 9th, the impact of economic sanctions and the most recent changes in the capital control legislation in Russia can be summarized as follows:

- Operations in both Russia and Kazakhstan continue undisrupted for the time being. The Company carries several quarters’ worth of inventories of critical materials, consumables and spare parts, and has recently initiated a review of logistics and procurement with the aim to increase supply chain resilience, and potentially shift critical supplies to domestic or Chinese-manufactured consumables and equipment.

- Sales of products from the Company’s Kazakhstan-based operations, which represent 48% of net earnings in 2021, continue as usual. In Russia, gold and silver concentrates from the Dukat, Mayskoye, and Nezhda operations are predominantly sold to customers in Kazakhstan as well as East Asia, and thus far, existing contracts continue in good standing. On the other hand, sales of bullion, which have traditionally been done via Russian financial institutions, have been impacted by sanctions imposed by the US, EU and UK. In order to mitigate this, the Company is working on expanding the number of counterparties for export bullion sales. Moreover, the Russian Central Bank recently announced that it will resume gold purchases in the domestic market. In a press release dated March 25th, the Russian Central Bank made the following announcement:

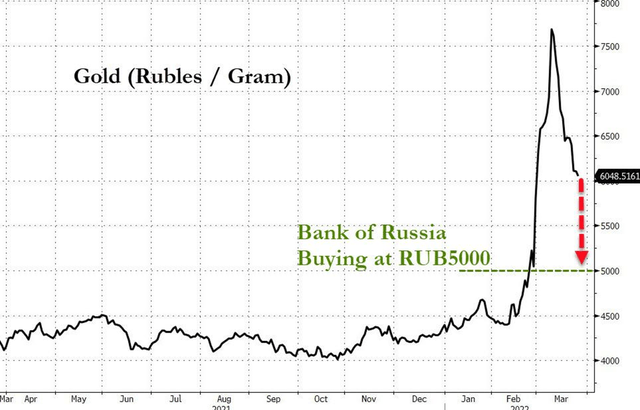

‘In order to balance supply and demand in the domestic precious metals market, the Bank of Russia will buy gold from credit institutions at a fixed price from March 28, 2022. The price from March 28 to June 30, 2022 inclusive will be 5’000 rubles per 1 gram. The established price level makes it possible to ensure a stable supply of gold and the smooth functioning of the gold mining industry in the current year. After the specified period, the purchase price of gold can be adjusted taking into account the emerging balance of supply and demand in the domestic market.’

Note that the ruble price at which the Russian Central Bank will resume gold purchases in the domestic market is significantly below the market price as of the announcement’s date, as shown below. However, it remains above the recent historic market price, prior to the ruble’s sharp devaluation following the start of hostilities. This can be seen as an effort by the Russian Central Bank to support the value of the ruble relative to other currencies.

Source: Zerohedge

- Another potential cause for concern revolves around the Company’s liquidity position, its ability to make interest payments and principal repayments on its current debt, as well as its ability to refinance its maturing debt. As of March 1st, Polymetal had a net debt of US$ 1.87 billion at an average cost of approx. 2.9%, and 96% of its debt was denominated in US$. Some 27% of the Company’s debt matures within the next 12 months. In view of current liquidity (US$ 0.4 billion in cash and cash equivalents deposited with non-sanctioned financial institutions) and projected free cash flows, the Company estimates that it has enough buffer to continue to fulfill its obligations and capital commitments in the next 12 months, even in the absence of new borrowings. Moreover, the Company maintains US$ 1 billion of undrawn credit lines from non-sanctioned financial institutions. Having said that, the Polymetal has warned that as it refinances maturing debt domestically in ruble, the cost of debt will rise substantially, following the Russian Central Bank’s increase in interest rate to 20% (from 9.5%) on February 28th.

- Lastly, recent changes in the capital control legislation make it unclear whether Polymetal will be able to remit dividends from its Russian subsidiaries to the holding company level, based in Jersey, in order to pay future dividends to investors. The Company has indicated that it intends to pay the final dividend for 2021 of US$ 0.52 per share (ex-date on May 5th for payment on May 27th) subject to adequate liquidity, and a final decision on whether the final dividend will be paid should be taken at the upcoming AGM on April 25th. Looking further forward, it seems clear that investors should prepare themselves for the high likelihood that it will be impossible to pay future dividends to investors while sanctions and capital controls remain in place. This is undoubtedly a blow for income-focused investors, yet we believe that long-term investors might stand to gain from this, especially if the Company focuses on utilizing its free cash flow to shore up its liquidity position, strengthen its balance sheet, and potentially deploys excess cash to repurchase shares at highly depressed levels.

Valuation

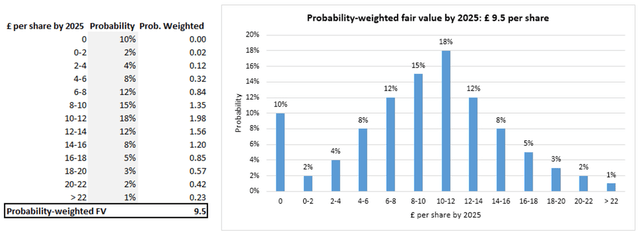

Needless to say, given the current extraordinary circumstances, it is impossible to make a precise estimation for the intrinsic worth of Polymetal’s stock. As is often the case with investing, a more appropriate approach here is to consider a wide range of scenarios, and try to apply probabilistic thinking.

As a worst-case scenario, we can consider a complete impairment of capital for shareholder. This may happen, for instance if the Russian government decided to nationalize its domestic gold and silver production, without any compensation being given to current foreign shareholders. We’ve put a 1 in 10 chance of this scenario coming to pass.

From there, we estimate the probability of Polymetal’s stock price by 2025 all the way to £ 22 per share, marginally above its all-time high of August 2020, when the price of gold first broke through US$ 2,000 per ounce (see Appendix). Our estimation of the probability distribution can be seen below:

Source: Oyat estimates

It goes without saying that we do not have any special powers of precognition, and anyone’s guess as to the probability distribution of the outcomes above is as good as ours. Feel free to enter your own assumptions in the attached spreadsheet: Probabilities.xlsx.

We can however highlight a number of data points which suggest that this is an appropriate range to consider, and help you determine the respective probabilities of various outcomes:

- The Company’s stock price fluctuated between £ 10-12 per share directly prior to the crisis in Ukraine.

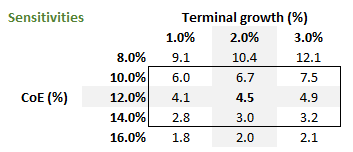

- Our DCF model Polymetal_03.2022.xlsx, which attempts to incorporate the negative impact of the current situation, indicates a fair value (FV) of £ 4.5 per share using a hurdle rate of 12%, and a FV of £ 10.4 per share using a hurdle rate of 8%.

Source: Oyat estimates

- Applying a 10x forward PE multiple, which is in-line with the long-term average, to our EPS estimates for 2022 (US$ 1.01) and 2023 (US$ 1.43), we get a FV of £ 7.7 and £ 10.8 per share respectively.

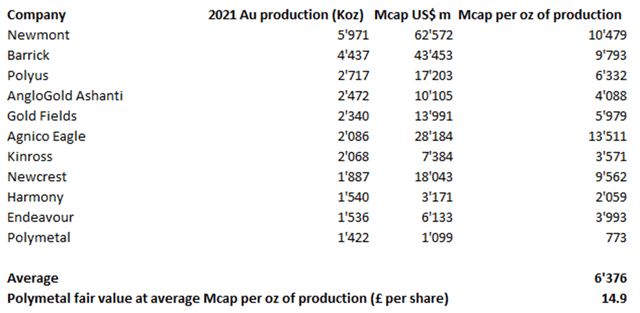

- If we estimate the fair value of Polymetal’s stock based on the average market capitalization per ounce of gold production for a peer group of the largest 10 miners in the world, we get a FV of nearly £ 15 per share, as shown below:

Source: KITCO, Eikon

Conclusion

A prospective investment in Polymetal is not for the faint-hearted. Most investors would perhaps rightly decline the opportunity based on the single fact that there is a certain possibility, or probability, of a total capital impairment. Having said that, should that scenario not come to pass, then there is a high likelihood that the current share price is grossly undervalued. According to our estimates, the probability-weighted magnitude of that undervaluation is over 5x. As such, the current situation surrounding Polymetal’s stock reminds us of a call option with no expiry date.

Clearly, this is most definitely not the kind of investment opportunity on which you want to bet the farm. On the contrary, strict discipline regarding maximum risk budget is required for current and prospective investors. For us at Oyat, having started buying shares in the Company prior to the current crisis, we have since continued to accumulate shares at depressed prices to our max. risk budget (approx. 2.5% of total assets) for this position.

[1] Please refer to the various publications and interviews of Anthony Deden and Edelweiss Holdings for more on the application of these notions to the practice of investment management.

Be the first to comment