minemero/iStock via Getty Images

Energy Transfer LP (NYSE:ET) is one of the largest midstream companies that’s seen its share price drop roughly 10%. The company has a market capitalization of just over $36 billion and a 9% market capitalization, which highlights the company’s financial strength. As we’ll see throughout this article, Energy Transfer has the ability to continue driving returns.

Energy Transfer Updates

Energy Transfer has had continued strong improvement with its portfolio.

Energy Transfer Investor Presentation

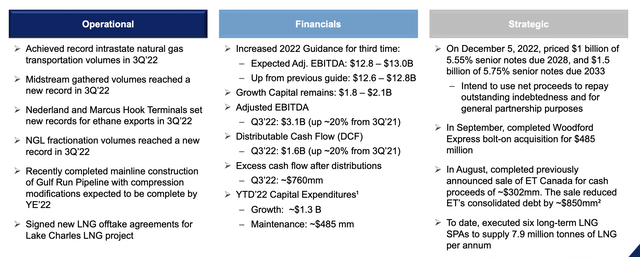

Energy Transfer has continued to perform well. The company achieved record volumes in the 3Q 2022 and gathering volumes in particular have remained strong, which shows a substantial amount of continued supply. The company has continued to expand LNG volumes, a high-margin long-term demand item.

The company has increased its 2022 guidance once again, with expected adjusted EBITDA at $12.9 billion and roughly $2 billion in growth capital. The company’s 3Q DCF was $1.6 billion, or $6.4 billion annualized, a 20% DCF field. The company is continuing to maintain its 9% dividend with almost 10% in post dividend DCF.

It’s also worth noting that the company is continuing to keep maintenance capital low when investing heavily in long-term growth. The company has managed to price some notes at reasonably strong percent rates, however, it has $10s of billions of debt that are expired to rising interest rates.

Energy Transfer Reliable Cash Flow

The company has continued to generate reliable fee-based cash flow.

Energy Transfer Investor Presentation

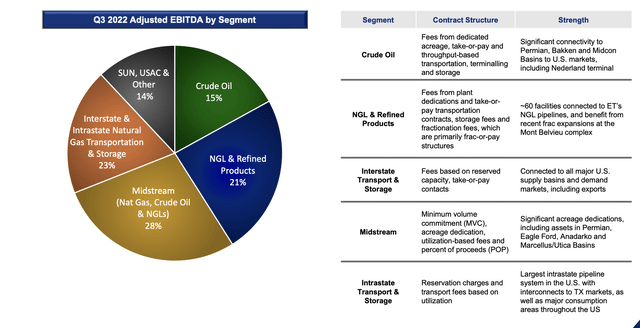

The company has diversified cash flow from a variety of assets including assets with long-term potential such as NGL. These assets will have long-term demand even if gas and crude oil demand declines. The company’s fee-based contracts will help the company continue to generate reliable free cash flow (“FCF”), making the company able to provide long-term shareholder returns.

Energy Transfer Insider Investment

The company continues to have strong and continued investment from insiders.

Energy Transfer Investor Presentation

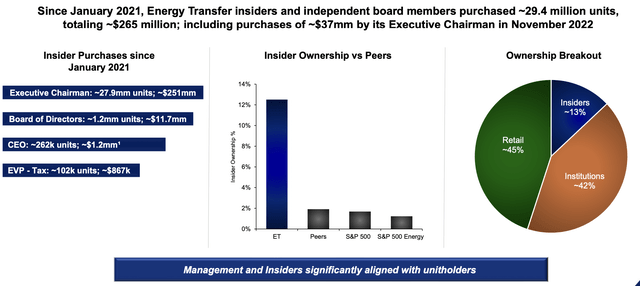

The company has more than 12% insider ownership, making it incredibly popular versus its peers. The company has strong diversification of investment between retail and institutions. The company has seen $265 million in new investments since January 2021 across 29.4 million units, with a new $37 million purchase in the last month.

That continued insider investment will continue to support high dividends for shareholders.

Energy Transfer Capital Investment

Despite its substantial debt, Energy Transfer continues to invest heavily in its business which we’re in-between on.

Energy Transfer Investor Presentation

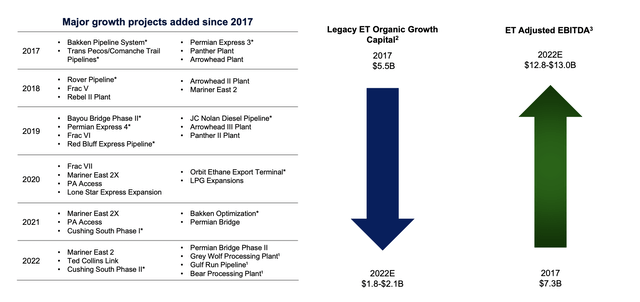

Energy Transfer has substantially reduced its annual growth capital to roughly $2 billion annualized. That’s enough for the company to take advantage of numerous incremental growth opportunities, and we expect the company to be able to generate a double-digit yield on invested capital. Still we’d like to see it manage its debt more than massive investments.

Shareholder Return Potential

Energy Transfer has a dividend of more than 9%, forming the core of its ability to continue generating shareholder rewards. The company has continued to opportunistically repurchase shares, and invest in growth capital at double-digit returns. However, the company has been reluctant to aggressively pay down its debt.

We’d like to see the company focus on debt, especially in a higher interest rate environment, however, the company has continued to achieve a strong interest rates on its debt.

Thesis Risk

The largest risk to the thesis is declining volumes. Energy Transfer is spending billions on assets with a multi-decade outlook, and predicting that far out is incredibly hard. Should the company’s planning not pan out, especially with its debt loads, it could quickly push the company towards a difficult position for its asset portfolio.

Conclusion

Energy Transfer has a unique and strong portfolio of assets. The company has a manageable debt load of just over $40 billion and despite the rise in interest rates, it’s continued to achieve strong interest rates on refinancing. The company continues to have a dividend yield of just over 9%, that it can comfortably afford.

Energy Transfer is continuing to invest in growth capital to the tune of $2 billion annually, where it is generating strong returns. However, we would like to see the company aggressively pay down debt to improve its financial positioning. Otherwise, a decrease in volume demand could hurt the company’s abilities to drive future returns.

Be the first to comment