ArtemisDiana

Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) is a $1.7bn biopharma company which uses the Recursion OS, or Operating System, methods that it claims makes the drug discovery process more efficient. I can’t claim to have understood the whole thing very clearly. Apparently, they use artificial intelligence to sort through petabytes of data to make the discovery funnel wider at the top and narrower as it approaches later stages. I get the concept, but I guess us traditionalists need to see the data to be convinced.

I spend some time trying to understand what they are all about, and the sentence that threw some light is this one from their 10-K:

Using data from a small subset of CRISPR-based gene knockout and small molecule profiling experiments, we built our first real map of biology in which we used machine learning and AI to predict how any two tested genes or molecules might interact with each other, even without physically testing them together.

Companies work through thousands and thousands of molecules in the lab before they arrive at one with therapeutic benefit. The approach here is to use these AI tools to make this process quicker. At the heart of it, biology is just mechanics. Mechanics is predictable. As the company says:

If we could predict whether different actions on biology (e.g. a gene knockout, addition of a protein or a small molecule) might interact with other actions on biology without testing all possible combinations, we could scale our exploration exponentially; the results of a set of physical experiments that might take 1,000 years to conduct using our previous approach could now be predicted after just a few months’ worth of data generation, and the best of those predictions could potentially be navigated to new medicines.

So far so good, but this is a vast, paradigm changing endeavor, and at least for the initial companies doing this sort of work, they have to do both; map their approach to traditional medicine in order to prove the concept. Thus, we need to look at their pipeline, and their data, and its success – the old-fashioned way.

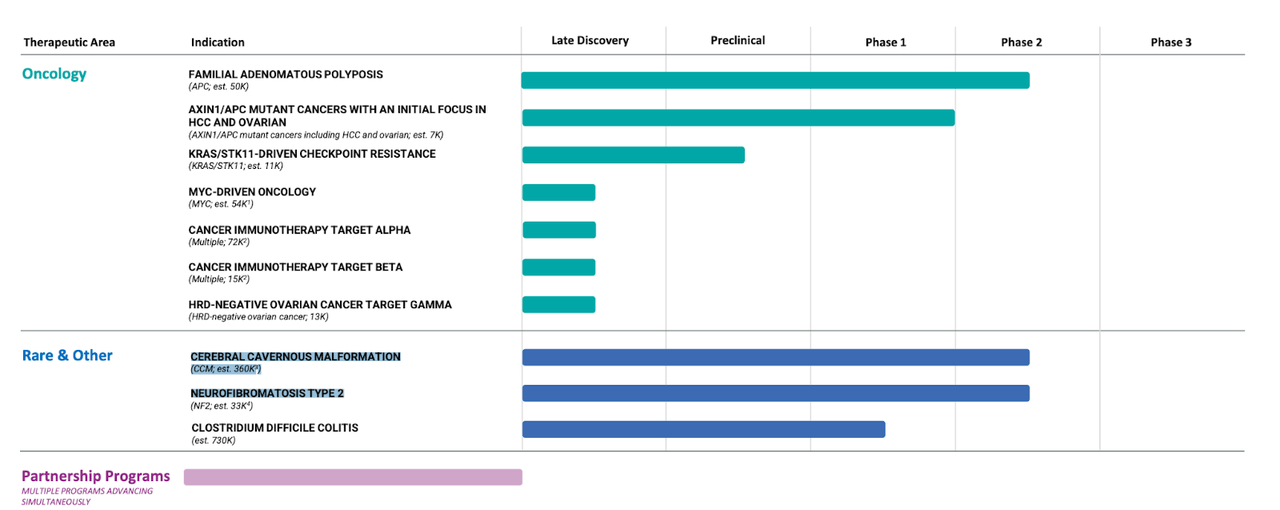

The pipeline looks like this:

RXRX pipeline (RXRX website)

The pipeline is extremely diverse. There are 3 phase 2 programs, one in oncology – Familial Adenomatous Polyposis, and two in rare diseases – Cerebral Cavernous Malformation and Neurofibromatosis Type 2. Two months ago, the company said it will end development on REC-3599, a drug candidate for GM2 gangliosidosis, to put more focus on cancer.

Now we come to the crux of the problem – lack of clinical data. The company has been in existence for almost a decade, there’s all those mid-stage trials, but there’s nothing in the earlier stage – here. The company seems to have jumped right from the lab into phase 2 trials – and these will read out 2, 4 and 5 years down the line. That could be what their AI approach is all about, but like I said, the first pioneer has to do it the hard way. All that AI is fine, but unless they quickly prove themselves in the traditional way, they will find little traction in the market. And that’s exactly what has happened with this stock. Despite logical-sounding theories, a number of big pharma collaborations, and a diverse pipeline, the stock has gone downhill almost from the IPO.

There is laboratory data, however, as follows:

Single agent and in combination with olaparib in HRD-negative ovarian cancer CDX and PDX models showed durable efficacy – including 100% complete response

Reduction in tumor growth vs anti-PD-1 alone in both CT26 checkpoint resistance and EMT6 models – including 40% and 80% complete response in combination in each model, respectively

REC-64151 restores anti-PD1 (aPD1) response of STK11 mutant CT26 tumors (Fig. A, B) and demonstrated enrichment of CD8+ T-cells

I put together all the preclinical data I could find on the corporate deck. I don’t put much stock to preclinical data except to show that there’s some background to the molecules being tested.

Recursion has a partnership with Bayer in fibrosis and with Genentech in neurosciences. The Bayer partnership consists of $30mn upfront and $50mn equity investment, plus up to $1.2bn in milestones for around 12 programs. There’s also mid single digit royalties. The Genentech program consists of $150M upfront and up to or exceeding $500M in research milestones. It also has around $300M in possible milestones per program for up to 40 programs, plus there’s mid-single digit royalties.

Financials

RXRX has a market cap of $1.73bn and a cash balance of $454mn. Research and development expenses were $40.8 million for the third quarter of 2022, while general and administrative expenses were $19.5 million. The company is funded for 8-10 quarters at that rate. Swedish investment company Kinnevik made a private placement of $150mn in October, which is not included in the cash balance.

Bottom Line

Recursion Pharmaceuticals, Inc. is about 2 years away from any kind of clinical data. Its partnerships and promises have valued it quite high, however the stock is on a steady downward trajectory. Data is its main hurdle right now, data and a catalyst desert looming ahead for 2 years. At this time, nothing can be said about Recursion Pharmaceuticals, Inc.’s investability. We have to wait for data.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment