OliverChilds/E+ via Getty Images

I’m considering buying Duke Energy’s (NYSE:DUK) common shares as part of a pivot away from my pandemic-era strategy that prioritised capital growth primarily from riskier stocks in near esoteric but fast-growing industries. To state that these have been hit disproportionately harder in the market rout over the last year would be an understatement. Hence, buying Charlotte, North Carolina-based utility Duke Energy could come to represent a hard pivot to a relatively low volatility and low-risk sector. The ambition is to make a break for stability and income and Duke’s recent historical performance conveys this.

Duke serves 8.2 million households and owns 50 GW of energy capacity. The company also owns a natural gas unit that supplies gas to 1.6 million households in a number of states including Tennessee and Ohio. Duke is currently executing the long-term transition of its energy capacity to clean energy sources in pursuit of net zero with the aim of a 50% carbon reduction from its electric generation by 2030.

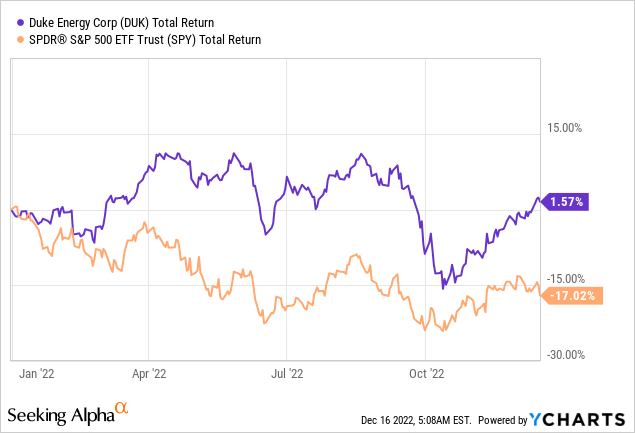

Compared to investments in some other sectors, utilities do not come with the same potential for ultrafast capital returns, but they do come with significantly more stability and can act as a defensive position. In a year the S&P fell 17% on a total return basis and industries from SaaS to video gaming to fintech are down more than 50%, Duke has been able to push out a 1.57% return. The need for this bulwark-like stability will be heightened in 2023 with 98% of company CEOs expecting a recession.

The Preferred Option

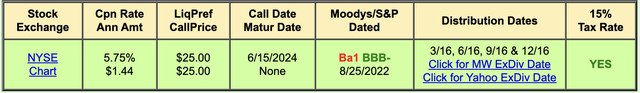

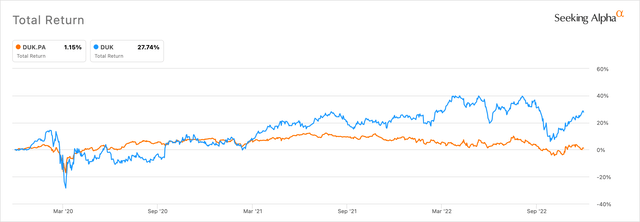

This has nearly rendered redundant a position in its Series A Cumulative Redeemable Perpetual Preferred Stock. Indeed, whilst the preferred pay out a $1.44 coupon annually for a 6.03% dividend yield, higher than the 3.92% yield on the commons, they’ve underperformed.

QuantumOnline

The commons are up nearly 28% on a total return basis over the last three years, this compares to a return of 1.15% for the preferred stock. This might change going into 2023, but I fail to see any core reasons for long-term investors to buy the preferred over the commons.

Seeking Alpha

However, the Series A currently trade at $23.90, just below its $25 redemption value. With a June 2024 call date, preferred holders could definitely argue that they form a near-guaranteed source of positive returns over the next year and a half. Assuming a purchase today and a Duke redemption at the end of June 2024, a holder would expect to earn an income of around $3.26. This amounts to a 13.6% yield to call. Hence, preferred owners might very well argue that broader market volatility expected in 2023 would make the preferred a stronger option.

Stability And Strength

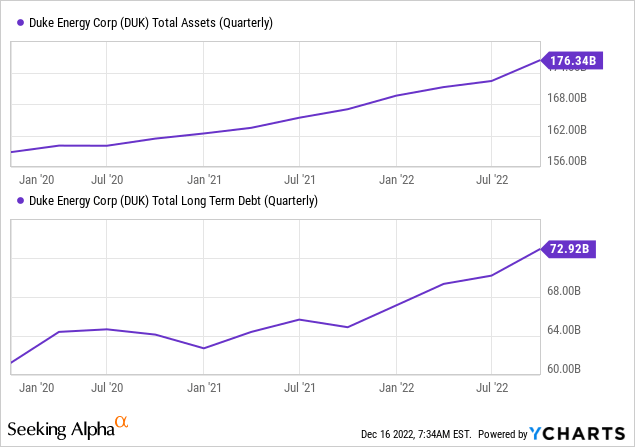

Duke last published revenues for its fiscal 2022 third quarter saw adjusted EPS come in at $1.78, down from $1.88 in the year-ago comp with the 5.3% decline due to fewer commercial renewables projects placed into service as well as higher interest expenses. The company held total long-term debt of $72.92 billion, less than 42% of total assets as of the end of the quarter.

With a total market cap of $78.9 billion, Duke trades at 1.63x its price-to-book ratio. This is 15.7% lower than its sector median’s 1.94x price-to-book ratio but is of course higher than 1x.

Duke is guiding adjusted EPS for its full fiscal year 2022 to come in a range of $5.20 to $5.30. At the midpoint, this would just be a $0.01 cent increase from adjusted EPS of $5.24 in fiscal 2021. This is expected to grow to a range of $5.55 to $5.75 in fiscal 2023 and then between 5% to 7% for the next few years until 2027. A broad risk to this comes from substation attacks which heavily disrupt electricity flows to customers and are costly to fix. Earlier in December, an attack at one of Duke’s substations in North Carolina left tens of thousands of its customers without electricity.

This comes as Duke completes a strategic review of its commercial renewables business. The company intends to fully dispose of this unit and has received indications of interest for the utility-scale business at attractive valuations and expects to announce a definitive transaction in the first quarter of 2023 and close as early as midyear. The company is also preparing the sale process for its distributed generation business and expects to follow a similar timeline. The majority of the proceeds from both transactions will be used to reduce long-term debt. This will strengthen the balance sheet and allow the company to fund its clean energy transition along with common equity issuances through at least 2027. Adjusted EPS guidance takes these disposals into account and sets the backdrop for the common shares over the next few years. I will look to initiate a position before the end of the year.

Be the first to comment