Michael Vi

Background

I wrote about Lending Club’s (NYSE:LC) business model, investment cases, and valuation model quite extensively. You might find it here and here.

This article is to provide some additional color as I review its 3Q22 results, including its reported numbers and management commentary during the conference call.

3Q22 Quarter Result

Lending Club was down ~10% after earnings despite its revenue and net income beats, attributed to disappointing 4Q22 guidance, surging funding cost, and lowered loan yield (thus compressed Net Interest Margin) as highlighted here.

The headline numbers are indeed concerning: 4Q22 guided revenue is ~5-8% lower YoY, and ~15% lower QoQ.

Let me take you for a quick tour that digs deep underneath the headline numbers, and hopefully explains why my perspectives are in contrast to market sentiments.

Summary Findings

A rapidly rising rates environment is a short-term macro headwind to a credit card debt consolidation business such as Lending Club (explained in the next section).

Facing such a headwind, Lending Club is taking prudent/necessary measures to manage its loan book size/quality, and its balance sheet, so as to best position itself when the environment stabilizes, and better risk/reward opportunities arrive.

With that context in mind, I examined its 3Q22 results and concluded that the management took disciplined actions and demonstrated its capability to think strategically and avoid chasing after Wall Street’s expectations.

Let us dive into it.

Compressed Net Interest Margin

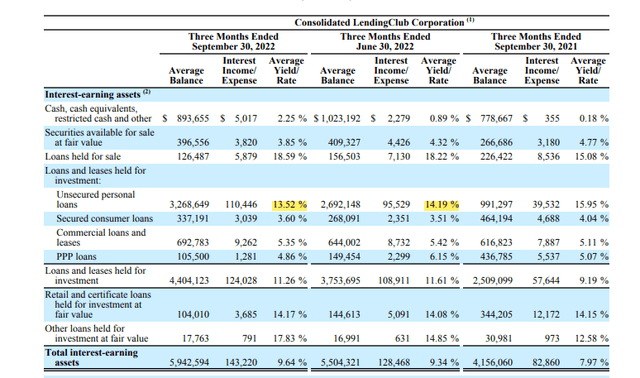

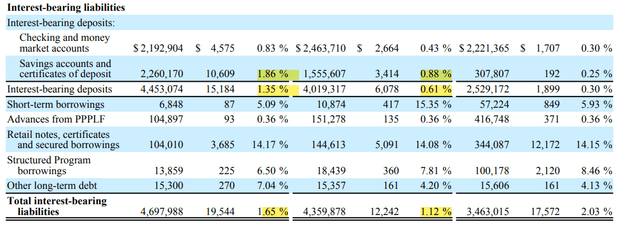

Data: unsecured loan (the bulk of Lending Club’s loan composition) average yield declined from 14.19% (2Q22) to 13.52% (3Q22), and the saving/CD funding yield increased from 0.88% (2Q22) to 1.86% (3Q22).

Assets Yield/Rate (3Q22 earning release) Liabilities Yield/Rate (3Q22 earning release)

Management Commentary:

From Drew Labenne/Scott Sanborn:

At this point, the Fed has moved 300. Credit cards have moved roughly 250, we’ve moved as of today, roughly 200. So we are — this is proceeding as we had indicated we thought it would, which is the Fed moves, then the cards move and then we move. (Lanenne)

The first is we’re remixing the portfolio to a lower risk profile, in terms of what we’re putting on the balance sheet. Also, we are seeing some increase in slowdown in prepayment speeds, which is impacting yields.

The third is that, the remix to the high-quality has a different fee structure and as those fees amortize in has a different profile.

My Notes:

At the first glance, that net interest margin compression is indeed concerning, especially considering players in the consumer credit sector, including banks (e.g. JPM, C), and credit card firms (e.g. AXP, DFS, etc.) reported solid results this quarter with expanding margins.

The management team offered some important colors here. What Labenne referred to (in his commentary above) is when the Fed rates rapidly rise ~3% since early 2022, there is a delay in credit card company’s response to raise the interest rate, and subsequent delay in consumers getting the bill (feeling the pain), thus shopping around credit card consolidation providers (e.g. Lending Club).

We are still in the process of this waterfall relay. Lending Club just can’t fully raise the rate before the delayed credit card debt consolidation demands arrive. To make the matter more challenging, the deposit rate increase pressure arrives much faster (e.g., avg saving/CD deposit interest rate increased from 0.88% to 1.86% in the last quarter, almost 100bps bump) therefore, the NIM (Net Interest Margin) faces pressure from both demand and supply side.

More importantly, the management projected that as the Fed rate stabilizes, and delayed debt consolidation demands arrive, Lending Club will be in a stronger position to harvest them sometime in 2023.

Disappointing Guidance

Data: 4Q22 guided net revenue: $255-265M (~5-8% lower YoY, and ~15% lower QoQ). Net income: $15M – 25M

Management Commentary:

If you remember, I used a car analogy last quarter when I said that we’re reducing our speed heading into the curve so that we can accelerate coming out of it. We are in the curve right now. But as we look further down the track, I would note that some of the negative dynamics in today’s market will point to future opportunities.

My Notes: Its 4Q22 revenue guidance is ~5-8% lower YoY, and ~15% lower QoQ, which led to investor concerns and resulted in its 10% drop right after the earnings report. But if one understands the cause of its compressed net interest margin (as laid out in the last section), it explains the rationality of why the management lowers the next quarter’s guidance.

Let us do simple napkin math: the current unsecured loan average interest rate is slightly above 13%, with deposit yield at 2%, and taking into consideration a 5-6% loan default loss, it projects a 5-6% annual return.

As we project deposit rates continue to rise, we might face sub 5% net return on loans in the very near term (4Q22).

Thus, it is in Lending Club’s interest to slow down the loan origination till the Fed rate stabilizes, then it can pick up the underwriting pace, deploy capital efficiently and earn a much higher risk-adjusted return.

I think the courage to not yield to the pressure from the capital market/investors, and not chase topline numbers that couldn’t generate meaningful profit, is an underrated yet crucial management quality in this industry. For that, I applaud how Lending Club’s management team handled it.

Marketplace Vs. Underwriting Split

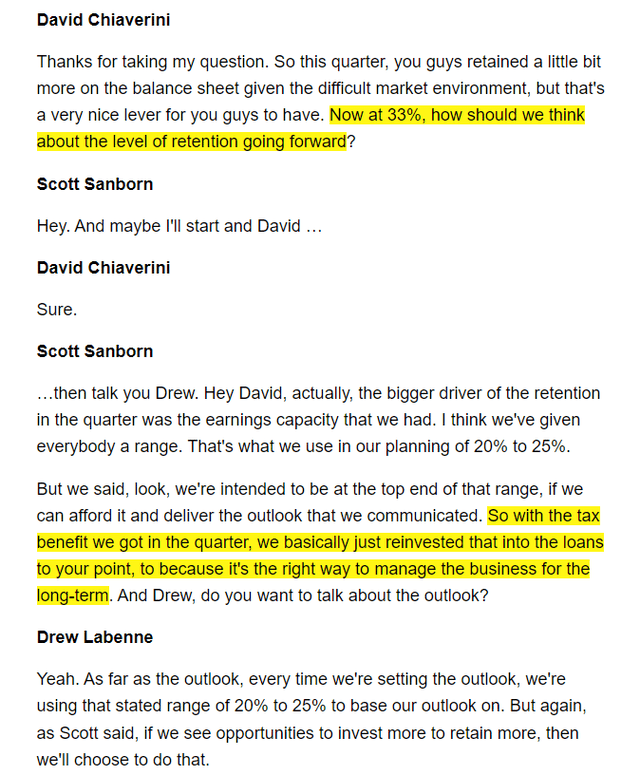

Data: The split ratio was 33%, above the 20-25% target. ($3.5B loan origination, $1.1B loan book, $2.4B marketplace)

Mgt commentary:

My Notes: As I explained in the last article, the power of Lending Club’s business model is its flexibility to balance between the marketplace and its own loan book. Marketplace offers immediate cash flow (via origination/servicing fee), while own loan book offers superior unit economics and recurring revenue. Taking on loans in its own book is also conditioned upon meeting regulatory requirements (e.g. CET1 ratio).

In this case, Lending Club had $132Mn tax benefits from the last quarter, which allows them to carry extra loans in its own book. They chose to do so to optimize long-term return when the condition allows.

Final Thought

I will be remiss if I don’t mention one more important point – this quarter’s macro challenges underscore the necessity for Lending Club to execute its multi-product vision (one of its 3 strategic pursuits) so that it can weather severe macro headwinds more gracefully going forward. I will monitor closely its progress on that front.

Be the first to comment