Alvin Man

Investment Thesis: While Air Canada has potential for growth over the longer-term, growth in the short term could be modest until the company sees a significant rebound in operating revenue per ASM.

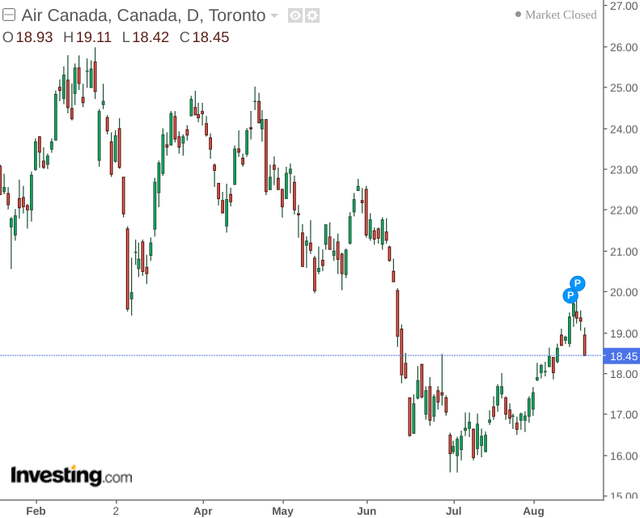

In a previous article back in May, I made the argument that Air Canada (OTCQX:ACDVF) (TSX:AC:CA) could see a significant potential for recovery despite short-term headwinds.

My reason for making this argument was that revenue per passenger mile was continuing to rebound strongly in spite of inflationary pressures, along with the company continuing to upgrade its fleet to more fuel-efficient models in spite of rising costs.

While the stock continued to see a downward trajectory since then – price has recently began to recover.

The purpose of this article is to assess whether the rebound can continue given recent performance.

Performance

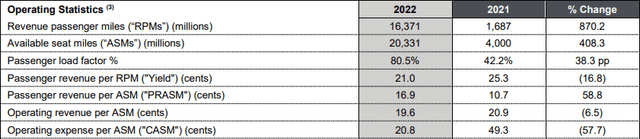

When looking at key operating statistics for Air Canada, we can see that revenue passenger miles saw a strong increase from Q2 2021 – while operating revenue per available seat miles conversely saw a decrease from last year.

Air Canada: Second Quarter 2022 Financial Results

In effect, this means that while Air Canada is generating more revenue per mile for passengers that fly with Air Canada – total operating revenue by seat (both full and empty) has declined – indicating that passenger capacity has fallen overall.

With Toronto’s Pearson reportedly ranking the second worst airport in the world for delays at present, this will have undoubtedly impacted the above metric – as the cost of refunding such flight delays and cancellations more broadly will invariably lower operating revenue. There is also the additional consideration that ramping up new aircraft and staff to accommodate higher passenger loads is taking time – which further places pressure on Operating Revenue per ASM.

Given that non-flying passengers invariably come at a cost to the airline – I take the view that investors will start to pay particular attention to Operating Revenue per ASM – the company will need to start seeing positive growth across this metric in order to sustain long-term growth.

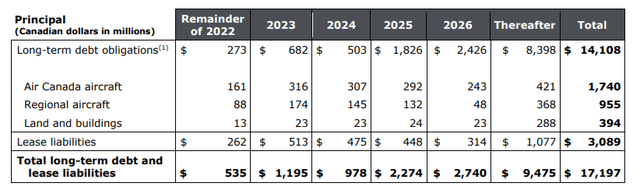

Additionally, Air Canada is also expecting to see a significant portion of its long-term debt mature by 2025 – meaning that earnings will need to have returned to significant profitability in order to fund such debt load.

Air Canada Second Quarter 2022: Condensed Consolidated Financial Statements and Notes

For reference, the diluted net loss per share for Q2 2022 stood at -$1.60.

From this standpoint, while investors would have previously been happy to see strong revenue growth emerging from the pandemic – more emphasis will now be placed on seeing a recovery in earnings growth. Without this – revenue generated will need to go towards funding long-term debt, which could impede overall growth in the longer term.

Looking Forward

Structural challenges across the aviation industry as a whole continue to remain, and it is likely that issues with flight cancellations and other bottlenecks could continue as the industry attempts to get back to original capacity levels.

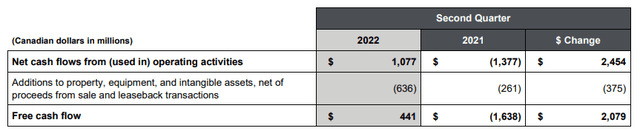

One encouraging sign for Air Canada has been its capacity to revitalise its free cash flow levels over the past year.

Air Canada: Second Quarter 2022 Financial Results

This puts the company in a better position to weather a potential decline in revenue going forward – which might be the case in the winter months as seasonal travel starts to decline once again.

In spite of the ongoing challenges facing the industry, Air Canada has started to make significant improvements – with flight delays reportedly declining by 48% in the week of August 8th as compared to June 27th, along with a 77% reduction in cancelled flights over the same period.

Should an improvement in these metrics result in a significant boost to operating revenue per ASM in the upcoming quarter, then we could see a situation where earnings start to rebound into positive territory.

Conclusion

To conclude, my overall view of Air Canada is that while the company has significant potential to grow its earnings back into positive territory once again, investors will want to see evidence of a rebound in operating revenue per ASM along with further growth in free cash flow to ensure that the company can sustainably grow earnings while meeting its long-term debt obligations.

From this standpoint, I take the view that the stock may see modest growth until clear signs of the above emerge.

Be the first to comment