Sundry Photography

We previously recommended investors buy Analog Devices, Inc. (NASDAQ:ADI) shares, but global supply-demand dynamics have changed since then. ADI CEO Vincent Roche reported that the company saw order cancelations during last week’s earnings call. We believe order cancelations are the first sign of upcoming demand moderation. We attribute demand moderation to supply chain issues and inflationary pressures.

The current global economic backdrop is not particularly incentivizing demand growth in ADI’s automotive, industrial, communications, and consumer segments. We expect a demand slowdown in ADI’s main markets during the coming months. We believe demand moderating will likely impact ADI revenue and EPS in the near term and recommend investors wait for a better entry point to buy the stock.

Automotive and industrial demand to moderate

Around two-thirds of ADI’s business is derived from its automotive and industrial markets. Both markets are forecasted to grow significantly over the coming decade. According to Bloomberg, the automotive market is expected to grow at an annual CAGR of 6.27% between 2022-2028.

While we believe demand in the automotive and industrial sectors is strong in the long run, we expect demand to moderate towards 1H23 due to supply chain issues and inflation. We expect a weak automotive market as the Federal Reserve hikes up interest rates. According to data from the U.S Bureau of Labor Statistics, consumers are seeing a 12.5% year-over-year increase in the price of new cars. With increasing interest rates, new car demand will likely pullback in the next few months. We have already begun seeing signs of weakening demand in global communication and consumer markets and expect this weakness to be reflected in demand for ADI’s products.

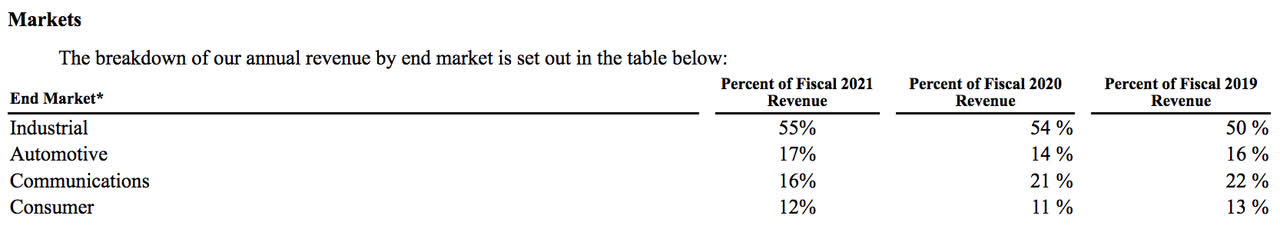

The following graph from ADI’s 2021 10K breaks down the company’s revenue by market.

ADI

We do not believe ADI is immune to the current worsening global dynamics. ADI CEO, Vincent Roche, confirmed our belief in ADI’s 3Q22 earnings. Roche reported that ADI is seeing demand for “orders slowing later in the quarter and cancellations increasing slightly.” We believe order cancelations will continue to materialize in the coming months and recommend investors wait for the dust to settle before buying the stock.

Near-term hiccups in ADI’s plans in the power management sector

We were excited about ADI’s full-force venture into the power management sector and the acquisition of Linear Technology and Maxim Integrated Products. Yet, we believe its plans will not be able to fully materialize in the near term as the company sees double ordering from customers. We believe ADI is well positioned in the power market in the long term but do not think the company can escape the negative impact of the current macro backdrop.

ADI also operates in the highly competitive power management market. While ADI is performing well considering global supply issues and inflation, we expect demand slowdown to be reflected in ADI’s stock in the coming months. We expect ADI will not be able to keep up with its biggest competitors as demand moderates. The company’s main competitors in power management are Texas Instruments (TXN) and Monolithic Power Systems (MPWR). The following graph outlines ADI’s stock performance compared to the competition.

Ycharts

Valuation

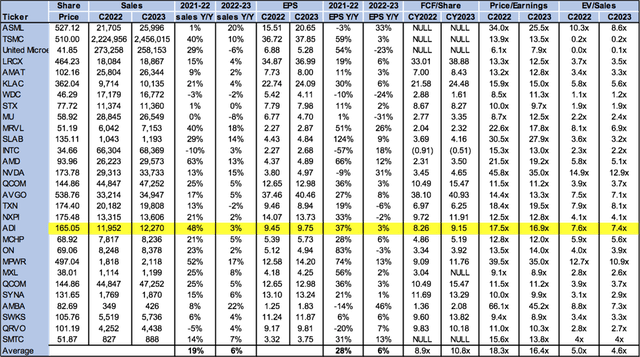

ADI is not a cheap stock, currently trading at around $165. On the P/E basis, the stock is trading at 16.9x C2023 EPS of $9.15 compared to the peer group average of 16.4x. ADI is trading at 7.4x on EV/C2023 sales versus the peer group average of 4.6x. We do not believe the stock will grow meaningfully in the near term because of demand headwinds. We expect revenue and EPS to be impacted in the near term, leading to a stock pullback from these levels.

The following chart illustrates the semiconductor peer group valuation.

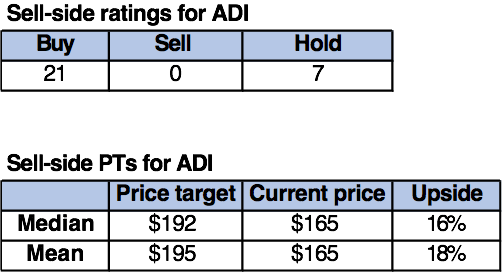

Word on wall street

Wall Street is primarily buy-rated on ADI. Of the 28 analysts, 21 are buy-rated, while the remaining are hold-rated. ADI is currently trading at $165. The median sell-side price target is $192, while the mean is $195, with a potential 16-18% upside. The following chart indicates ADI stock’s sell-side ratings and price targets:

Techstockpros & Refinitiv

What to do with the stock

We urge investors to be patient with ADI. In the near term, ADI stock will likely be volatile with a higher downside risk. We expect demand for automotive and industrial segment products to moderate in the next few months, leading to a pullback in shares. In the longer term, we believe ADI is well-positioned in the power management market and will participate in the global growth of the automotive and industrial markets. In the nearer term, we do not expect the stock to work and, hence, recommend investors wait for the dust to settle before buying the stock.

Be the first to comment