pepifoto/iStock via Getty Images

In March of 2019, I penned – If I Could Only Own 10 Stocks. Of course, markets have been on a roller coaster ride from 2019 thanks to the first modern day pandemic. The economy has also been taken for a ride thanks to record amounts of stimulus that went on to fuel inflation. We currently sit in the early stages of a stagflationary environment.

As for goals for this 10 stock portfolio, I offered…

Obviously, safety and longevity and perhaps a wide moat would become the main considerations.

In that post, I presented my Canadian Wide Moat Portfolio. I had already embraced a concentrated portfolio model. The wide moat portfolio holds 7 companies, all paying a generous dividend.

I suggested that I would simply remove one company, TransCanada (TRP), leaving me with the biggest Canadian banks by way of Royal Bank (RY), Toronto-Dominion Bank (TD) and Scotiabank (BNS), and two of the largest Canadian telcos by way of Bell Canada (BCE) and TELUS (TU), and one energy/pipeline company Enbridge (ENB).

That’s 6 Canucks, here’s the Americans

We will fill in the remaining 4 positions from our U.S. stock portfolio. From that post you’ll see that we (for my accounts and that of my wife) hold a collection of Dividend Achievers (VIG) and also have three U.S. stock picks by way of Apple (AAPL), BlackRock (BLK), and Berkshire Hathaway (BRK.B).

Here are the picks with quote rationales from the original top 10 post.

1. Berkshire Hathaway

Out of the gate, the most obvious pick for my money is Berkshire. And yeah, that’s cheating. One could argue that with Berkshire Hathaway, you are essentially able to own a concentrated fund run by the world’s greatest investor with zero fees.

2. Johnson & Johnson (JNJ)

JNJ is simply a well-diversified global healthcare conglomerate. The company operates in a space with the obvious positive trend of aging world population in developed nations and the need to spend more on healthcare solutions. Certainly, management has to execute well, but it has done that in the past, and it is a unique Dividend King. I like the odds of a continued repeat.

3. Walmart (WMT)

Yes, this may not be a popular suggestion, but remember I am looking for the greatest potential stability and longevity, not market-beating returns or even great growth. Walmart has that wide moat by simply owning the low-price retail space. It has more than answered the e-commerce challenge.

4. Nike (NKE)

Yup, for me as a former ad and brand guy, I will identify an incredibly strong brand with a wide moat. Consumer and brand loyalty can equal continued sales success. In the land of consumers, Nike is an elite company along with the likes of Apple, Microsoft (MSFT), Toyota (TM), Google (GOOG) (GOOGL), Amazon (AMZN), McDonald’s (MCD), and Coca-Cola (KO).

This would give the portfolio a little growth kicker and some wonderful international diversification.

What team are you on?

Defense: Bell, TELUS, Enbridge, Walmart, Johnson & Johnson

Economic Growth: Royal Bank of Canada, TD Bank, Scotiabank, Nike, Berkshire Hathaway

Inflation protection: Enbridge, Walmart, Johnson & Johnson

It is also possible that the total portfolio’s dividend growth could provide some protection against inflation. And generally, Canadian stocks perform better than U.S. stocks in inflationary and stagflation environments due to the Canadian economy’s energy and materials concentration. That sector concentration can filter into many other sectors, including banking.

The 10 stock portfolio offers some nice balance between offense and defense. Where it might be weak is on the inflation-protection front. When we look to all-weather portfolios, we know that commodities and energy stocks will lead the way in that department.

The performance of the 10 stock portfolio

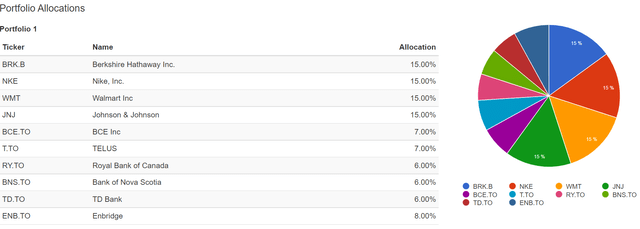

I will aim for an allocation that will deliver a 60% U.S. and 40% Canadian mix.

Given that, here is the portfolio weightings:

Top 10 Stock Portfolio (Author, Portfolio Visualizer)

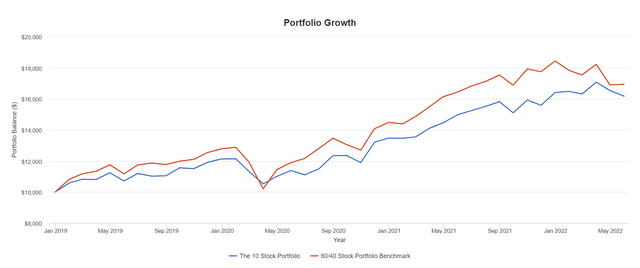

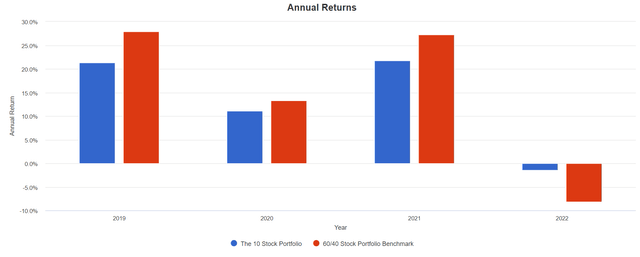

And here is the returns history. I will start in January of 2019, the period ends at the end of May 2022.

Top 10 Stocks vs Benchmark (Author, Portfolio Visualizer)

For the benchmark, I’ve used a blend of the S&P 500 (IVV) and the Canadian market – ticker XIC. That is a Canadian-listed index. I did not adjust for currency in the top 10 or benchmark.

The benchmark outperforms the top 10 for the total period, thanks to the U.S. market concentration in tech, and tech outperformance in the initial stages of the pandemic recovery. That said, when push came to shove and as we entered the current, and more prolonged bear market, the top 10 is greatly outperforming. Keep in mind that the portfolio was built for defense and stability.

The sharpe ratio and sortino ratios are far superior for the 10 stock portfolio. It has simply delivered much better risk-adjusted returns.

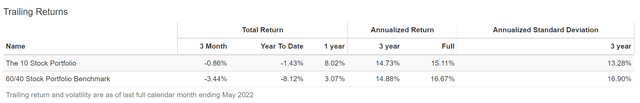

Top 10 vs Benchmark Trailing Returns (Author, Portfolio Visualizer)

And here’s the annual returns.

Top 10 vs Benchmark Annual Returns (Author, Portfolio Visualizer)

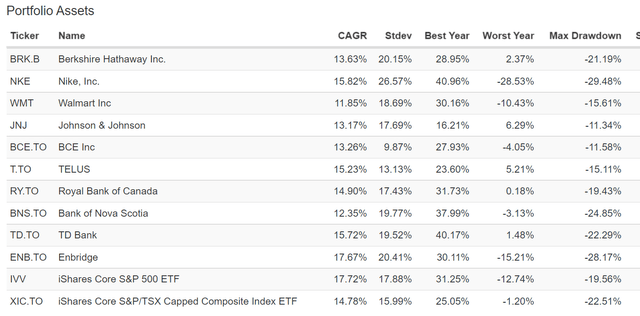

Here are the returns for the individual assets.

Top 10 and Benchmark Individual Assets (Author, Portfolio Visualizer)

Performance from U.S. stocks running on fumes

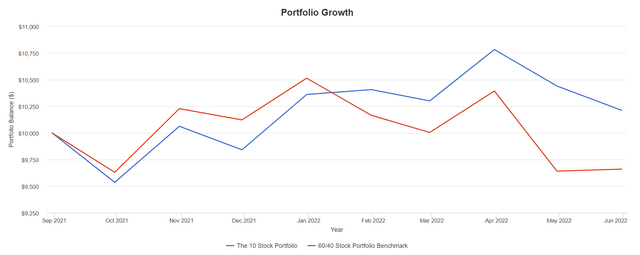

It was my suspicion that U.S. stocks were running on fumes from early Fall of 2021. A solid earnings season gave them a final boost. I was suspicious that the stock market would not like what it sees when it got to the other side of the pandemic. That has played out.

Top 10 vs Benchmark from September 2021 (Author, Portfolio Visualizer)

- Top 10 stocks: up 2.1%

- Benchmark: down 3.4%

Stock portfolio shaping

You can see that we can arrange types of stocks to shape the portfolio. Of course, we could shape for growth – I’d suggest that strategy for those in the accumulation stage with decades to go.

In retirement, we can use types of stocks to build a more defensive portfolio.

Liz Sonders of Charles Schwab offered this Tweet on recent sector performance. We see utilities, consumer staples and healthcare leading the way.

Lisa Abramowicz of Bloomberg presents a chart that shows how the recent rally is a rotation to defense.

I am happy with the defensive posture of our portfolios. The top 10 stock idea is merely a condensed version of what we hold. And the top 10 demonstration shows that when you pick for quality and pick with a defined strategy, you can use a concentrated portfolio. Selecting (overweighting in) certain sectors or types of stocks is a powerful weapon for the retiree. The strategy can be used in concert with the more universal asset allocation strategies for retirees.

Dividend sidenote: the portfolio would have offered a starting yield of 3% in 2019 and has delivered 29% dividend growth for the period, without dividend reinvestment.

What would I do today?

Today, I would tweak the above portfolio. I would drop Scotiabank and add Apple. I have enough bank coverage with the top 2 – RBC and TD. Apple would add more growth and an incredible brand franchise. I’d also be happy to find a way to add Microsoft. Perhaps I would drop one of the telcos.

Of course, past performance does not guarantee future returns. And this is not advice.

Read. Decide. Invest.

Thanks for reading. You can follow me on Seeking Alpha, or on my personal blog – Cut The Crap Investing.

We’ll see you in the comment section. I’m happy to address any questions or concerns.

Be the first to comment