Lemon_tm

Introduction

Ever since oil and gas prices crashed back in late 2014, W&T Offshore (NYSE:WTI) was battling with difficult operating conditions and burdensome leverage but to their relief, the global energy shortage during 2022 is providing immense help. Apart from lifting their share price, when looking ahead in light of the fundamental improvements they are making internally, they appear like a coiled spring ready to jump higher, possibly as soon as next month when their upcoming results for the third quarter are released.

Coverage Summary & Ratings

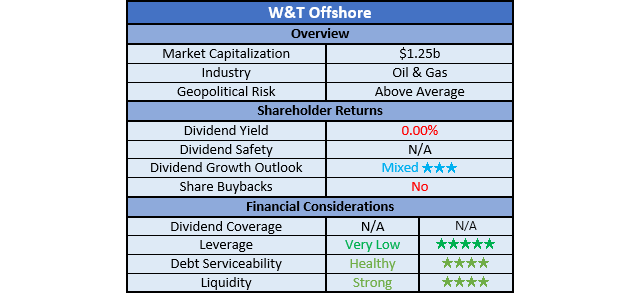

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

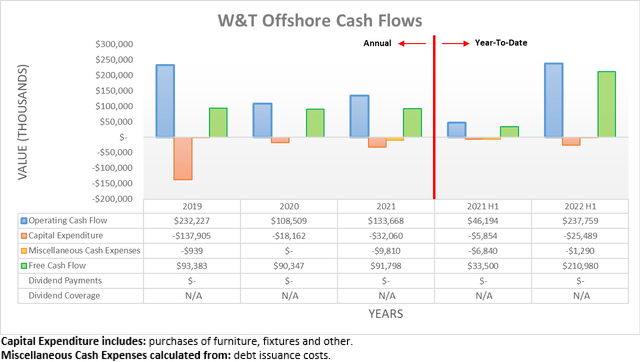

When viewing their cash flow performance, the benefits of the booming oil and gas prices during 2022 are quickly apparent, as their operating cash flow surged ahead to $237.8m during the first half, which represents a more than 400% increase year-on-year. Thanks to their continued restrained capital expenditure, they were able to translate almost the entirety of this into free cash flow of $211m. Even though this already eclipses anything seen during 2019-2021, it was actually materially held back by their working capital movements.

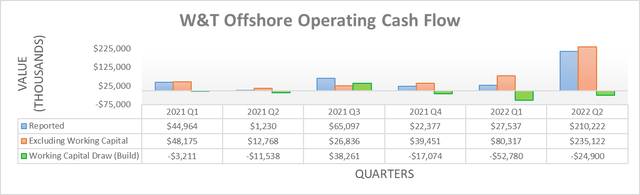

If viewing their operating cash flow on a quarterly basis at the underlying level, which excludes their working capital movements, it can be seen that both the first and second quarters of 2022 saw material working capital builds of $52.8m and $24.9m respectively. Once aggregated, these total $77.7m and thus if not for this temporary impact, their free cash flow during the first half would have actually been nearly 37% higher. Even if ignoring these working capital builds, their reported free cash flow of $211m still annualizes to $422m, which if compared against their current market capitalization of approximately $1.25b, sees an insanely high 30%+ free cash flow yield. Apart from obviously indicating desirable value for their shares, it also points to immense potential for shareholder returns and naturally, many investors are likely pondering their outlook on this front.

Interestingly, when viewing their capital allocation strategy, it makes no mention of shareholder returns during the foreseeable future, as per slide twenty-five of their Barclays September 2022 presentation. Apart from pursuing organic projects and acquisitions, which is par for the course in the oil and gas industry given their assets deplete over time, their focus remains on repaying debt. Whilst this may sound like a hindrance, which is arguably true in the short-term, when looking into the medium to long-term after their 2023 debt maturity, it stands to unlock even more value.

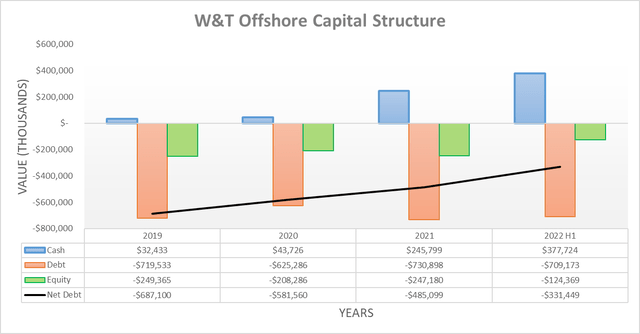

Thanks to their cash flow performance powering ahead along with oil and gas prices, they have materially decreased their net debt during the first half of 2022 with its latest level of $331.4m down almost one-third versus its previous level of $485.1m at the end of 2021. When looking ahead, this is virtually assured to continue because apart from the still supportive oil and gas prices, their working capital build of $77.7m during the first half of 2022 should reverse and thus this alone could wipe out almost another quarter of their net debt and that is before counting their upcoming free cash flow from the third quarter.

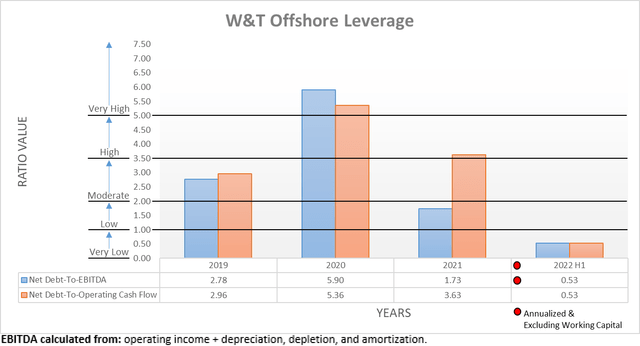

Thanks to their dramatically lower net debt, it helped their stronger financial performance send their leverage plunging during the first half of 2022. As a result, their net debt-to-EBITDA and net debt-to-operating cash flow are both now sitting at only 0.53, which is easily beneath the threshold of 1.00 for the very low territory. Since their net debt should continue trending lower during the second half and likely onwards into 2023, there will be further downward pressure on their leverage, despite oil and gas prices recently softening.

Admittedly, seeing very low leverage during booming operating conditions is not necessarily rare and thus the bigger question is how they would fair if they were to experience a severe downturn, such as during 2020. If their now much lower net debt is compared against their suppressed financial performance during 2020, it would see their net debt-to-EBITDA and net debt-to-operating cash flow at 3.36 and 3.05 respectively. Whilst noticeably higher than their current results, they are still within the moderate territory of between 2.01 and 3.50, which is actually quite good considering it would stem from a severe downturn, thereby highlighting the fundamental improvements they have made since this recovery began early in 2021.

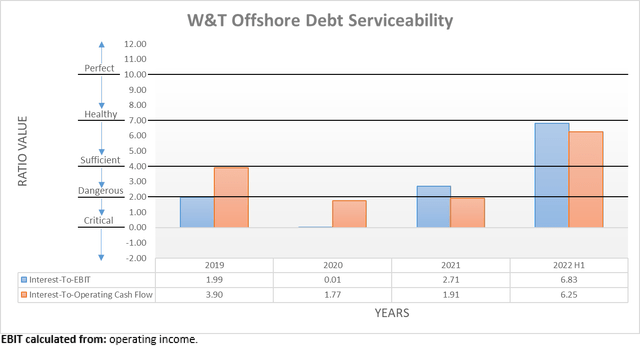

Not only did their leverage see dramatic improvements but so did their debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. Thanks to the same driving forces behind their very low leverage, their interest coverage is now healthy following the first half of 2022, regardless of whether taking an accrual or cash-based approach with results of 6.83 and 6.25 when compared against their EBIT and operating cash flow, respectively. Similar to their leverage, this now carries a margin of safety if they were to experience a severe downturn with further improvements to come following their debt maturity in 2023.

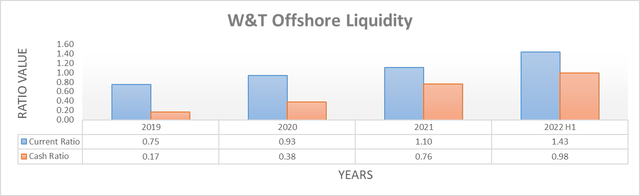

Thanks to their relatively very large cash balance, their liquidity is easily strong with current and cash ratios of 1.43 and 0.98 respectively following the first half of 2022. The biggest hurdle they have to jump on the horizon is the maturity of their senior second lien notes in November 2023, which currently houses $552.5m of their debt, thereby representing slightly more than three-quarters of their total debt of $709.2m. Thankfully, this has not been forgotten at the upper levels of their company with their eyes on refinancing, if possible, as per the commentary from management included below.

“Now regarding our second — our senior second lien notes that are approaching maturity, we continue to monitor the debt capital markets to refinance all or a portion of those notes. Our preference is to refinance the notes with financing, providing longer tenors and market-based covenants at an attractive interest rate. However, should the debt market continue to be difficult to access due to market volatility, there’s a path for us to pay off those notes at maturity.”

-W&T Offshore Q2 2022 Conference Call.

Since central banks have further tightened monetary policy during the following months after this commentary from management, which does not appear likely to change for the foreseeable future, it makes repayment increasingly more likely than refinancing. Whilst refinancing provides an instant and easy solution in the short-term, assuming the interest rates were not too burdensome, there are still benefits with repayments.

Since their senior second lien notes carry a high interest rate of 9.75%, repayment would materially boost their debt serviceability, as alluded to earlier. Furthermore, apart from increasing their financial health, it would also provide a lasting benefit to their cash flow performance via reducing their interest expense by circa $50m per annum. If thinking back to earlier, the first half of 2022 saw free cash flow of $211m or $422m once annualized, which if boosted by circa $50m would represent an increase of circa 12% with the benefit relatively even greater during years with lower oil and gas prices. This should unlock value for shareholders by permanently boosting their prospects for either shareholder returns, organic projects or acquisitions.

Thankfully, their cash balance of $377.7m is already making solid inroads towards funding a complete repayment and with more than one year remaining, they should have no issues generating the remaining circa $180m required. Elsewhere, the remainder of their debt structure relates to their term loan that does not mature until May 2028 and thus once they have addressed their 2023 maturity, they have ample breathing room.

Conclusion

I expect the refinancing or repayment of their upcoming senior second lien notes will act as a catalyst to see either the resumption of shareholder returns or if not, meaningful acquisitions that grow the size of their company. Whilst November 2023 may seem like a long wait, their share price should continue powering higher during the interim as the date nears and risks continue subsiding. If their upcoming third quarter of 2022 results show progress on early repayment or refinancing, their shares may end up climbing higher very soon. Either way, their insanely high 30%+ free cash flow yield makes their shares like a coiled spring with desirable upside on the cards as they jump higher and thus I believe that a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from W&T Offshore’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment