Justin Sullivan

While in recent years Nvidia (NASDAQ:NVDA) has been able to deliver stellar results thanks to the increase in videogame sales and a growth of demand for crypto mining, it seems that those times are over for now given the company’s weak preliminary results for Q2. At the same time, a much greater threat to the company’s business will materialize next year when a new global corporate tax of 15% will be implemented across most of the jurisdictions in the world. This should prevent Nvidia from significantly improving its earnings in the long run, even if there’s going to be an increase in demand for GPUs in years to come since the company will lose the ability to continue to pay almost nothing in taxes by utilizing its presence in low-tax jurisdictions, as it did so in recent years. Therefore, Nvidia’s stock has more downside from the current levels and is unlikely to reward its shareholders anytime soon.

Things Are Not Going Well For Nvidia

To ease the blowout from weak performance, earlier this month Nvidia released its preliminary Q2 earnings results, which showed that for the July quarter the company’s revenues decreased by 19% Y/Y to $6.7 billion, significantly below the consensus of $8.1 billion. The biggest decline came from the company’s gaming business, which has experienced a 33% Y/Y decline. While Nvidia will release full results on Wednesday after the market closes, the preliminary numbers already show that the business is in a tough spot, as it seems that the decline of videogame sales is not over yet and there’s a risk that the Q3 results will be relatively weak as well due to the slowing consumer sentiment.

On top of that, even if we assume that the economic downturn is temporary and over time things will improve, there’s still a major development on the way, which Nvidia investors can’t ignore. If we go through the company’s latest annual income statement, we’ll see that Nvidia pays an extremely small amount in taxes. For instance, while the company’s earnings before interest and taxes were ~$10 billion in FY22, the firm paid only $189 million in income taxes that year, which translates to an effective tax rate of only ~1.9%.

Last year, S&P Global reported that Nvidia has one of the lowest tax rates among its peers primarily because it realizes its earnings in low-tax jurisdictions like Israel, Hong Kong, and the British Virgin Islands. The problem is that in 2021, the G7 members adopted a plan to push for the implementation of a global 15% corporate tax rate in order to prevent big businesses like Nvidia from utilizing the low-tax jurisdictions that help it to pay significantly less in taxes than others. At the same time, OECD reported that 130 countries that account for 90% of global GDP have already agreed to this plan and are planning to implement a new tax rate as soon as 2023. Out of those 130 countries, jurisdictions such as Israel, Hong Kong, and the British Virgin Islands, which Nvidia uses to realize its earnings there, all have agreed with the proposal and are currently in the process of preparing legislation to implement a universal corporate tax rate of at least 15% on national levels. As a result of this, we could be confident in saying that Nvidia’s future earnings are likely going to disappoint the company’s shareholders in years to come given the upcoming changes in the global regulatory environment.

Global Corporate Tax Rate Creates A Significant Downside For NVDA

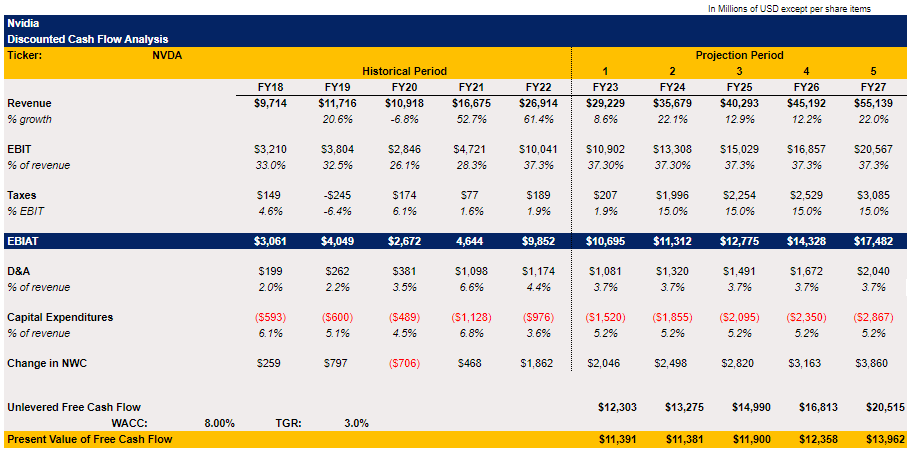

To see how big of an effect a global corporate tax of 15% will have on Nvidia, I created a DCF model, in which most of the metrics except for the effective tax rate are relatively optimistic, while the tax rate itself is raised to substantial levels. The revenue forecast itself is pretty bullish as it includes a double-digit growth rate in the following years except for FY23, but those growth rates themselves are mostly in-line with the street estimates. EBIT as a percentage of revenue in the following years is the same as it was in FY22, while percentages for D&A and Capital Expenditures in the following years are averages of the previous five years.

At the same time, the change in net working capital in the model continues to be positive, which increases the company’s valuation in the end. Since Nvidia’s fiscal year ends in January, I decided to give the company a 1.9% tax rate for FY23, which is the same as in FY22, while in all the following years the rate is increased to 15% due to the implementation of a global corporate tax rate.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

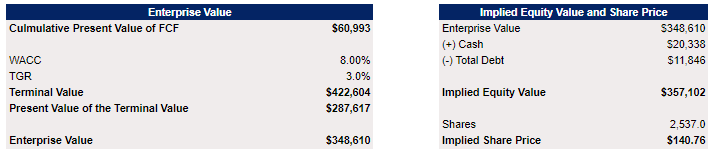

The terminal growth rate in the model is 3%, while WACC is only 8%. In the end, all of those assumptions are giving us an enterprise value of $348.6 billion, while the equity value is $357.1 billion and the implied fair value is $140.76 per share, which represents a downside of around 18% from the current levels.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

We could see that despite the efforts to create the most optimistic model that includes mostly a double-digit top-line growth, and higher earnings in comparison to most of the previous years, the increase in taxes alone already substantially decreases Nvidia’s intrinsic value and overrides those optimistic assumptions. If we assume that the revenue growth will be even weaker than it’s currently estimated, then the fair value of Nvidia’s shares will be much lower than in my model. As a result, Nvidia becomes uninvestable, as the implementation of a global corporate tax rate of 15% creates a significant downside for the company’s stock.

Counterarguments

Several catalysts could help Nvidia’s stock rebound and continue to trade above its fair value for a while. First of all, it appears that the rate at which GPUs were decreasing in price has slowed down, which could be a sign that the bottom is near and the demand is about to pick up. At the same time, despite the ongoing struggles, the GPU market is estimated to grow at a CAGR of 32.82% by 2028 and be worth $246.51 billion by that time. Considering that Nvidia is one of the biggest GPU makers in the world, it will likely benefit the most from such growth, as it will be able to continue to aggressively improve its top-line performance, which could encourage investors to invest in the business and prop up the company’s shares.

At the same time, Nvidia has been actively expanding its presence in the data centers space and will likely talk about this more during the upcoming conference call later today. The latest reports suggest that the data center market is about to grow at a CAGR of 21.98% and worth $615.96 billion by 2026, and if Nvidia manages to successfully penetrate the market with its GPUs, it will able to significantly diversify its streams of income and rely less on videogame sales and crypto mining in the long run.

Considering all of this, there’s a possibility that Nvidia’s stock could further appreciate from its current levels, especially if the macro environment improves, and mitigate some of the risks that come with the implementation of a global corporate tax rate of 15%. This is something that investors need to be aware of as well.

The Bottom Line

The discussion of a global corporate tax has become less frequent in recent months, but it doesn’t change the fact that there’s a high chance that it will be implemented as soon as 2023 since the majority of countries agreed to do so last year. As a result, after years of paying almost nothing in taxes by locating its business in different jurisdictions, Nvidia is now at risk of generating weaker earnings, which will negatively affect its valuation and the ability to create additional shareholder value. Therefore, despite all the growth opportunities, Nvidia is likely to become a less attractive investment in a new global regulatory environment, where it needs to pay significantly more in taxes than before.

Be the first to comment