Scott Olson/Getty Images News

A name that has appeared on one of my top momentum sorts over the last week is Molson Coors Beverage (NYSE:TAP). This stock has also been the best total return performer during 2022 in the alcoholic beverage industry. After going nowhere over five years (in share price and sales/income terms), investors in TAP today own a business with strong underlying fundamental value, although with muted growth expectations. In a nearly recession-proof sector for consumer spending, any material uptick in demand for its beverage creations could launch the share quote 50%+ during 2022-23 just to reach a normalized industry valuation zone.

The Business

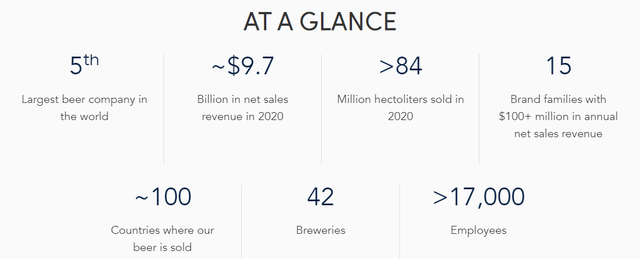

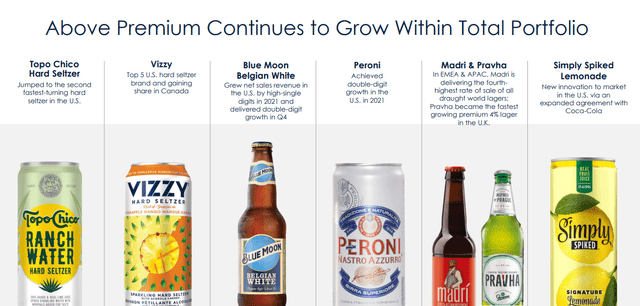

For over two centuries Molson Coors has been brewing beer, with a push into new beverage markets like Seltzers now taking place. From Coors Light and Miller Lite to Molson Canadian, Carling and Staropramen, to Coors Banquet, Blue Moon Belgian White, Blue Moon LightSky, Vizzy, Leinenkugel’s Summer Shandy, Creemore Springs, Hop Valley and more, Molson Coors produces numerous popular/iconic beverage brands.

About Us / Company Website Company Summary Webpage – Investor Relations Q4 2021 Earnings Presentation Q4 2021 Earnings Presentation

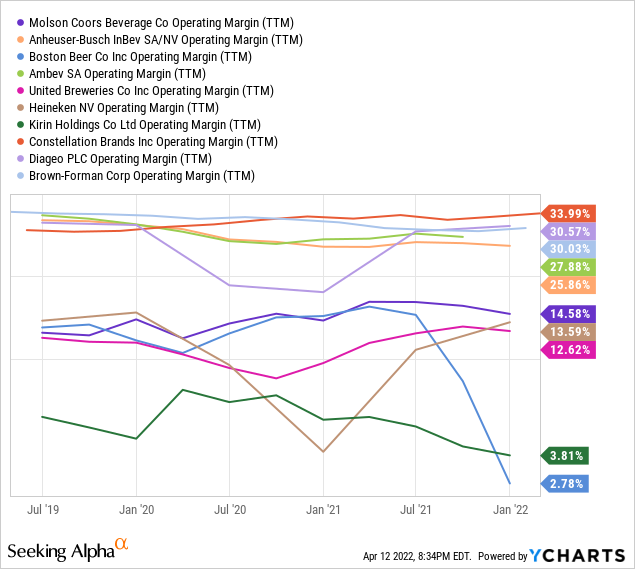

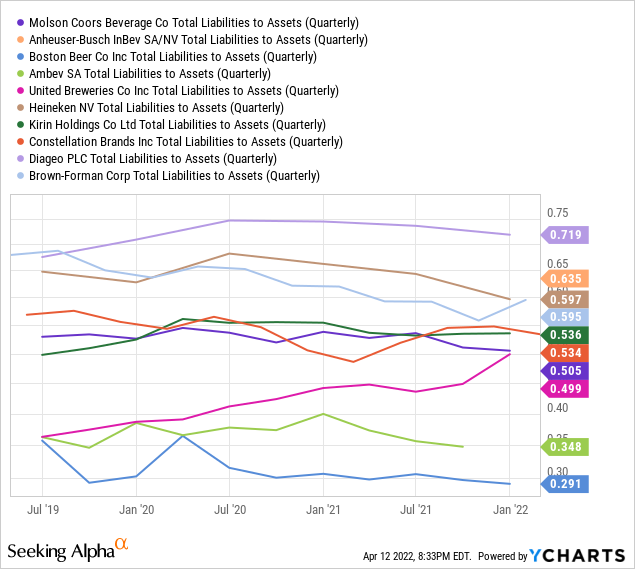

The biggest knock against owning Molson Coors is its profit margins are lower than other brewing and distillery businesses, selling cheaper beer items. Leverage on the balance sheet is also higher than I (and other long-term investors) would like. Another way to look at the situation is room exists for much better margins on new product introductions, while a dedicated effort to reduce debt could lead to a rising common share price trend.

Below are 3-year graphs of operating margins on sales and the ratio of total liabilities to assets for TAP, alongside major peers and competitors available for public investment by retail investors. The list of industry peers includes Anheuser-Busch InBev (BUD), Boston Beer (SAM), Ambev SA (ABEV), United Breweries (CCU), Heineken NV (OTCQX:HINKF), Kirin Holdings (OTCPK:KNBWF), Constellation Brands (STZ), Diageo plc (DEO), and Brown-Forman (BF.B).

YCharts YCharts

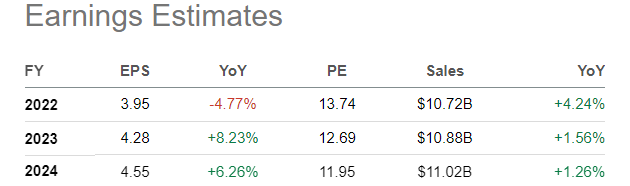

Wall Street analyst estimates are calling for slow growth in sales, and a slight increase in EPS. 2022-24 consensus estimates are pictured below.

TAP Consensus Estimates – April 13, 2022 – Seeking Alpha

Low Valuation

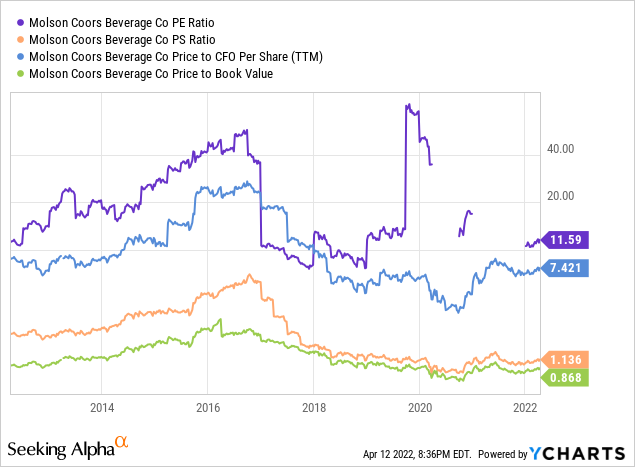

Right now investors are not discounting in any real growth in the business with a super-low valuation setting. In fact, the present ratios of price to trailing 12-month earnings, sales, cash flow, and book value are just above the decade-lows outlined in 2020, during the middle of the COVID-19 economic slowdown.

YCharts

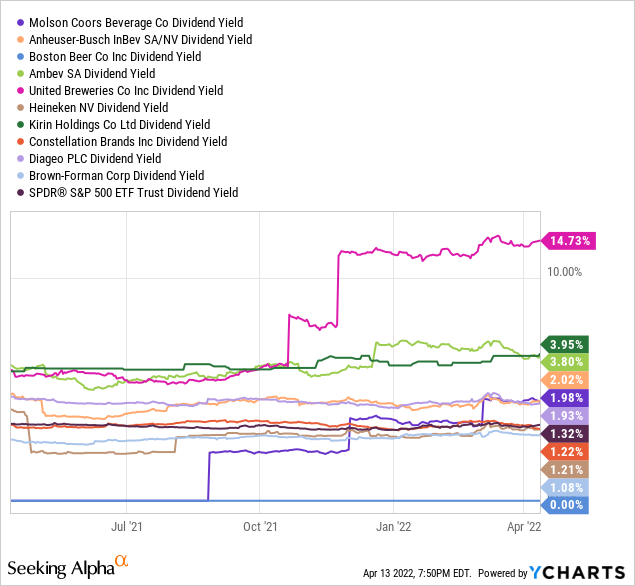

Management reinstated a dividend in 2021, following a cut in 2020 to conserve cash during the pandemic. A trailing 2% cash distribution is quite respectable vs. 1.3% from the S&P 500 blue-chip index or the median peer average of 1.9%. The really good news is the forward indicated dividend payout rate of $0.38 quarterly by management works out to a yield of almost 2.8%.

YCharts

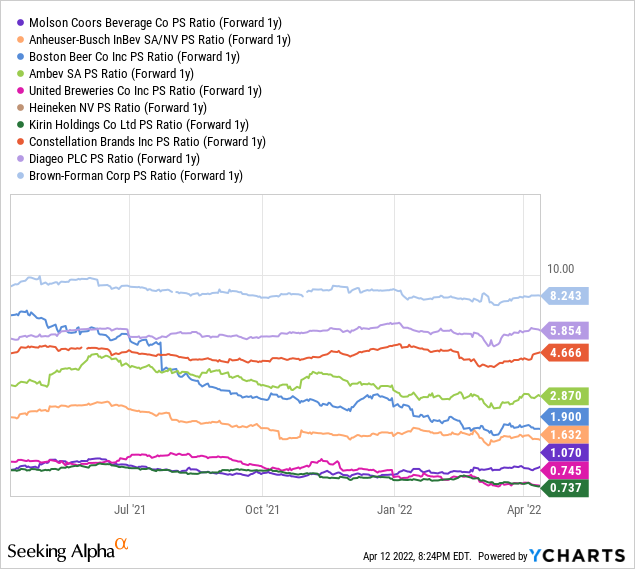

The price to sales ratio on forward 1-year estimates again highlights the company as a superb value pick today. Discounted at 1.07x future sales is ultra-cheap vs. a median sector average of 2x or an estimated S&P 500 ratio of 2.5x.

YCharts

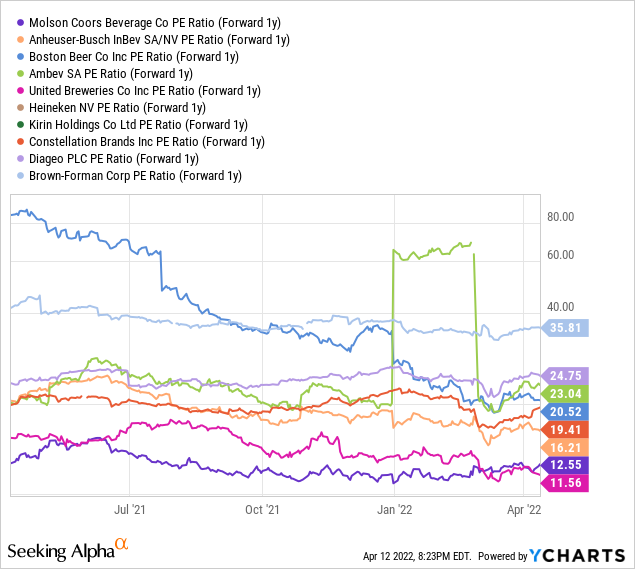

Forward price to earnings calculations point to TAP as a true bargain in the group. A multiple of 12.5x near-future EPS is under the peer median average and S&P 500 estimate closer to 20x.

YCharts

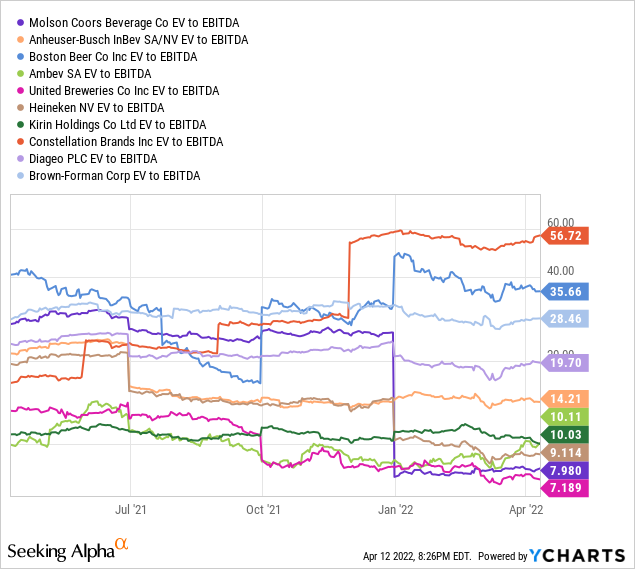

Even when we add debt into its enterprise value calculation, Molson Coors is amazingly inexpensive vs. trailing earnings before interest, taxes, depreciation and amortization. EV to EBITDA of 8x is far under the peer median average of 14x or S&P 500 equivalent around 16x.

YCharts

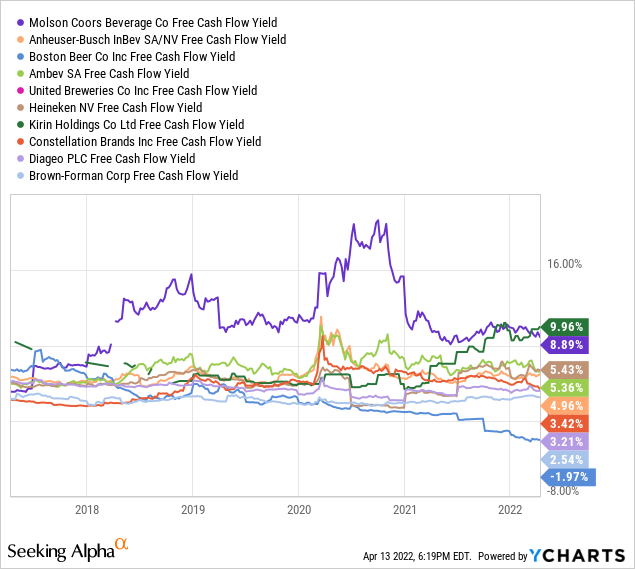

Lastly, free cash flow generation has been stellar, even during the worst days of the pandemic. TAP has been the leading choice in the sector for free cash flow yield, pictured below over the last five years. How many other blue-chips are delivering 9% for shareholders today in cash earnings not needed to keep the operating business moving in the right direction? The current dividend payout represents a low 30% of free cash flow, leaving plenty of money for capital spending initiatives, share buybacks or debt repayment. A similar level of cash investment flexibility and optionality is hard to find in early 2022, especially in the traditionally recession-proof industries represented by brand name pharmaceutical, consumer product, food and beverage makers.

YCharts

Building Technical Momentum

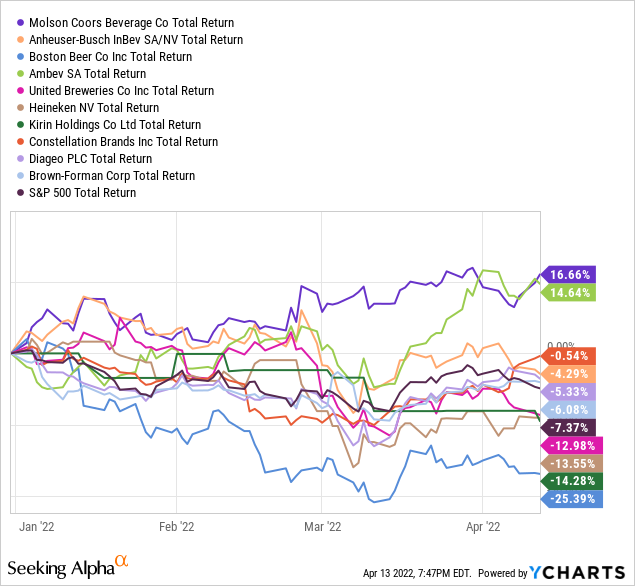

All of these bullish arguments to own Molson Coors appear to be gaining traction with smart investors. The total return on investment produced by TAP since January 1st has been tops for the alcoholic beverage sector. The +16.6% price gain plus dividends has likewise handily outperformed the -7.3% loss in the S&P 500 index average on Wall Street.

YCharts

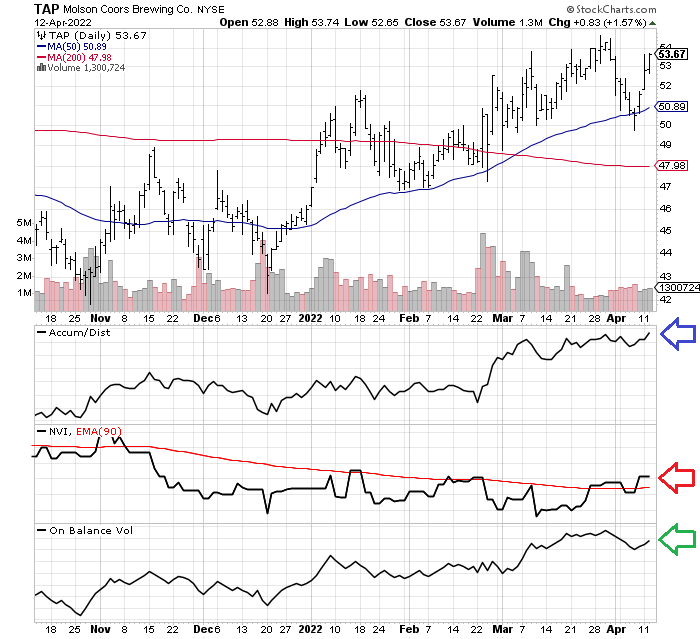

On the 6-month technical chart below of daily price and volume changes, we can review the positive jump in momentum, which appears to be getting stronger as time passes. Price is above the important 50-day and 200-day moving averages, and both are turning higher for direction.

Momentum indicators like the Accumulation/Distribution Line, Negative Volume Index and On Balance Volume have been moving in a bullish manner at the same time. ADX marked with the blue arrow is telling us the final stock trade has been priced closer to the session’s high each day, more often than not. The NVI marked with a red arrow has stabilized since December and improved nicely since March. Basically, low-volume days are seeing increased buy interest, which is a big plus in my research. Lastly, OBV marked with a green arrow has been in a steady and consistent uptrend since October. If you believe volume precedes price, TAP is becoming more interesting by the day.

6-Month TAP Chart with Author Reference Points, StockCharts.com

Final Thoughts

When you put together all of the pieces of the investment puzzle, Molson Coors is sitting at an enviable intersection of steady business results, a low valuation, and growing interest by investors. My view is investment upside could be quite high if management can execute a better growth plan. Given a 10% EPS growth rate, instead of its projected 5% path over several years, and placing industry-norm valuation multiples on those results, I come up with a price target zone of $80-$100 a share in 18-24 months. Plus, while you wait for a rising stock quote, investors can capture a nearly 3% cash dividend annually, far better than the majority of U.S. equities.

On the downside, a feel risks are limited. Poor management execution with a small downtick in operating results would hurt, but not be catastrophic. Today’s already low valuation would cushion the blow of weaker than anticipated operating results. A bigger risk may be rising inflation and interest rates cause a markdown in all financial assets, including TAP’s stock price during the rest of 2022. I am modeling a worst-case risk drawdown to $45 per share over the short term, assuming a major bear market on Wall Street and economic recession are next for America (hopefully this remains a mental exercise only).

Including dividends, my risk vs. reward analysis is projecting potential downside of -25% vs. upside of +85% including dividends over the next 24 months (2 years). The most probable returns are heavily tilted to the upside, when buying shares around $54. With a flat forecast for the S&P 500 during 2022, and gains limited again in 2023 from rising interest rates and subpar GDP expansion, owning TAP’s estimated yearly total return of +15% to +25% makes sound investment sense. I currently rate Molson Coors a Buy and purchased shares in my personal account during April.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment