Chesky_W/iStock via Getty Images

Introduction to Beam

While I am often a devout supporter of sustainable technologies, sometimes it is important to consider that there is always a difficult path forward for innovation. While 2020 was a freak event where valuations exploded across the industry, 2021 and 2022 have made investors realize what is at stake. Thankfully, many companies took advantage of the high valuations and IPO’d or brought shares to market to raise significant levels of cash. This stimulus allowed many companies to gain 3-5 years’ worth of cash in one go. Now, it is up to investors to find who will make the most of that money. Beam (NASDAQ:BEEM) is one such company who has ramped up production and is set to grow revenues by over 100% in 2022 thanks to their EV solar charging port.

BEAM

Beam Products Vs Competition

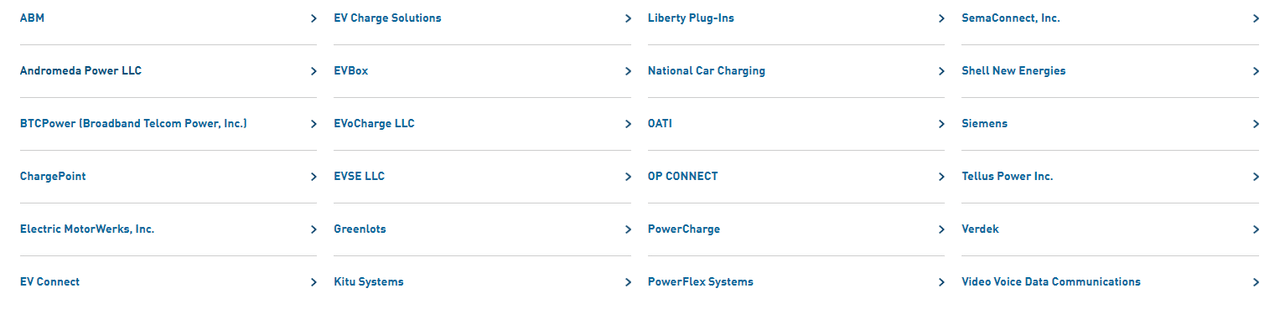

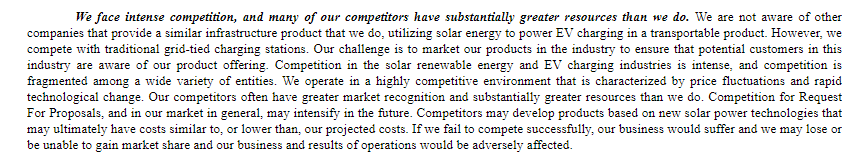

The major problem that I find with Beam is that many believe their product to be groundbreaking, the peak of innovation. However, I find this untrue, and unfair to the dozens of EVSE developers and contractors out there. In fact, it is quite easy to see how strong the competition is, as PG&E has a list of almost 30 partner contractors who are able to work with clients in building a charging port of any size. Even if Beam is listed on the website, they may just be passed up as potential customers scroll by. Regardless of whether the Beam product works or has a minor time advantage, there will always be cost, supply & demand, and experience issues that prevent meaningful growth. Beam is not developing the next miracle drug, and so it is important to not value it like that.

PG&E

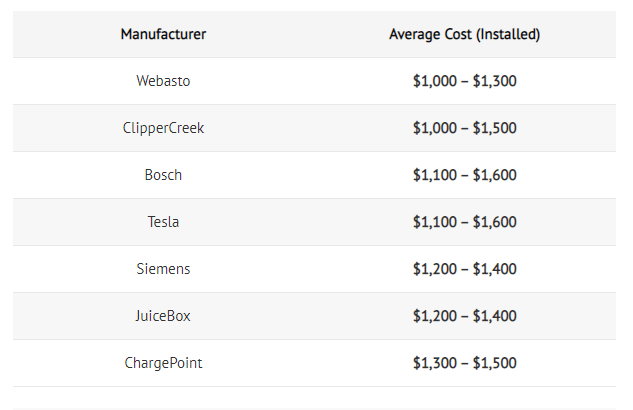

A few months ago, my apartment complex converted 6 parking spots to EV charging spots in less than a week, although they are not covered with solar. While I have no information on the demand for solar vs normal EV ports, I assume that the majority of applications are not solar. Multiple factors including cost, time to establish, and scalability all are superior for non-solar stations. Therefore, customers looking for a cheap option will choose a normal $1,000 to $2,000 per unit bollard-style charge station. No need for a clumsy, potentially unsightly, solar port.

Considering that the price has been estimated to be around $65,000 USD, there is a significant gap in customer wealth to consider. Not everyone needs a solar and battery-powered unit, but I am sure Beam will have their niche. I will just expect a slower growth rate into the future as the niche becomes smaller. As is already distinct, the company mostly can only gain contracts with municipalities such as cities and states, and the reduced private enterprise investments may be a signal towards poor cost efficiencies. Cities gain popularity from these types of investments, while most other organizations are looking for value.

Climatebiz

Growth

The first couple million in sales and backlog are the easy part, the hard part is to continue innovating and producing products while maintaining profitability. Many companies have had to return to losses in just a few years after production. Names like Clean Energy Fuels (CLNE) and Green Plains (GPRE) offer looks into how growth may occur, but losses remain. On the renewables side, Infrastructure and Energy Alternatives (IEA) offers insights into how profitability and valuations are quite low. We can also compare to one major EV charger brand ChargePoint (CHPT), and I will discuss this comparison later.

BEAM 10-K

For fiscal year 2021, Beam earned $9 million in revenues, while orders and deliveries improved by 134% and 47% respectively. This is a new high for the company, as 2018, 19, and 20 saw revenues of $6.2, $5.1, and $6.2 million respectively. This poor growth is a major concern as it may indicate numerous problems. The current backlog also does little to support a positive 2022, as it is only $4.1 million, with $3.9 of that due this year. Whether this is for full production of EV ARCs – estimated at 260 per year – or not, I find current growth expectations for the company to be quite high.

The company’s supposed competitive advantage is at risk if sales are not growing at a rapid clip. While on paper the Beam products seem advanced, innovative, and desirable, issues due to the cost and alternative options may be a major reason for the lack of growth. Second, the issue may be due to a long and expensive production ramp-up process, which may continue indefinitely. Continued losses over the next few years may wreak havoc on the company’s valuation. However, there are a few potentially positive points to consider.

In February, the company announced that they purchased AllCell Batteries in order to provide a cheaper source of Li-ion storage. However, the small problem is that AllCell has, 1.) took over 20 years to develop their specialized thermal regulation technology (which remains commercially and economically unproven), and 2.) is another small business like Beam that increases the need for further production costs. This information is from 2020, and I have not found any new updates on the success of their market research. I assume favorable data has come out otherwise Beam would not have purchased them. While I hope to see improved margins and growth from this acquisition, I find risk exists in the long term as losses perpetuate and growth stalls.

Now with the continued rise in electric mobility and ongoing improvement in lithium-ion battery affordability, AllCell is working with NREL again, this time with another Center for Integrated Mobility Sciences research engineer, Chuanbo Yang.

The team will be testing the properties of the composite and battery management system to see how they best fit with fast-charging stations.

They will also be running techno-economic calculations to see where the technology fits in the marketplace: who would be interested in buying, what justifies an investment in their composite, and what the competing technologies are.

“As an entrepreneur, unbiased third-party validation has always helped us to answer questions in the marketplace, to evaluate what we have before we go out and make claims,” said Al-Hallaj.

In fact, the researched-focused CEO said Al-Hallaj went on to find another energy storage company, NETenergy while waiting for commercial success of AllCells. However, the recently updated website now states that the company will be expanding their production scale in 2021 and 2022, which hopefully brings supply up to par with Beam demand. I will recommend investors watch how the companies mesh into the future for both profitability, growth, and innovation.

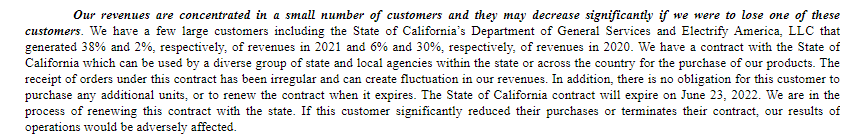

The good aspect of growth for Beam lies in the fact that the fiscal spending environment has led to many municipalities around the US to purchase the units. In fact, the company recently announced a State of California contract for 52 EV ARC systems. In fact, California State funding and local municipalities account for 55% of revenues in 2021, according to the recent earnings report. However, I find this reliance on local and state spending is a double-edged sword as typically the contracts are a single occurrence to test the system and have a favorable press release, but lacks long-term revenue base. What if the recent inflationary and recessionary pressures prevent spending on these types of expensive Beam products rather than cheap EV bollards? Already there is pressure as the CA contract is set to expire, and no news on an extension is present. The image below highlights this risk factor.

BEAM 10-K

In particular, I find there is some risk for the EV Arc product for their certified wind load of 120 mph. If any major storm system, hurricane, tornado, or other wind event causes damage due to exceeding that load limit, I find that litigation and broken contracts may prevent more public spending on the products. Will the company not be able to sell in the Southeast US? However, I find risks associated with the current lack of EVs on the road to be a temporary issue as major companies such as Rivian (RIVN), Ford (F), Tesla (TSLA), and more increase their EV offerings in the next few quarters. Let us perform some calculations to determine how the current growth rate stands up to the valuation.

Valuation

With $9 million in sales for 2021 and a current $250 million market cap, Beam has a trailing price to sales of 25x. This is surprising in today’s market as most renewable names have fallen well below a 10x P/S, no matter how much growth they see. Considering Beam has a flat growth rate over the past three years, and essentially no commercial sales before that, there is little evidence to support such a high valuation. Second, the current backlog only provides transparency for $3.9 million in revenues over the next 12 months, and so, more contracts must be earned. Lastly, the company provides little in terms of guidance. The last earnings call had management claim a $90 million available pipeline, but it is unknown how fast this will play out for Beam.

To understand the 2022 potential, we can use the Wall Street analyst estimates that expect an average of $18 million in revenues for 2022. This would be an increase of 100% YoY, and far higher than any stage prior, especially compared to the current 45% growth YoY. To reach this, the company must sell at least 250-300 units for the year. This would be at full operations for Beam as the company can only produce approximately 260 EV Arcs per year at the moment. Significant increases in operations at the facility will eventually allow for 4,000 per year, but it is unknown when this will be possible or true for the company. Therefore, the company has stated that prices per unit have been increasing to address production costs and improve the bottom line. At 260 units sold for 2022, the company must average a price per unit of $70,000.

Performing calculations for the share price offers a tale of two distinctly different outcomes. First, if the valuation remains close to the same, ~20x P/S, then investors are likely to see between 17% and 63% return over the next year. At the same time, if the valuation becomes more reasonable at a 10x P/S, then investors are set to see a decline between 19 and 42%. As such, The outcomes are volatile, and I find the downside risk is more plausible. Why such a low valuation? Well, first is the fact that the State of California contract is due to expire in June 2022 and has not been renewed as of yet. Failure to do so will significantly impact revenues as the state accounts for 50% of revenues. Further, the company offers no insight into another major revenue source, Electrify America, who may not continue with their purchases.

|

Revenues FY 2022 |

$13 million (45% increase YoY) |

$15.5 million (halfway growth) |

$18 million (100% growth YoY) |

|

% Gain at 20.0 P/S |

16.7 |

40.0 |

62.2 |

|

% Gain at 10.0 P/S |

-41.1 |

-30.0 |

-18.7 |

Another way to understand why I believe the valuation is high is by comparing to other innovative, high-growth renewables companies. The table below compares the valuations and historical/Wall Street expected growth rates of various companies.

|

Company |

Price to Share |

FWD Analyst Growth Rate FY 2022 (%) |

3-Year Revenue Growth Rate (%) |

|

Beam Global |

24.6 |

107 |

13.5 |

|

iSun (ISUN) |

0.95!! |

250 |

41.5 |

|

ChargePoint |

18.8 |

72 |

37.8 |

|

Blink (BLNK) |

48.4 |

98.3 |

|

|

EVgo (EVGO) |

37.9 |

130.2 |

11.5 |

|

Tesla |

18.0 |

53.9 |

35.9 |

Oh wait, the entire EV industry is overvalued except for iSun. As a reference point, iSun just obtained a $29.3 million contract for almost 1800 off-grid solar canopy charging units and has a legacy renewable energy EPC business to support new EV innovations. Perhaps Beam investors do have a chance for gains then. The industry is set for tremendous growth, but one has to consider volatility at these levels. If Beam can meet their targets, and the rest of the industry performs well, then valuations will remain skewed towards to the high side.

Conclusion

As a result of my research, I find the outlook for Beam to be both positive and negative. While the growth rate and valuation are right amongst peers in the EV charging industry, I find the entire industry overvalued. Losses and competition abound. Perhaps Beam is the best choice for the industry then? The company must first work on meeting their full production capacity, grow their customer base, and hopefully maintain their contract with the State of California. The recent acquisition of an innovative battery company adds diversification and supports their innovation of products, but it is yet unknown how impactful this will end up.

I see the company ending up as a niche, almost luxury provider that is relegated to slower growth than mass production peers. As such, the company must scale back operating costs to a meaningful level, and increase the cost of their products. I find if they meet this target, they can have meaningful and sustainable growth of revenues, earnings, and shareholder returns through the years. However, there is too much risk at the moment, and I will remain on the side.

Am I being too strict and pessimistic? Let me know in the comments!

Be the first to comment