imaginima

Enterprise Products Partners L.P. (NYSE:EPD) is one of the largest and most well-known midstream partnerships in the United States. The company has long been a favorite among income-focused investors due to its historically high yield, which stands at 7.65% as of the time of writing. It reinforced the confidence of this group of investors back in 2020 as it was one of the midstream partnerships that did not need to reduce its distribution. In fact, the company has a history of steadily increasing its distribution over time. This is something that is quite nice in our current inflationary economic environment since it helps maintain the purchasing power of the distribution. The company is certainly not resting on its laurels; however, as it does still have some growth potential that we should certainly not ignore as it should allow the company to continue with its historical track record. There are plenty of other reasons to like the company as well, some of which we will discuss in this article. Overall, though, Enterprise Products Partners is a company that belongs in the portfolio of any investor that is interested in the generation of income.

About Enterprise Products Partners

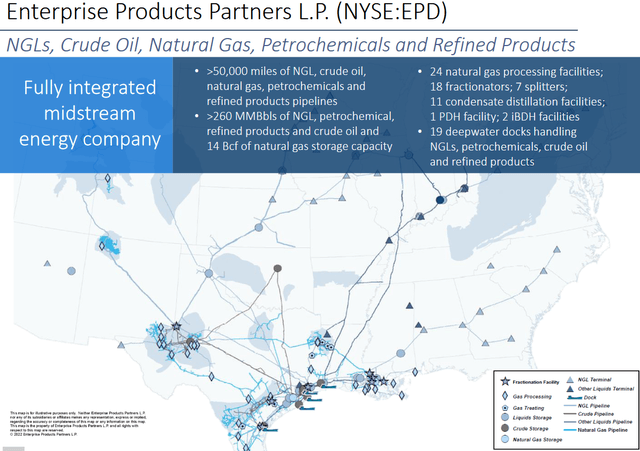

As stated in the introduction, Enterprise Products Partners is one of the largest and most well-diversified midstream partnerships in the United States. The company owns more than 50,000 miles of liquids and natural gas pipelines, 260 million barrels of liquids storage, fourteen billion cubic feet of natural gas storage, 24 natural gas processing plants, eighteen fractionators, and many other types of related infrastructure:

Enterprise Products Partners

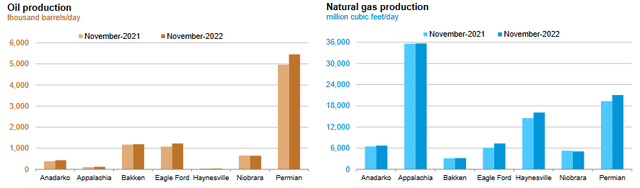

One of the things that we notice is that while the company’s infrastructure spans most of the central and eastern parts of the United States, it is primarily focused around the Permian Basin and the Gulf Coast. This is not exactly surprising since this has long been the center of America’s energy industry due to the substantial mineral wealth of the Permian Basin. The basin is by far the largest source of crude oil and natural gas in the United States and one of the largest in the world. The Permian Basin has also been a beneficiary of the high energy prices that have dominated the industry for the past two years. We can see this in the fact that the production in the basin has been increasing:

U.S. Energy Information Administration

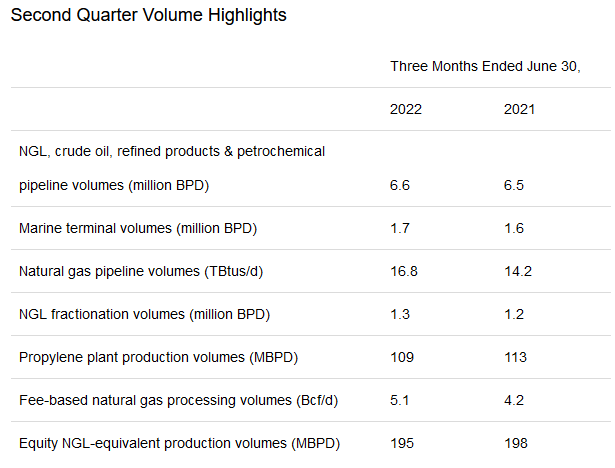

Enterprise Products Partners benefits from this despite the fact that it does not actually produce any crude oil or natural gas. This is because of the business model that the company uses. Basically, Enterprise Products Partners enters into long-term (usually five to ten years in length) contracts with its customers under which the customer sends resources through Enterprise Products Partners’ pipelines or utilizes its storage facilities to store their resources. The customer compensates Enterprise Products Partners based on the volume of resources transported or stored. This provides Enterprise Products Partners a great deal of insulation against fluctuations in energy prices since its pricing structure is not dependent on the value of the hydrocarbon products. It does benefit from producers increasing their production though since that should generally result in rising volumes. The company did indeed see this in the second quarter of 2022 (the most recent quarter that has been announced as of today):

Enterprise Products Partners Earnings Press Release

This was one of the major factors that allowed the company to increase its distributable cash flow from $1.599 billion to $2.018 billion over the period. Although the company does generally benefit from rising production, which tends to accompany rising energy prices, the company is not significantly hurt by declining volumes that may accompany falls in crude oil and natural gas prices. We saw this back in 2020 when numerous upstream producers cut their production. This is because the company’s contracts include something called minimum volume commitments. These commitments specify a certain minimum volume of resources that must be sent through the company’s infrastructure or paid for anyway. These commitments therefore effectively guarantee the company a certain amount of baseline revenue and cash flow, which add a significant amount of support to the distribution. This is something that any income-focused investor should appreciate.

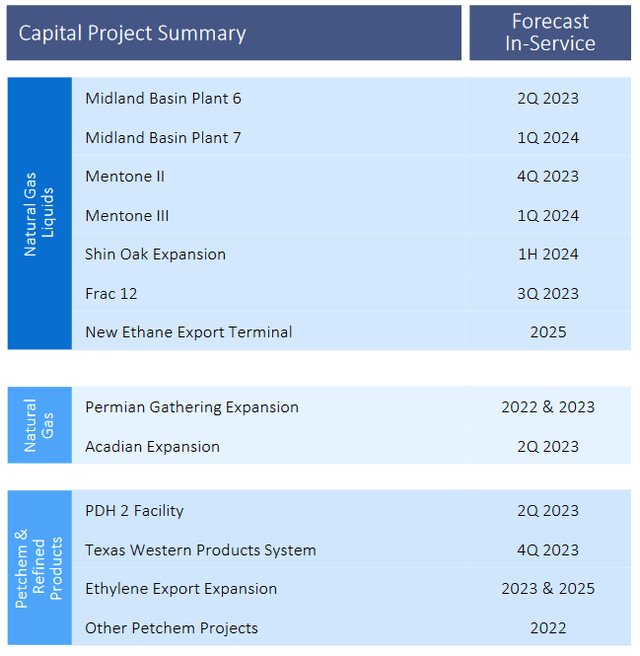

As I have pointed out in various previous articles, such as this one, the demand for crude oil and natural gas is expected to increase going forward. This supports energy prices remaining at much higher levels long term than most of us are used to as upstream producers are unlikely to increase production sufficiently to meet the demand growth. However, it does seem likely that producers in the United States will increase their production somewhat in order to take advantage of the positive environment for the sector. Enterprise Products Partners is positioning itself to take advantage of the higher volumes that would accompany this. We can see this in the fact that the company has a number of growth projects under construction. This is necessary because the company’s infrastructure by its very nature can only handle a limited supply of liquids or natural gas. Therefore, the only way that the company can significantly increase the volume of resources that it can handle is by constructing more infrastructure. Enterprise Products Partners currently has $5.5 billion worth of projects under construction at various stages of development:

Enterprise Products Partners

One of the nice things about these projects is that the company already has contracts in place from its customers for the use of this infrastructure. This provides two advantages to the company. The first of these is that it can be certain that it is not spending a great deal of money to construct infrastructure that nobody wants to use. The second advantage is that Enterprise Products Partners knows in advance how profitable each project will be in advance so that it knows that it will earn a sufficient return to justify the investment. We can also be sure that each of these projects will begin contributing to Enterprise Products Partners’ financial performance once it begins operating. As we can see, the company’s projects are generally coming online over the 2023 to 2025 period, although it does have a few projects coming online over the remainder of 2022. Thus, it appears that Enterprise Products Partners is positioned for steady cash flow growth over the next few years.

Another potential source of growth materialized earlier this year. Back in January, Enterprise Products Partners announced the acquisition of Navitas Midstream Partners LLC for $3.25 billion in cash. The company did not use any debt to complete this transaction, which is nice because it allows Enterprise Products Partners to maintain its balance sheet strength. The acquisition added 1,750 miles of pipelines and approximately one billion cubic feet of natural gas per day processing capacity to Enterprise Products Partners’ infrastructure network. The most important contribution that Navitas adds to Enterprise Products Partners though is that it expands the company’s operations to the Midland Basin. This is a region that Enterprise Products Partners had no exposure to but it is seeing very strong production growth. The company completed the acquisition several months ago so it was likely another factor that contributed to the increased cash flow that Enterprise Products Partners reported during the second quarter of 2022. However, it is worth noting that it will not see the full impact from the acquisition in 2022 since it will not have owned the assets for the entire rather. The company does state that it expects to generate a distributable cash flow of $0.18 to $0.22 per share in 2023 from the former Navitas assets. This will likely result in a distribution increase, which is nice for any investor that is currently feeling pinched by the rising costs for nearly everything across the economy.

Financial Considerations

It is always critical to have a look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. This is typically accomplished by issuing new debt to repay the existing debt at maturity since few companies have the ability to completely pay off their debt with cash. This can cause a firm’s interest costs to increase following the rollover depending on the conditions in the market. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes cash flow to decline may push a company into financial distress if it has too much debt. Although midstream companies like Enterprise Products Partners tend to have very stable cash flows, bankruptcies are certainly not unknown in the sector. Thus, we should always be cognizant of this risk.

One metric that we can use to measure a midstream company’s level of debt and its ability to pay it is the leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how long it would take a company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. This ratio currently stands at 3.1x based on Enterprise Products Partners’ trailing twelve-month adjusted EBITDA. Analysts generally consider anything below 5.0x to be reasonable so the company clearly meets that requirement. I am more conservative though and like to see this ratio at 4.0x, which is a level that most of the strongest companies in the sector currently possess. Enterprise Products Partners clearly meets this requirement as well. Therefore, it appears that the company’s balance sheet is quite reasonable and we see a lot of financial strength here. Investors should not really have to worry too much about the company’s debt load.

Distribution Analysis

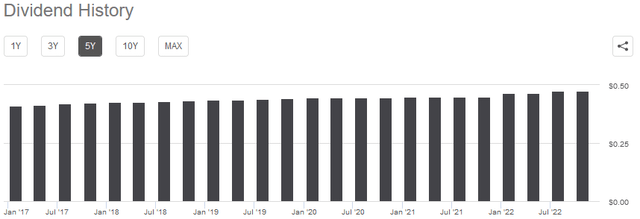

One of the biggest reasons why investors purchase partnership units in midstream companies like Enterprise Products Partners is because of the substantial yields that these entities tend to possess. Indeed, as mentioned in the introduction, Enterprise Products Partners currently boasts a 7.65% yield, which is substantially higher than the 1.63% yield of the S&P 500 index (SPY). Enterprise Products Partners also has a history of steadily increasing its distribution over time:

Seeking Alpha

This is something that is very nice today considering that inflation is currently running at the highest levels that we have seen in forty years. This is because inflation is constantly reducing the number of goods and services that we can purchase with the company’s distribution. Thus, any investor that is depending on their portfolio for income likely feels as though they are getting poorer and poorer. The fact that the company increases the amount that it pays out over time helps to offset this effect and maintain the purchasing power of the distribution. With that said, the company’s increases are generally less than the current rate of inflation so it is still not completely offsetting the ravages of inflation but the increasing distribution is still better than a flat one. As is always the case though, it is critical that we ensure that the company can actually afford the distribution that it pays out. After all, we do not want it to be forced to reverse course and cut the distribution since that would reduce our incomes and most likely cause the company’s unit price to decline.

The usual way that we evaluate a midstream company’s ability to pay its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the limited partners. As mentioned earlier in the article, Enterprise Products Partners reported a distributable cash flow of $2.018 billion in the second quarter of 2022. This was sufficient to pay the distribution 1.9 times over, which is reasonable. Analysts generally consider anything about 1.20x to be reasonable and sustainable. However, I am much more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the distribution. As we can clearly see, Enterprise Products Partners manages to surpass even my more restrictive requirements. Overall, we should not need to be worried much about a potential distribution cut.

Conclusion

In conclusion, Enterprise Products Partners continues to earn its place as one of the best midstream partnerships in the sector for those investors seeking both growth and income. The firm has been benefiting from some of the production growth that we have seen this year, especially in the Permian Basin, as well as being positioned to take advantage of further opportunities. In fact, the company is likely to deliver further growth over the next few years as it sees some of its growth projects come online. When we combine this with a very strong balance sheet and sustainable high distribution yield, the company is clearly deserving of being a core holding in any income-focused portfolio.

Be the first to comment