Lemon_tm/iStock via Getty Images

By Peter Hayes; James Schwartz; & Sean Carney

Market overview

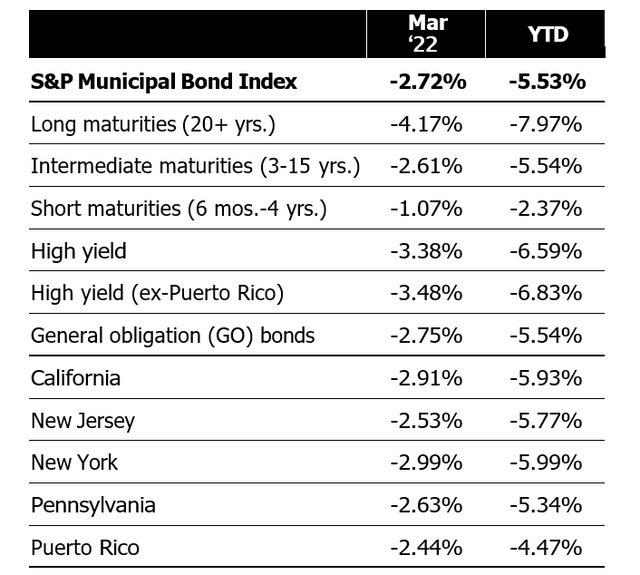

Municipal bonds posted their third consecutive month of negative performance and cemented their second-worst quarter on record in March. Surging inflation, the first U.S. Federal Reserve rate hike since 2018, and expectation for a faster pace of future tightening pushed Treasury yields higher across the curve and pressured fixed-income assets. Challenged supply-and-demand dynamics prompted considerable municipal underperformance. The S&P Municipal Bond Index returned -2.72%, bringing the year-to-date total return to -5.53%. Higher-rated bonds outperformed, as did those with a shorter duration, as they are less sensitive to interest rate movements.

Soft demand, elevated secondary trading, and robust supply stressed the market in March. Outflows continued unabated as negative performance and heightened volatility continued to weigh on sentiment. Bid-wanted activity remained elevated at more than $1.1 billion per day and provided added price transparency as investors raised cash to meet redemptions. Issuance swelled to $43 billion, 37% above the 5-year average, and significantly outpaced reinvestment income (from maturities, calls, and coupons). New issue oversubscriptions fell to just 3.0 times on average, down from 5.5 times last month, and some deals required restructuring to get done.

In our 2022 Municipal Market Outlook, we stressed that patience would be rewarded early this year. After a quarter of severe correction, we believe that higher absolute yields and attractive relative valuations provide a favorable entry point. While bouts of volatility could persist in the near term, we think investors will ultimately benefit from entering early and taking advantage of the current muni availability ahead of the typically strong summer season.

Strategy insights

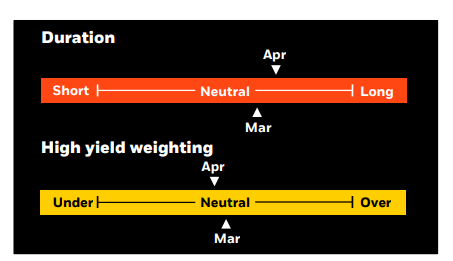

We maintain a long duration stance on municipal bond positioning while targeting minimal cash balances. We favor intermediate maturities, given that 86% of the full yield curve can be captured by extending out just 10 years. We prefer an up in quality bias overall, with a neutral allocation to non-investment grade bonds.

Author

Overweight

- Essential-service revenue bonds.

- Select highest quality state and local issuers with broadest tax support.

- Flagship universities and diversified health systems.

- Select issuers in the high yield space.

Underweight

- Speculative projects with weak sponsorship, unproven technology, or unsound feasibility studies.

- Senior living and long-term care facilities in saturated markets.

Credit headlines

The strong U.S. economy is bolstering fundamentals across the municipal market. Robust revenue growth, improving financial operations, and elevated fund balances have prompted the upgrade of several high-profile municipal credits. In early March, Moody’s raised the State of New Jersey’s credit rating by one notch to A2. S&P followed later in the month, increasing the state’s GO bonds from BBB+ to A-. This was the first upgrade for New Jersey since 2005, reflecting the dramatic turnaround in revenues since the state’s issuance of $4 billion in emergency bonds to cover shortfalls during the onset of the pandemic. The City of Detroit, which emerged from bankruptcy in 2014, and Chicago Public Schools, which teetered near insolvency in 2016, were both upgraded by Moody’s from Ba3 to Ba2, moving them two notches closer to an investment-grade rating.

Despite strong fundamentals, rising rates and weak supply-and-demand dynamics have caused cheapening across the municipal market. Investors should view this as an opportunity to source high-quality tax-exempt assets at better levels than at the start of the year. Investment-grade municipal bonds have cheapened relative to corporate bonds, with ratios moving from 45% to 71%, reflecting a decline in valuation to a level not seen since late 2020.

Ratios comparing high yield municipals to corporates started the year at 73%, richened to 62% when corporate high yield spreads spiked in mid-March and retraced back to 72% by month-end. With ratios now in the 70s, munis are no longer expensive relative to corporates. Investors have an opportunity to swap into similarly rated credits that are better situated to deal with inflation and economic volatility. Within the municipal market, A-rated bonds are attractive relative to lower-rated bonds. The A-to-BBB ratio has spiked to almost 90%, a level not seen since the credit crunch in 2007. The BBB-to-high yield ratio has also risen from last summer’s low of 45% to 72%. But, the extra carry offered by tax-exempt high yield bonds remains attractive.

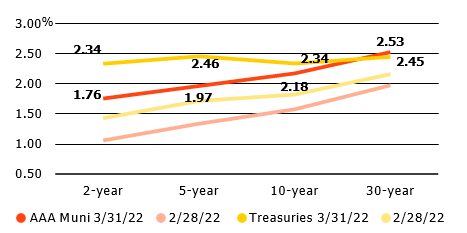

Municipal and Treasury yield movements

BlackRock, Bloomberg

Municipal performance

Investment involves risk. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. There may be less information available on the financial condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. A portion of the income from tax-exempt bonds may be taxable. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

This post originally appeared on the iShares Market Insights.

Be the first to comment