imaginima

Berkshire Hathaway (BRK.A) (BRK.B), according to its latest 13F holdings report, increased its ownership interest in Occidental Petroleum (NYSE:OXY) by 22.2M shares in the second quarter, bringing its investment in the energy company to approximately 20%. Additionally, the Federal Energy Regulatory Commission gave Berkshire Hathaway its approval on Friday to acquire up to 50% of Occidental Petroleum’s shares, which could be an indication that Warren Buffett may ultimately want to acquire 100% of the company. Warren Buffett’s interest in the energy company creates a potent catalyst for Occidental Petroleum and shares are still trading cheaply!

FERC approval

Shares of Occidental Petroleum soared 10% on Friday after the Federal Energy Regulatory Commission gave Berkshire Hathaway the green light to acquire up to 50% of Occidental Petroleum. The regulator’s job is to ensure that acquisitions in the energy industry don’t hurt the competition or lead to higher prices for consumers. The regulatory approval clears the path for a sizable increase in Berkshire Hathaway’s holding of Occidental Petroleum. It may also indicate that Warren Buffett is looking to acquire all of Occidental Petroleum’s shares at a later stage.

According to Berkshire Hathaway’s latest 13F holdings report, Buffett bought 22.2 million shares of Occidental Petroleum in the second quarter, showing a 16% increase in his energy holding compared to the prior quarter. Occidental Petroleum was the second-most aggressive purchase for Berkshire Hathaway in Q2’22, right after Ally Financial (ALLY).

Dataroma: Berkshire Hathaway Q2’22 Buys

Warren Buffett may ultimately decide to acquire 100% of Occidental Petroleum

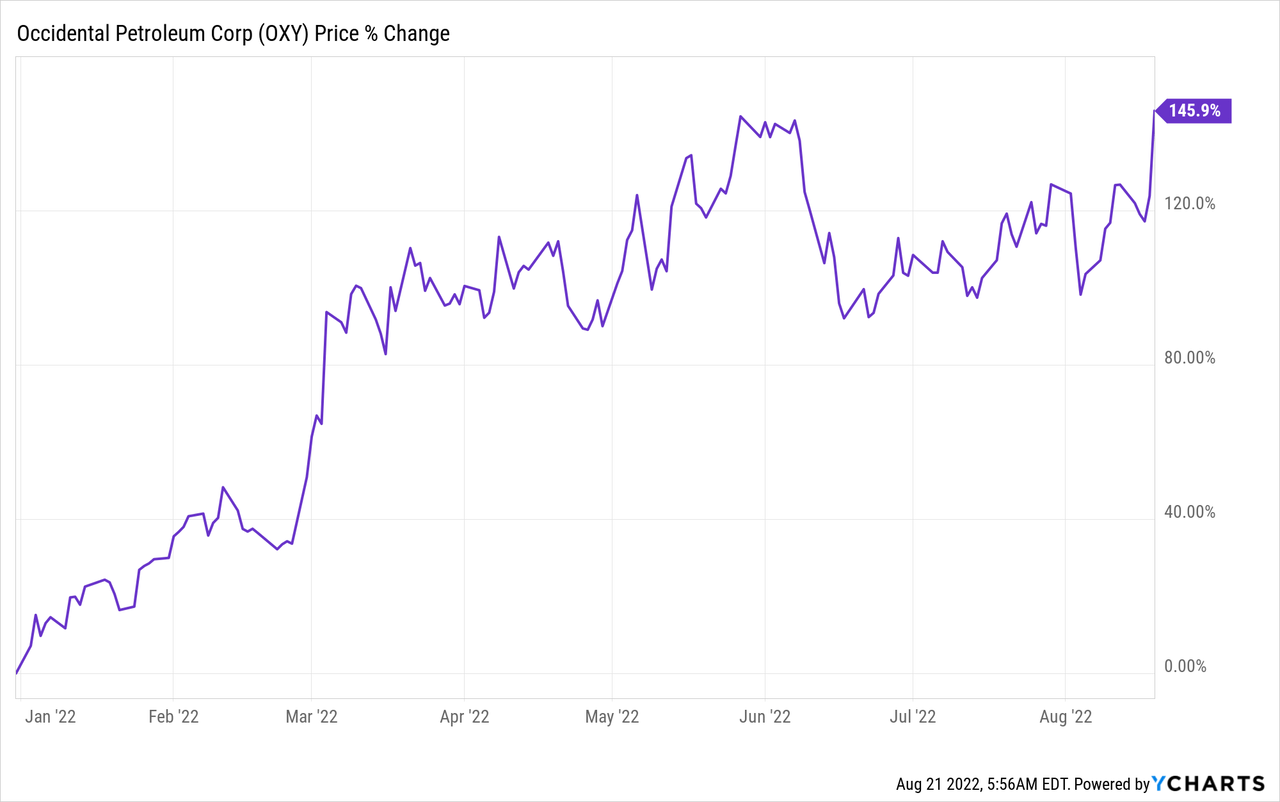

Shares of Occidental Petroleum have returned 147% this year, in large part because the firm’s earnings and cash flow prospects have fundamentally improved after Russia invaded the Ukraine and the country curtailed energy flows to Europe. Warren Buffett’s obvious interest in the company has also helped in driving the share price higher in 2022. I believe that Berkshire Hathaway will ultimately want to own more than just 50% of Occidental Petroleum and there may be two reasons for that.

The first one is that Occidental Petroleum is seeing fundamentally improved free cash flow (“FCF”) prospects in the current market. The company generated $4.2B in FCF in the second quarter, showing an increase of 108% year over year. Due to pricing strength, Occidental Petroleum’s FCF margins remained high at 39% in Q2’22 as well. Since there is nothing that Warren Buffett likes more than free cash flow, Occidental Petroleum would be an obvious acquisition target.

|

$millions |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

|

Product Net Sales |

$5,958 |

$6,792 |

$7,913 |

$8,349 |

$10,676 |

|

Net cash provided by operating activities |

$3,324 |

$2,910 |

$3,231 |

$3,239 |

$5,329 |

|

Plus: Working Capital/Other |

($614) |

$57 |

$636 |

$939 |

($181) |

|

Less: Purchases of Property and Equipment |

($698) |

($656) |

($937) |

($858) |

($972) |

|

Free cash flow |

$2,012 |

$2,311 |

$2,930 |

$3,320 |

$4,176 |

|

Free cash flow margin |

33.8% |

34.0% |

37.0% |

39.8% |

39.1% |

(Source: Author)

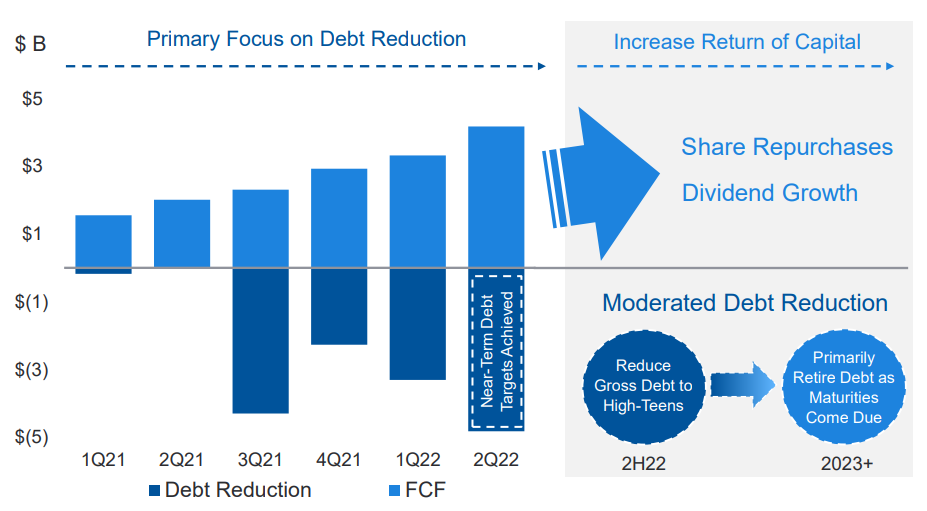

Because of strong growth in free cash flow, Occidental Petroleum is set to prioritize share repurchases going forward. Occidental Petroleum repurchased $1.1B worth of its shares through August 1, 2022 and FY 2023 could see an acceleration of buybacks when the company expects to shift its focus away from debt reduction to more capital returns.

Occidental Petroleum: More Share Buybacks Coming In FY 2023

Because of strong pricing effects in the market, I believe Occidental Petroleum could be making between $12B and 13B in free cash flow in FY 2022.

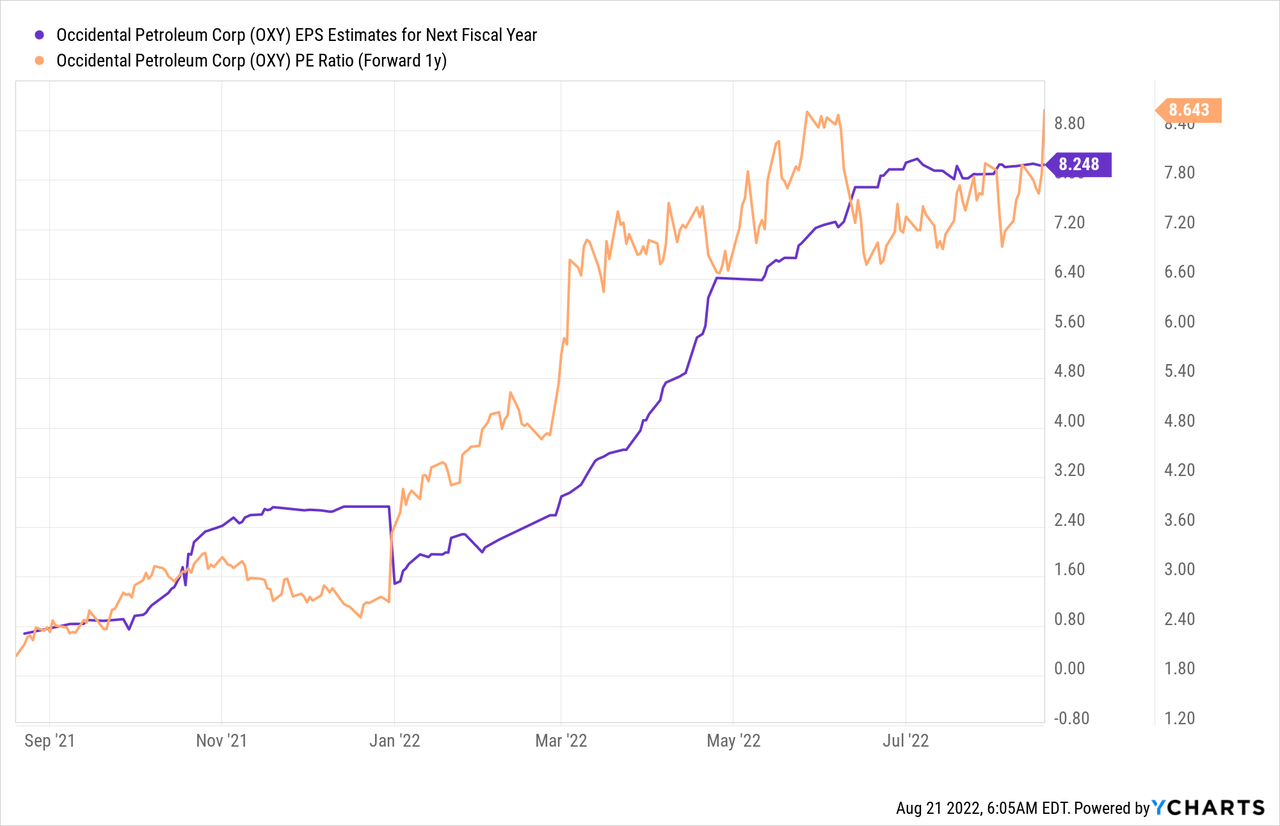

The second reason why Warren Buffett may want to acquire 100% of the company is that Occidental Petroleum’s commercial prospects in the energy market are still cheaply valued based off of forward earnings. The energy producer is expected to generate EPS of $8.25 in FY 2023, implying a P-E ratio of just 8.6 X.

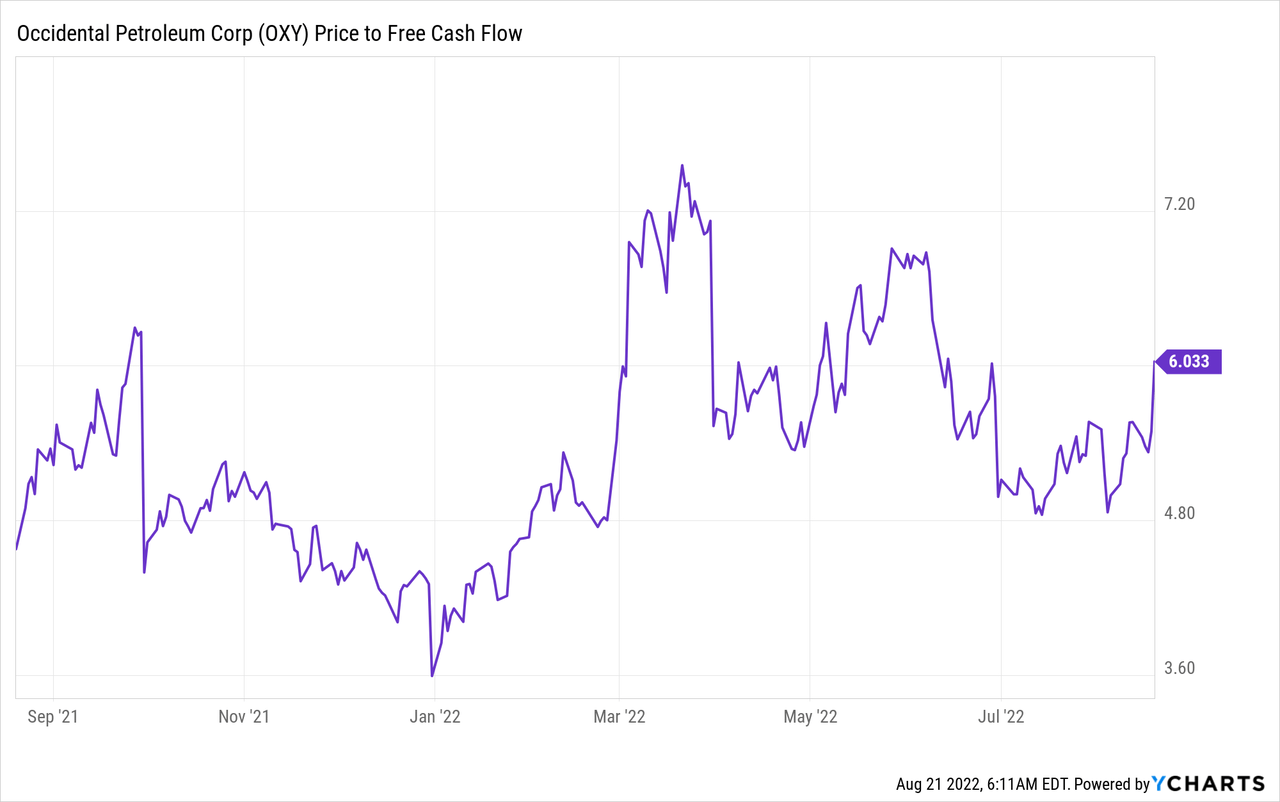

Occidental Petroleum’s free cash flow is even cheaper. Based off of consensus free cash flow expectations, Occidental Petroleum has a P-FCF ratio of 6.0 X.

Risks with Occidental Petroleum

The biggest commercial risk for Occidental Petroleum does not relate to Warren Buffett’s involvement in the company, but to the current pricing of petroleum products. With prices still high due to macroeconomic and political reasons, Occidental Petroleum is earning a ton of money right now. However, if market prices for petroleum and other energy products were to fall, Occidental Petroleum would be set to see significantly lower profits and free cash flow going forward.

Final thoughts

Warren Buffett got the OK to buy up to half of Occidental Petroleum’s outstanding shares and it could be a game-changer for the energy company and its investors because the regulatory approval paves the way for a full acquisition of Occidental Petroleum by Berkshire Hathaway. With prices for petroleum products remaining high and Buffett ramping up his equity investment, shares of Occidental have two powerful catalysts that could result in shares revaluing sharply to the upside!

Be the first to comment