AvigatorPhotographer

Thesis

Danaos Corporation’s (NYSE:DAC) Q2 earnings demonstrated the resilience of its operating model, as it reported robust results despite the normalization in freight rates.

We noted that Danaos’ average gross daily charter rates improved from Q1, as vessel utilization was close to 100%. Therefore, the company has managed to perform admirably even though DAC fell close to 50% from its March highs to its July lows.

Given the robust bottoming process seen in DAC in July, we are confident it has likely bottomed out in the medium term. The market had also anticipated a solid Q2 release, as it recovered remarkably pre-earnings. However, the momentum has stalled somewhat post-earnings, digesting some of its recent gains.

We postulate that DAC’s valuation is pretty well-balanced. Therefore, we don’t consider it attractively undervalued. Notwithstanding, we are confident that the company should be able to confidently navigate the oncoming macro headwinds robustly, given the resilience of its charter rates moving ahead.

Accordingly, we rate DAC as a Buy for now.

Danaos’ Q2 Was Remarkable

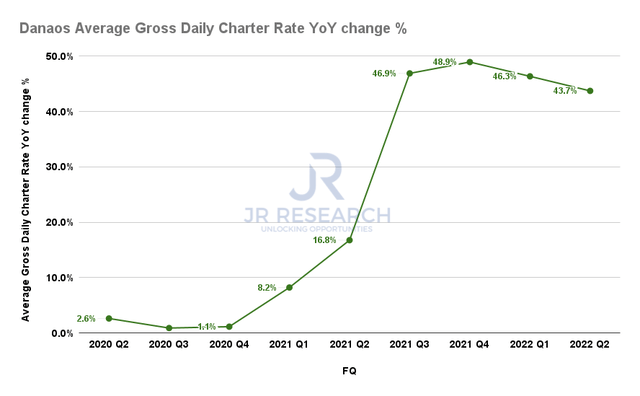

Danaos average gross daily charter rate change % (Company filings)

Danaos registered an average gross daily charter rate of $38.89K in Q2, up 43.7% YoY. Notably, the growth in its charter rate has continued to moderate, albeit still robust. Furthermore, it also increased by 7.13% QoQ, corroborating the strength of its operating model. In addition, management also highlighted that its backlog is filled to the brim through H2’22, as CFO Evangelos Chatzis accentuated:

As of the end of the second quarter, our contracted cash revenue backlog stood at $2.3 billion, with a 3.6-year average charter duration while contract coverage is at 99% for 2022 and 80% for 2023, while even 2024 is already contracted at 55%. (Danaos FQ2’22 earnings call)

However, management reminded investors that macro headwinds could intensify in the near term, impacting freight rates. However, the ongoing supply chain disruption should keep rates at much higher levels than pre-COVID days, lending tremendous revenue visibility moving forward.

Furthermore, the company also highlighted that it remains highly disciplined in its investment plans as costs have surged significantly. Management articulated that it remains confident that the industry is in pretty good shape now, despite the potential of rates normalization ahead. CEO John Coustas highlighted:

The long-term rates in the market are dictated by a combination of the actual newbuilding costs and the financing costs. These 2 are really very much in the high side. Because the owners are not in distress, they are not prepared really to, let’s say, to put their [ pens ] down as they did the changes in the past in order just to get fixed at any rate. That’s why no one will go and build ships today, if they are not really compensated. (Danaos earnings)

Investors Should Expect Normalization In Growth

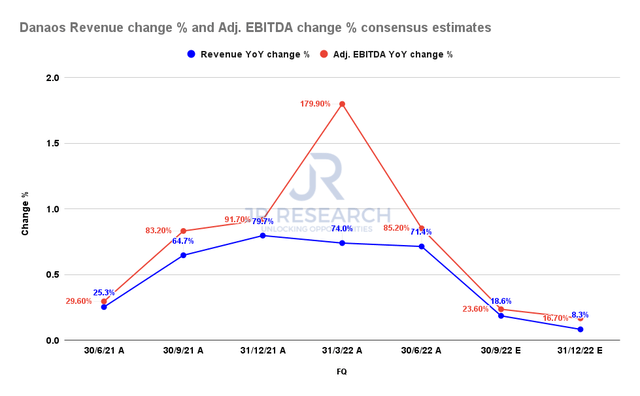

Danaos revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Danaos’ revenue and adjusted EBITDA growth should moderate markedly through FY23. We believe normalization assumption is reasonable, as management also alluded to the possibility in the earnings call. Furthermore, freight rates have also moderated markedly since their highs in 2021.

Therefore, we postulate that the battering in DAC over the past four to five months is justified, as the market de-risked the slower growth expectations in Danaos moving forward. The critical question is whether the de-rating has been completed.

DAC’s Valuation Is More Reasonable Now

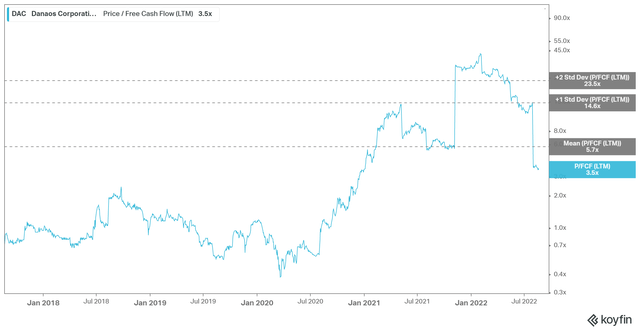

DAC TTM P/FCF valuation trend (koyfin)

As seen above, DAC’s TTM P/FCF has moderated markedly below its 5Y mean. Therefore, we postulate that the froth from its March 2022 highs has likely been digested.

We believe that DAC’s valuation currently seems more well-balanced, even though we wouldn’t consider it undervalued.

Is DAC Stock A Buy, Sell, Or Hold?

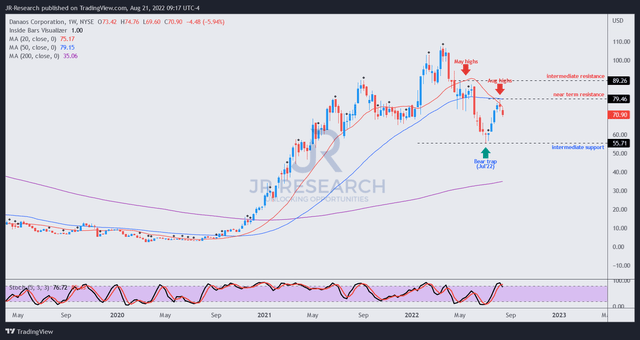

DAC price chart (weekly) (TradingView)

We posit that DAC has likely formed its medium-term bottom in early July, as it formed a validated bear trap (indicating that the market denied further selling downside decisively) at its early July lows.

Therefore, the sharp recovery from its July bottom should not be surprising, given the bear trap, as the market anticipated a solid Q2 earnings card.

However, the buying upside has stalled since its Q2 release, as the market took the opportunity to digest the recent recovery.

Hence, the current price structure for DAC does not indicate a strong buy trigger. Investors who prefer to bide their time can consider a re-test of its near-term support before adding exposure.

Notwithstanding, we posit that the market should support DAC’s July lows robustly. Therefore, we are confident that investors can capitalize on its near-term downside volatility to add exposure.

Accordingly, we rate DAC as a Buy.

Be the first to comment