Joe Raedle/Getty Images News

Laredo Petroleum, Inc. (NYSE:LPI) is a small oil and gas company with operations solely in the Midland sub-basin of the vast Permian field. It is benefiting from higher oil and gas prices and laser-focused operations.

Laredo does not pay a dividend, is servicing high-cost debt, and its upside is partially limited by hedges. However, it has a new share repurchase program and has increased its debt repayment target to $700 million by year-end 2023. In 2022, it expects to earn $900 million in free cash flow-triple the level predicted a few months ago. Trailing price-earnings ratio is 8.9 and forward price-earnings ratio for 2022 is a bargain 2.7.

I recommend Laredo Petroleum as a speculative buy to those seeking capital appreciation based on expectations of oil and gas prices, and more particularly for the company’s reorientation toward a higher oil percentage in its production.

I recently bought shares in LPI.

Macro

The Russian invasion of Ukraine and the sanctions against Russia-explicit and implicit-continues to roil global oil and gas markets. Prior to the invasion, Russia produced about 10% of the world’s oil, and exported 5 million barrels per day (BPD) of crude and 3 million BPD of crude products. Russian gas exports supplied about 40% of Europe’s natural gas in 2021.

Russia is redirecting its oil to buyers in China, India, and other non-European countries. It has also been cutting back on its natural gas exports to Europe.

Despite Europe’s need for natural gas, the Biden administration is largely continuing its many anti-hydrocarbon, pro-renewable regulations and policies. In a bizarre move, the administration is urging Saudi Arabia–but not US producers–to supply more oil.

For many reasons, current and expected future inflation is high, leading to substantial uncertainty about additional Federal Reserve interest rate increases.

Laredo’s 1Q22 Results & Guidance

In the first quarter of 2022, Laredo reported a net loss of -$86.8 million or -$5.18/share and cash flows from operations of $170.9 million. Production was 40,300 barrels per day (BPD) of oil and 85,118 barrels of oil equivalent per day (BOE/D), which includes natural gas liquids and natural gas.

The company has been able to contract for its second-half 2022 capex program-no easy task with inflation-and increased its borrowing base.

First-quarter operating expenses were higher than expected. While it is working to offset those costs, Laredo expects cost pressures through the rest of the year.

For 2Q22, Laredo plans total production of about 86,000 BOE/D, of which about 41,000 BPD is oil. It also expects to pay $155 million for matured commodity derivatives.

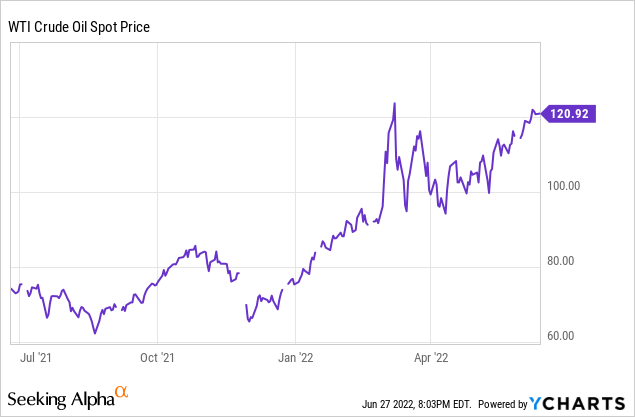

West Texas Intermediate, $/BBL

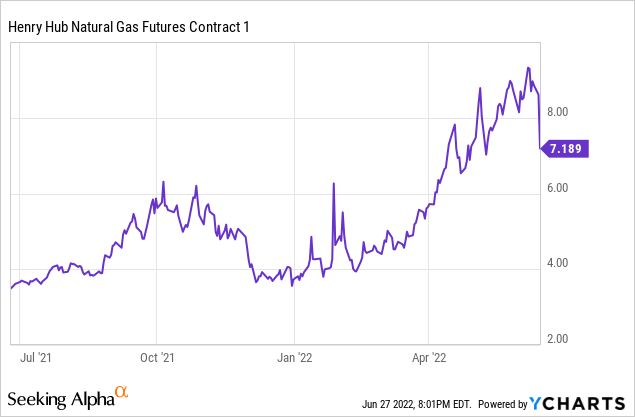

Henry Hub Gas, 1-Month Futures

U.S. Oil & Natural Gas Prices And Oil Production

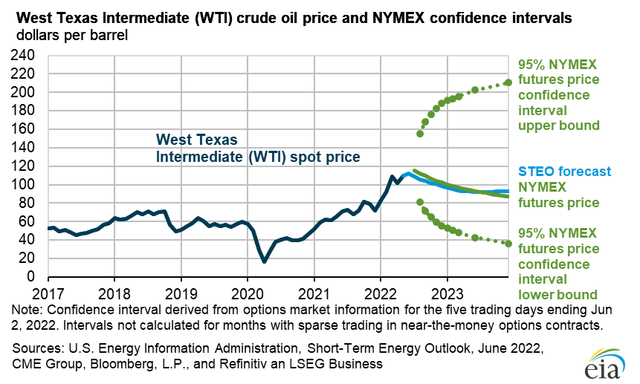

The June 27, 2022, West Texas Intermediate oil futures price (for August 2022 delivery) is $110.16/barrel. The Henry Hub natural gas futures price for July 2022 delivery, was $6.39/MMBTU.

NYMEX strip prices for future months are similarly high but backwardated (lower) for oil and relatively flat for natural gas. Gas prices have been high due to large U.S. exports of liquefied natural gas to Europe and Asia; however, the temporary loss of 17% of U.S. LNG export capacity due to the Freeport LNG accident in mid-June dropped natural gas prices by a few dollars per MMBTU.

For the week ending June 10, 2022, U.S. oil production was 12.0 MMBPD. (U.S. field prod EIA) This is 1.1 million BPD less than the highest-ever level of U.S. oil production of 13.1 MMBPD in February and March 2020.

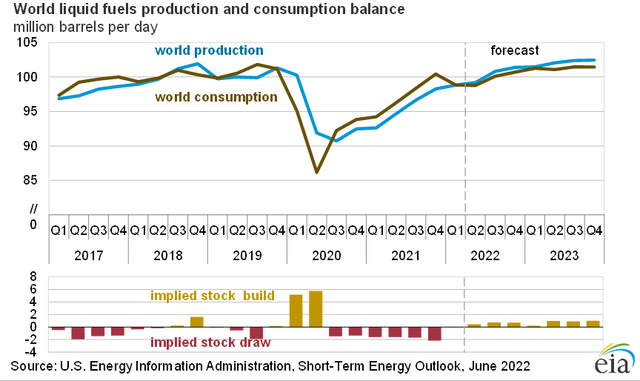

The graphs below show the EIA’s oil supply-demand balance and the current 10-90 confidence interval around future oil prices.

Hedges

Laredo Petroleum’s remaining 2022 hedges on average cover:

*34,000 BPD (or most) of estimated oil production at a weighted floor price of $62.42/bbl;

*9900 BPD of natural gas liquids volume;

*92,000 MCF/D of natural gas production at a weighted average floor price of $3.05/MMBTU, plus a fixed -$0.36/MMBTU decrement for Waha basis swaps.

Some hedges extend into 2023 but at much smaller volumes and higher floors.

Reserves

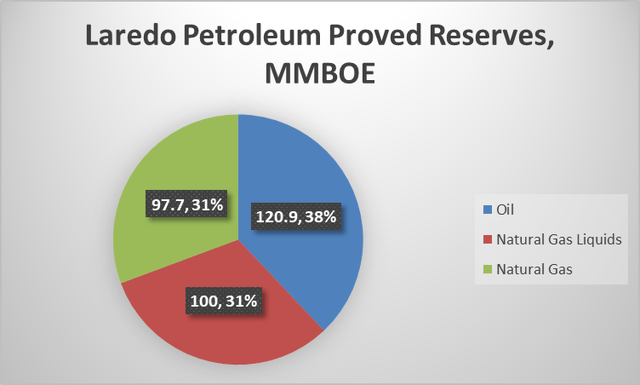

According to Laredo’s 10-K, at December 31, 2021, it had an estimated 318.6 million BOE of proved reserves, of which 73% were proved developed, with an oil percentage of 48%. The SEC PV-10 value of proved reserves was $3.7 billion, using SEC benchmark prices of $63.04/barrel for oil and $3.35/MMBTU for natural gas, both lower than current prices.

Laredo Petroleum & Starks Energy Economics, LLC

Strategy

The Midland sub-basin core consists of parts of nine west Texas counties.

Last year Laredo sold gas acreage in Glasscock and Reagan counties and acquired oilier acreage in Howard and western Glasscock counties to reweight toward oil reserves and production.

Laredo plans 2022 capital expenditures of $550 million (up from $520 million).

Competitors

Laredo Petroleum is headquartered in Tulsa, Oklahoma. As a Midland sub-basin producer, it competes with all Permian producers, e.g. most US shale companies. A few competitors in the Midland sub-basin are Earthstone Energy (ESTE), Diamondback Energy (FANG), and Occidental (OXY). Laredo also has significant competition from private companies.

Competition extends from hiring executives and professionals, to competing for service contractors, equipment, and takeaway capacity, to selling oil, NGLs, and natural gas.

Governance

At June 1, 2022, Institutional Shareholder Services ranks Laredo Petroleum’s overall governance as 4, with sub-scores of audit (5), board (2), shareholder rights (5), and compensation (5). These are stronger, better metrics than just three months ago. (In this measurement, a score of 1 represents lower governance risk and a score of 10 represents higher governance risk.)

Insiders own 6.7% of the stock. At May 31, 2022, 8.6% of the floated stock was shorted.

Beta (stock volatility relative to the market) is an extraordinarily high 3.67.

At March 30, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Blackrock (12.8%), State Street (12.1%), Vanguard (5.9%), Canadian investment firm Maple Rock Capital Partners (3.2%), and private equity firm EnCap–no longer the largest holder–with a stake of 2.3%.

Blackrock, State Street, and Vanguard are signatories to the Glasgow Financial Alliance for Net Zero, a group that manages $57 trillion in assets worldwide and which advocates limiting hydrocarbon investment.

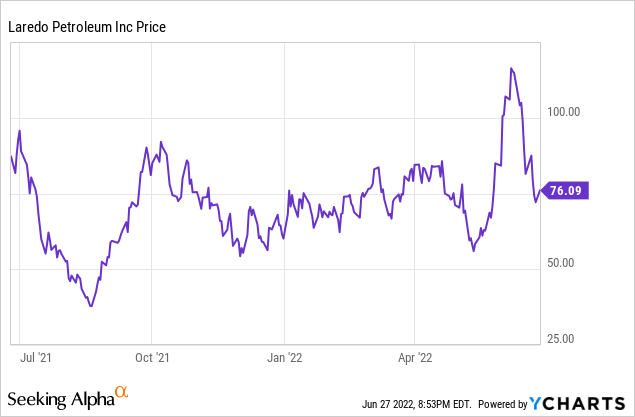

LPI’s Stock & Financial Highlights

Laredo’s market capitalization is $1.32 billion at a June 27, 2022, stock closing price of $76.12/share.

The 52-week price range is $36.25-$120.86 per share, so the closing price is 63% of the high and 58%of the average one-year target price of $131.63/share. Put another way, there is over 70% upside from the current price to the one-year target.

Laredo’s trailing twelve months’ earnings per share (EPS) is $8.53, giving it a low-side trailing price-earnings ratio of 8.9. The average of analysts predicted full-year 2022 and 2023 EPS are $28.57 and $43.91, respectively, for truly bargain price/earnings ratio of 2.7 and 1.7.

Laredo Petroleum does not pay a dividend, but it has implemented a $200 million share repurchase program.

Average analyst rating for is 2.4, or between “buy” and “hold” from 23 analysts.

Notes On Valuation

Laredo’s book value per share of $25.15 is a third its market price, implying positive investor sentiment.

At March 31, 2022, the company had $2.30 billion in liabilities, including $1.42 billion of net long-term debt, and $2.73 billion in assets. This debt includes a $400 million high-rate (7.75%) 8-year bond maturing in 2029.This gives Laredo a liability-to-asset ratio of 84% and a long-term debt to market capitalization ratio of 108%.

The company’s enterprise value is $2.9 billion and the SEC PV-10 value of its reserves is $3.7 billion.

Its ratio of enterprise value to EBITDA is a bargain 6.6 (less than maximum 10.0) and the ratio of net long-term debt to EBITDA is 3.1.

Market capitalization to production is cheap at $15,500/flowing BOE and $32,800/flowing barrel of oil.

Positive & Negative Risks

Laredo’s biggest positive and negative risk is simply future oil and gas prices. It could also be challenged by higher costs, as it was in 1Q22.

Inflation has increased operating and financing costs for oil production. Completion crews, for example, are much harder to find.

Even more importantly, higher-cost oil and gas products will dampen demand.

Other risks are political and regulatory-particularly with the Biden administration, banks, and several states taking a race-to-zero-hydrocarbons posture, keen to increase production costs in the near term and eliminate U.S. oil and gas production in the long term.

Recommendations

I recommend Laredo Petroleum to investors interested in capital appreciation from a focused Midland oil and gas producer.

Although the company expect to pay off $700 million in debt by year-end, Laredo is still a speculative buy since the company has considerable debt, some high-priced, and a debt-to-market cap ratio of 108%. This is reflected in its bargain price/earnings ratios: 8.9 now, 2.7 for estimated 2022 earnings, and an incredible mere 1.7 for estimated 2023 earnings.

While I do not recommend Laredo Petroleum to dividend hunters, its new $200 million share repurchase program is a good enhancement. But again, the company’s first priority is to pay down debt.

Laredo has increased the oil in its mix, reflected in its $3.7 billion SEC PV-10 reserve value. There is a +70% upside from the current price to the one-year target.

The company has a lot of debt relative to its market capitalization. It thus has a hedge program that will limit upside. Still, the company has bargain forward price/earnings ratios, good acreage in a more oil-focused strategy, and a new share repurchase program. It expects $900 million of free cash flow in 2022-triple the level of just a few months ago–and has updated its debt repayment target to $700 million by year-end 2023.

laredopetroleum.com

Be the first to comment