PonyWang/E+ via Getty Images

The semiconductor industry has been dominating headlines since mid-2021 due to the chip shortage that has crippled some of America’s largest industries. The chip drought has impacted everything from vehicle production to PCs, but how are the companies that provide semiconductor manufacturing services doing? Lam Research (NASDAQ:LRCX) is one such company, and for some time, it has significantly benefited from the increased demand and pricing power, but there are signs that it is starting to see its fair share of supply chain disruptions and the company has been tight-lipped about its ability to pass those costs on to customers.

So What Does Lam Research Do?

The first thing you may be wondering is what exactly does Lam Research do? Lam Research provides wafer fabrication equipment and services to the semiconductor industry. In short, they sell chips, chip manufacturing equipment, and chip-making services. The company operates in three main segments DRAM chips, NAND chips, and foundry logic (making chips for companies based on the designs provided).

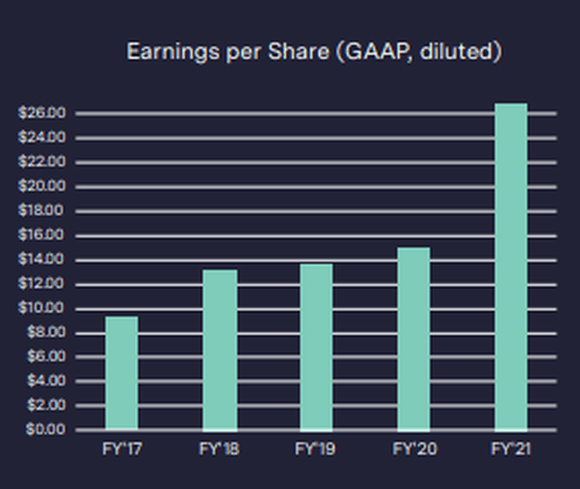

As you can imagine, Lam Research is nowhere near as popular as some of the major names in the industry like Nvidia (NVDA) and Micron (MU). Still, investors should pay attention here because of the support role it plays in the semiconductor industry and the solid gross margins. Since the pandemic, global digital transformation trends have accelerated, and Lam has benefited significantly, posting record revenue and record EPS in the calendar year 2021. This performance saw record revenue in all three of their main segments, and they even had record revenue in their customer support business unit. Total revenue stood at 16.5 billion dollars, and EPS stood at 32.46 dollars per share, representing a 59% increase over the calendar year 2020 and capping a steady trend over the last five years.

Lam Research

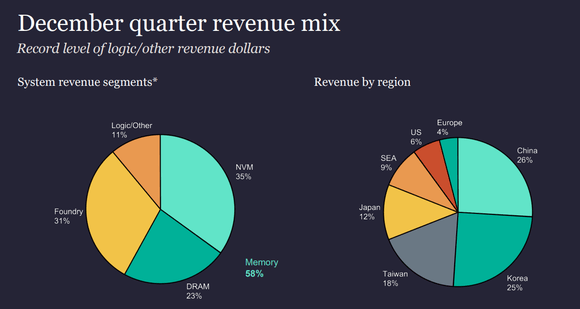

Exposure to the Asian markets remains heavy, with more than 50% of revenue being derived from the region. In the past, this was a risk factor for investors, but it seems that US-China relations have reached a new normal, which should help investors breathe a bit more easily.

Lam Research

Another encouraging sign is the diverse revenue mix. All of its segments are performing well, but no one segment is an elephant which ties in nicely with the broad-based elevated demand the industry is currently experiencing.

Supply Chain Concerns

Supply chain concerns initially created an imbalance that drove up pricing power among the major players in the semiconductor space. With a gross margin of 46.8%, it’s hard to argue that Lam has not felt the tailwinds, but there are warning signs on the horizon. Towards the end of 2021, the firm started to feel more significant effects of supply chain constraints, with one of their major suppliers coming out with their inability to fulfill all of their orders. We’ve seen similar cases throughout the industry with major players like Micron. In the Q4 2021 earnings release, the leadership team called out the expectation that supply chain constraints will likely play a more prominent role in the first half of the calendar year 2022. As a result, investors should expect this to impact gross margins modestly. I would say anywhere from a 1 to 3% reduction in gross margin would be an acceptable range for supply chain disruptions when considering the unprecedented constraints companies face. According to the leadership team, the supply chain issues should resolve during the back half of the calendar year 2022, which bodes well for revenue and margins toward the end of the calendar year should demand persist. The supply chain issue isn’t exactly a new challenge for semiconductor companies, but management has not been sitting on its hands. The company has improved capacity in its domestic factories and has invested heavily in its Malaysian facility. The leadership team has targeted 3 billion dollars in revenue from that facility alone. With demand expected to remain elevated for an extended period, these investments will likely turn out to be prudent moves, and shareholders should benefit.

Strong Tailwinds Despite A Hawkish Fed

The Fed has indicated that they will likely be hiking rates multiple times this year, which will temporarily pump the brakes on growth stocks like Lam Research. Still, a good business in a low rate environment will likely be a good business in a high rate environment. So even if multiples are compressed temporarily, there is a lot to look forward to for long-term investors. The stock has been in turmoil lately due to the rate hike talk and tensions in Ukraine, but I would argue that this could be a great buying opportunity. Beyond resolving supply chain constraints, Lam Research has several long-term tailwinds that could make it a generational purchase. The Metaverse, AI, cloud, increasing device complexity, 5G, and improved adoption of complex devices globally are long-term drivers for the success of memory chipmakers. The company is particularly excited about AI’s role and immersive gaming will play in the Metaverse. As immersive gaming and AI become more engrained in society, the demand for memory will increase.

The Takeaway

In closing, Lam Research is a semiconductor supplier that will support the global digital transformation. Moreover, the firm has an excellent track record of returning free cash to shareholders. In Q4 2021, they returned an astonishing 94% of free cash flow to shareholders in the form of repurchases and dividends, which isn’t something you often hear from a large semiconductor company. Of course, a hawkish Fed will temporarily put the brakes on growth plays like semiconductor stocks. Still, long-term-oriented investors will likely find the recent turbulence to be an excellent buying opportunity.

Be the first to comment